The sign of NPV can explain a lot about whether the investment is good or not:

- NPV > 0: The PV of the inflows is greater than the PV of the outflows. ...

- NPV = 0: The PV of the inflows is equal to the PV of the outflows. ...

- NPV < 0: The PV of the inflows is less than the PV of the outflows. ...

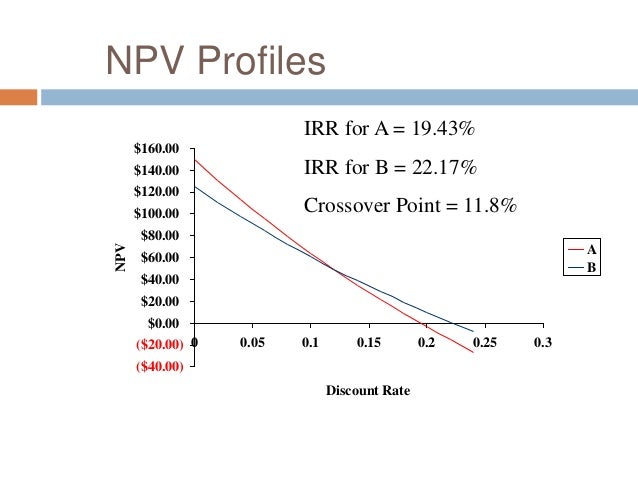

Why is NPV better than IRR?

- From the above calculation, you can see that the NPV generated by the plant is positive and IRR is 14%, which is more than the required rate of return

- This implies when the discounting rate will be 14%, NPV will become zero.

- Hence, the XYZ company can invest in this plant.

Which NPV is better higher or lower?

When comparing similar investments, a higher NPV is better than a lower one. When comparing investments of different amounts or over different periods, the size of the NPV is less important since...

How to use NPV formula?

How to use the NPV calculation formula. To use the NPV formula to estimate the net present value of a proposed investment, you need to determine the expected net present value of the future cash flows from the investment and deduct the project's initial investment. Accept the project if the NPV result is zero or positive.

How to figure out NPV?

From there, you could complete your calculations in this order:

- List future cash flows for each year you expect to receive them.

- Calculate the present value for each cash flow.

- Add all present values for future cash flows together.

- Subtract cash outflows from the present value sum of future cash flows.

What is IRR when NPV 0?

IRR is a discount rate at which NPV equals 0. So, IRR is a discount rate at which the present value of cash inflows equals the present value of cash outflows. If the IRR is higher than the required return, you should invest in the project. If the IRR is lower, you shouldn't.

Is that rate of discount at which NPV 0?

Which means no profit or no loss. When IRR is greater than the discount rate, then NPV is going to be positive. NPV is the difference between the actual money invested and the present value of future cash flows. So IRR makes NPV zero.

How do you find the NPV of 0?

If the present value of a project is exactly $0, the project is earning exactly the interest rate used to discount the future cash amounts. In other words, if a project has an internal rate of return of 15%, and you discount the project's future cash amounts by 15%, the project's net present value will be exactly $0.

When NPV 0 cost of capital of a firm is equal to?

If the present value of the expected cash outflows is equal to the present value of the expected cash inflows then NPV = 0. If the present value of the expected cash outflows is less than the present value of the expected cash inflows then NPV > 0.

How do you interpret NPV?

If the net present value is positive, your project is profitable. But, if the NPV is negative, your project is unprofitable. When comparing multiple projects, the one with the largest NPV will provide the highest return.

Should a project with zero NPV be accepted?

Investment should be accepted if the NPV is positive and rejected if NPV is negative. So, when NPV is zero means investment inflows and outflows are equal means no profit or loss so just to invest in this means just to waste time.

Why is NPV zero in an efficient market?

Efficient Market Hypothesis (E.M.H.): Prices of securities fully reflect available information. All investments in an efficient market are zero NPV investments. Equivalently, because information is impounded in prices, investors should be expected to earn a normal rate of return.

What is a good NPV?

What Is a Good NPV? In theory, an NPV is “good” if it is greater than zero. 2 After all, the NPV calculation already takes into account factors such as the investor's cost of capital, opportunity cost, and risk tolerance through the discount rate.

What is the discount rate for NPV?

It's the rate of return that the investors expect or the cost of borrowing money. If shareholders expect a 12% return, that is the discount rate the company will use to calculate NPV. If the firm pays 4% interest on its debt, then it may use that figure as the discount rate.

How does discount rate affect NPV?

NPV is the sum of periodic net cash flows. Each period's net cash flow -- inflow minus outflow -- is divided by a factor equal to one plus the discount rate raised by an exponent. NPV is thus inversely proportional to the discount factor – a higher discount factor results in a lower NPV, and vice versa.

When NPV is zero is equal to Mcq?

If the NPV of a project is greater than 0, its PI will equal 0. If the IRR of a project is 0%, its NPV, using a discount rate, k, greater than 0, will be 0. If the PI of a project is less than 1, its NPV should be less than 0.

Is the discount rate the rate of return?

In investing, the discount rate is the rate of return used to figure out what future cash flows are worth today.

What is the NPV of a security?

For example, if a security offers a series of cash flows with an NPV of $50,000 and an investor pays exactly $50,000 for it, then the investor’s NPV is $0. It means they will earn whatever the discount rate is on the security. Ideally, an investor would pay less than $50,000 and therefore earn an IRR that’s greater than the discount rate.

What is NPV analysis?

NPV analysis is a form of intrinsic valuation and is used extensively across finance. and accounting for determining the value of a business, investment security, capital project, new venture, cost reduction program, and anything that involves cash flow.

What is XNPV function?

The XNPV function =XNPV () allows for specific dates to be applied to each cash flow so they can be at irregular intervals. The function can be very useful as cash flows are often unevenly spaced out, and this enhanced level of precision is required.

What are the two functions of net present value?

Excel offers two functions for calculating net present value: NPV and XNPV. The two functions use the same math formula shown above but save an analyst the time for calculating it in long form.

What does negative net present value mean?

If the net present value of a project or investment, is negative it means the expected rate of return that will be earned on it is less than the discount rate (required rate of return or hurdle rate#N#Hurdle Rate Definition A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved, current opportunities in business expansion, rates of return for similar investments, and other factors#N#). This doesn’t necessarily mean the project will “lose money.” It may very well generate accounting profit (net income), but since the rate of return generated is less than the discount rate, it is considered to destroy value. If the NPV is positive, it creates value.

What is terminal value?

Finally, a terminal value is used to value the company beyond the forecast period, and all cash flows are discounted back to the present at the firm’s weighted average cost of capital. To learn more, check out CFI’s free detailed financial modeling course.

What does a zero NPV mean?

So a negative or zero NPV does not indicate “no value.”. Rather, a zero NPV means that the investment earns a rate of return equal to the discount rate. If you discount the cash flows using a 6% real rate and produce a $0 NPV, then the analysis indicates your investment would earn ...

What does negative NPV mean?

Additionally, a negative NPV means that the present value of the costs exceeds the present value of the revenues at the assumed discount rate. Any investment will produce a negative NPV if the applied discount rate is high enough.

What does NPV mean?

There are only 3 possible categories NPV will fall into: Positive NPV. If NPV is positive then it means you’re paying less than what the asset is worth.

What Is NPV?

First of all, what exactly is NPV? Net present value (NPV) is defined as an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (C) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

What is NPV in investment?

First of all, what exactly is NPV? Net present value (NPV) is defined as an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (C) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

What does a negative NPV mean?

Negative NPV. If NPV is negative then it means that you’re paying more than what the asset is worth. Zero NPV. If NPV is zero then it means you’re paying exactly what the asset is worth. NPV Examples. Let’s take a look at a few examples to see exactly how to calculate and interpret the net present value or the NPV.

What is NPV in real estate?

What is NPV and How Does It Work? The Net Present Value, abbreviated simply as NPV, is one of the most important concepts in finance and commercial real estate. Compared to the Internal Rate of Return , the concept of NPV is easy to understand, yet it’s also still commonly misunderstood by many commercial real estate and finance professionals.

When is NPV equal to zero?

Why is this? Well, intuitively if you think about the IRR as the actual return you get from a given set of cash flows, and the discount rate as what you want the return to be from the same set of cash flows, then when these are both equal, NPV will be zero. This means what you want to earn on an investment (discount rate) is exactly equal to what the investment’s cash flows actually yield (IRR), and therefore value is equal to cost.

What is net present value?

The net present value is simply the present value of all future cash flows, discounted back to the present time at the appropriate discount rate, less the cost to acquire those cash flows. In other words NPV is simply value minus cost.

What is the Net Present Value Rule?

The net present value rule is the idea that company managers and investors should only invest in projects or engage in transactions that have a positive net present value (NPV). They should avoid investing in projects that have a negative net present value. It is a logical outgrowth of net present value theory.

Understanding the Net Present Value Rule

According to the net present value theory, investing in something that has a net present value greater than zero should logically increase a company's earnings. In the case of an investor, the investment should increase the shareholder 's wealth.

How the Net Present Value Rule is Used

Net present value, commonly seen in capital budgeting projects, accounts for the time value of money (TVM). Time value of money is the idea that future money has less value than presently available capital, due to the earnings potential of the present money.

What does negative NPV mean?

It could be profitable, but a negative NPV means the return won’t exceed the company’s cost of capital, therefore decreasing shareholder value. If the investment does not exceed a company’s cost of capital, the money is better off invested in something else.

What is the NPV rule?

The NPV Rule states that investing in something that has an NPV greater than zero increases shareholder wealth and should be pursued.

What is Net Present Value?

Net present value (NPV) is the present value of all future cash flows of a project or investment in excess of the initial amount invested. The future cash flows are discounted at the company’s cost of capital, adjusted for specific risk to the investment.

Why is NPV used?

NPV is commonly used to determine the profitability of potential projects because of how comprehensive it is. Unlike other metrics, NPV takes into account the time value of money. It uses the company’s discount rate, adjusted for risk, and looks at the cash inflows and outflows of a potential investment.

What happens if you invest with a NPV of less than zero?

An investment with an NPV less than zero will decrease shareholder wealth and should not be pursued.

What is the goal of a positive net present value?

The goal of any company is to increase shareholder wealth. A positive net present value indicates that the investment will exceed the costs of the initial investment and cost of capital . This leads to an increase in shareholder wealth. A negative NPV value would result in a decrease in shareholder wealth because the investment would not cover ...

What is the result of the NPV formula?

The result of the NPV formula gives managers a very black and white result. If the value is positive, pursue the project. If it is negative, don’t pursue the project .