What does BAA stand for?

Graph and download economic data for Moody's Seasoned Baa Corporate Bond Yield (BAA) from Jan 1919 to Dec 2021 about Baa, bonds, yield, corporate, interest rate, interest, rate, and USA. Moody's Seasoned Baa Corporate Bond Yield

What is a BAA bond?

Bonds rated below BAA -- BBB from Standard & Poor's -- are considered to be non-investment grade. That makes the BAA rating the lowest investment grade rating. The lower the credit rating, the higher the yield a bond will pay.

What is the current yield on a BAA corporate bond?

Moody's Seasoned Baa Corporate Bond Yield is at 4.11%, compared to 4.01% the previous market day and 4.84% last year. This is lower than the long term average of 7.33%. Category: Interest Rates. Region: United States. Report: H.15 Selected Interest Rates. Source: Federal Reserve.

Is'corporate bond'a good investment?

BREAKING DOWN 'Corporate Bond'. Corporate bonds are considered to have a higher risk than government bonds. As a result, interest rates are almost always higher on corporate bonds, even for companies with top-flight credit quality.

What is AAA and Baa?

Credit Ratings 101 The top of the credit rating spectrum, so-called investment-grade bonds, is bracketed by AAA—the safest credit rating—at one end and BAA (on the Moody's rating scale) or BBB (on the S&P rating scale, equivalently) at the other.

What is BAA corporate yield?

Basic Info. Moody's Seasoned Baa Corporate Bond Yield is at 6.00%, compared to 5.71% last week and 3.19% last year. This is lower than the long term average of 7.96%. Report.

Which has a higher default risk premium AAA rated or Baa rated corporate bonds?

Corporate Baa bonds have the highest yields because they have the highest default risk (of those graphed), and the markets for their bonds are generally not very liquid.

What is BAA in banking?

A Baa rating is equivalent to the BBB rating range used by Fitch and S&P. A Baa rating represents a relatively low-risk bond or investment; banks are allowed to invest in Baa rated bonds.

What is the 10 year corporate bond rate?

United States - 10-Year High Quality Market (HQM) Corporate Bond Par Yield was 4.49% in August of 2022, according to the United States Federal Reserve.

What are corporate bond rates today?

Moody's Seasoned Aaa Corporate Bond Yield is at 4.87%, compared to 4.86% the previous market day and 2.69% last year. This is lower than the long term average of 6.52%.

Are Baa bonds safe?

AAA bonds are considered the absolute safest by the three primary bond rating agencies: Fitch, Moody's, and Standard & Poor's. Grades go as low as "D" for Fitch and Standard & Poor's. The lowest rating Moody's grants is "C."

Is Baa an investment grade?

Bonds given the Baa rating are considered as medium-grade obligations, meaning they are neither highly protected nor poorly secured. Bonds rated Baa and above are considered investment grade.

Are bonds better than Treasury bills?

If the money will be needed in the short term, a Treasury bill with its shorter maturity might be best. For investors with a longer time horizon, Treasury bonds with maturities up to ten years might be better.

What is the full form of BAA?

The Bachelor of Applied Arts, often abbreviated as BAA or B.A.A. is an undergraduate degree, with different meaning in different countries.

What is a Baa credit rating?

Baa. Obligations rated Baa are subject to moderate credit risk. They are consid- ered. medium-grade and as such may possess speculative characteristics.

What is a blocked accounts agreement?

What is a blocked accounts agreement? A BAA is a tripartite agreement between a lender, a borrower and a third party bank maintaining a deposit or collection account of the borrower (the “Subject Account”).

Are AAA corporate bonds safe?

Corporate bonds are rated by services such as Standard & Poor's, Moody's, and Fitch, which calculate the risk inherent in each specific bond. The most reliable (least risky) bonds are rated triple-A (AAA). Highly-rated corporate bonds constitute a reliable source of income for a portfolio.

What is yield bond?

Bond yield is the return an investor realizes on an investment in a bond. A bond can be purchased for more than its face value, at a premium, or less than its face value, at a discount. The current yield is the bond's coupon rate divided by its market price.

What are High Yield bond Funds?

What Are High-Yield Bonds? High-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they pay a higher yield than investment-grade bonds to compensate investors.

Are corporate bonds high risk?

Corporate bonds are considered to have a higher risk than government bonds, which is why interest rates are almost always higher on corporate bonds, even for companies with top-flight credit quality.

What Is a Corporate Bond?

A corporate bond is a type of debt security that is issued by a firm and sold to investors. The company gets the capital it needs and in return the investor is paid a pre-established number of interest payments at either a fixed or variable interest rate. When the bond expires, or "reaches maturity," the payments cease and the original investment is returned.

Why do corporate bonds have call provisions?

Corporate bonds sometimes have call provisions to allow for early prepayment if prevailing interest rates change so dramatically that the company deems it can do better by issuing a new bond. Investors may also opt to sell bonds before they mature. If a bond is sold, the owner gets less than face value.

What does it mean when an investor buys a bond?

An investor who buys a corporate bond is lending money to the company. An investor who buys stock is buying an ownership share of the company.

Why do corporations sell bonds?

Why Corporations Sell Bonds. Corporate bonds are a form of debt financing. They are a major source of capital for many businesses, along with equity, bank loans, and lines of credit. They often are issued to provide the ready cash for a particular project the company wants to undertake.

What happens when a bond expires?

When the bond expires, or "reaches maturity," the payments cease and the original investment is returned. The backing for the bond is generally the ability of the company to repay, ...

Why do retirees invest in bonds?

Retirees often invest a larger portion of their assets in bonds in order to establish a reliable income supplement. In general, corporate bonds are considered to have a higher risk than U.S. government bonds.

What is backing for a bond?

The backing for the bond is generally the ability of the company to repay, which depends on its prospects for future revenues and profitability. In some cases, the company's physical assets may be used as collateral .

What is the difference between AAA and BAA bonds?

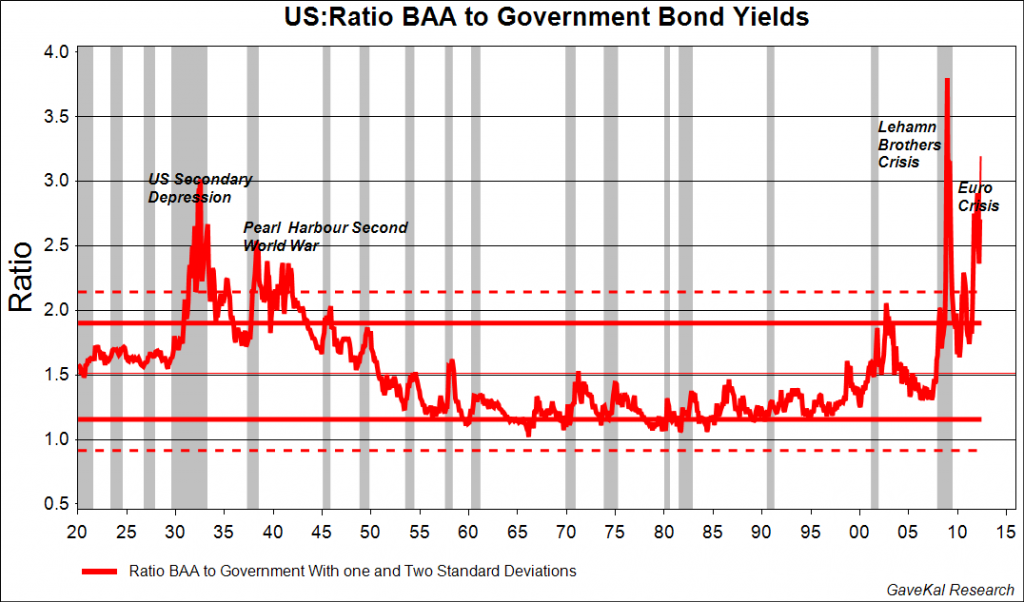

The difference in yield between an AAA bond (the top) and a BAA bond (at the bottom of the investment grade) represents a yield spread or yield grade. A higher yield grade implies a recession, as investors switch to the more guaranteed returns on AAA bonds. As the recession evolves, BAA investors increase, which reduces the ratio between AAA and BAA.

What is AAA bond?

An AAA bond is the top of the heap; the AAA bond rate is what's called prime. This bond comes with high confidence of repayment including interest rate, and the risk of default is low. A bond rated BAA may be at the bottom of this category, meaning it offers a higher return for higher risk, but both bonds fall into the investment-grade category, meaning the likelihood of bonds paying out true as expected is high enough to achieve this rating.

What Are Bond Ratings?

With so many bonds available, investors look at benchmarkers like Standard & Poor's and Moody's to determine whether a specific bond represents a low risk of default. The low risk of default means the investor has a high chance of payback.

What is bonding in finance?

Bonds represent a transaction between an investor and a borrower. Much like a loan, a bond represents money an investor gives to a borrower to use however they like, with set rules regarding interest rates and payback terms. Bonds are rated based on the associated risk of default. There are important distinctions between AAA and BAA corporate bond yields.

What does it mean when a bond is low risk?

The low risk of default means the investor has a high chance of payback.

What is the highest bond rating?

The credit-rating agencies Moody's and Standard & Poor's provide credit ratings on bond issuers and their bonds to give investors an idea of the investment reliability of the bonds, concerning the payment of interest and principal. AAA is the highest bond rating and indicates the safest bonds for investors.

What is a non investment grade bond?

Bonds listed at lower levels end up being listed as non-investment grades. This category is defined related to the level of risk versus the potential reward. They're also called high-yield bonds or junk bonds; these terms are based on the higher interest rates these bonds offer in return for a higher risk of non-payment.