LendingClub Help Business Tax returns. We use these to verify your income and sales. We may ask for copies of your recent tax returns, or for tax forms, such 1099s or Schedule K1s to verify all of the details.

See more

Is LendingClub hard to get approved?

Accessible to most borrowers: LendingClub requires a minimum credit score of 600 to qualify. However, the best loan terms will go to borrowers with high incomes and excellent credit scores. Offers joint applications: If you won't qualify for a loan on your own, you may be able to apply with a co-borrower.

Does LendingClub do a credit check?

When you check your rate through LendingClub, we use a soft inquiry. We'll only do a hard pull of your credit (which could affect your credit score) once your loan is approved. If your loan application isn't approved, there's no need to worry. Being declined doesn't hurt your credit.

How long does it take LendingClub to verify income?

Once you've uploaded all the documents we've requested, you'll see a status update that your documents are in review. If we need additional information while your application is in review, we'll reach out to you by phone or email. It usually takes about two business days for us to review your documents.

Does LendingClub do a soft credit check?

Checking your rate with LendingClub Bank has absolutely no impact to your credit score because we use a soft credit pull. A hard credit pull that could impact your score will only occur if you continue with your loan and your money is sent.

Does LendingClub Call your employer?

To process your loan, we may need to confirm your income matches what was on your application. If this happens, we'll ask you to submit documents like recent pay stubs or bank statements through your To-Do List. Your employer might also be contacted for more information.

What bank does LendingClub use?

LendingClub Bank, N.A.How LendingClub is regulated. All loans are made by LendingClub Bank, N.A., which operates under federal banking law. LendingClub Bank is FDIC-insured and is subject to consumer lending regulations, including the Truth in Lending Act, the Equal Credit Opportunity Act, and the Fair Credit Reporting Act.

Does LendingClub ask for proof of income?

A completed form can quickly help us verify your income. Your Client Advisor will work with you to complete the form and ensure the signatures are valid. Proof of personal income. We may ask for additional documents to verify your personal income, such as recent bank statements or pay stubs.

Does lending point ask for Paystubs?

Qualifying for a LendingPoint Personal Loan Job history (12 months or more at the same job is an advantage) Verifiable income (pay stubs, bank statements or tax forms)

Why does LendingClub need my bank account?

Linking your bank account to your LendingClub account tells us where your loan should be deposited and can help speed things along. If you choose to use autopay, your payments will come from this same account.

Where can I borrow money immediately?

If you need to borrow money immediately, the most popular options are personal loans, cash advances online, payday loans, pawn shop loans, and banks or credit unions.

Is Lending Tree and LendingClub the same?

How they're different. The main difference is that LendingClub is a peer-to-peer lender, while LendingTree is an online lending marketplace. This means that LendingClub relies on investors to fund your loan while LendingTree can help you prequalify for multiple lenders with one application.

Who owns LendingClub?

Renaud LaplancheRenaud Laplanche, CEO and founder of Lending Club. More than two years after his ouster from LendingClub, Renaud Laplanche still owns millions of dollars worth of stock in the company he created, even though he's since started a rival online lender that's rapidly growing.

Does applying for LendingClub affect credit score?

No, checking your rate and applying for a loan with LendingClub Bank won't affect your credit score. It generates a soft credit inquiry to provide insight into your creditworthiness. You'll see that soft inquiry on your credit report, but others who access your report won't see it.

Does LendingTree do a soft or hard pull?

Simply answer a few questions, provide some basic personal and income information, including your social security number, and wait for the results. At this point, LendingTree will perform a soft credit check and send your information to its lending partners. Within minutes you'll get offers from 5 different lenders.

What's the difference between a hard credit check and a soft credit check?

There are two different types of credit inquiries: hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which don't affect your score at all.

Is Lending Tree and LendingClub the same?

How they're different. The main difference is that LendingClub is a peer-to-peer lender, while LendingTree is an online lending marketplace. This means that LendingClub relies on investors to fund your loan while LendingTree can help you prequalify for multiple lenders with one application.

How does Lending Club verify your income?

We use these to verify your income and sales. We may ask for copies of your recent tax returns or for tax forms, such as 1099s or Schedule K1s, to...

Do loan companies check your employment?

Mortgage lenders usually verify your employment by contacting your employer directly and by reviewing recent income documentation. The borrower mus...

Do personal loan companies call your employer?

The lender will call your Human Resources department if there is one or will call directly to your supervisor. Some companies require lenders to ta...

Is Lending Club hard to get approved?

LendingClub loans are reportedly easier to get than the average unsecured personal loan, however, with a credit score requirement somewhere between...

How to check if lendingclub has withdrawn money?

Check your bank account online, by phone, or at a branch to determine the small amount LendingClub has withdrawn and deposited to your account.

What happens when you verify your bank account?

Once you have successfully verified your bank account, a checkmark will appear next to that task in your To-Do List.

How to link bank account?

Linking and verifying your bank account 1 Select whether the bank account you’re providing is for a checking or savings account. 2 Enter your name as it appears on your bank account. 3 Enter your bank name, routing number, and account number.#N#For checking accounts, you’ll find this information at the bottom of your checks.

Do credit unions use different account numbers?

Note: Credit unions sometimes use a different account number for automatic transactions, like the ACH process we use for withdrawing payments. If you have a credit union account, confirm that you have the account number for ACH deposits and withdrawals.

What is Lending Club?

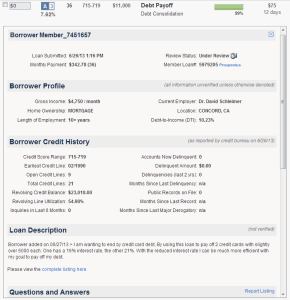

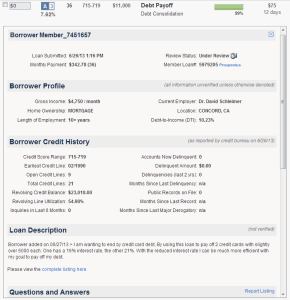

Lending Club, formerly the largest peer-to-peer lending network, is responsible for over $60 Billion in loans as of September 2020. They moved to be a more traditional lender at the end of 2020 and their acquisition of Radius Bancorp.

What is the final step to getting a loan from lending club?

The final step to receiving your Lending Club loan will require the most legwork. Lending Club asks that borrowers who have reached this step to submit a variety of paperwork electronically to prove income. You may be asked to submit anything from tax returns to pay stubs to bank statements.

How long does it take for a loan to lower your credit score?

While simply checking your rate to get the ball rolling with Lending Club does not affect your credit score, this hard inquiry will lower your score for a few months. If you do take a loan with Lending Club, it’s a good idea to wait at least six months before applying for another loan to let your score recover.

What to do if lending club denies loan?

Alternatives to Borrowing from Lending Club. If Lending Club denies you a loan, there are some other options you may want to consider. But before you move on to other lenders first review your credit report and make sure there are no negative marks that would affect your ability to get a loan.

How much is the origination fee for lending club?

In addition to your APR, it’s important to remember that Lending Club charges an origination fee of between 1 and 6% on each loan, depending upon your credit. The origination fee is how Lending Club makes its money. This is something you need to take into account when you request your loan.

What is the interest rate on a lending club?

Lending Club interest rates vary between 6.46% and 27.27%, depending on the loan grade. Loan are graded from A to E with A being the best grade with the lowest rate. There are no application, brokerage, or prepayment fees.

How long does it take for a loan to be paid off in lending club?

One month after the loan is deposited in your bank account, Lending Club will begin automatically debiting your monthly payment from the same account where the loan was deposited. If you do nothing, your monthly payment will continue until the loan is paid off.

What is Lending Club?

Before investors can determine if Lending Club is a safe and legitimate company, we need to know exactly what Lending Club's business is.

How to file a complaint with lending club?

If in doubt, go to lendingclub.com or call Lending Club directly at 1.888.596.3157. If you have had this experience you can file a complaint with the IC3 (internet crime complaint center) at www.ic3.gov. Lending Club also recommends adding a fraud alert to your credit bureau report and filing a complaint with the FTC and CFPB. Lending Club continues to work with consumers and any and all appropriate and willing law enforcement agencies to find and prosecute these criminals (FBI Complaint Id: I1309251131004212, FTC Complaint Id: 48697737).

What happens if lending club goes bankrupt?

For example, if Lending Club goes bankrupt, there is no government guarantee that all investors will be paid the principal amount in their Lending Club accounts.

What is the 1% service fee for lending club?

The 1% service fee Lending Club collects on each payment received by the investor comparable to the trading commission an investor might pay on a corporate bond.

Is lending club a legitimate business?

Lending Club is a legitimate business that offers investors a chance to make loans to bor rowers and earn higher interest rates than those offered by banks, savings and loans, and credit unions. Lending Club is regulated by the SEC, and does business with FDIC insured banks.

Is lending club a member of FDIC?

Lending Club is NOT a member of FDIC - it's not a bank. However, cash not invested in Lending Club Notes is held at Wells Fargo Bank in trust for all Lending Club investors, so uninvested money is fully protected by the FDIC. All Lending Club loans are unsecured, fully amortized personal loans. This means investors are taking risks with ...

Who is the main competitor of lending club?

Lending Club's main competitor is a company called Prosper. It managed to generate better rates for both investors and borrowers.

How to confirm employment before loan?

The fastest way to confirm your employment is to provide your work email address. Your work email address is ONLY used for employment verification.

What is the email address used for employment verification?

Your work email address is ONLY used for employment verification. All other emails about your loan will go to the email address you put on your loan application.

What is lending club?

Lending Club is a peer to peer lending company that offers loans through the internet. Unlike a traditional bank, Lending Club works by connecting borrowers who need a loan to investors who have extra cash to lend. Since there’s no banks involved, no vaults or tellers or other expensive bank things, Lending Club can pass ...

What is the biggest complaint about lending club?

The biggest complaint people have about Lending Club, more than all other complaints, is that their request for a loan gets denied. This can be really frustrating considering how much time it takes to fill out the application, especially if they are applying because they received an advertisement from Lending Club in the mail telling them that they were “pre-approved”.

What makes a good borrower?

Simply put, a good borrower is someone who has (A) a long healthy history of paying back their loans, and (B) who has a good job to help them pay their loans back. There may be a few other things that make people good loan candidates (like renting vs. owning a home), but those are the big two, credit history and income, so let’s talk about those one by one.

Why is credit history important?

Option A: Lower rates through better credit history. Your credit history is an important part of being a healthy person. It allows you to get a home mortgage or take out a loan to start a small business. Your credit report is something you should be aware of and nurture, like a garden.

How to get lending club off your back?

Whatever it is, the best way to get Lending Club off your back is to create a budget and stick to it. If all else fails, you can always try calling Lending Club and telling them about your situation. Maybe they have a payment plan to offer you.

Is there a prepayment penalty on lending club loans?

Not only is the interest rate usually lower than a credit card, but the rate is also fixed which means it will never go up, even if you make a late payment. Finally, there is no prepayment penalty. You can always pay your loan off early without a fee.

Does lending club ask for money?

Did Lending Club ask you to send them money or a gift card to receive your loan? Sorry, but you are being scammed. Lending Club never asks for money up front. Their fee is taken from your loan after you are approved. So if you apply for a $5,000 loan and your fee is 5% then you will have $250 taken from the lump sum they send you, meaning you will have $4750 deposited into your bank from Lending Club, yet still have to pay back the full $5,000. See how that works? Lending Club never ask you for money to get a loan through them. Instead, they take their fee from your loan transfer.