List of Tax Deductible Homeowner's Expenses

- Real Estate Taxes. You pay taxes on real property to state and local governments. When the taxing authority charges an...

- Mortgage Interest. If you took out a loan to buy a home, received state assistance, or got help from the Department of...

- Sales Taxes. You may deduct state and local taxes you pay in the tax year to lower...

What expenses can be deducted when you buy a home?

You can deduct some of the ongoing payments you make for owning your home, including:

- Real estate taxes actually paid to the taxing authority

- Qualifying home mortgage interest

- Mortgage insurance premiums

What home improvement expenses can I deduct?

What Home Improvements are Tax Deductible?

- 7 Home Improvement Tax Deductions for Your House

- Making Improvements for Medical Reasons. There are home improvements you can also make that technically count as medical expenses. ...

- Get Tax Credits for the Way You Generate Energy. Certain energy-generating modifications can also allow you to lower your taxes. ...

- Exclusion on the Sale of Your Home. ...

What can homeowners deduct on taxes?

they can still claim allowable home mortgage interest, real estate taxes and casualty losses as itemized deductions on Schedule A. These deductions need not be allocated between personal and ...

What house expenses are tax deductions?

The following can be eligible for a tax deduction:

- Your property taxes. ...

- The mortgage interest on your primary residence, as well as on a second residence. ...

- The interest on up to $100,000 borrowed on a home equity loan or home equity line of credit, regardless of the reason for the loan (for tax years prior to ...

How much can you deduct on a mortgage?

How much can you keep in your home without a tax obligation?

What is the standard deduction for 2020?

What is the size of a deduction based on?

What is home equity loan?

How much is a discount point on a mortgage?

What is capital gains tax?

See 4 more

About this website

Tax Deductions for Homeowners in 2021 | ConsumerAffairs

Whether you're buying your first home or you’ve owned for years, there are quite a few deductible expenses, from mortgage interest to property taxes.

53 tax deductions & tax credits you can take in 2022

1. Recovery rebate credit. The IRS began paying the third coronavirus stimulus check (also called an economic impact payment) in March 2021. If you didn’t receive the full value of your payment — up to $1,400 for an individual, $2,800 for a couple, and $1,400 per dependent — you can receive any missing amount on your 2021 tax return by claiming the recovery rebate credit.

12 Common Tax Write-Offs You Can Claim On Your Taxes

10. IRA Contributions. The maximum contribution for 2021 in a traditional or Roth IRA is $6,000, plus another $1,000 for people who are 50 years old or more.

How much can you deduct on your mortgage?

The money paid in interest can be deducted up to a certain amount, depending on when the mortgage was taken out. The maximum mortgage interest tax deduction you can take annually is up to $750,000.

What is tax deduction?

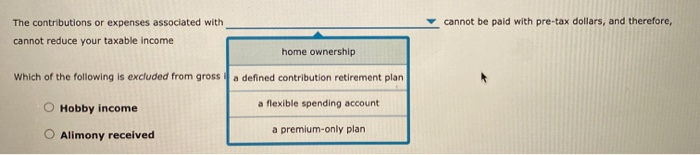

A tax deduction reduces the amount of taxable income for individuals on federal and state levels. A deduction is an expense that a taxpayer can subtract from their gross income to reduce the total that is subject to income tax. There are two types of deductions taxpayers can choose from:

What Is No longer Tax Deductible?

Certain expenses that were deductible as homeowners tax are no longer recognized by the government as deductibles. Before considering a specific deduction, make sure that it’s covered in the same year of your filing. Deductions that homeowners can no longer itemize in 2021 include:

How many Americans opted for standard deduction in 2018?

NOTE: 90% of tax-filing Americans opted for the standard deduction in 2018. Calculating itemized deductions will indeed bring you more money.

What is a write off on a mortgage?

The primary ‘write-offs’ for homeowners are mortgage interest rates and property taxes. Although there are other expenses you can itemize, the largest part of the return is based on property tax and mortgage interest.

What are the biggest tax breaks for homeowners?

The largest tax breaks for homeowners are mortgage interest returns, as well as interest on private mortgages or home equity loans, and on other related expenses , such as discount points.

How much is the child tax credit?

If you’re a homeowner with children or dependents, you can now get up to $3,000 per child ( aged 6 to 17) and up to $3,600 for a child under 6 years old.

Is owning a home expensive?

Owning a home is expensive, there’s no doubt about it. There are ways to make it more affordable, though. One such way is with tax deductible expenses. Chances are, you may not be taking full advantage of the benefits available to you. Here we will discuss the most common as well as the lesser known tax deductions.

Is mortgage interest a deduction?

Mortgage Interest – A Big Deduction. Your mortgage itself provides you with several tax deductions. The interest you pay every month is a great place to start. If you look at your current mortgage statement, you’ll see a breakdown of principal and interest.

Can you deduct home insurance if you have a sudden loss?

Sudden Losses. While you can’t deduct the money you pay for homeowner’s insurance, there is a loophole. If you experience a sudden loss pertaining to your home and insurance doesn’t cover it, you may be able to deduct the costs. This only pertains to sudden losses, such as those due to a fire or natural disaster.

Can you deduct points on a mortgage?

Points Paid for Your Mortgage. Many homeowners pay points to secure the mortgage they want. Whether it was points to bring the interest rate down or to make up for a risky loan, they are deductible . As long as you paid less than $1 million for your home, you can deduct the full amount of the deposits paid.

Can you deduct HELOC interest on taxes?

You can use the money for down payment funds or home improvements. If you do, you can claim all of the interest on your taxes.

Can you write off real estate taxes?

If you reimbursed the seller for any real estate taxes they already paid, you can deduct those as well. You can write off all property taxes on an owner-occupied property.

Can you write off interest on a second mortgage?

As disheartening as it is, you can write that interest off. This pertains to your first mortgage. If you have a second mortgage, such as Home Equity Line of Credit, there are some limitations. They are as follows: Any money used from a HELOC that directly impacts your home is 100% tax deductible.

How much of your home office can you deduct?

Let’s say you have a 2,000 square foot home with a 100 square foot office. Your home office takes up 5% of your house. As a result, you can deduct 5% of your mortgage and utilities.

Is owning a home a major achievement?

Owning a home is a major achievement. It takes patience, credit improvement, and savings, to say nothing of the stressful home buying process. So why does it sometimes feel like a punishment for your wallet?

Is property tax deductible?

Fortunately, both state and city property taxes are deductible from your federal taxable income. Some homeowners put funds in escrow throughout the year to pay their property taxes.

Can you deduct interest on a home equity loan?

Before you jump for joy, there are limits to consider. If you have an expensive home, you can only deduct the interest on the first $750,000 of your mortgage.

Is trimming back a tree tax deductible?

If you have to remove branches to prevent them from damaging your house, it’s deductible. If you’re removing or trimming a tree for cosmetic reasons, it isn’t tax deductible. 4.

Is mortgage interest tax deductible?

Mortgage Interest. There is no faster way to depress yourself than to calculate how much interest you’ll pay on your mortgage by the time you pay it off. It feels like you’re sending tens of thousands of dollars or more down the drain. The bright side is that all that interest is tax deductible.

Can you deduct tree removal expenses?

In both the US and Canada, you can deduct tree removal expenses if you’re doing it to stop or prevent damage. For instance, perhaps a tree is dying or dead. Its weakening structure makes it likely to fall and damage your house. The same applies to trimming back a tree instead of removing the whole thing.

Loan Deductions

Up to certain limits, you can deduct the interest you pay on your mortgage loan from your taxable income. Make sure your lender provides you with Form 1098, because it tells you exactly how much of your payments represent interest. Subject to certain restrictions, you can deduct the cost of fees you paid to obtain the mortgage.

Property Taxes

You may deduct state and local real estate taxes from your taxable income. State and local governments impose a variety of taxes and fees, however, so you need to make sure that the tax you are deducting qualifies under Internal Revenue Service rules. Generally, if the tax is based on the assessed value of your home, it qualifies.

Home Office

If you have dedicated an area of your home exclusively to your work, the IRS allows you to deduct certain expenses from your taxable income.

How to claim home tax deductions?

You can do that by completing the Schedule A tax form and figuring out how much you can deduct. Itemizing your deductions might not be worth it, however, if you can reduce more of your taxable income by taking the standard deduction.

How long does a second home have to be rented out to be considered income?

Note that if your second home doubles as a residence and rental property, it’s considered an income-producing property for tax purposes if it’s rented out for more than 14 days out of the year (or you use it for personal reasons for less than 10% of the total days you rent it out, whichever is greater).

How to claim energy efficient credit?

For example, in order to claim the Residential Energy Efficient Credit, you’ll need to complete IRS Form 5695 and attach it to your tax return.

Can you deduct prepaid interest on a mortgage?

In order to deduct your mortgage points as prepaid interest, you must meet certain requirements. For example, the money you used to pay mortgage points must come from your own bank account, not a loan. And the points must be discount points. For your first and second home, you cannot get a deduction for paying origination points, which are what you pay to have a loan processed (and they may include fees and closing costs).

Can you deduct interest on a home equity loan?

You can deduct interest for paying down a home equity loan, too, if you have debt of up to $100,000 (or $50,000 if your filing status is married filing separately). Another deduction can give homeowners a tax break for paying mortgage points. Homebuyers can pay points to reduce their mortgage rate.

Can you deduct mortgage interest on taxes?

Homeowners can get a tax deduction for various expenses (although many of these tax breaks tend to favor the rich ). If you qualify for the mortgage interest deduction, you can deduct mortgage interest on up to $1 million of debt (up to $500,000 if you and your spouse are filing separate tax returns) that accrued while you were buying or improving a first or second home before December 16, 2017. Debt accrued after this date has limits of $750,000 and $350,000, respectively. You can deduct interest for paying down a home equity loan, too, if you have debt of up to $100,000 (or $50,000 if your filing status is married filing separately).

Can you deduct home improvement expenses?

For example, you can’t directly deduct expenses that you paid while working on a home improvement project. Of course, if fixing up your home boosts your property value, you may be able to deduct the additional property tax payments that you made during the year.

How long do you have to own a home to deduct real estate taxes?

You owned your new home during the property tax year for 122 days (September 1 to December 31, including your date of purchase). You figure your deduction for real estate taxes on your home as follows. 1. Enter the total real estate taxes for the real property tax year. $730.

What is deductible sales tax?

Deductible sales taxes may include sales taxes paid on your home (including mobile and prefabricated), or home building materials if the tax rate was the same as the general sales tax rate. For information on figuring your deduction, see the Instructions for Schedule A (Form 1040). .

What is the tax on real estate?

Most state and local governments charge an annual tax on the value of real property. This is called a real estate tax. You can deduct the tax if it is assessed uniformly at a like rate on all real property throughout the community. The proceeds must be for general community or governmental purposes and not be a payment for a special privilege granted or special service rendered to you.

What is the basis of a home after 1976?

If someone gave you your home after 1976 and the donor's adjusted basis, when it was given to you, was equal to or less than the FMV, your basis at the time of receipt is the same as the donor's adjusted basis, plus the part of any federal gift tax paid that is due to the net increase in value of the home.

What percentage of expenditures are used for acquisition, construction, management, maintenance, or care of the corporation's property?

At least 90% or more of the expenditures paid or incurred by the corporation were used for the acquisition, construction, management, maintenance, or care of the corporation’s property for the benefit of the tenant-shareholders during the entire tax year.

Can you deduct itemized charges on real estate taxes?

An itemized charge for services to specific property or people isn’t a tax, even if the charge is paid to the taxing authority. You can’t deduct the charge as a real estate tax if it is:

Can you deduct delinquent taxes?

If you agree to pay delinquent taxes when you buy your home, you can’t deduct them. You treat them as part of the cost of your home. See Real estate taxes , later, under Basis.

1. The mortgage interest deduction

When you pay off your mortgage, a portion of each monthly payment you make goes toward your loan's principal, while a portion goes toward interest. It's the interest portion you're eligible to deduct on your taxes.

2. Property tax deductions

Property taxes are an unavoidable expense when you own a home. You can deduct up to $10,000 in property taxes each year, but that $10,000 limit also includes whatever state and local taxes you may be looking to deduct.

3. The home office deduction

If you're self-employed, you may be eligible to take a deduction for maintaining a home office. You can calculate your deduction in one of two ways. First, you can figure out what you spent on total housing expenses, from utilities to internet fees, and then take a deduction based on the percentage of your home your office takes up.

4. Mortgage points

Sometimes, mortgage borrowers pay discount points to secure a lower interest rate on their home loans. If you paid points when your mortgage closed, you may be eligible to deduct them on your tax return.

5. Home equity loan or HELOC interest

Home equity loans and lines of credit (HELOCs) let you borrow against your home equity and use that money for any reason. However, if you took out a home equity loan or HELOC in order to improve your home, then you're allowed to deduct the interest you paid on it.

What tax breaks will you be eligible for?

Clearly, there are plenty of tax breaks you may be eligible to enjoy as a homeowner. But to capitalize on these, you'll need to itemize your deductions on your tax return rather than claim the standard deduction.

Top credit card wipes out interest into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent's full review for free and apply in just 2 minutes.

How much can you deduct from your taxes?

Now, you can only deduct up to $10,000 from property tax, state income tax, and state/local sales taxes. There’s no index for inflation, and both single and married taxpayers have the same limit.

How much interest can you deduct on a home loan?

The way it works is if you bought your home before December 15 th, 2017, you’re entitled to deduct interest payments up to $1 million in loans that you used for buying a home, building a home, home improvement, or purchasing a second home.

How many points can you deduct on your taxes?

Most home loans have between one and three points, which inevitably leads to thousands of extra dollars you must find from somewhere. If you have a mortgage, you can fully deduct the value of the points from your tax. If you have a refinanced mortgage, you can also deduct the points.

How many deductions does H&R Block have?

When you file with H&R Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund, guaranteed.

How is selling cost deducted from total gain?

Every selling cost can be deducted from your total gain. The gain is the selling price minus closing costs, selling costs , and what’s known as your tax basis. On a side note, your tax basis is calculated by taking the original purchase price and adding on the cost of capital improvements minus depreciation. 8.

Can you deduct interest on a home equity loan?

For example, a homeowner could deduct interest from a home equity loan and then use it to pay for a college education or to pay down credit card debt. That deduction has been removed from 2018 up to 2025.

When will the deduction for taxes be removed?

That deduction has been removed from 2018 up to 2025.

How much can you deduct on a mortgage?

In the past, homeowners could deduct up to $1 million in mortgage interest. However, the Tax Cuts and Jobs Act has reduced this limit to $750,000 as a single filer or married couple filing jointly. If you are married but filing separately, the deduction limit is $375,000 for each party.

How much can you keep in your home without a tax obligation?

As a single filer or married couple filing separately, each party can keep up to $250,000 of capital gains without a tax obligation.

What is the standard deduction for 2020?

In 2020, the standard deduction breaks down like this: For single and married individuals filing taxes separately, the standard deduction is $12,800. For married couples filing joint, the standard deduction is $24,800. For heads of households, the standard deduction is $18,650.

What is the size of a deduction based on?

In terms of the deductions, the size of the deduction is based on the percentage of your home dedicated to the place of business.

What is home equity loan?

A home equity loan is essentially a second mortgage on your house. With a home equity loan, you can access the equity you’ve built in your home as collateral to borrow funds that you need for other purposes.

How much is a discount point on a mortgage?

If you have this option, one discount point will equate to 1% of the mortgage amount.

What is capital gains tax?

The capital gain is the difference between the value of the home when you bought it and when you sold it. For example, let’s say you bought your home for $100,000. A few years later, you sell your home for $150,000.