Full Answer

What is the macroprudential approach?

Macroprudential regulation is the approach to financial regulation that aims to mitigate risk to the financial system as a whole (or " systemic risk "). In the aftermath of the late-2000s financial crisis, there is a growing consensus among policymakers and economic researchers about the need to re-orient...

What is the main goal of macroprudential regulation?

The main goal of macroprudential regulation is to reduce the risk and the macroeconomic costs of financial instability. It is recognized as a necessary ingredient to fill the gap between macroeconomic policy and the traditional microprudential regulation of financial institutions.

What is macroprudential supervision and regulation?

Macroprudential supervision and regulation assess how a financial institution is connected with the rest of the financial system and real economy. It assesses the risk that a firm’s distress could have on the financial sector and economy, and feedback effects to that firm. (Think Lehman Brothers in 2008.)

What are the components of macroprudential analysis?

Finally, macroprudential analysis looks at key components of the financial markets, including prevailing credit ratings and the yields and market prices of financial instruments. Macroprudential analysis is designed to identify, well in advance, the risks to an operation or structure of financial institutions or markets.

What is macroprudential tool?

Macroprudential policies are financial policies aimed at ensuring the stability of the financial system as a whole to prevent substantial disruptions in credit and other vital financial services necessary for stable economic growth.

What is the purpose of macroprudential policy?

The ultimate objective of macroprudential policy is to preserve financial stability. This includes making the financial system more resilient and limiting the build-up of vulnerabilities, in order to mitigate systemic risk and ensure that financial services continue to be provided effectively to the real economy.

What are macroprudential risks?

Macroprudential analysis is designed to identify, well in advance, the risks to an operation or structure of financial institutions or markets. These risks are called systemic risks. At worst, the realization of such a risk could lead to financial crises and intensify the macroeconomic impact of such crises.

What is the difference between microprudential and macroprudential regulations?

Microprudential policy adjusts capital based on individual institutions' risks, while macroprudential policy adjusts overall levels of capital based on the financial cycle and systemic relevance to guard against systemic risk buildup.

Who is responsible for macroprudential regulation?

Macroprudential bodies The European Systemic Risk Board (ESRB), established in 2011, is a top-level body responsible for macroprudential oversight of the financial system in the EU. The ESRB has a broad responsibility that includes all EU Member States and all financial system sectors.

What is macroprudential policy framework?

While there is no universally accepted definition, most refer to macroprudential policy as the use of prudential actions to contain risks that, if realised, could have widespread implications for the financial system as a whole as well as the real economy; these risks are often referred to as systemic risks.

What is macroprudential regulation UK?

Macro- prudential regulation involves the identification, monitoring and mitigation of systemic risks before they can crystallise, preventing those risks from triggering instability in the financial sector.

Why is it a good idea for macroprudential policies to require countercyclical capital requirements?

55. Why is it a good idea for macroprudential policies to require countercyclical capital requirements? B. This type of policy reduces lending and helps to mitigate credit bubbles during economic booms.

What is macroprudential policy IMF?

Macroprudential policies are designed to identify and mitigate risks to systemic stability, in turn reducing the cost to the economy from a disruption in financial services that underpin the workings of financial markets—such as the provision of credit, but also of insurance and payment and settlement services (FSB/IMF ...

What is the difference between the FCA and PRA?

The PRA and the FCA are two separate entities – although we do work closely with the FCA Opens in a new window on certain issues/firms. The main difference is that the FCA works with firms to ensure fair outcomes for consumers.

Why is it important for the US government to have resolution authority?

Why is it important for the U.S. government to have resolution authority? A. Resolution authority solves asymmetric information problems and thus prevents a contagion effect.

Are shadow banks regulated?

The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking. It is generally unregulated and not subject to the same kinds of risk, liquidity, and capital restrictions as traditional banks are.

What is macroprudential policy IMF?

Macroprudential policies are designed to identify and mitigate risks to systemic stability, in turn reducing the cost to the economy from a disruption in financial services that underpin the workings of financial markets—such as the provision of credit, but also of insurance and payment and settlement services (FSB/IMF ...

What do the FPC do?

The Financial Policy Committee (FPC) leads our work on financial stability. It identifies and monitors risks that threaten the resilience of the UK financial system as a whole. It also has power to take action to counter those risks. An example of such a risk is unsustainable levels of debt and credit growth.

What is the meaning of financial stability?

Financial stability is a condition in which an economy's mechanisms for pricing, allocating, and managing financial risks (credit, liquidity, counterparty, market, etc.) are functioning well enough to contribute to the performance of the economy (as defined above).

What does quantitative easing do to inflation?

How does quantitative easing affect inflation? Quantitative easing's primary goal is to encourage spending in the economy. Therefore, an increase in consumer demand and supply of money implies an increase in inflation.

Are we missing a good definition for macroprudential? Don't keep it to yourself..

The ASL fingerspelling provided here is most commonly used for proper names of people and places; it is also used in some languages for concepts for which no sign is available at that moment.

Definitions & Translations

Get instant definitions for any word that hits you anywhere on the web!

What is macroprudential regulation?

Macroprudential regulation is an approach to financial regulation, aiming to mitigate risk to the entire financial system and thus avoiding and reducing the macroeconomic costs of financial instability. The approach is used by central banks and regulators around the world.

Where have you heard about macroprudential regulation?

Macroprudential regulation was born after the late-2000s financial crisis as an attempt to restructure the regulatory framework. The term 'macroprudential' was first used in the late 1970s in unpublished documents by the Cooke Committee and the Bank of England.

What you need to know about macroprudential regulation

Macroprudential regulation should not be confused with microprudential regulation, which aims to enhance the safety of individual financial institutions, rather than the entire financial system as a whole.

What does macroprudential mean?

The prefix macro indicates that the policies or actions relate to the whole or significant parts of the financial system rather than individual financial institutions. Supervisory or regulatory policies for individual financial institutions, by contrast, are known as microprudential policies.

What are macroprudential policies and why do we have them?

Macroprudential authorities monitor the financial system and identify risks and vulnerabilities. Policies addressing such risks and vulnerabilities can be put in place and limit them from building up further and spreading across the financial system.

Examples of risks that could lead to systemic risk

The building-up of asset price bubbles. When the prices of assets, such as houses, increase far beyond their intrinsic value, the risk of a sudden fall in those prices creates dangers

What action do the authorities take based on these policies?

The authorities (often, central banks) can take a range of actions designed to directly address the risk.

When was the term "macroprudential" first used?

History. As documented by Clement (2010), the term "macroprudential" was first used in the late 1970s in unpublished documents of the Cooke Committee (the precursor of the Basel Committee on Banking Supervision) and the Bank of England. But only in the early 2000s—after two decades of recurrent financial crises in industrial and, most often, ...

When did macroprudential approach become increasingly promoted?

But only in the early 2000s—after two decades of recurrent financial crises in industrial and, most often, emerging market countries —did the macroprudential approach to the regulatory and supervisory framework become increasingly promoted, especially by authorities of the Bank for International Settlements.

What are the three paradigms of prudential regulation?

On theoretical grounds, it has been argued that a reform of prudential regulation should integrate three different paradigms: the agency paradigm, the externalities paradigm, and the mood swings paradigm. The role of macroprudential regulation is particularly stressed by the last two of them.

What is macrorudential regulation?

Macroprudential regulation is the approach to financial regulation that aims to mitigate risk to the financial system as a whole (or " systemic risk "). In the aftermath of the late-2000s financial crisis, there is a growing consensus among policymakers and economic researchers about the need to re-orient the regulatory framework towards a macroprudential perspective.

Is macroprudential regulation a leakage?

On the international level, there are several potential sources of leakage and arbitrage from macroprudential regulation, such as banks' lending via foreign branches and direct cross-border lending. Also, as emerging economies impose controls on capital flows with prudential purposes, other countries may suffer negative spillover effects. Therefore, global coordination of macroprudential policies is considered as necessary to foster their effectiveness.

When was the macrorudential toolkit conference?

Office of Financial Research and the Financial Stability Oversight Council conference, entitled “The Macroprudential Toolkit: Measurement and Analysis” December 1-2, 2011 Washington, DC.

Is there agreement on which one should play the primary role in the implementation of macroprudential policy?

A large number of instruments have been proposed; however, there is no agreement about which one should play the primary role in the implementation of macroprudential policy.

What is macroprudential policy?

Macroprudential policies are financial policies aimed at ensuring the stability of the financial system as a whole to prevent substantial disruptions in credit and other vital financial services necessary for stable economic growth. The stability of the financial system is at greater risk when financial vulnerabilities are high, such as when institutions and investors have high leverage and are overly reliant on uninsured short-term funding, and interconnections are complex and opaque. High vulnerabilities increase the likelihood that a firm’s failure or other negative shock would cause distress at other financial institutions because of direct exposures and through fire sales, contagion, or other negative externalities arising from the initial shock. Macroprudential policies aim to reduce the financial system’s sensitivity to shocks by limiting the buildup of financial vulnerabilities.

What are some examples of macroprudential policies?

One example of a macroprudential policy is the higher capital charge applied to Global Systemically Important Banks (G-SIBs), banks that pose more risk to the system. The G-SIB capital surcharge is based on five types of characteristics viewed to increase a bank’s systemic risk: size, complexity, interconnectedness, lack of substitutes, and cross-jurisdictional activity. Higher capital charges reduce the likelihood that a G-SIB would fail because they will have thicker capital cushions to absorb losses.

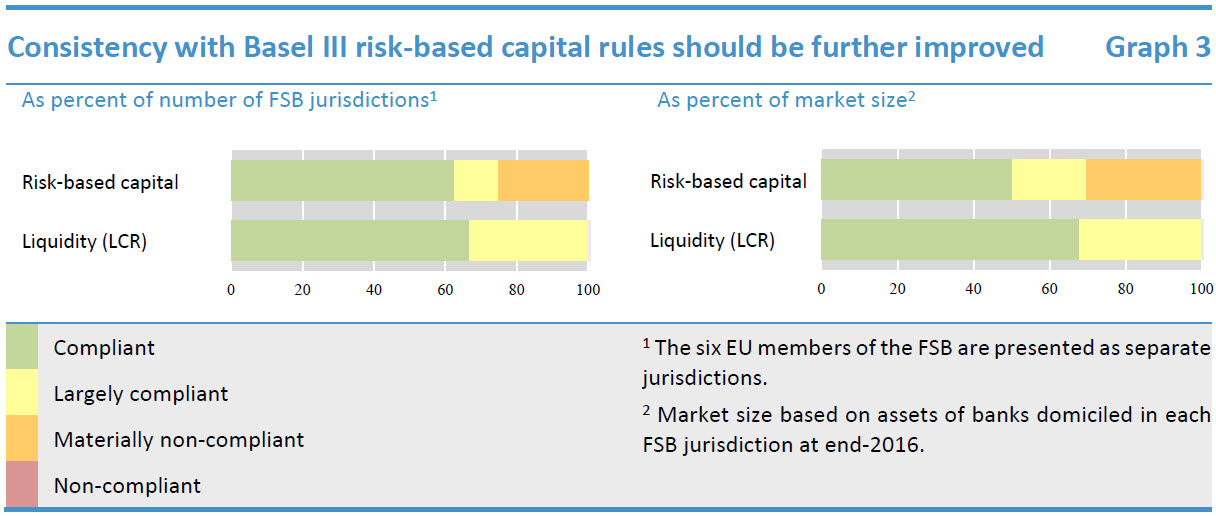

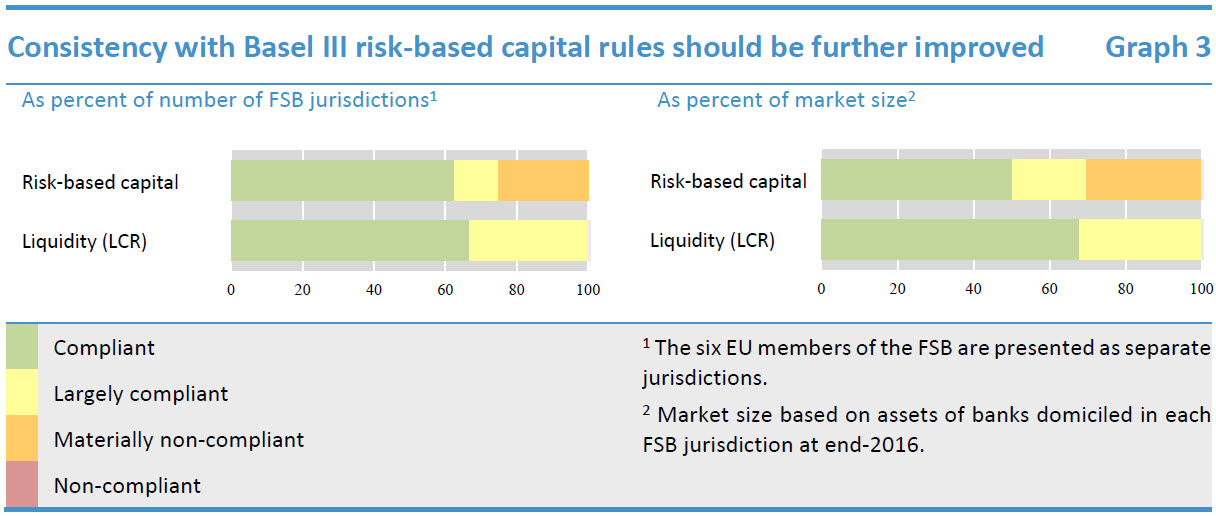

Why did governments adopt macroprudential policies?

To reduce the risks of a repeat of the global financial crisis of 2007-09 — which revealed the inadequacy of the capital, liquidity, and transparency of banks and other big financial firms — governments around the world have embraced “macroprudential policies” to supplement traditional “microprudential policies.”.

Can macroprudential policies increase credit growth?

All in all, although the research on effectiveness of macroprudential policies is limited, largely because the use of these policies in many countries is relatively new, multiple studies find that macroprudential policies can limit credit growth and improve resilience.

What is macroprudential supervision?

Macroprudential supervision focuses on the stability of entire industries and the health of the relationships within the financial sector that can significantly impact the economy. The main goal of a regulatory framework is to monitor systemic risk in order to prevent unnecessary constraints on the supply of credit, especially in time of stress. We learned from the crisis that financial institutions that do not fully bear the cost of their actions but affect other participants in the financial system can generate such a risk. Most policymakers (governments, central banks, and international institutions) agree on the need for macroprudential policy to reduce systemic risk, whether it is to correct for market failure, that is the risk of contagion due to the failure of systemically important institutions or smooth financial cycles, that is avoiding bubbles.

Can macroprudential policies be supplemented?

As an alternative, macroprudential policy can complement and supplement monetary policy in dealing with macroeconomic as well as stability issues. Yet the debate on macroprudential policy remains quite obscure for many.

Understanding Macroprudential Analysis

- Macroprudential analysis looks at the health of the underlying financial institutions in the system and performs stress tests and scenario analysisto help determine the system's sensitivity to economic shocks. Macroeconomic and market data are also reviewed to determine the health o…

Purpose of Macroprudential Analysis

- Macroprudential analysis is designed to identify, well in advance, the risks to an operation or structure of financial institutions or markets. These risks are called systemic risks. At worst, the realization of such a risk could lead to financial crisesand intensify the macroeconomic impact of such crises. Risk may arise from credit cycles, built-in structural features, and vulnerabilities of t…

Conducting Macroprudential Analyses

- Typically, financial institutions will cooperate on executing a comprehensive macroprudential analysis. The Bank of Finland, for example, cooperates closely with the Finnish Financial Supervisory Authority and the country's Ministry of Finance in macroprudential risk analyses to establish the interlinkages between the real economy and the financial markets. It has deep exp…