A proof of funds letter must include the following:

- Your bank’s name and address

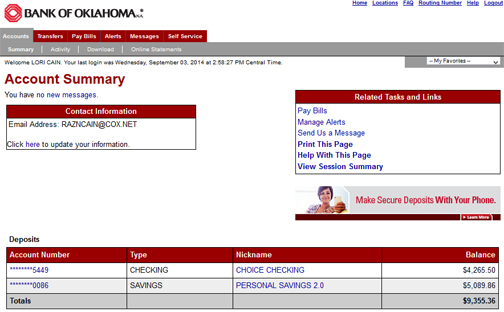

- An official bank statement, either printed at a branch or as an online statement

- The balance of total funds in your accounts

- The balance of funds in your checking or savings account

- The signature of an authorized bank employee or notary

- Verification of the date the funds were in your account

How do I get a proof of fund letter from a bank?

Getting a proof of funds letter is fairly painless. You can obtain the letter by requesting one from the bank or other financial institution holding your money. An online or paper bank statement may also suffice. The bank should be able to get the letter back to you in less than a week, and often within a day or two.

Can proof of funds be a screenshot?

A Proof of Funds Letter (POF) is a letter, bank statement, PDF, screenshot, or other document showing that a person or company has the financial ability to close a real estate transaction.

What is acceptable as proof of funds?

Proof of funds refers to a document that demonstrates the ability of an individual or entity to pay for a specific transaction. A bank statement, security statement, or custody statement usually qualify as proof of funds. Proof of funds is typically required for a large transaction, such as the purchase of a house.

What should a proof of funds letter say?

Essentially, a proof of funds letter includes the account holder's name and current balance of available funds—all on bank letterhead and signed by a bank official.

Can I use a screenshot for a bank statement?

Unfortunately, not all banks offer statements on their mobile banking apps. If not, you can screenshot a bank statement that's been emailed to you, or, as a last resort, you'll have to jump over to a desktop and finish verification.

How do you provide proof of sources of funds?

Supporting documents and proofbank statements.recently filed business accounts, or.documents confirming the source, such as: sale of a house. sale of shares. receipt of a personal injuries award. a bequest under an estate. a win from gambling activities.

Can I screenshot my banking app?

Hold the Home button and ask Google assistant “What's on my screen?” Then specify the location to save the screenshot.

How to get proof of funds?

A Proof of Funds letter must include the following: 1 Your bank’s name and address 2 An official bank statement, either printed at a branch or as an online statement 3 Balance of total funds in the account 4 Balance of funds in checking or savings account 5 Copy of an online banking statement 6 Might require the signature of an authorized bank employee or notary 7 Includes the date that the funds were in the account

What is a Proof of Funds letter?

If you’re in the market to buy a home, you may need to provide a Proof of Funds letter to show the seller, or even your lender, that you have the funds needed to purchase the property. A POF is simple to obtain. Once your funds are all in one account, you can ask your financial institution to provide the letter, and this should serve as the documentation required to buy the home.

What Does Proof Of Funds (POF) Mean?

Proof of Funds is a document that demonstrates how much money a person or entity has available. When purchasing a home, you may need a POF to show the seller that you can cover the purchase costs of a home. Remember that purchase costs can include the down payment, escrow and closing costs.

What is a preapproval letter?

A preapproval letter is a document stating that a lender will provide a buyer with a loan , whereas a POF letter states that a buyer has funds available to pay for other costs associated with the purchase of a home.

How long does it take to get a POF letter?

Request The Letter From Your Bank. If your funds are all in one place, you can likely get your POF in 1 day. If you are moving funds from one bank to another, it can take several days. You will want to ensure that all your contact information is up-to-date on your POF letter.

What documents qualify as POF?

What Other Documents Qualify As POF? Several documents qualify as POF. Proof of Funds usually comes in the form of a bank, security or custody statement, and can be procured from your bank or financial institution that holds your money.

Do you need POF to buy a house?

If you’re buying a home in cash, you will need to prove that you have the funds to do so. You might need POF to mortgage a house if your lender requires seeing how much money you have to cover the remainder of the cost of the home. If you are making a down payment in cash, you’ll be asked to prove that you have the funds and that they’re not a loan.

Where does proof of funds come from?

This ensures not only that the buyer has the money available to make the purchase, but also has legal access to the funds, as the proof of funds comes from a verified authority, such as a bank. Particularly for the purchase of a home, the seller and/or mortgage company wants to see if you have enough money for the down payment and ...

Why do you need proof of funds?

Once you have your proof of funds document in hand you want to ensure that it is secure at all times. Some con-artists planning a financial scam may seek/request a proof of funds to make sure that they are concentrating their efforts on someone with significant financial worth. In addition, it contains important financial information that should be safeguarded. Therefore, it is important to make sure that you only give proof of funds to trusted individuals whom you have thoroughly investigated.

What Are Proof of Funds (POF)?

Proof of funds (POF) refers to a document or documents that demonstrate a person or entity has the ability and funds available for a specific transaction. Proof of funds usually comes in the form of a bank, security, or custody statement. The purpose of the proof of funds document is to ensure that the funds needed to execute the transaction fully are accessible and legitimate.

What is proof of deposit?

In commercial banking, proof of deposit is the financial institution’s verification that funds have been deposited into an account and where these deposits came from. To do so, the institution will compare the amount written on the check to the amount on the deposit slip. When applying for a mortgage, in addition to demonstrating proof of funds, ...

How long does it take to get proof of funds?

It is possible to get a proof of funds document within a day or two from most banks.

Where do mortgage companies want to see deposits?

Mortgage companies typically want to see where the deposits originate from, whether they come from the borrower or are they gifts from other parties . This helps determine if the borrower will be able to furnish the mortgage loan.

What do you need to show when applying for a mortgage?

When applying for a mortgage, in addition to demonstrating proof of funds, a buyer will have to demonstrate that funds in fact have been deposited into an account and demonstrate where they came from.

What Is A Proof of Funds Letter In Real Estate?

A Proof of Funds Letter (POF) is a letter, bank statement, PDF, screenshot, or other document showing that a person or company has the financial ability to close a real estate transaction. Essentially, it’s your “PROOF” that you can close the real estate deal.

When Is A Proof of Funds Required?

A Proof of Funds (POF) is typically required for each and every piece of real estate you’d like to purchase. For example, if you are a wholesaler sending 20 offers a week on potential deals, then you’d need a Proof of Funds for each of those offers given that all the properties are different addresses.

Why Is A Proof Of Funds Required To Buy Real Estate?

The Proof of Funds is required to buy real estate so that deals close with a higher percentage because the buyer has proven they have (or have access to) the funds to close the deal. See, real estate agents and sellers do not like working with jokers & amateurs who do not have the financial ability to close a deal.

Is A Proof Of Funds Needed For A Cash Offer?

Yes, be sure to include a proof of funds on each and every cash offer you send. A majority of new wholesalers do not know that they need a POF and this leads to a significant amount of their cash offers being rejected. To be taken seriously, you need a legitimate proof of funds for the cash offers you submit to buy real estate.

What Should A Proof Of Funds Letter Say?

The POF should have the name of the Company, Person, or Bank with access to the funds.

How To Get Proof of Funds From A Cash Buyer Investor

When wholesaling houses & real estate, a Proof of Funds (POF) is needed with every offer. One way to get a Proof of Funds is from one of your Cash Buyers. A Cash Buyer is the real estate investor that is in the business of buying wholesale homes from you to renovate & sell at a profit.

How To Get A Proof Of Funds Letter From A Hard Money Lender

Hard Money Lenders are in the business of lending out capital on real estate investing deals, especially to investors who need capital for fixing & flipping homes. Because of this, hard money lenders are a great source for a proof of funds letter.

How to get proof of funds?

Once your account is set up with the necessary money, request a proof of funds letter by calling your bank. In most cases, it takes only a day or two to process and provide you with the letter. However, if you are waiting for transfers or deposits to process, you will need to wait until these are complete. Review the letter to ensure all of the information is accurate before submitting it alongside your offer.

What Is A Proof Of Funds Letter?

A proof of funds (POF) letter is an official statement showing that a homebuyer has enough liquid capital to cover the costs of buying a home. The proof of funds letter must demonstrate that the homebuyer can afford the down payment, escrow, and closing costs. It is typically required by sellers in addition to a pre-approval letter. You can obtain a proof of funds letter from your bank or financial institution.

How long does it take to get a proof of funds letter?

The various steps in the homebuying process can be intimidating to navigate, especially as you discover more and more requirements. While a proof of funds letter may seem like one more addition to this process, they are relatively easy to obtain. These letters are necessary to demonstrate that you have enough capital to purchase the property. While it can take a few days to get all of your money in one place, once you do, a proof of funds letter should be available the very next day.

What is POF in banking?

The funds that qualify as POF include any capital that you can access on the spot or assets that can be easily liquidated. These funds could be in a bank account or money market account, for example. If you have funds across multiple accounts, you can provide multiple statements as your proof of funds. In some cases, a credit line may also be acceptable as proof of funds.

Do sellers want to see if you have enough cash to cover down payment?

Cash Down Payment: Sellers may want to see if you have enough cash to cover the down payment instead of relying on credit or loans. As this can make the offer more concrete.

Why do you need proof of funds?

Much like you’re usually required to have a pre-approval letter to put in an offer on a house you plan to mortgage, cash offers often require a POF to show that you have the funds to pay for the house. Many sellers won’t accept a cash offer without one, but even if it’s not required, a seller is more likely to accept your offer if you have a POF.

What is a POF in a bank offer?

The most common POF is a signed letter from your bank on its letterhead, dated the day you’re making your offer, that shows your current balance. This will demonstrate that the money is available to you on the day you make your offer.

What if the money is in another type of account?

If your money is in a savings account or investment account, a signed letter from the bank will usually be enough to qualify as POF. However, if your money is in an account that takes some time to draw funds from like a 401 (k) or IRA, you will have to move the funds to a more accessible account in advance.

What do you need to make a cash offer on a house?

But there are some things you’ll need to know to ensure your transaction goes smoothly. Most importantly, you will need to provide a proof of funds (POF) if you want to make a cash offer on a house. POFs are documents that prove that you have enough money to pay for the house and show where the money came from.

Can a real estate agent give you information?

Your real estate agent can give you detailed information about your case, so be sure to let them know your intention to pay with cash and where you’re keeping your funds before you find a house.

Can you provide bank statements?

You can’t simply make an offer with your bank statement from last month showing that you have the money. There’s no proof that the money is still in the bank as of the day you bring in the letter.

So what should you look for in a proof of funds letter?

A proof of funds letter should contain several vital pieces of information, including how much funds are available to the buyer and where those funds are coming from. It should also include the name of the private lender, hard money lender, or banking officer stating the funds are available.

Is a bank statement an acceptable form of proof of funds?

The short answer is yes – but with some caveats. Remember that these days, almost anything can be doctored using photoshop. Be sure the statement contains all pertinent information, such as the bank’s name, the account holder, their account number, and the current balance.

Potential red flags to look for in proof of funds letters from private lenders

Anyone can type up a letter in Word claiming to have the funds available to purchase the home. But there are a few things you should look for when attempting to evaluate the letter’s legitimacy.

Always verify the information contained in any form of proof of funds

No matter what type of proof of funds you’re provided, you should always verify the information contained within it independently. Legitimate cash buyers will welcome sellers to verify the legitimacy of their funds.

What Are Proof of Funds (POF)?

Understanding Proof of Funds

- When an individual or entity is making a large purchase, such as buying a home, the seller usually requires proof of funds. This ensures not only that the buyer has the money available to make the purchase, but also has legal access to the funds, as the proof of funds comes from a verified authority, such as a bank. Particularly for the purchase of a home, the seller and/or mortgage co…

Requirements of A Proof of Funds (POF) Document

- When providing a proof of funds document, there is certain information that is required to be included. The following are some of the most common pieces of information that will need to be disclosed on a proof of funds document: 1. Bank's name and address 2. Official bank statement 3. Balance of funds in the checking and savings accounts 4. Balance of total funds 5. Signature of …

Proof of Funds

- In commercial banking, proof of deposit is the financial institution’s verification that funds have been deposited into an account and where these deposits came from. To do so, the institution will compare the amount written on the check to the amount on the deposit slip. When applying for a mortgage, in addition to demonstrating proof of funds, a buyer will have to demonstrate that fun…