Stock splits divide a company’s shares into more shares, which in turn lowers a share’s price and increases the number of shares available. For existing shareholders of that company’s stock, this means that they’ll receive additional shares for every one share that they already hold.

Full Answer

Which stock has the most splits?

Stock splits usually work, and the 20-for-1 split by Google’s parent company Alphabet may spark a wave. That’s according to analysis from Bank of America, which found that companies that have announced stock splits have outperformed the market.

Why do companies engage in stock splits?

- Stem CEO discusses acquisition for solar firm Also Energy Holdings and 'green bond' opportunity CNBC

- The Week Ahead: Handful of earnings next week, including Nike and Micron CNBC

- Bitcoin 'may not last that much longer,' academic warns CNBC

- Final Trades: WRK, NVO, LULU & TGT CNBC

- The Chartmaster on why you should avoid brokers and investment banks CNBC

How do I calculate stock splits?

Formula for Calculating Stock Splits

- A Quick Analogy. An easy way to remember how a split works is to think of it like exchanging one dime for two nickels.

- Reasons to Split. Companies may choose to split its stock if the current stock price is too high, especially if the price is significantly higher than other companies in the ...

- Split Ratios. ...

- Calculating Split Ratios. ...

- Price Per Share. ...

How to find stocks that are going to split?

How to Find Stocks That Are Going to Split

- Finding Pending Stock Splits. Visit any financial website that provides a stock splits calendar, such as Yahoo Finance, Nasdaq or MSN Money.

- Determine the Specific Split. Find a stock on the list and identify its split ratio in the “Ratio” column. ...

- Locating the Date of the Split. Find the date in the “Announced” column. ...

- A Word of Caution. ...

Is it good if a stock splits?

Stock splits are generally a sign that a company is doing well, meaning it could be a good investment. Additionally, because the per-share price is lower, they're more affordable and you can potentially buy more shares.

Is it better to buy before or after a stock split?

Should you buy before or after a stock split? Theoretically, stock splits by themselves shouldn't influence share prices after they take effect since they're essentially just cosmetic changes.

Do you lose money when a stock splits?

Do you lose money if a stock splits? No. A stock split won't change the value of your stake in the company, it simply alters the number of shares you own.

Do stocks do well after a split?

In two separate studies in1996 and in 2003, David Ikenberry, Chairman of the Finance Department at the University of Illinois at Urbana-Champaign, found price performance of split stocks outperformed the market by 8 percent during the year following the split and by 12 percent over the ensuing three years.

What are the disadvantages of a stock split?

Greater volatility: One drawback to stock splits is that they tend to increase volatility. Many new investors may buy into the company seeking a short-term bargain, or they may be looking for a well-paying stock dividend.

Should you sell before a stock split?

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Is Tesla doing a stock split?

New York (CNN Business) Tesla shares are about to get three times less expensive. The company announced Friday that its board approved a 3-for-1 stock split, its first split since August 2020. The split would need to be approved by shareholders at the company's annual meeting in August.

How do you handle a stock split?

Common Stock Splits An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Using the example above, divide $40 by two and we get the new trading price of $20. If a stock does a 3-for-2 split, we'd do the same thing: 40/(3/2) = 40/1.5 = $26.67.

Is Tesla going to split again?

Today, as part of the release of its prospectus for its 2022 annual shareholder meeting, Tesla announced that it is going with a three-for-one stock split – meaning that if you own one Tesla share, you will get two more.

What does a 4 to 1 stock split mean?

If you owned 1 share of Example Company valued at $700 per share, your investment would have a total value of $700 (price per share x amount of shares held). At the time the company completed the 4-for-1 forward split, you would now own 4 shares valued at $175 per share, resulting in a total value invested of $700.

Did Amazon have a stock split?

Today marked the first trading day following Amazon's (AMZN) 20-for-1 stock split that the company announced on March 9. Amazon shares were revalued to $120 per share, after trading well above $2000 per share prior to the stock split.

How long does a stock split last?

A company announcing a split usually sets an effective date of 10–30 days after the announcement. All shareholders who own the stock the trading day before the ex-date will take part in the split. The shares might take another few days to settle.

What happens to my shares if they undergo a stock split?

After a split, the stock price will decline since the number of outstanding shares has increased. This, however, does not change the market capital...

What are the types of stock splits?

The most standard stock splits are traditional stock splits, such as 2-for-1 and 3-for-1. For example, in a 2-for-1 stock split, a shareholder rece...

Are stock splits good?

Stock splits are predominantly the result of the company's significant stock price rise that might impede new investors. Thus, a split is often the...

What is a reverse stock split?

A reverse split reduces a company's outstanding shares increasing per-share value. It is typically done to avoid being delisted from an exchange if...

What is a stock split?

A stock split is when a company’s board of directors issues more shares of stock to its current shareholders without diluting the value of their stakes. A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall valuation ...

Why do companies split their stock?

When a company is concerned that its share price is too high or too low, it can opt for a stock split or a reverse stock split. A stock split can help a company lower its share price to appeal to new investors, while a reverse stock split can boost its share price and help preserve its listing on a major stock exchange.

Does a stock split change the underlying value of an investment?

Because a stock split doesn’t change the underlying value of your investment, you may not notice any more substantial changes than the number of shares in your investment account. “There’s no particular advantage for those who already have shares,” Holden says. “Nothing about ownership is going to change.

Is a stock split a two for one?

Two-for-one and 3-for-1 stock splits are relatively common, says Holden. While Apple ( AAPL) and Tesla ( TSLA) have gotten a lot of publicity for their 2020 stock splits, their 5-for-1 or 4-for-1 stock splits were more unusual.

Can more people buy stock?

The ability for more people to buy a stock can bump up its price, which in turn may actually increase a company’s value, at least temporarily, Holden says. “With more people able to buy, you see more demand, and the price can go up. If you have more shares, this can be beneficial to you if you hold on,” Holden says.

Can you have more shares if you hold on?

If you have more shares, this can be beneficial to you if you hold on,” Holden says. “However, that stock and total value bump is generally temporary. To see long-term gains, you usually need to keep holding that stock to get the benefit over time.”.

Does a stock split affect current investors?

The Bottom Line. In the end, a stock split—or even a reverse stock split—doesn’t have a huge practical impact on a company’s current investors. A stock split’s biggest impact is on investors who might be watching a particular stock and hoping to purchase a full share for a lower price. For those investors, a stock split can provide ...

Stock split definition

A stock split occurs when a company decides to increase the number of shares outstanding to boost the stock’s liquidity. Though the number of shares increases, the overall value of shares outstanding stays the same because the split does not fundamentally change the company’s value.

How does stock split work?

A stock split is a way for companies to change the per-share price without changing market capitalization. Market capitalization (cap) refers to the total value of a company’s issued stock. It is calculated by multiplying the price per stock by the total number of shares outstanding.

Why would a company split its stock?

Many public companies implement a stock split after the share price has exhibited significant growth. Reducing the trading price into a more comfortable range will make their stock look more attractive from a per-share price and encourage investors to buy it.

What does it mean for investors?

A stock split is normally an indication that a company is thriving and its stock price has increased. Though theoretically, it should not affect a stock’s price, it often results in renewed investor interest, which can positively influence the stock price.

Example of a stock split

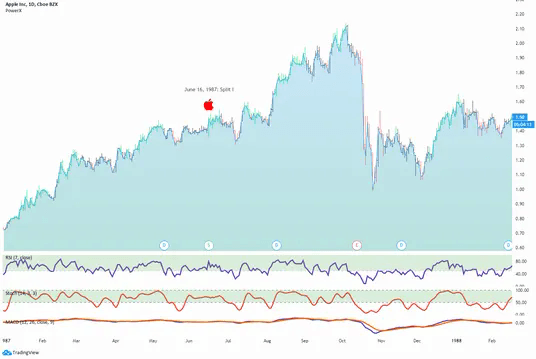

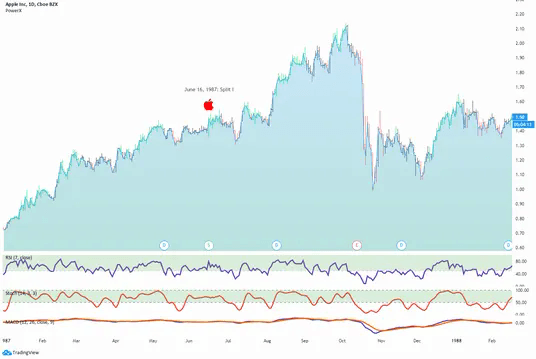

In August 2020, Apple ( AAPL) split its shares 4-for-1. Right before the split, each share was trading at around $540. Post-split, the share price was $135 (approximately $540 divided by 4).

Reverse stock split explained

A reverse stock split is the opposite of a stock split (also known as a forward stock split). A reverse stock split occurs when a company consolidates the number of existing shares of stock into fewer higher-priced shares. Like with a forward stock split, the market value of a company after a reverse split stays the same.

The downturns of reverse stock split

A reverse stock split can often signify a company in distress and is not perceived positively by market participants. It is usually an indicator that the stock price has plummeted, and the company’s board of directors is attempting to inflate the prices artificially without any fundamental business proposition.

What is a stock split?

A stock split is a corporate action by a company's board of directors that increases the number of outstanding shares. This is done by dividing each share into multiple ones—diminishing its stock price. A stock split, though, does nothing to the company's market capitalization.

Why do you split a stock?

Splitting the stock also gives existing shareholders the feeling that they suddenly have more shares than they did before , and of course, if the price rises, they have more stock to trade. Another reason, and arguably a more logical one, is to increase a stock's liquidity.

Why is the total dollar value of the shares the same?

The total dollar value of the shares remains the same because the split doesn't add real value. The most common splits are 2-for-1 or 3-for-1, which means a stockholder gets two or three shares, respectively, for every share held.

Why do companies reverse split?

Reverse stock splits are usually implemented because a company's share price loses significant value. Companies can also implement a reverse stock split. A 1-for-10 split means that for every 10 shares you own, you get one share. Below, we illustrate exactly what effect a split has on the number of shares, share price, ...

Why do companies split their stock?

There are several reasons companies consider carrying out a stock split. The first reason is psychology. As the price of a stock gets higher and higher , some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable.

Should I buy a stock split?

The Bottom Line. A stock split should not be the primary reason for buying a company's stock. While there are some psychological reasons why companies split their stock, it doesn't change any of the business fundamentals. Remember, the split has no effect on the company's worth as measured by its market cap.

Is buying before a split a good strategy?

Historically, buying before the split was a good strategy due to commissions weighted by the number of shares you bought. It was advantageous only because it saved you money on commissions. This isn't such an advantage today since most brokers offer a flat fee for commissions.

What Is a Stock Split?

A stock split is a corporate action that companies take to increase the number of outstanding shares and decrease the value of each share. In other words, as a company’s stock price increases, investors are rewarded with higher returns.

Why Companies Do Stock Splits

A stock split is often a sign that a company is thriving and that its stock price has increased. While that’s a good thing, it also means the stock has become less affordable for investors. As a result, companies may do a stock split to make the stock more affordable and enticing to individual investors.

What Happens When A Stock You Own Splits?

As a shareholder, you may worry that a stock split will affect your investment. But ultimately, there’s little impact on you as an investor.

What Does This Mean for the Average Investor?

Typically, stock splits are neither good nor bad, especially in the long run. When a stock splits, investors usually see an uptick in interest in that stock but everything should settle down in a few days when the fuss is over.

What Is a Reverse Stock Split?

The opposite of a stock split is a reverse stock split. It’s when a company reduces the number of outstanding shares. Rather than breaking each share into multiple new shares, a reverse stock split is when a company condenses multiple shares into a single share, which trades at a higher price point.

Are Stock Splits Announced Before They Happen?

If a company that you’re a shareholder of goes through a stock split, you’ll get some advanced notice. Once a company’s board of directors approves a stock split, the company is required to notify the Securities and Exchange Commission at least 10 days before the proposed split.

Should You Invest After a Stock Split?

If you’ve been considering investing in a particular company, after a stock split can be a good time to do so. Stock splits are generally a sign that a company is doing well, meaning it could be a good investment. Additionally, because the per-share price is lower, they’re more affordable and you can potentially buy more shares.

What is a stock split?

A stock split is a tactic for making a stock more attainable to smaller investors, particularly when its price has ratcheted sky-high over time. One recent example: On July 30, Apple announced a 4-for-1 stock split in a bid to bring its share price back to around $100.

Why do investors react positively to stock splits?

However, investors generally react positively to stock splits, partly because these announcements signal that a company’s board wants to attract investors by making the price more affordable and increasing the number of shares available. As a result, your portfolio could see a handsome benefit if the stock continues to appreciate.

What is reverse stock split?

There is also such a thing as a “reverse” stock split — as the name suggests, this kind of split goes the opposite way: The number of shares is reduced, but the price per share increases. This is often done to meet the minimum stock price required for a company to be listed on an exchange.

Do you have to be a shareholder to split a stock?

You need to be a shareholder by a certain date, specified by the company, to qualify for a split. If you're not yet an investor in a company, and a stock split has made its share price more affordable, you'll want to research the stock to ensure it's a good investment for your portfolio before you buy.

Does a stock split make you rich?

A stock split doesn't make investors rich. In fact, the company’s market capitalization, equal to shares outstanding multiplied by the price per share, isn’t affected by a stock split. If the number of shares increases, the share price will decrease by a proportional amount.

What does 2-1 mean in stock splits?

For example, a 2 for 1, or 2-1, stock split means that the company gives shareholders 2 shares for every 1 they currently own. If you had 100 shares of Apple and Apple announces a 2-1 stock split, you would then have 200 shares after the split occurs.

What would happen if Apple announced a 1 for 2 split?

For example, if Apple announced a 1 for 2, or 1-2 reverse stock split, investors would be given 1 share for every 2 shares they have. In addition, the price of the shares would double.