Buying a foreclosed home can be a good way to score a deal while hunting for real estate. A foreclosure is a house whose owners were unable to pay the mortgage or sell the property. As a result, the real estate lender assumed ownership and is now trying to sell it to recoup some of its costs.

How do you buy a house in foreclosure?

The housing market is red hot, so if you’re considering buying a house at auction, here’s what you should know. More in Watch Now: Tips to become a morning person, and more videos to improve your life (8 of 11) 1 2 3 Here are some tips to become an ...

How to buy real estate foreclosures?

- Research how long the foreclosure sat vacant, whether it endured freeze and thaw seasons unattended, or experienced anything that may have caused significant structural damage. ...

- Hire a home inspector to thoroughly check out the foreclosed home for major problems. ...

- You can try to add loan and inspection contingencies to your offer. ...

How to buy a foreclosed home?

Watch now: ‘That’s the T! ... The T is transgender,’ House representatives debate bill The Bottom Line: Will Missouri legalize sports gambling? Ten Hochman: Friday Q&A!

How do buying foreclosures work?

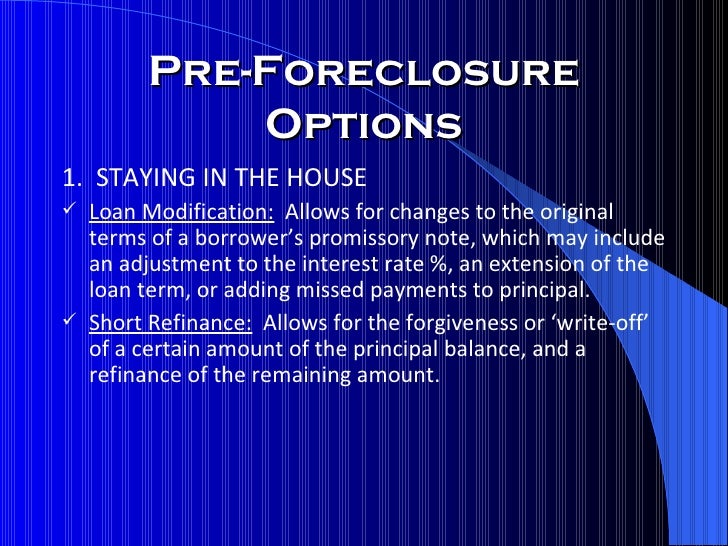

My advice is to work with your lender to develop a way to keep you in your home. They do not want to foreclose any more than you want to be foreclosed on. Time is of the essence. If you are unable to work something out with your lender to remain in your ...

What is foreclosure in real estate?

A foreclosure is a house whose owners were unable to pay the mortgage or sell the property. As a result, the real estate lender assumed ownership and is now trying to sell it to recoup some of its costs.

Why do banks foreclose on homes?

So to salvage their investment , banks foreclose on homes with unpaid mortgages and sell the properties at a foreclosure auction.

What is REO property?

Real estate owned properties, or REO properties, are houses that have been seized by banks or other lenders from people who are unable to pay their mortgages. Essentially, it’s a foreclosure that has been seized by the bank.

What to do if you spot a foreclosed home?

If you spot a home you like, contact the real estate agent on the listing as usual . The biggest caveat when buying a foreclosed home is that it is typically sold as is, which means the bank is not going to fix any problems.

How long does it take to pay off a mortgage if you can't pay?

This form will be sent to the mortgagee via a certified letter, and it typically gives a homeowner 90 days to pay off the most recent bill. This is the beginning of the formal process.

Can you back out of a foreclosure deal without losing your deposit?

That way, if you do encounter problems with the home or attaining a mortgage for it, you can back out of the deal without losing your deposit. Just keep in mind that asking for contingencies does not mean the bank will accept them; they’re not the norm when you buy a foreclosure.

Can you get a foreclosure after one late payment?

And it’s rare for lenders to begin foreclosure after just one late mortgage payment. Lenders usually offer alternatives during this period, including different payment plans to help the homeowners get back on track, keep their home, and keep paying their monthly mortgage bill.

Why buy a foreclosed home?

This is because they’re priced by the lender, who can only make a profit (or get some or all of their money back) if the home gets sold.

What does it mean when a house is foreclosed?

When you see a home listed as foreclosed, it means that it’s owned by the bank. Every mortgage contract has a lien on your property. A lien allows your bank to take control of your property if you stop making your mortgage payments. Foreclosures are typically the result of a financial disaster for the current homeowner that left them unable ...

Why do lenders require appraisals?

Lenders require appraisals before they offer home loans because they need to know that they aren’t lending you too much money.

What is notice of trustee sale?

Notice of trustee’s sale: The lender must record the impending sale with the county and publish news of it in the local paper. This is one way of finding a foreclosure to buy, although in general an online search will be more effective. Trustee’s sale: The lender attempts to sell the property at public auction.

What is an inspection for a foreclosure?

An inspection is a more in-depth look at a home. An expert will walk through the home and write down everything that needs to be replaced or repaired. Because foreclosures usually have more damage than homes for sale by owner, you should insist on an inspection before buying a foreclosed home.

What happens if a bank does not sell at auction?

Real estate-owned: If the property does not sell at auction, the bank will become the owner. They will then attempt to sell the property . For most people looking to buy a foreclosed home, this is the stage of foreclosure in which they will buy.

How long does a foreclosure notice have to be sent?

A notice of default is usually sent by the bank after 90 days of missed payments.

What is foreclosure property?

What, exactly, is a foreclosure property? A foreclosed home is when a lender or lien holder seeks to take a property from a homeowner to satisfy a debt. The lender can either take ownership of the property or, most likely, sell the property to pay off the debt.

What to do if you are an auction newbie?

If you’re an auction newbie, attend a few with the intention of learning not buying. Some are small trustee auctions that don’t take long; others are held by large auction firms and include multiple properties. Seeing how the auction works will prepare you to jump in once you’ve found a property you like.

What are some sources of distressed property information?

Other sources of distressed property information include newspaper legal notices, bank websites, and government websites such as the Federal Housing Administration. Beware of ad-based, subscription websites because which may include inaccurate or outdated listings.

Is distressed property a warranty?

There are no warranties so make sure a certified inspector looks over the property before you make an offer . You need to know how much it will cost to make the place habitable or flippable.

Is a pre foreclosure property for sale?

A pre-foreclosure property is not necessarily for sale. The pre-foreclosure stage is the period after a default notice has been sent to the homeowner and before the property is sold at a foreclosure auction.

What does it mean to buy a foreclosure?

What Does it Mean to Purchase a Foreclosure Property? A foreclosure property is a piece of real estate that a mortgage lender sells to pay off a defaulted mortgage loan. Every foreclosure culminates in a public auction where the lender sells the property and anybody can purchase the property.

How to buy a foreclosure property?

First, you can bid at the sheriff's sale or trustee's sale and if you are the high bidder then the property is yours. More commonly, though, banks and lenders purchase the property at the sale, fix the property up a bit, and then resell the property. This second type of foreclosure property is commonly referred to as banked-owned properties or REOs (real estate owned).

What is foreclosure in mortgage?

Foreclosure is the legal process that occurs when a borrower defaults on a mortgage loan. Lenders foreclose on property to satisfy the outstanding balance on the mortgage loan. For example, if you borrow money from the bank to purchase your home, the bank will require you to sign either a mortgage or a trust deed giving the bank ...

What is a sheriff's sale?

Sheriff's Sale. There are two types of foreclosure processes in California. Under a standard mortgage document the lender will file a foreclosure lawsuit in a California state court, and the judge will order the sheriff's department to sell the mortgaged property. This is called a sheriff's sale because the sheriff runs the auction.

How long can you redeem a foreclosure in California?

The risk of buying a foreclosure property is that the defaulting borrower has the right to "redeem" the mortgage for up to one year after the foreclosure auction. This means that if the borrower comes up with the money to pay off the full mortgage balance plus costs incurred in the foreclosure process then the borrower can take the property back, even if somebody else purchased the property at the auction. So, in California at least, all foreclosure property comes with a risk that the property could get taken away within one year after the auction.

What is trustee sale in California?

More common than a sheriff's sale in California, though, is a trustee's sale. A trustee's sale occurs under a trust deed. A trust deed is similar to a mortgage except that a trust deed allows the lender to foreclose without filing a lawsuit or even involving a judge or sheriff at all. Instead, a trustee appointed by the lender will advertise public notice of the foreclosure auction and then the trustee administers the auction. The trustee sells the property to the highest bidder at the auction.

How long does it take for a lender to pay off a short sale?

During this time — anywhere from 30 to 120 days, depending on local regulations — the borrower can work out an arrangement with the lender via a short sale or pay the outstanding amount owed. If the borrower pays off the default during this phase, foreclosure ends and the borrower avoids home eviction and sale.

What is a trustee sale?

If the default is not remedied by the prescribed deadline, the lender or its representative (referred to as the trustee) sets a date for the home to be sold at a foreclosure auction (sometimes referred to as a Trustee Sale). The Notice of Trustee’s Sale (NTS) is recorded with the County Recorder’s Office with notifications delivered to the borrower, posted on the property and printed in the newspaper. Auctions can be held on the steps of the county courthouse, in the trustee’s office, at a convention center across the country, and even at the property in foreclosure.

What happens if a third party does not purchase a foreclosure?

If a third party does not purchase the property at the foreclosure auction, the lender takes ownership of it and it becomes what is known as a bank-owned property or RE O (real estate owned).

Why can't I make my mortgage payments?

Usually, it’s because they can’t, due to hardships such as unemployment, divorce, death or medical challenges.

What happens if you don't pay off your debt?

If the owner can’t pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction. If the property doesn’t sell there, the lending institution takes possession of it.

What happens at auction for foreclosure?

At the auction, the home is sold to the highest bidder for cash payment.

What is stage 2 of a mortgage?

Stage 2: Public notice . After three to six months of missed payments, the lender records a public notice with the County Recorder’s Office, indicating the borrower has defaulted on the mortgage. In some states, this is called a Notice of Default (NOD); in others, it’s a lis pendens — Latin for “suit pending.”.

What happens if a house is vacant?

If the home has been vacant for some time, its pipes may have frozen or it may now be home to new tenants, in the form of rodents and bugs.

What does "as is" mean in auction?

The highest bidder at the auction buys the property “as is.”. That means you get the title — along with all the liens, unpaid taxes and encumbrances that go along with it. 2. The property may be occupied.

What does it mean when you buy a house as is?

1. You’re buying the home “as is”. Foreclosures occur when a lender repossesses a home from a borrower who has failed to make mortgage payments. The lender, generally, then offers the home for sale at a public foreclosure auction. The highest bidder at the auction buys the property “as is.”. That means you get the title — along with all ...

Can a post sale delay closing?

In some instances, post-sale legal issues can delay the closing for weeks or even months. 5. It might not actually be a bargain. By the time you figure in the costs to remove liens, make repairs and pay back taxes, your foreclosure may not be the great deal you hoped it might be. In a traditional real estate market, ...

Is buying a foreclosure more complicated than buying a house?

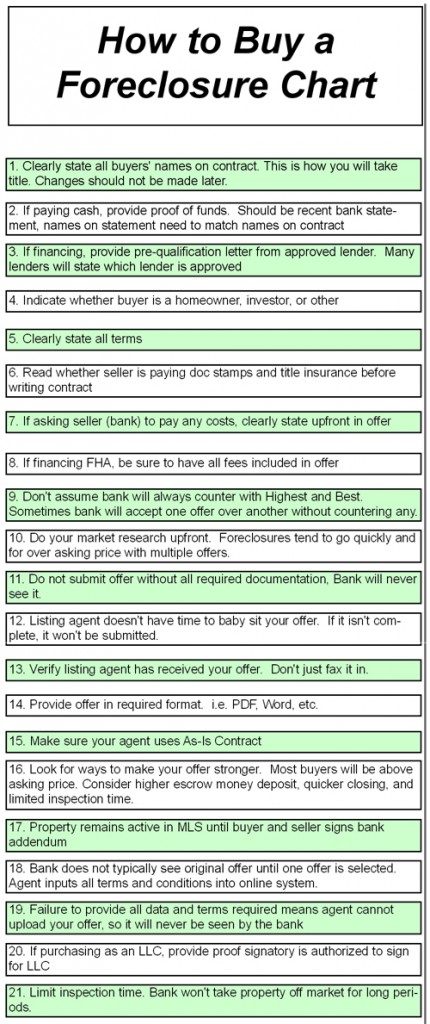

Buying a foreclosure is more complicated than buying a traditional property. The foreclosure process includes waiting periods, which vary from state to state. If you’re buying from a bank, there are often layers of approvals necessary along the way.

Is it better to buy a bank owned or REO property?

Many buyers find it’s a better option to purchase bank-owned or real estate owned (REO) properties. Typically, once the bank owns the property, it addresses any outstanding issues. When buying an REO property, you can — and should — have a home inspection done as a contingency to purchase. 4. There could be delays.

Can you have your home inspected at a foreclosure auction?

The home won’t be inspected. If you buy a property at a foreclosure auction, not only will you not get a chance to have the home inspected, it’s likely you won’t have stepped in the door before you become the legal owner. No inspection means you won’t know about necessary repairs until it’s too late.

Why does foreclosure happen?

Foreclosure commonly comes about because a homeowner has failed to make mortgage payments, but it can happen for other reasons too , like unpaid property taxes.

Why are pre foreclosures surer bets?

The first two could be surer bets because the seller's bank is already on board with the sale. Also, some properties marked pre-foreclosure aren't even for sale; the price is simply an estimate based on area sales data and it was included on the website because there's a public notice on file.

What happens if a short sale is not underwater?

If it is a short sale, the purchase price will be less than the seller owes on the mortgage. The seller and the lender may be actively trying to avoid a foreclosure and thus motivated to make a concession on the price. For more on this topic, see our article on short sale purchases.

What are the stages of foreclosure?

From a purchaser's perspective, foreclosure has three distinct stages: pre-foreclosure, auction and post-foreclosure. Homes can be purchased during any of those three stages. During the pre-foreclosure period, you are purchasing from a struggling homeowner trying to fend off foreclosure. In the other two stages, ...

What happens if a house doesn't sell at an auction?

If the home doesn’t sell at auction, it becomes a bank-owned or real estate owned (REO) property, and the lender can sell it in the general real estate market or at a later REO auction.

What does "as is" mean in a title sale?

Condition and title knowledge: An as-is sale means the bank cannot provide disclosures as to property history or condition, and often inspections are not allowed. The buyer must also research the title before the auction and any liens or back taxes owed will be the responsibility of the buyer.

What is short sale property?

A short sale property is generally sold as-is. Lack of certainty and timeframe: Sellers may back out of a transaction if their financial situation improves. It can take a long time to negotiate with lenders, dragging out the process and sometimes nixing the sale altogether.

Why do foreclosed homes sell so fast?

Part of the reason foreclosed homes sell so fast is because there are fewer on the market, and their prices also usually aren’t as low as they were after the Great Recession.

What are the drawbacks of buying a foreclosed house?

One of the biggest ones is that when dealing with a foreclosure auction, you aren’t allowed to tour the inside of the house, so there are a lot of unknowns.

What does REO mean in foreclosure?

REO property. If the foreclosed house fails to sell at auction, it then becomes an REO property. REO means “real estate owned ” and is another way of saying it’s owned by the bank. There are REO agents you can find who specialize in foreclosure listings.

What is short sale?

Short sale. Another option for you to check out is a short sale. A short sale is a home that’s about to go into foreclosure but is still owned by the homeowner. When you buy a home in a short sale, you might be able to buy the house for the amount of the remaining mortgage balance, or just above it. This means sometimes you can buy a house ...

What percentage of first time homebuyers want a turnkey home?

When you’re looking to buy a foreclosed property, there won’t be as many traditional buyers to compete with. Forty-eight percent of first-time homebuyers want a turnkey home, meaning they aren’t looking for the work associated with most foreclosed properties.

What does "as is" mean when buying a house?

When you’re buying a home “as is,” that means you get not only the house in the shape it’s currently in, but also the title — including any liens placed on the property.

Can a foreclosed home be a loss?

While a foreclosed property might be your gain , for the previous owner, it’s often a traumatic loss. Prior homeowners often fall behind on mortgage payments because of unemployment or health problems. With emotions running high, it’s not unheard of for foreclosed homeowners to destroy a home before their eviction.

What is phase 1 of mortgage?

Phase 1: Payment Default. A payment default occurs when a borrower has missed at least one mortgage payment. The lender will send a missed payment notice indicating that it has not yet received that month’s payment.

What happens if you miss two payments?

After two payments are missed, the lender will often follow up with a demand letter. This is more serious than a missed payment notice. However, at this point, the lender may be still willing to work with the borrower to make arrangements for catching up on payments.

How long does it take to get a house foreclosed on?

There are typically six phases in the foreclosure process and the exact steps vary state by state. Before a home is foreclosed on, owners are given 30 days to fulfill their mortgage obligations. Most lenders would actually prefer to avoid foreclosing on a property.

How many phases of foreclosure are there?

If you (or a loved one) are facing foreclosure, make sure you understand the process. While there is variation from state to state, there are normally six phases of a foreclosure procedure.

How long does a notice of default last?

A notice of default (NOD) is sent after 90 days of missed payments. 4 In some states, the notice is placed prominently on the home. At this point, the loan will be handed over to the lender’s foreclosure department in the same county where the property is located. The borrower is informed that the notice will be recorded.

What happens if a property is not sold at a public auction?

If the property is not sold during the public auction, the lender will become the owner and attempt to sell the property through a broker or with the assistance of a real estate owned (REO) asset manager. 8 These properties are often referred to as “bank owned,” and the lender may remove some of the liens and other expenses in an attempt to make the property more attractive.

What happens when you buy a foreclosed home?

When a foreclosed property is purchased, it is up to the buyer to say how long the previous owners may stay in their former home. Once the highest bidder has been confirmed and the sale is completed, a trustee’s deed upon sale will be provided to the winning bidder.

What, Exactly, Is A Foreclosure Property?

What Is Pre-Foreclosure?

- A pre-foreclosure property is not necessarily for sale. The pre-foreclosure stage is the period after a default notice has been sent to the homeowner and before the property is sold at a foreclosure auction. The owner may be working to fix the loan default or be hoping a cash buyer will purchase the property before foreclosure, which would damage his or her credit. Most experts consider thi…

How Does A Foreclosure Auction Work?

- If you’re an auction newbie, attend a few with the intention of learning not buying. Some are small trustee auctions that don’t take long; others are held by large auction firms and include multiple properties. Seeing how the auction works will prepare you to jump in once you’ve found a property you like. Once that happens, use Zillow’s Foreclosure Estimateto determine what the home will li…

How to Find Foreclosure Properties

- To see pre-foreclosure and foreclosed properties on Zillow, enter your search area, click “Filter,” and then click the “Pre-Market” category. Or you can check Zillow’s Agent Finderto find agents who have experience with foreclosures; open the “Advanced” menu under Service Needed and click Foreclosures in the list of Specialties. Your agent will guide you to foreclosure property listi…

A Few Words of Caution

- Distressed properties are generally sold “as-is,” as in what you see is what you get. There are no warranties so make sure a certified inspector looks over the property before you make an offer. You need to know how much it will cost to make the place habitable or flippable. Lenders typically clear the title before listing a foreclosure, but it’s wise to hire a title company to research and cur…