Condo projects may not be FHA

Federal Housing Administration

The Federal Housing Administration is a United States government agency founded by President Franklin Delano Roosevelt, created in part by the National Housing Act of 1934. The FHA sets standards for construction and underwriting and insures loans made by banks and other private lenders for home building. The goals of this organization are to improve housing standards and conditions, to provide an ade…

What are the benefits of having a FHA approved condo?

FHA Condo Approval dramatically increases the pool of potential buyers. First and foremost, FHA Condo Approval opens up a sea of buyers. Statistics show that approximately 60% of new homebuyers intend to use an FHA Loan. If your community does not have FHA condo approval, you potentially limit the buying pool to only 40% of homebuyers.

Should we make our condo FHA approved?

If a mortgage loan that will be sold to one of those agencies is secured by a condo unit, the condo project must be approved by the agency purchasing the loan. If a condo is FHA approved, a unit in the condo can be sold to a borrower who needs the low down payment available on an FHA mortgage to make the purchase.

How to get a condominium FHA approved?

To get an unfinished condo building FHA-approved, the developer must submit:

- An application for environment review, using HUD Form 92250

- A document describing the type of condominium structure, number of proposed units, and common facilities

- A location map

- A preliminary site plan

- An Equal Opportunity Employment certificate, using HUD Form 92010

- An Affirmative Fair Housing Marketing Plan

Do condos qualify for FHA?

The types of condos eligible for FHA approval either contain at least two units; are detached or semidetached units; are manufactured housing; are row houses; or are walk-up, mid-, or high-rise units. Due to the fairly rigid requirements imposed by the FHA, buyers are often left with a smaller pool of properties.

Why do you have to go through the FHA condo approval process?

What are the requirements for a FHA mortgage?

Why are FHA loans lower down payment?

How many people use FHA condos?

How much does a FHA review cost?

What happens if you become FHA certified?

Can you get a reverse mortgage without FHA?

See 2 more

What does FHA not approved mean?

A house that is too expensive cannot qualify for an FHA loan. HUD sets loan limits annually, which vary by area and number of units . The FHA can only insure an amount up to this limit. A high-end home, with the standard FHA down payment of 3.5 percent, might have a loan amount that exceeds the limit.

Why do some properties not accept FHA?

The other major reason sellers don't like FHA loans is that the guidelines require appraisers to look for certain defects that could pose habitability concerns or health, safety, or security risks. If any defects are found, the seller must repair them prior to the sale.

What does FHA approval mean?

FHA loans are insured by the Federal Housing Administration, or FHA. They're meant for first-time homebuyers or those who haven't owned property in the last three years. An FHA-approved condo is a condominium that is eligible to be purchased with an FHA loan.

Can a seller not accept FHA?

The Bottom Line: Sellers Can Refuse FHA Loans And May Be Especially Inclined To Do So In A Seller's Market. Home buyers attempting to get FHA-backed loan offers accepted will probably have a harder time than conventional borrowers until the housing market swings into widespread buyer's market territory.

What will fail FHA?

The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

Do sellers care if its FHA or conventional?

Should a seller consider an offer from a borrower obtaining a Conventional loan over an FHA Loan? The short answer is, no. FHA loans get approved at the same rate as Conventional loans. In fact, you could make the case that they offer more flexibility.

Is it hard to get FHA approved?

An FHA loan only requires a 3.5% down payment, 43% debt-to-income ratio, and 580 credit score. Actually, you can apply for an FHA loan with a credit score as low as 500. But if your credit score is between 500 and 579, then you'll need at least 10% for a down payment.

How long does FHA take to approve?

FHA loans take about the same amount of time to be processed as a conventional or VA loan, approximately 45 days. That includes the entire process, from the loan application to the final approval and closing.

Is FHA hard to get?

FHA loan requirements make home buying easier FHA loan requirements are more flexible than many other programs. Home buyers need only a 580 credit score and 3.5% down payment to be eligible for an FHA home loan. Other requirements apply, too; for instance, you need a steady history of income and employment.

Why do sellers prefer conventional over FHA?

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Can someone be on title but not mortgage FHA?

FHA loan rules state clearly: “Non-applicant individuals can have an ownership interest in the property at the time of settlement without executing the mortgage note and security instrument, regardless of whether the transaction is a purchase or a refinance.”

Is Conventional better than FHA?

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option.

Why do sellers prefer conventional over FHA?

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Is it harder to get a home with an FHA loan?

It's easier to qualify for an FHA loan than for a conventional loan, which is a mortgage that isn't insured or guaranteed by the federal government. FHA loans allow for lower credit scores than conventional loans and, in some cases, lower monthly mortgage insurance payments.

Is it hard to get a house with FHA?

FHA loan requirements make home buying easier FHA loan requirements are more flexible than many other programs. Home buyers need only a 580 credit score and 3.5% down payment to be eligible for an FHA home loan. Other requirements apply, too; for instance, you need a steady history of income and employment.

Why would a condo not be FHA approved? - Quora

Answer (1 of 4): In many places Condos can be a risky investment, at least riskier than a single family home. Often condos, especially in popular vacation areas, are merely second homes/ vacation homes for their owners. 1 common example were in various beach towns in Florida and California. When ...

FHA approved condos — Complete 2022 guidelines and updates

Popular Articles. Your Guide To 2015 U.S. Homeowner Tax Deductions & Tax Credits October 8, 2015; ; Minimum FHA Credit Score Requirement Falls 60 Points October 11, 2018; ; Fannie Mae HomePath ...

Why Would FHA Not Approve a Home for Financing? - FHAHandbook.com

1. It does not meet minimum property requirements. The FHA loan program is managed by the Department of Housing and Urban Development (HUD). And HUD has specific guidelines as to the condition of the home that is being purchased.. If the house falls short of these guidelines — and the issue cannot be corrected for some reason — then the home might not be approved for FHA mortgage financing.

Why do you have to go through the FHA condo approval process?

Going through the FHA Condo Approval process gives homeowners the sense that the Board cares about the community and wants it to thrive. By avoiding the approval process, it will hamper unit owners when they go to sell, refinance, or reverse their units.

What are the requirements for a FHA mortgage?

These requirements include mortgage score, credit history, bankruptcy and foreclosure/short sale history, and employment verification. .

Why are FHA loans lower down payment?

They simply have lower down-payments because they are backed by the Federal Government. People using FHA loans are not statistically more likely to default. FHA Condo Approval is a privilege, not a right. Not all Associations will be eligible for FHA Condo Approval.

How many people use FHA condos?

First and foremost, FHA Condo Approval opens up a sea of buyers. Statistics show that approximately 60% of new homebuyers intend to use an FHA Loan. If your community does not have FHA condo approval, you potentially limit the buying pool to only 40% of homebuyers.

How much does a FHA review cost?

FHA Review charges a flat rate of $850 per submission or $765 for FHA renewals.

What happens if you become FHA certified?

If we become FHA Certified, the FHA will have control over our community – FALSE. The FHA will not have any “control” over the governing of the community. An FHA certified community has no obligation to maintain its certification, and the FHA does not monitor or visit the Association.

Can you get a reverse mortgage without FHA?

Many owners use these types of loans as a financial planning tool and cannot stay in their units without this type of financing. Without FHA condo approval, unit owners cannot obtain a reverse mortgage.

What are FHA-approved condos?

FHA condos are simply residential properties that meet the specific requirements of the U.S. Department of Housing and Urban Development and can be purchased using an FHA loan. If you’re looking to buy a condo with an FHA loan, you must choose from a list of complexes that have been fully vetted by the administration.

What type of condos are eligible for FHA approval?

The types of condos eligible for FHA approval either contain at least two units; are detached or semidetached units; are manufactured housing; are row houses; or are walk-up, mid-, or high-rise units.

How to find FHA condos?

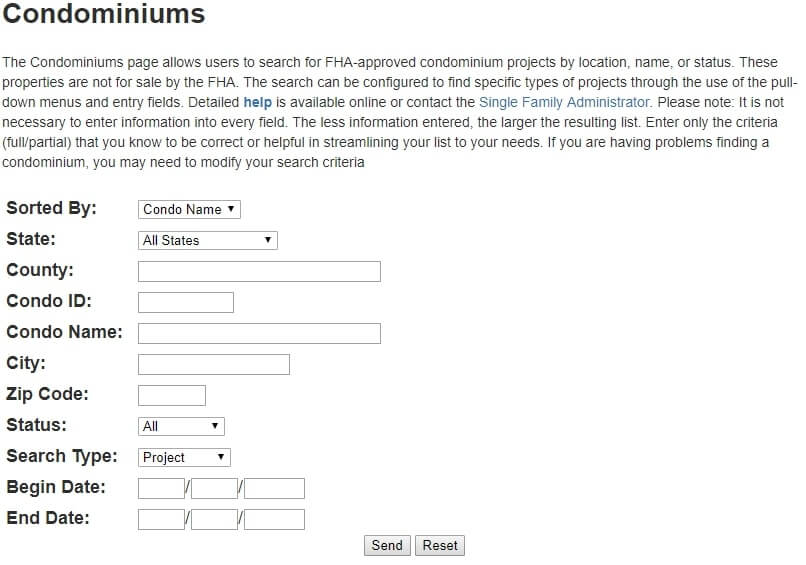

A real estate agent can help you find an FHA-eligible condo in your area through the multiple listing service. You can also visit the HUD website to find FHA-approved condos through its search feature. Just enter your state and county to see a list of eligible condos.

What are additional requirements?

Additional requirements cover factors such as being located within a reasonable distance of a well-traveled throughway and ensuring that all initial building is completed on the project before approval will be granted. Essentially, the requirements make sure that the property remains in good standing and will be desirable.

How much of HOA budget should go toward reserve?

At least 10% of the HOA’s budgeted income must go toward a reserve account. The HOA must have enough reserve funds to cover capital repairs and replacements for at least the next two years. The property must be properly insured. The board of directors cannot have the power to approve or deny leasing.

Is the FHA a mortgage lender?

Note: The FHA is not a mortgage lender—it insures mortgage loans from approved banks and lenders. In turn, these lenders give loans to people who meet insurance standards. The FHA must reimburse the bank or lender for a portion if the loan defaults.

How much of a property can be used as commercial space?

No more than 50% of the property can be used as commercial space. No more than 15% of units can have delinquent dues spanning more than 60 days. No more than 50% of the units can be investor-owned or used as rentals. At least 10% of the HOA’s budgeted income must go toward a reserve account.

What is an FHA-approved condo?

An FHA-approved condo is a condominium that is eligible to be purchased with an FHA loan.

What percentage of FHA insured condo buyers have never owned a home before?

Higher applicant pool – HUD estimates that 84 percent of FHA-insured condo buyers have never owned a home before. This allows condominiums to keep open units to a minimum and increases the number of potential buyers who can be approved for mortgages.

What is the process of condo approval?

Condo developments looking to get approved need to complete the HUD Review and Approval Process (HRAP) or Direct Endorsement Lender Review and Approval Process (DELRAP) for lenders. Once a condo is approved through HRAP or DELRAP, it’ll receive a condo ID used for the project, as well as a submission number.

How much of a condo can be commercial?

No more than 35 percent of the property can be for commercial use. There are other restrictions, such as forbidding FHA loans for units in condotels (condos that have many hotel-like amenities and which rent units to vacationers) or for condos in undesirable areas, such as close to a landfill or airport.

What percentage of down payment do you need for a conventional mortgage?

Buying a home or condo with a conventional loan means you’ll need a 20 percent down payment, which is a hefty chunk of change.

Can condos be FHA approved?

Under the new rules, individual condo units can be eligible for FHA loans even if the full development isn’t FHA-approved . This type of single-unit approval is called spot approval. The approval process varies depending on the original structure requesting approval.

Do condos need FHA approval?

Before you get started buying an FHA-approved condo, make sure you know what condos need in order to qualify: According to HUD, the property or project must be completed, which means if a project is still in the process of being built, it won’t qualify.

What is an FHA loan?

FHA home loans are designed to help any financially qualified borrower get into an affordable home with a low down payment. These FHA mortgages can be used to build or buy a home and you don’t have to be a first-time home buyer or demonstrate financial need in order to apply and be approved.

Can you build a house with an FHA loan?

These properties are considered unique, have few “comparables” that can be used to establish a fair market value, and are generally problematic for the FHA lender in general. That’s why you won’t have the option to build such houses using an FHA loan but you WILL have the option to build more traditional type housing.

Can a FHA loan be closed one time?

For example, most lenders won’t approve FHA One-Time Close construction mortgages for the following housing types: These properties are considered unique, have few “comparables” that can be used to establish a fair market value, and are generally problematic for the FHA lender in general.

Is there a standard for FHA loans?

For any home loan you apply for under the FHA loan program, there are FHA standards but ALSO lender standards. Both must be satisfied. Lender standards are not centralized and they will vary from one financial institution to another.

Is FHA a government agency?

FHA.com is a privately owned website, is not a government agency, and does not make loans.

What are the FHA Requirements for Condos?

In what follows, I will get you up to speed with the specific requirements that a condominium project must meet to get approved by the FHA:

What does FHA look for in condos?

The FHA will also look at where the condominium project is located. In this context, it requires that the condo is within a reasonable distance from a well-traveled road, railroad, airport, or military airfield.

Why are there so few condos approved by FHA?

This is a major reason why only few condominiums get approved by FHA. Even though developers would benefit from an FHA approval, especially if the condominium is in its early stages of development, the FHA prevents them from getting approval unless the project is substantially completed.

How old do you have to be to have a FHA review?

The review of the reserves must not be older than 12 months.

How much of a condominium is owner occupied?

The owner occupancy rule of the FHA applies also to condominium properties and the FHA requires that at least 50% of the units are owner occupied or sold to owners that intend to occupy the property.

How much of a condo can be owned by a single investor?

Therefore, as per the FHA’s requirements only 10% of the total units in the condominium may be owned by a single investor.

How much of a unit can be behind homeowner association dues?

To ensure financial integrity and the ability to provide maintenance and adequate insurance coverage, the FHA mandates that no more than 15% of units can be behind their homeowner’s association dues payments.

Why won't the FHA approve my home?

Why Would the FHA Not Approve a Home? There are several reasons why a home might not be eligible for this mortgage insurance program. Property conditions are a common cause, but there are others as well. Here are some of the most common reasons why the FHA might not approve a particular home for financing. 1.

What happens if you use an FHA loan to buy a condo?

If a home buyer attempts to use an FHA loan to purchase an un approved condo, the loan will likely be rejected. 4. It’s a vacation or investment property.

When is a house appraisal required?

The house appraises below the purchase price. A property appraisal is usually required when a person uses an FHA loan to buy a house. In addition to evaluating the property’s condition, as explained above, the appraiser will also determine how much the home is worth in the current market. If the appraisal “comes in low” (meaning ...

What does standing water in basement mean?

Standing water in the basement or elsewhere that suggests an active leak is present. These are certainly not the only items the appraiser will look for. These are just some of the most common “hits” that might result in the FHA not approving of a home. 2.

What is the purpose of a property evaluation?

The appraiser basically wears two hats during this process. He must determine the market value of the house being purchased, and must also evaluate the property to ensure that it meets HUD’s minimum guidelines.

What is electrical issue?

Electrical issues such as exposed wiring that may present a hazard to the occupant. An installed system (plumbing or electrical) that does not function properly. A roof that is in disrepair (rotting, leaking, etc.) Standing water in the basement or elsewhere that suggests an active leak is present.

Who manages FHA loans?

The FHA loan program is managed by the Department of Housing and Urban Development (HUD). And HUD has specific guidelines as to the condition of the home that is being purchased.

How long does a FHA loan last?

FHA insures condominium loans for up to 30-year terms to purchase or refinance a unit in an FHA-approved condominium project or in a project that is not FHA-approved but meets the Single-Unit Approval requirements.

What is 203b in mortgage?

Section 203 (b) of the National Housing Act provides authority to insure any mortgage covering a one-family unit in a project coupled with an undivided interest in the common areas and facilities which serve the project. FHA insures condominium loans for up to 30-year terms to purchase or refinance a unit in an FHA-approved condominium project or in a project that is not FHA-approved but meets the Single-Unit Approval requirements

How many units are required for single unit approval?

To be eligible for Single-Unit Approval, the unit must be located in a project that is not FHA-approved, that is complete and ready for occupancy, has at least five dwelling units and it is not a manufactured home. The project must also meet a subset of the requirements set forth for project approval, including FHA insurance concentration, owner-occupancy percentage, and financial condition of the project.

When did the FHA final rule for condos come out?

On August 15, 2019, FHA published its Condominium Project Approval Final Rule in the Federal Register (Docket No. FR-5715-F-02). Additionally, it added two new sections—Section II.A.8.p "Condominiums" and Section II.C "Condominium Project Approval" —and incorporated new condominium project approval policy guidance in other sections ...

How are condos kept up?

Condo communities and their HOAs are kept up through their members' fees or dues. A condo community with 20 percent or more of its members delinquent on fees may be struggling to exist. FHA always looks at condominium community fee delinquency rates before deciding to insure mortgages for condominium purchases.

What percentage of FHA reserve funds are needed for condos?

FHA lending guidelines require condo HOAs to maintain their reserve funds to at least 60 percent.

Why would unit property values drop?

An association that can't keep its community well-maintained and operated could cause unit property values to drop. FHA normally won't insure a mortgage offered by a FHA-approved lender if the condo being bought is controlled by what it considers a financially risky HOA.

What is FHA housing assistance?

Housing Assistance. |. Home Repair. By Tony Guerra. Since its creation in 1934, the Federal Housing Administration (FHA) has insured millions of mortgages for homebuyers. FHA-insured mortgages are used to finance purchases of residences, including single-family homes and condominiums. FHA's lending guidelines occasionally can result in a refusal ...

Do condos have to have HOA funding?

According to FHA, newly constructed condominium communities are subject to different lending requirements than existing condo communities. New condo communities feature units being sold to their very first owners. There are no HOA reserve funding requirements for newly constructed condo communities, but such communities must have current approved operating budgets. FHA may deny insuring mortgages for newly constructed condos if the communities' operating budgets are stressed financially or lack details.

Does the FHA insure a mortgage for a condominium?

HOA Reserve Funding. The FHA has specific lending guidelines when considering a mortgage for a condominium purchase. For example, FHA won't insure a mortgage for a condominium if the HOA in that community suffers from a funds shortage.

Who is Tony Guerra?

He also spent seven years as an airline operations manager. Guerra is a former realtor, real-estate salesperson, associate broker and real-estate education instructor. He holds a master's degree in management and a bachelor's degree in interdisciplinary studies.

Why do you have to go through the FHA condo approval process?

Going through the FHA Condo Approval process gives homeowners the sense that the Board cares about the community and wants it to thrive. By avoiding the approval process, it will hamper unit owners when they go to sell, refinance, or reverse their units.

What are the requirements for a FHA mortgage?

These requirements include mortgage score, credit history, bankruptcy and foreclosure/short sale history, and employment verification. .

Why are FHA loans lower down payment?

They simply have lower down-payments because they are backed by the Federal Government. People using FHA loans are not statistically more likely to default. FHA Condo Approval is a privilege, not a right. Not all Associations will be eligible for FHA Condo Approval.

How many people use FHA condos?

First and foremost, FHA Condo Approval opens up a sea of buyers. Statistics show that approximately 60% of new homebuyers intend to use an FHA Loan. If your community does not have FHA condo approval, you potentially limit the buying pool to only 40% of homebuyers.

How much does a FHA review cost?

FHA Review charges a flat rate of $850 per submission or $765 for FHA renewals.

What happens if you become FHA certified?

If we become FHA Certified, the FHA will have control over our community – FALSE. The FHA will not have any “control” over the governing of the community. An FHA certified community has no obligation to maintain its certification, and the FHA does not monitor or visit the Association.

Can you get a reverse mortgage without FHA?

Many owners use these types of loans as a financial planning tool and cannot stay in their units without this type of financing. Without FHA condo approval, unit owners cannot obtain a reverse mortgage.