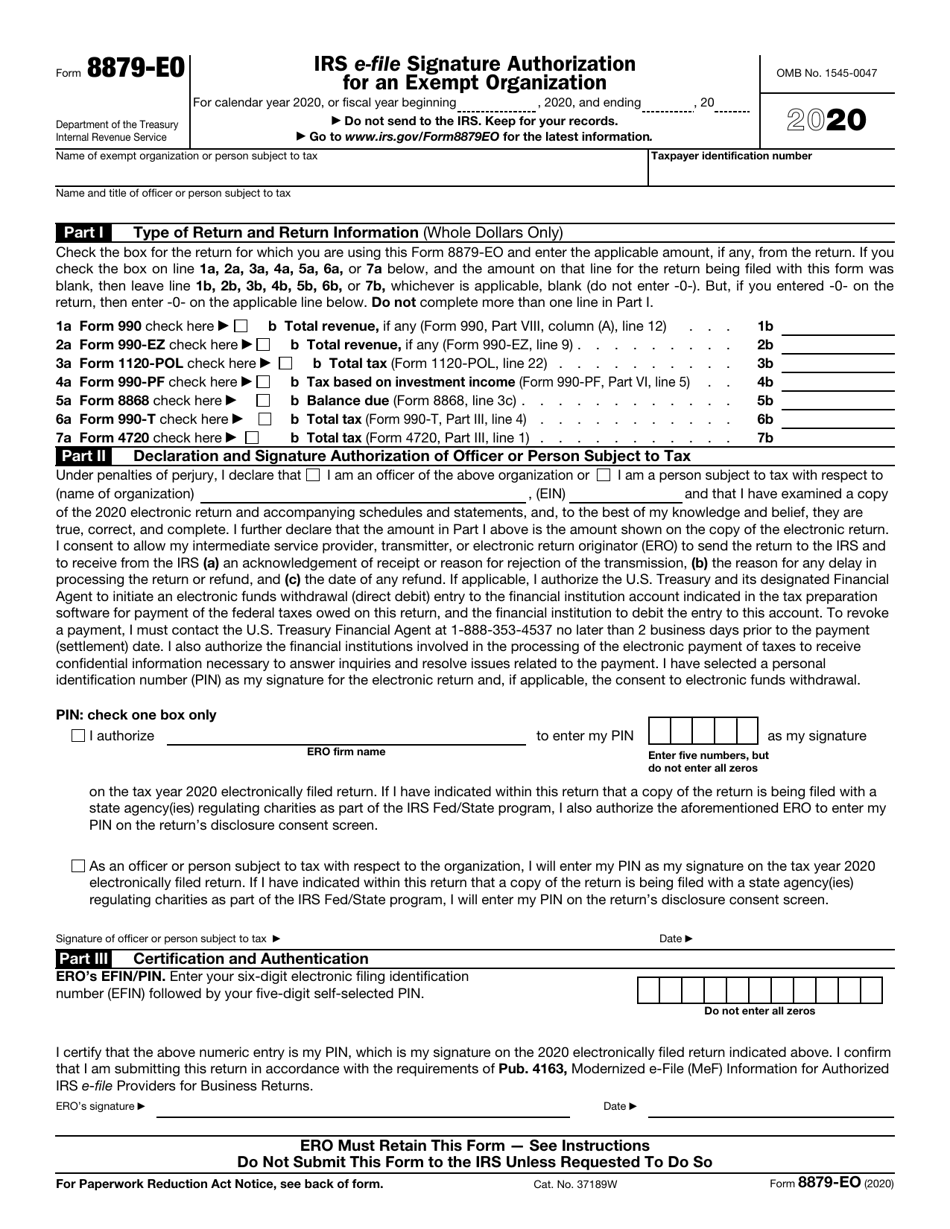

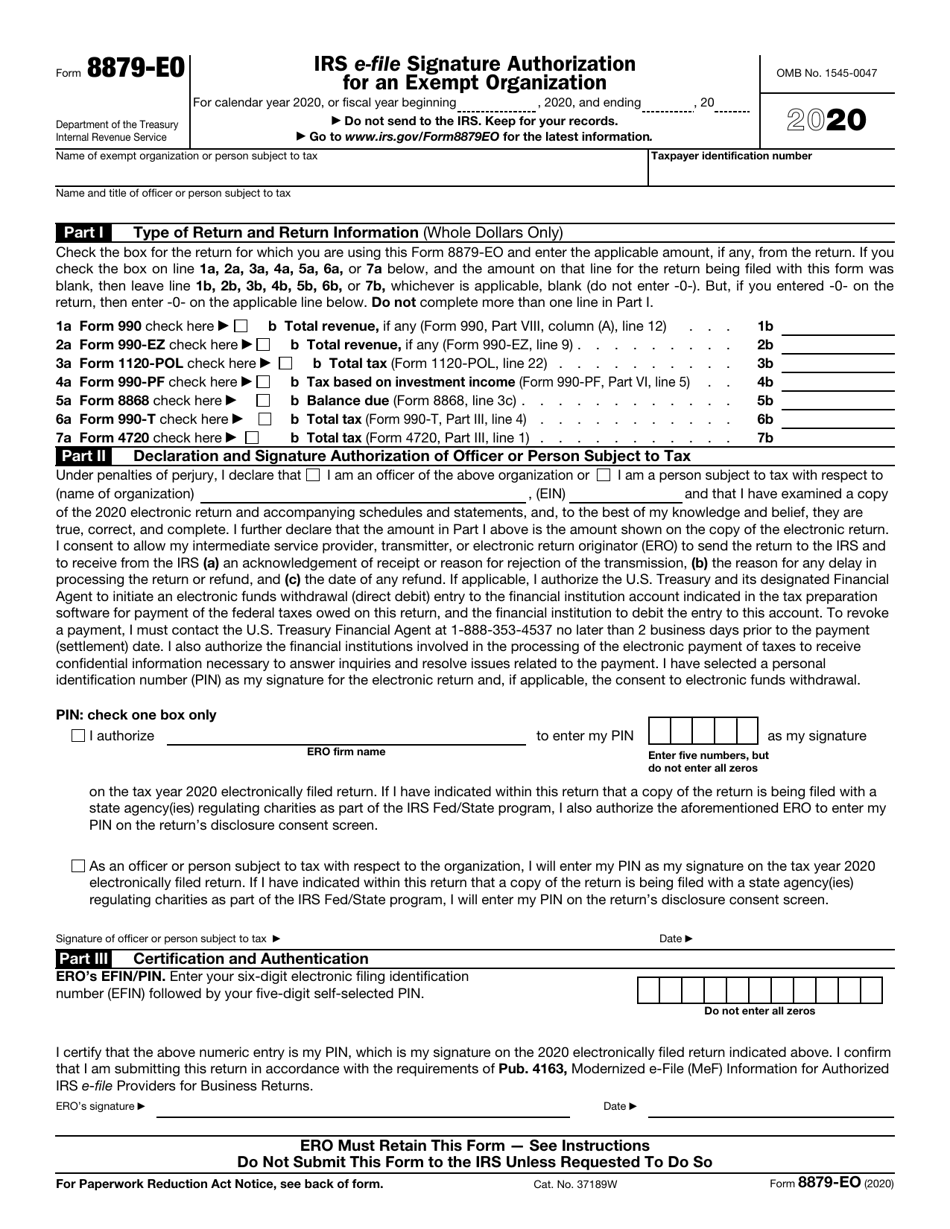

Is a 8879 form the same as a 1040?

No, 8879 is the e-signature authorization form, and 1040 is the actual tax form. June 7, 2019 5:46 PM Is a 8879 form the same as a 1040? No, 8879 is the e-signature authorization form, and 1040 is the actual tax form.

How long should tax return preparers retain form 8879?

You will need to retain the completed Form 8879 for three (3) years from the return due date or IRS received date, whichever is later. Exit out of Practitioner PIN Menu to go to the E-File Menu. Click the black magnifying glass icon in the tool bar at the top of the screen.

How many years do we have to keep form 8879?

The IRS would then retain these documents for the mandatory three year retention period. The retention requirement of these documents is resource intensive on our volunteers and employees as well as the increased postage cost. Forms 8879 being held in our possession have not been utilized in criminal cases. Process

Can 8879 be signed electronically?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used. The taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his or her e-filed individual income tax return.

Is form 8879 Federal or state?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO)....Federal Form 8879 Instructions.IF the ERO is . . .THEN . . .Using the Practitioner PIN method and the taxpayer enters his or her own PINComplete Form 8879, Parts I, II, and III.3 more rows

Do I need 8879?

Are taxpayers required to sign Forms 8878 or 8879 electronically? No. Taxpayers may continue to use a handwritten signature and return the form to the ERO in-person, via U.S. mail, private delivery, fax, e-mail, or an Internet website.

What is a 8878 form for?

A person authorized to sign an electronic funds withdrawal authorization and an electronic return originator (ERO) use Form 8878-A to use a personal identification number (PIN) to authorize an electronic funds withdrawal of the balance due on an electronic Form 7004.

Does the IRS accept electronic signatures on form 8879?

D. CPAs have become familiar with the electronic filing requirements and filing Form 8879, IRS efile Signature Authorization, especially since the IRS has mandated e-filing for almost all tax practitioners. This requirement, in effect, has added one more step to the tax preparation process for practitioners.

What states require an e file authorization form?

Which states require their own signature authorization when electronically filing?StateIndividual (1040)Fiduciary (1041)California (CA)XXColorado (CO)XDistrict of Columbia (DC)Georgia (GA)X15 more rows

Is 8878 required?

Taxpayers must sign Form 8878 by handwritten signature, or electronic signature if supported by computer software. 5.

What is the difference between 8879 and 8878?

Form 8878: This is the IRS e-file Signature Authorization used by filers of extension requests on Form 4868 or Form 2350. The latter form is for taxpayers living outside the United States. Form 8879: This is the IRS e-file Signature Authorization required for filers of Form 1040, 1040A, Form 1040EZ or Form 1040-SS.

Who must file form 8948?

specified tax return preparersForm 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. A specified tax return preparer may be required by law to electronically file (e-file) certain covered returns (defined below).

What is the practitioner PIN method?

Practitioner PIN - The Practitioner PIN method is another signature option in which you authorize your tax practitioner to enter or generate your PIN. This method doesn't require you to provide your prior year AGI, date of birth, or SSP for authentication.

What is the penalty for not signing a tax return?

A $50 penalty per return is assessed for failing to sign the tax return. A $50 penalty per return is assessed for failing to include the preparer tax identification number (PTIN) on the taxpayer's tax return.

Can you DocuSign form 8879?

Use DocuSign with Intuit to send and sign tax documents Now, you can send and sign IRS Forms 8878 and 8879 electronically—right from your Intuit product. DocuSign ensures compliance with the latest IRS regulations for e-signing.

Does the IRS need original signatures?

The IRS doesn't specify what technology a taxpayer must use to capture an electronic signature. The IRS will accept images of signatures (scanned or photographed) including common file types supported by Microsoft 365 such as tiff, jpg, jpeg, pdf, Microsoft Office suite or Zip.

How do I get 8879 from TurboTax?

Form 8879 is not included in TurboTax because it is never used when you file your tax return yourself with TurboTax. Form 8879 is used only to authorize a paid tax preparer to file your tax return for you. You don't have to authorize yourself to file your own tax return.

Who is the ERO on a tax return?

Definition. The Electronic Return Originator (ERO) is the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS. The ERO is usually the first point of contact for most taxpayers filing a return using IRS e-file.

Does North Carolina have an e-file authorization form?

Business Electronic Filing Mandate - North Carolina does not mandate e-filing returns.

What is ERO signature?

What is an ERO signature? The Practitioner PIN method is an additional signature method for taxpayers who use an Electronic Return Originator (ERO) to sign their return by entering a five-digit PIN. The PIN can be any five digits except all zeros.

What is a 8879 form?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his or her e-filed individual income tax return.

How long to keep 8879?

Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date , whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc. 97-22, which is on page 9 of Internal Revenue Bulletin 1997-13 at

Instructions

A person filling out an 8879 form either declares on the form that he will enter the personal identification number on an electronically filed tax return or authorizes another party, an electronic return originator, to do so.

Retention

All 8879 forms are to be retained by the taxpayer/signee. Form 8879 is not sent to the IRS unless the department requests it.

What is a 8879 form?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his or her e-filed individual income tax return.

How long to keep 8879?

Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date , whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc. 97-22, which is on page 9 of Internal Revenue Bulletin 1997-13 at

What is a 8879 form?

The Form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the Form 8879 matches the information on the return. That declaration and signature authorization on Form 8879 gives the ERO permission to electronically submit ...

Who can sign 8879?

The taxpayer declaration on the Form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. For a corporation, that would be an officer of the company. For a partnership, it would be a general partner or managing member. For individual returns, the authorization must be given by the taxpayer or by both the taxpayer and spouse if filing a joint return. CPAs may be questioned as to who can sign an authorization, so they should be aware of some special cases in which a taxpayer can sign Form 8879 for someone else.

How long do you have to keep 8879?

EROs are required to keep the signed Forms 8879 on file for three years after the date the return was received by the IRS or the due date of the return, whichever is later. If these recordkeeping rules are not complied with, the ERO is subject to IRS sanctions, as mentioned above.

How long does it take to get a 8879 from the IRS?

The IRS requires the ERO to transmit the return for e - filing within three days of receiving the signed Form 8879. A client may be out of town and unable to receive mail or may not have access to email, or fax or scanning capabilities.

What is the problem number 2 on Form 8879?

Problem No. 2: Failure to obtain signed Form 8879 before submitting the return

Can an ERO be a tax preparer?

Even if the ERO is not considered the tax preparer, the practitioner is at risk for sanctions for violating ERO regulations, as explained below, and could possibly lose the ability to participate in the IRS e - file program. Such sanctions would severely impact the CPA's ability to practice.

Can a practitioner send a 8879?

Clients can be anxious to get their tax returns submitted with deadlines approaching quickly, so they may request that the practitioner send the Form 8879 electronically so that it can be signed and the return submitted promptly.

What is the purpose of Form 8879?

Purpose of Form Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his on his or her e-filed individual income tax return.

What is a 8879?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer's self-selected PIN and the Electronic Return Originator's (ERO's) Practitioner PIN.

Is there an adjustment line on Form 1120-S?

No, there is not an entry or line on Form 1120-S for "adjusted gross income". This is for individual returns only (1040) as you noted.