Key takeaways:

- A general ledger is the foundation of a double-entry accounting system.

- General ledgers transactions are entered as either a debit or a credit.

- A general ledger provides information to produce other financial reports.

- General ledgers list transactions under seven categories: gain, loss, assets, liabilities, equities, revenue and expenses.

What is a general ledger and why is it important?

- A journal entry: The number of each journal entry posted to the account and the date of the entry.

- A description: A description of the transaction.

- Debit and credit columns: Each journal entry posts a debit or credit to the general ledger.

- A balance: A general ledger lists the account balance each time a debit or credit posts to the account. ...

What does general ledger mean?

General Ledger is a principal book that records all the accounts of your company. It is one of the important books of accounts for your business. Furthermore, all the accounting entries are transferred from the Journal to the Ledger. This means you first need to record a business transaction in your Journal.

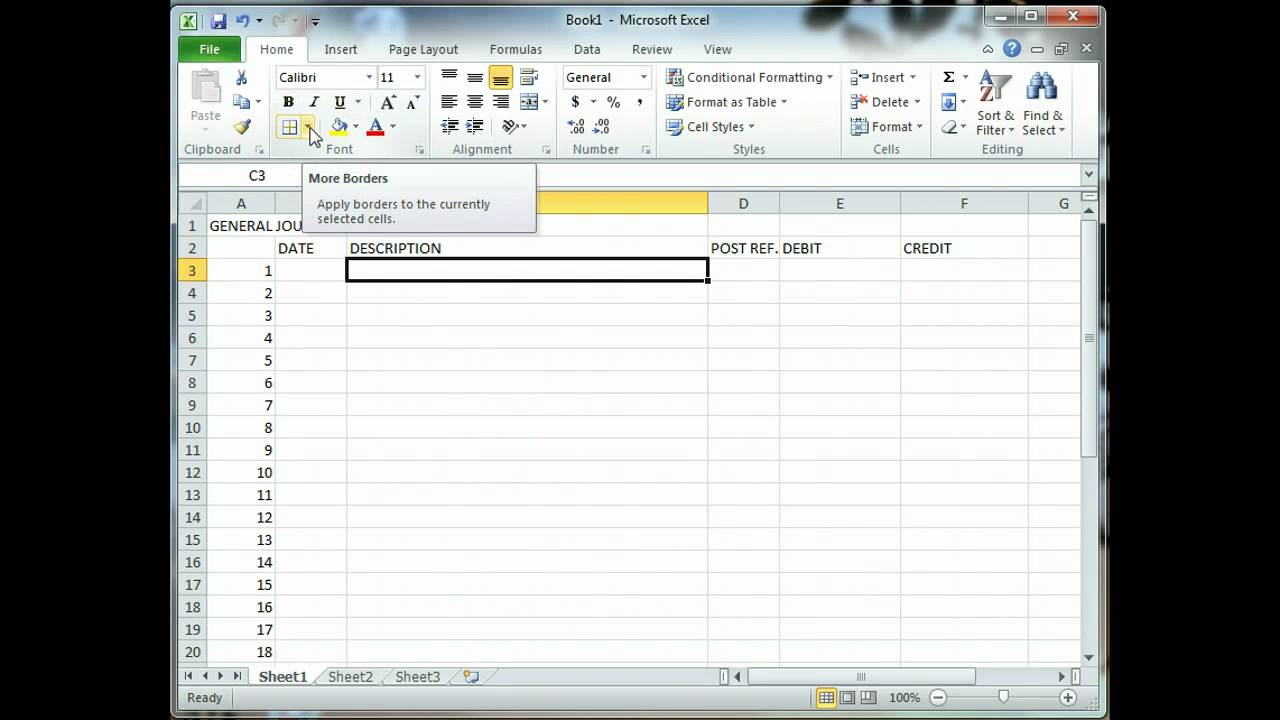

How to post journal entries to the general ledger?

- Accounting Mode is set to Final.

- Transfer to General Ledger is set to Yes.

- Post in General Ledger is set to Yes. If you don't have the privilege to post or posting from the Enable Posting from Subledger option is disabled, the Post in ...

What is a General Ledger (GL)?

What is a General Ledger (GL)? A General Ledger (GL) contains every financial transaction recorded during any given account period (also known as account cycle). Nowadays, businesses record their account data electronically on software such as QuickBooks.

What is a general ledger?

A general ledger is a recordkeeping system used to sort, store, and summarize a company’s financial transactions. A general ledger has four primary components: a journal entry, a description, debit and credit columns, and a balance.

How does a general ledger work?

A general ledger uses the double-entry accounting method for generating financial statements. Double-entry accounting uses debits and credits and dollar amounts.

What are sub-ledgers?

Sub-ledgers, or subsidiary ledgers, within each account provide additional information to support the journal entries in the general ledger. Sub-ledgers are used when a particular account has a lot of activity.

What information does a general ledger tell you?

The general ledger can help generate financial statements for stakeholders like investors, creditors, and regulators. Ledger information can also produce management reports for decision-making purposes.

What is the difference between a general ledger and a general journal?

A general journal is a record of every business transaction in chronological order. It is the first point of entry into the company’s accounts. The general journal is a good place to review all accounting transactions.

How can I set up a general ledger in QuickBooks?

If you’re ever audited, you won’t have to dig through paper files to get organized. You can pull your general ledger report, specify an account, and review the details and supporting documentation (invoices, receipts, etc.).

How many categories are there in a general ledger account?

General ledger accounts include five account categories. The balance sheet uses three categories (assets, liabilities, and equity), and the income statement reports two categories (revenue and expenses).

What is a subsidiary ledger?

A subsidiary ledger (sub-ledger) is a sub-account related to a GL account that traces the transactions corresponding to a specific company, purchase, property, etc. If a GL account includes sub-ledgers, they are called controlling accounts. For example, Companies X, Y, and Z are the clients of Company A.

What is GL account?

A general ledger account (GL account) is a primary component of a general ledger. A GL account records all transactions for that account. The transactions are related to various accounting elements, including assets, liabilities,#N#Types of Liabilities There are three primary types of liabilities: current, non-current, and contingent liabilities. Liabilities are legal obligations or debt#N#equity#N#Equity Method The equity method is a type of accounting used in investments. It is used when the investor holds significant influence over investee but does#N#, revenues, expenses,#N#Accrued Expenses Accrued expenses are expenses that are recognized even though cash has not been paid. They are usually paired up against revenue via the matching principle#N#gains, and losses.

What is a GL?

, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. General Ledger (GL) accounts contain all debit ...

What is the job of a bookkeeper?

General Ledgers and Double-Entry Bookkeeping. Bookkeeper The primary job of a bookkeeper is to maintain and record the daily financial events of the company. A Bookkeeper is responsible for recording and maintaining a business' financial transactions, such as purchases, expenses, sales revenue, invoices, and payments.

When is accrued expense used?

It is used when the investor holds significant influence over investee but does. , revenues, expenses, Accrued Expenses Accrued expenses are expenses that are recognized even though cash has not been paid. They are usually paired up against revenue via the matching principle. gains, and losses.

Can everyone access the ledger?

Therefore, everyone within the company network can access the ledger at any point and make a personal copy of the ledger, making it a self-regulated system. This mitigates the risks that Centralized General Ledgers have from having one source control the ledger.

Is blockchain a distributed ledger?

Blockchain technology has given rise to a decentralized or distributed ledger. Blockchain allows the ledger to be distributed across users worldwide, and each user is part of the entire network, making it less dependent on a single centralized node.

What is a general ledger?

A general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. A general ledger helps to achieve this goal ...

How Does a General Ledger Work?

Preparing a general ledger is a crucial step in the accounting process Accounting Process The accounting process is the series of steps followed by the business entity to record the business financial transactions, which includes steps for collecting, identifying, classifying, summarizing, and recording of the business transactions in the company's books of accounts so that the entity's financial statements can be prepared and the profits and financial position of the business can be known at regular intervals of time. read more. An organization initially records every financial transaction in a general journal, where the entries are called journal entries. The next step involves classifying journal entries as separate accounts in a general ledger.

Why are journal and ledger important?

As such, the journal and ledger both have the most crucial roles in an accounting process to ensure that no transaction is missed out. For any details on the transaction, confusion or rectification, accountants refer to these two books of accounts.

What is a ledger?

are left with an organization at the end of an accounting year. Using this computation, an organization’s balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders' equity , liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company. read more remains free of accounting errors.

What is ledger balancing?

Ledger balancing assists in computing how much assets, liabilities Liabilities Liability is a financial obligation as a result of any past event which is a legal binding. Settling of a liability requires an outflow of an economic resource mostly money, and these are shown in the balance of the company. read more or revenue sources, etc., are left with an organization at the end of an accounting year. Using this computation, an organization prepares its financial statements.

What is the purpose of preparing a general ledger?

Preparing a general ledger is a crucial step in the accounting process. An organization initially records every financial transaction in a general journal, where the entries are called journal entries. The next step involves classifying journal entries as separate accounts in a general ledger. Resultantly, there will be a cash account, salary ...

What is general journal accounting?

General Journal The General Journal is a book of entry that holds the initial record of every transaction before being posted to the concerned accounts like Sales Journal, Purchase Journal, & Cash Journal etc. read more. .

What is the general ledger?

The general ledger tracks all of a company's accounts and transactions and serves as the foundation of its accounting system. It's typically divided into five main categories: assets, liabilities, equity, revenue, and expenses. These categories contain all accounting data derived from a company's different sub-ledgers, ...

What is included in a general ledger?

Expenses consist of money paid by the business in exchange for a product or service. Expenses can include rent, utilities, travel, and meals. The general ledger typically includes a front page that lists the names of the accounts documented within, and this list is known as the "chart of accounts.".

Why do businesses use ledgers?

Instead, financially-minded individuals -- and businesses -- use ledgers to fastidiously document money that's they're paying out, or being paid.

What is general journal?

A general journal lists business transactions according to the date. A business' financial transactions are first recorded in a general journal. From there, the specific amounts are posted into the correct accounts within the general ledger.

How many categories are there in the general ledger?

There are five different categories the general ledger is broken down into, and these categories are known as "accounts." The categories are:

What is a sub-ledger in accounting?

Sub-ledgers within each account provide details behind the entries documented in account ledgers, such as if they are debited or credited by cash, accounts payable, accounts receivable, etc.

What is double entry bookkeeping?

The double-entry bookkeeping method ensures that the general ledger of a business is always in balance -- the way you might maintain your personal checkbook. Every entry of a financial transaction within account ledgers debits one account and credits another in the equal amount. So, if $1,000 was credited from the Assets account ledger, it would need to be debited to a different account ledger to represent the transaction.

General Ledger Account

Controlling Accounts vs. Subsidiary Ledger

- For a large organization, a general ledger can be extremely complicated. In order to simplify the audit of accounting records or the analysis of records by internal stakeholders, subsidiary ledgers can be created. A subsidiary ledger (sub-ledger) is a sub-account related to a GL account that traces the transactions corresponding to a specific company, purchase, property, etc. If a GL ac…

General Ledgers and Double-Entry Bookkeeping

- A general ledger summarizes all the transactions entered through the double-entry bookkeepingmethod. Under this method, each transaction affects at least two accounts; one account is debited, while another is credited. The total debit amount must always be equal to the total credit amount. Assets = Liabilities + Shareholder’s Equity is known as the Accounting Equat…

Link to Balance Sheet and Income Statement

- As a General Ledger (GL) records all of the transactions that affect a company’s accounting elements, such as Assets, Liabilities, Equity, Expenses, and Revenue, it is the data source used to construct the Balance Sheet and the Income Statement. The set of 3-financial statements is the backbone of accounting, as discussed in our Accounting Fundamentals Course.

Decentralized Ledger – Blockchain Technology

- Blockchain technology has given rise to a decentralized or distributed ledger. Blockchain allows the ledger to be distributed across users worldwide, and each user is part of the entire network, making it less dependent on a single centralized node. Therefore, everyone within the company network can access the ledger at any point and make a personal copy of the ledger, making it a …

Additional Resources

- Thank you for reading CFI’s guide to General Ledger. To continue learning and advancing your financial career, these additional CFI resources will be helpful: 1. Adjusting Entries 2. Financial Accounting Theory 3. How to Link the 3 Statements 4. T Accounts