5 Factors That Affect Your Mortgage Rate

- 1. Economic conditions Many external factors impact the national average mortgage rates, which in turn affect the rate you are charged. ...

- 2. Your credit score Your own personal financial credentials also have a big impact on the rate you'll pay -- and your credit score is one of the most important factors. ...

- 3. Your loan term ...

- 4. Your down payment ...

- 5. Other debts you have

Full Answer

What influences mortgage interest rates?

What Are the Factors That Influence Mortgage Interest Rates?

- Credit Report. Mortgage rates are influenced by your credit report. ...

- Market Conditions. Mortgage rates are influenced by a variety of market conditions, including the prime rate, inflation, and the demand for housing.

- Type of Interest Rate. Mortgage rates are influenced by the type of interest rate. ...

- Loan Term. ...

- Location and Home Price. ...

What determines mortgage interest rate?

What determines mortgage rates?

- Mortgage bonds

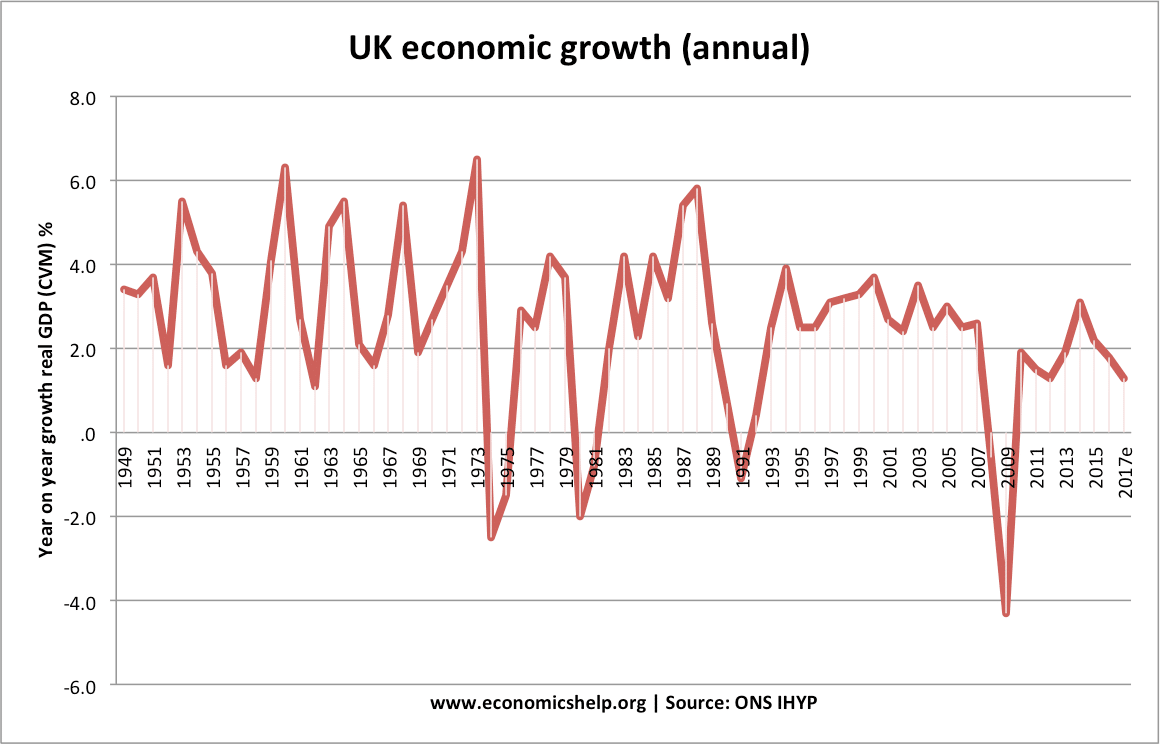

- The economy

- Inflation

- The Federal Reserve

- Industry competition

- Housing market

- Your personal finances

What causes mortgage rates to rise or fall?

Why Mortgage Rates Go Up or Down

- Effect of inflation on mortgage rates. Inflation causes prices of all commodities to gradually increase. ...

- Effect of the strength of the economy. A strong economy creates a strong demand for commodities and assets, including property. ...

- Current scenario of the housing market. ...

- The Federal Reserve. ...

- The bond market. ...

What drives mortgage interest rate?

The Mortgage Rates Puzzle

- A lot of factors go into determining your mortgage rate

- Things like credit score are huge

- As are down payment, property type, and transaction type (refi vs. purchase)

- Along with any points you’re paying to obtain said rate

- The state of the economy will also come into play

- This means there are some things you can control, and others you cannot

What factors influence a mortgage rate?

Here are seven key factors that affect your interest rate that you should knowCredit scores. Your credit score is one factor that can affect your interest rate. ... Home location. ... Home price and loan amount. ... Down payment. ... Loan term. ... Interest rate type. ... Loan type.

What are the 4 factors that influence interest rates?

Interest rate levels are a factor in the supply and demand of credit. The interest rate for each different type of loan depends on the credit risk, time, tax considerations, and convertibility of the particular loan.

What factors affect mortgage rates Canada?

More risk means a higher interest rate.Repayment or credit risk. The most important risk for the lender is that you won't repay the loan. ... Interest rate risk. Most mortgage loans in Canada are renegotiated every 5 years, but they can be as short as 6 months or as long as 10 years. ... Prepayment risk.

What is causing the rise in mortgage interest rates?

Mortgage rates have more than doubled since January, lenders and real estate companies say, spurred by aggressive interest rate increases as the Fed attempts to curb high inflation. Many Americans searching for homes are lowering their budgets and making trade-offs -- as they face higher monthly mortgage payments.

How can I lower my mortgage interest rate?

7 ways to reduce mortgage ratesShop around. When looking for mortgages, be sure to contact several different lenders. ... Improve your credit score. ... Choose your loan term carefully. ... Make a larger down payment. ... Buy mortgage points. ... Rate locks. ... Refinance your mortgage.

Will interest rates go up in 2022?

Fed Chair Jerome Powell signaled officials will likely take interest rates even higher than the 4.5-4.75 percent they initially projected in September, but might take smaller steps to get there. That could mean rate hikes worth a slower half a percentage point — and eventually a quarter point.

What rates are mortgages based on?

Contrary to popular belief, mortgage rates are not based on the 10-year Treasury note. They're based on the bond market, meaning mortgage bonds or mortgage-backed securities.

Will mortgage interest rates go down in 2022?

There is a possibility of a temporary decline if the news on consumer price inflation shows improvement. However, the near certainty of two more rounds of short-term interest rate hikes by the Federal Reserve should keep the mortgage rates elevated.” Freddie Mac: Forecasts an average 6.8% rate in the fourth quarter.

Do mortgage rates go up with inflation?

If you have an existing fixed-rate mortgage, inflation will not affect your current mortgage. Unless you refinance or recast your mortgage, you'll pay the same amount every month. But if you're looking to take out a different mortgage, inflation can impact fixed-rate mortgages on new home loans.

What will mortgage rates be at the end of 2022?

Mortgage rate predictions for late 2022 The National Association of Home Builders and the National Association of Realtors sit at the low end of the group, estimating the average 30-year fixed interest rate will settle at 5.39% and 6.6% for Q4.

How high will mortgage rates go in 2023?

But the upshot for homebuyers is that mortgage rates are expected to come down next year, Fratantoni said. MBA is forecasting mortgage rates to end 2023 at around 5.4%. The average rate for a 30-year fixed rate mortgage is currently 6.94%, according to Freddie Mac.

Will mortgage interest rates go down in 2023?

And they don't see much mortgage rate relief coming next year. "The fiercely hawkish Fed is one reason why we expect mortgage rates to remain above 6% through Q4-2023." Whatever you call it—housing downturn, housing correction, or housing recession—the housing slump is clearly putting downward pressure on home prices.

What are the five determinants of interest rates?

Define and recognize the components of interest rates, including real risk-free rate, inflation rate, default risk premium, liquidity premium, and maturity risk premium.

What are the 3 interest rates?

There are essentially three main types of interest rates: the nominal interest rate, the effective rate, and the real interest rate. The nominal interest of an investment or loan is simply the stated rate on which interest payments are calculated.

What determines the interest rate?

Interest rates are determined in a free market where supply and demand interact. The supply of funds is influenced by the willingness of consumers, businesses, and governments to save. The demand for funds reflects the desires of businesses, households, and governments to spend more than they take in as revenues.

What are 3 factors that can affect the terms of a loan for a borrower?

7 Main Factors That Determine Loan Amounts1) Credit Score. Lenders determine loan amounts based on a borrower's credit score. ... 2) Credit History. ... 3) Debt-to-Income Ratio. ... 4) Employment History. ... 5) Down Payment. ... 6) Collateral. ... 7) Loan Type & Loan Term. ... Apply for a Loan with HRCCU.

What factors affect interest rates?

Here are seven key factors that affect your interest rate that you should know. 1. Credit scores. Your credit score is one factor that can affect your interest rate. In general, consumers with higher credit scores receive lower interest rates than consumers with lower credit scores. Lenders use your credit scores to predict how reliable you’ll be ...

Why is it important to keep in mind the overall cost of a mortgage?

That’s because you’re paying mortgage insurance—which lowers the risk for your lender. It’s important to keep in mind the overall cost of a mortgage. The larger the down payment, the lower the overall cost to borrow. Getting a lower interest rate can save you money over time.

Why is a larger down payment better?

In general, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property. So if you can comfortably put 20 percent or more down, do it—you’ll usually get a lower interest rate.

What is a point in a mortgage?

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points , lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time.

Why are points good for a loan?

Points can be a good choice for someone who knows they will keep the loan for a long time. Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs.

What are the two types of interest rates?

Interest rates come in two basic types: fixed and adjustable. Fixed interest rates don’t change over time. Adjustable rates may have an initial fixed period, after which they go up or down each period based on the market.

Can you shop around for interest rates in rural areas?

If you are looking to buy in a rural area, our Explore Interest Rates tool will help you get a sense of rates available to you, but you’ll want to shop around with multiple lenders, including local lenders. Different lending institutions can offer different loan products and rates. Regardless of whether you are looking to buy in a rural or urban area, talking to multiple lenders will help you understand all of the options available to you.

How does the housing market affect mortgage rates?

Trends in the housing market affect mortgage rates. When fewer homes are built or put on the market, fewer people buy homes. A shaky economy might drive more people toward renting instead of buying. These factors cause demand for mortgages to decline, which means mortgage rates drop, too.

What happens after a borrower closes on a home loan?

After a borrower closes on a home loan, the lender may package that mortgage with a bunch of others and sell them on the secondary market. Fannie Mae and Freddie Mac are government-sponsored companies that buy, bundle, and resell those home loans as mortgage-backed securities.

Does the Federal Reserve set mortgage rates?

The Federal Reserve doesn’t set mortgage rates. But it does set a target for something called the federal funds rate, which is what banks charge each other for overnight deposits. When officials raise or lower the target, other interest rates can go up or down, too.