What does 200DB hy mean for depreciation?

The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset's life but slower in the later years.

How do you calculate 200 DB Hy depreciation?

You calculate 200% of the straight-line depreciation, or a factor of 2, and multiply that value by the book value at the beginning of the period to find the depreciation expense for that period.

What does Hy mean in depreciation?

half-year conventionThe half-year convention for depreciation is the depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year.

How do you calculate 150 DB Hy depreciation?

Calculate the depreciation expenses for 2011, 2012 and 2013 using 150 percent declining balance depreciation method. Asset Life = 5 years. Hence, the straight line depreciation rate = 1/5 = 20% per year. Depreciation rate for 150 percent declining balance method = 20% * 150% = 20% * 1.5 = 30% per year.

What does 200 db mean?

The expression 200 DB stands for 200 percent declining balance, also known as double-declining-balance depreciation (DDB). This type of depreciation differs from the standard, straight-line depreciation in a few ways.

What is MQ depreciation method?

Mid-Quarter (MQ)- If the total depreciable bases (before any special depreciation allowance) of MACRS property placed in service during the last 3 months of your tax year exceed 40% of the total depreciable bases of MACRS property placed in service during the entire tax year, the mid-quarter, instead of the half-year, ...

What is SL hy?

For form 4562, TurboTax part V item G says SL-HY (Straight Line - Half Year).

How does mid quarter convention work?

Under this convention, all property placed in service during any quarter is treated as being placed in service at the midpoint of the quarter. So, under the mid-quarter convention your depreciation deduction will be lower than if you were using the half-year convention.

When must you use half-year convention?

If you place property in service between January and September (the first nine months), you must use the half-year convention. This convention assumes you placed property in service in the middle of the year even if it was placed in service the beginning of the year.

How do you calculate Modified Accelerated cost Recovery?

How the modified accelerated cost recovery system (MACRS) worksFind your property class and recovery period. ... Determine the asset basis. ... Identify the depreciation method and convention. ... Calculate MACRS depreciation deduction. ... Create a MACRS depreciation schedule. ... Find your property class and recovery period.More items...•

What are the 3 depreciation methods?

What Are the Different Ways to Calculate Depreciation?Depreciation accounts for decreases in the value of a company's assets over time. ... The four depreciation methods include straight-line, declining balance, sum-of-the-years' digits, and units of production.More items...

Is salvage value and residual value the same?

The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life.

Double Declining Balance Depreciation Formulas

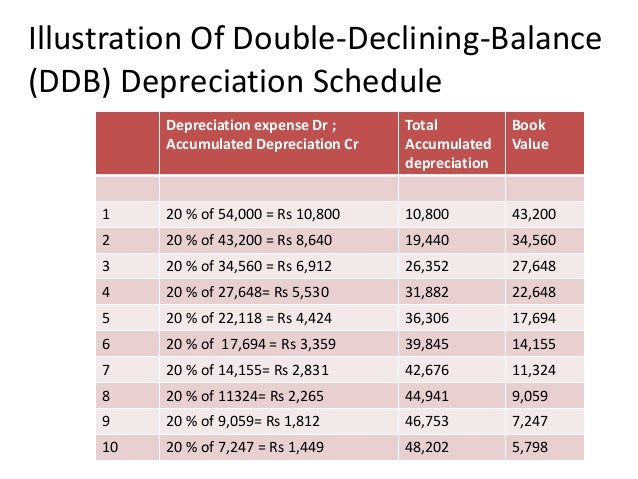

The double declining balance method is an accelerated depreciation method. Using this method the Book Value at the beginning of each period is mult...

Double Declining Balance Depreciation Example

An asset for a business cost $1,750,000, will have a life of 10 years and the salvage value at the end of 10 years will be $10,000. You calculate 2...

Full-Month, Mid-Month, Mid-Year, Mid-Quarter Conventions

Some accounting systems allow for Full-Month, Mid-Month, Mid-Year or Mid-Quarter Conventions. 1. For full month convention, for example, an asset p...

Microsoft® Excel® Functions Equivalent: DDB

The Excel equivalent function for Double Declining Balance Method is DDB(cost,salvage,life,period,factor) will calculate depreciation for the chose...

Definition of Double Declining Balance Method of Depreciation

The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset's life but slower in the later years.

Example of Double Declining Balance Depreciation

Let's assume that a retailer purchases fixtures on January 1 at a cost of $100,000. It is expected that the fixtures will have no salvage value at the end of their useful life of 10 years. Under the straight-line method, the 10-year life means the asset's annual depreciation will be 10% of the asset's cost.

What is double declining balance?

Using this method the Book Value at the beginning of each period is multiplied by a fixed Depreciation Rate which is 200% of the straight line depreciation rate, or a factor of 2. To calculate depreciation based on a different factor use our Declining Balance Calculator .

Does double declining balance include salvage value?

The double declining balance calculation does not consider the salvage value in the depreciation of each period however, if the book value will fall below the salvage value, the last period might be adjusted so that it ends at the salvage value.