There are three main types of endorsements:

- Blank endorsement. The term "blank endorsement" can be confusing because it doesn't mean that an endorsement is, strictly speaking, blank. ...

- Restrictive endorsement. This type of endorsement includes your signature and the words, "for deposit only." A check endorsed this way can be deposited into a bank account but not cashed. ...

- Endorsement in full. ...

What are the three types of check endorsements?

There are three main types of endorsements:

- Blank endorsement. The term "blank endorsement" can be confusing because it doesn't mean that an endorsement is, strictly speaking, blank. ...

- Restrictive endorsement. This type of endorsement includes your signature and the words, "for deposit only." A check endorsed this way can be deposited into a bank account but not cashed. ...

- Endorsement in full. ...

What does it mean to endorse a check?

Endorsing a check means that the checking (or other types of) account owner and the check recipient agree to the exchange of the amount written on the check. The account owner's signature is their confirmation to pay the amount written. The other blank space is for the recipient to sign.

What are the 5 types of endorsements?

Types of Endorsement

- Blank or General Endorsement. It is a type of endorsement when the endorser just signs on the instrument without mentioning the name of the person in whose favour the endorsement ...

- Special or Full Endorsement. ...

- Partial Endorsement. ...

- Restrictive Endorsement. ...

- Conditional or Qualified Endorsement. ...

How to endorse a check?

Simple Steps On How To Endorse A Check

- Verify The Information Of The Check. First and foremost, you have to verify all the information provided in the check and ensure that they are correct.

- Determine Who Should Endorse The Check. If there is only your name on the check, only your signature is required. ...

- Find The Endorsement Area On The Back And Endorse It. ...

What are the 3 types of endorsements for checks?

Before depositing a check, it must be endorsed. There are three ways to endorse a check, blank endorsements, special endorsements, and restrictive endorsements.

Who fills out the endorsement on a check?

First, take a look at the payee line on the front of the check, which will specify who needs to endorse the check. The payee line is located near the top of the check, next to the words “Pay to the order of.” If your name is the only one on the payee line, you're the only person who needs to endorse it.

Do I endorse a check made out to my bank?

Endorsing a check helps the bank verify you as the recipient and authorizes the bank to make the transaction. You may only need to sign your name on the back of the check, but other information may help protect you from fraud. For mobile deposits, follow the endorsement instructions in your bank's app.

What happens if you don't endorse a check?

Generally, the bank or credit union will likely either not accept the check or return it to you. You will have to get the person who gave you the check to sign it before you can cash it.

How do I endorse a check to someone?

Write “Pay to the Order of” and the third party's name below your signature. It's important to write the name of the person that you are signing the check over to in the endorsement area under your signature. This signals to the bank that you are endorsing the transfer of ownership for the check.

How do I deposit a check without an endorsement?

1 Turn the check over. Turn the check over. First, turn the check over so the back of the check is facing up. ... 2 Write For Deposit Only . '' ... 3 Write your account number. Write your account number. ... 4 Deposit the check. Deposit the check.

How do I endorse a check for mobile deposit?

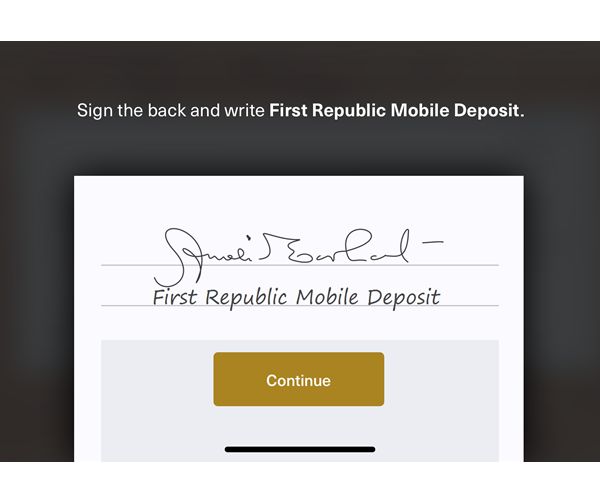

You can make deposits in a snap with your iPhone® or Android™ device. Due to a new banking regulation, all checks deposited via a mobile service must include: “For Mobile Deposit Only” handwritten below your signature in the endorsement area on the back of the check or the deposit may be rejected.

Can I deposit a check that is not in my name?

Call your bank and explain that you intend to deposit a check that has been made payable to someone else. Ask what you need to have them write on the back of the check, and be sure to ask if you both need to be present to deposit it.

How do I deposit a check without an endorsement?

1 Turn the check over. Turn the check over. First, turn the check over so the back of the check is facing up. ... 2 Write For Deposit Only . '' ... 3 Write your account number. Write your account number. ... 4 Deposit the check. Deposit the check.

How do I endorse a check for mobile deposit?

You can make deposits in a snap with your iPhone® or Android™ device. Due to a new banking regulation, all checks deposited via a mobile service must include: “For Mobile Deposit Only” handwritten below your signature in the endorsement area on the back of the check or the deposit may be rejected.

Can I deposit someone else's check in my account?

Having Someone Endorse a Check So You Can Deposit It In Your Account. The exact process whereby someone endorses a check so that you can deposit it into your own account may vary from bank to bank or credit union to credit union. In general, this involves the person writing your name on the back and signing the check.

Can I deposit a check that is not in my name?

It all depends on your bank's policies. Some banks may not allow you to deposit or cash a check made payable to someone else (a third-party check) while others may have special requirements you'll need to meet.

What is bank endorsement?

A bank endorsement is a guarantee by a bank confirming that it will uphold a check or other negotiable instrument, such as a banker's acceptance, from one of its customers. This assures any third-party that the bank will back the obligations of the creator of the instrument in the event the creator cannot make payment.

What documents are required before a bank guarantees a bankers acceptance?

Certain documents are required before a bank guarantees a bankers acceptance. Documents can include a bill of lading and an invoice. The company generating the banker's acceptance in this case would typically be an importer in a transaction where they are concerned about sending out money before receiving goods.

What is a letter of credit?

A letter of credit is similar to a banker's acceptance in that a bank will guarantee an exporter payment for goods or services in the event that payment for the goods or services are not made on time or for the right amount. A letter of credit does not work on a time draft function like a banker's acceptance.

What are negotiable instruments?

Negotiable instruments, including bills of exchange, promissory notes, drafts, and certificates of deposit, represent payment promises to a specified person (the assignee). Checks are common forms of negotiable instruments but the most common types of bank endorsements are a banker's acceptance, also known as a time draft, and a letter of credit .

How does a banker's acceptance work?

A banker's acceptance works as a time draft, specifying payment at a future date. Letters of credit guarantee payment and come in different forms.

How long does it take for a bank to pay a deposit?

It is an instrument from a bank that promises to pay the holder a specified amount at a specified date, usually between 30 to 180 days. A company issues a banker's acceptance, which a commercial bank guarantees. Certain documents are required before a bank guarantees a bankers acceptance.

Do importers have to pay back bank acceptances?

The importer would need to pay the bank back before the maturity date. Due to the perceived safety of banker's acceptances, these instruments commonly facilitate international institutions to complete transactions; at times, banker's acceptances can eliminate the need to extend credit.

How to endorse a check?

First, a word about safety and check fraud. Wait as long as possible to endorse the check. Endorse the check at the bank before getting in line or during a mobile deposit.

Where is the endorsement on a check?

You endorse a check on the back of the check. There may be a simple line or a box that reads: “Endorse Here.” There’s usually another line that says, “Do not write, stamp, or sign below this line.” The endorsement area is typically about 1.5” long and covers the breadth of the check.

What is it called when you sign a check?

Signing the back of it is called “endorsing the check.”. What you write when you sign it—how you endorse the check—depends upon what you want to do with the check and how the check is written.

How to check if a check is made out to multiple people?

If a check is made out to multiple people, look for “and” or “or” in the pay-to line. If the check is made out to “John and Jane Smith,” then John and Jane must both endorse the check. If the check is made out to “John or Jane Smith,” then John OR Jane can endorse the check. This is commonly seen when people give a check inside a wedding card. Check the pay-to line to make sure you’re endorsing the check correctly.

How to do a blank endorsement?

You do a blank endorsement by simply signing your name on the back of the check. Then, when you’re at the bank, you tell the teller if you want to cash it or deposit it. People will also do a blank endorsement when they’re depositing a check through an ATM or using mobile deposit. If you’re doing a blank endorsement, ...

What happens when someone pays you a check?

When someone pays you with a check, it’s like handing you cash; but, there are few more steps involved. You can take that check to the issuing bank (the bank listed on the front of the check) and cash it or you can take it to your bank and deposit it into your account.

What does FBO mean on a check?

FBO—For the Benefit of —Endorsement on a Check. Sometimes checks will be payable to a person or company for the benefit of another person. For example, someone might write a check to an assisted living facility for the benefit of an elderly or special needs family member.

Why do banks require you to endorse checks?

First, though, a general word of warning about check fraud. The reason why banks require you to endorse checks is in order to prevent fraud. Signing the back of a check helps to confirm your identity. 2

How to endorse a check?

You endorse a check by signing the back of it. On most checks there is a box at the top containing a stack of at least three lines that has the heading “Endorse Here,” and another, larger box beneath it with the heading "Do Not Write, Stamp, or Sign Below This Line." You should endorse the check in the top box. 3

What Is a Blank Endorsement?

A blank endorsement consists simply of the signature of the person to whom the check is made out on its back side. This makes the check negotiable tender for anyone holding it, not just the endorser, so it is not a very safe from of endorsement. That said, it is the most common form.

What Is a Restrictive Endorsement?

A restrictive endorsement includes not only the signature of the endorser but also the words “For Deposit Only” and the bank account number in which it is to be deposited. This prevents anyone else cashing or depositing the check.

Why do you wait until the last possible moment to endorse your check?

Wait until the last possible moment to endorse your check, so that it cannot be intercepted before it is processed. Doing this helps to guard against check fraud.

How to sign a check made out to someone else?

You first write “Pay to the order of” followed by the name of the person you wish to have the funds. Then you sign your below that. A number of banks will no longer accept such an endorsement, so make sure in advance that your bank will. And even if it will, it may require you to be present for identification purposes when your third party cashes or deposits the check.

Why do you sign the back of a check?

Different types of checks require different types of endorsement, but most involve signing the back of a check to prove that you are the legal owner of the funds it represents.

What is a check endorsement?

A check endorsement is a signature on the back of a check. Financial institutions require all parties listed on the check to sign the back to be able to cash or deposit the check. A check typically has a designated area for customers to sign, and it is usually marked with the statement "Do not write, stamp or sign below this line.".

What does it mean when a check has a signature on the back?

If the check already has a signature on the back of it, anyone with an ID matching that name would be able to cash the check. Using a phrase such as "deposit only" indicates to the bank teller that he or she is not to give cash on that transaction, and it limits the transaction to a deposit only.

Do you sign a check on the back or on the front?

The signature on the back of the check should match the name on the front. If the payer of the check spells the name incorrectly, financial institutions advise individuals to sign it the way it's written and then sign it normally.

What is a blank endorsement check?

A blank endorsement is made when the back of a check is signed without any added restrictions. Because a blank endorsement check can be deposited by anyone (even if their name is not written on the check), this method is best used when the check will be deposited immediately, like while using a mobile banking app.

Who Endorses a Check?

In some cases, it can be tricky to figure out who should be endorsing the back of the check. But just like any other check, the person receiving the check needs to be the one to endorse it.

How to endorse a check for mobile deposit?

When endorsing a check for mobile deposit, be sure to do your best to keep your signature on the line and any other necessary information in the endorsement area.

What is a restrictive endorsement?

A restrictive endorsement ensures that a check will be deposited into a specific account. Adding a restriction such as “for deposit only” or “for mobile deposit only” to the endorsement area helps to reduce the risk of the money being stolen if the check is lost.

How to endorse a check written to multiple people?

When endorsing a check that is written to multiple people, it is important to look at the pay-to line on the front of the check to look for the words “and” or “or”. If a check is made out to “Ms. and Mr. Smith” both parties will need to sign the check. If the check is made out to “Ms. or Mr Smith” either party can endorse the check. Just like when endorsing a check written to one person, it is important that when endorsing the back of the check the signature matches the spelling on the front of the check on the pay-to line.

Why do banks use special endorsements?

Because there is a potential risk of forgery when using special endorsement, banks are discouraged from cashing these types of checks unless the payee is present. Using a mobile banking app to deposit a special endorsement check helps the bank to legitimize the payment and protect your account from fraud.

What to check when signing a check for endorsement?

Check Your Signature. When you sign a check for endorsement, it is important that you check that the name on the front of the check matches the name you sign on the back. For instance, if the check is made payable to “Ms. Smithe,” but the correct spelling of your name is “Ms. Smith,” the back of the check should be signed with ...

Why do you endorse a check?

By endorsing the check you are attesting to the fact that you have transferred said document to them and they can draw on that account. The best reason for endorsing a check is in case it is lost. If the back is blank, a crooked finder could simply write "pay to the order of " on it and deposit it in his own account.

What happens if you endorse a check?

If you endorse the check, it legally authorizes them to debit your account, if the check is later returned for non-sufficient funds (NSF). It mostly protects the bank, and not the customer. When the check is deposited, the bank verifies the signature in the check matches your signature in file. Highly active question.

Do you need a signature to endorse a check?

You do not need a signature for the endorsement. The safest way to endorse a check is to write "FOR DEPOSIT ONLY" followed by an account number, in which case the signature is not needed. most businesses make up rubber stamps with this and stamp it the minute they receive a check. That way it has no value to anyone else.

Can a bank compare a signature to an ID?

So the bank can (theoretically) compare that signature to the ID you provide, showing that the names and signatures match and that you are the person to whom the check was written.

Do banks require endorsements?

I believe the banks are protecting themselves when they "require" your endorsement. Years ago. they used to ask for your endorsement, and not require it. If you endorse the check, it legally authorizes them to debit your account, if the check is later returned for non-sufficient funds (NSF). It mostly protects the bank, and not the customer.

Does Chase have an applet for depositing checks?

That way it has no value to anyone else. Depositing checks is increasingly going the way of the dodo. Many businesses today use check truncation - the business scans the check in, sends the digital image to the bank, and stores the check. I was surprised that Chase already has an applet for iPhones that you can use to deposit a check by taking ...