When the U.S. dollar appreciates, it gains value against other currencies. Say $1 goes from being the equivalent of 0.8 euros to 0.85 euros. The opposite of dollar appreciation is dollar depreciation -- the dollar losing value relative to other currencies.

What happens when the US dollar appreciates or falls?

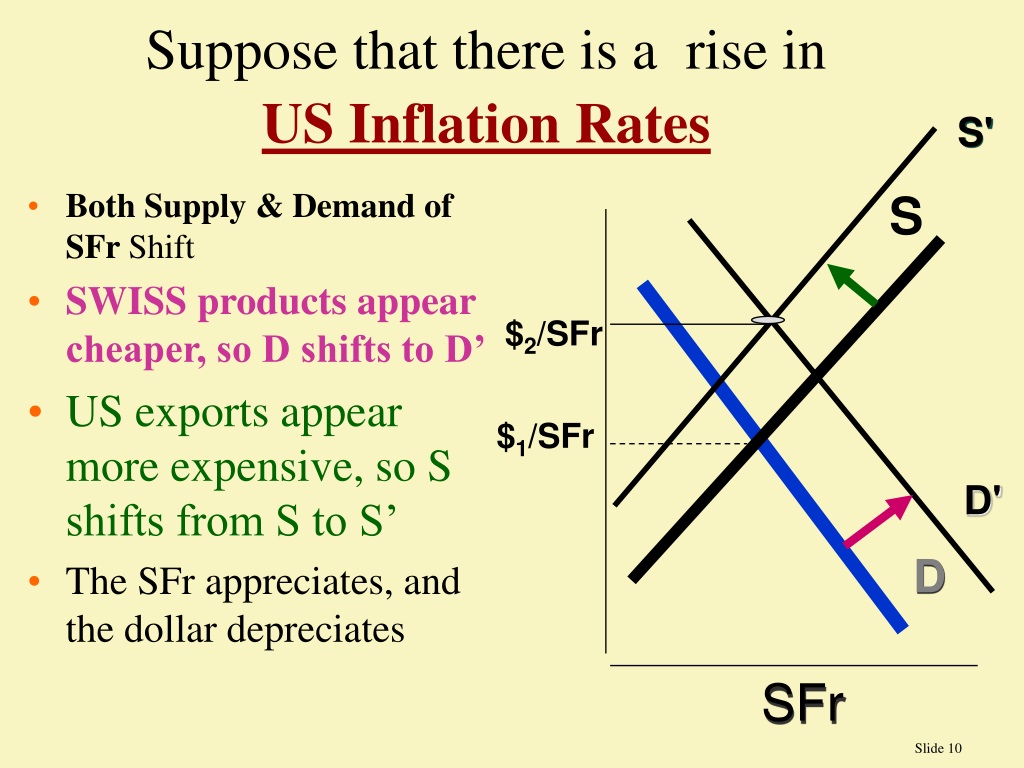

Apr 26, 2020 · If the dollar appreciates (the exchange rate increases), the relative price of domestic goods and services increases while the relative price of foreign goods and services falls. The change in relative prices will decrease U.S. exports and increase its imports.

What happens when a currency appreciates or depreciates?

When a currency appreciates, it means it increased in value relative to another currency; depreciates means it weakened or fell in value relative to another currency. When a dollar buys more than its equivalent in another currency, it’s often labeled strong. When it buys less than its equivalent, it’s weak.

What happens to exports when the dollar appreciates?

When the U.S. dollar appreciates, it gains value against other currencies. Say $1 goes from being the equivalent of 0.8 euros to 0.85 euros. Now 1 euro is worth a little less than $1.18. To buy...

What happens when the dollar increases in value?

If the dollar appreciates (the exchange rate increases), the relative price of domestic goods and services increases while the relative price of foreign goods and services falls. The change in relative prices will decrease U.S. exports and increase its imports.

What happens when the U.S. dollar is strong or appreciates?

When the U.S. dollar appreciates, it gains value against other currencies. Say $1 goes from being the equivalent of 0.8 euros to 0.85 euros. Now 1 euro is worth a little less than $1.18. To buy that French-made 500-euro item, you now need about $588.

Who benefits from an appreciating dollar?

A strong dollar is good for some and relatively bad for others. With the dollar strengthening over the past year, American consumers have benefited from cheaper imports and less expensive foreign travel. At the same time, American companies that export or rely on global markets for the bulk of sales have been hurt.

What happens to aggregate demand when the U.S. dollar appreciates?

Therefore, when the dollar appreciates, American goods become more expensive to foreign buyers and exports fall. If the dollar depreciates to 7.5015 pesos, the beer costs 43.13 pesos. So, when the dollar depreciates, American goods become less expensive to foreign buyers and exports rise.

What happens when a country's currency appreciates?

When a country's currency appreciates in relation to foreign currencies, foreign goods become cheaper in the domestic market and there is overall downward pressure on domestic prices. In contrast, the prices of domestic goods paid by foreigners go up, which tends to decrease foreign demand for domestic products.

Why does a currency appreciate?

Currency appreciation is the increase in the value of one country's currency relative to another country's currency. An increase in government spending or a cut in taxes as well as an increase in investment demand typically causes currency to appreciate.

What are the effects of peso appreciation and depreciation?

The cost of foreign goods and services increases. For instance, if one is traveling to other countries, the cost of travel (in local peso terms) becomes more expensive: airline tickets , accommodations, meals, all purchases abroad. Hence, a peso depreciation has the effect of discouraging the purchase of imports.

How does appreciation affect aggregate demand?

An appreciation in the exchange rate will tend to reduce aggregate demand (assuming demand is relatively elastic) Because exports will fall and imports increase.Mar 24, 2022

When the U.S. dollar appreciates relative to the Canadian dollar then?

When the dollar appreciates relative to the Canadian dollar: U.S. goods become more expensive in Canada. When the U.S. dollar price of a foreign currency rises: it becomes cheaper for foreigners to buy U.S. goods.

What happens to net exports when currency appreciates?

Anything that changes the value of a currency changes net exports. When a currency appreciates, its goods are more expensive to other countries. When a currency depreciates, its goods are less expensive to other countries.