How do you deposit cash into a checking account?

These are the steps you’ll likely need to follow to make an ATM deposit:

- Insert your debit card and punch in your PIN to access your account. ...

- Select “deposit” from the transaction types available.

- Select the account you want to receive the money.

- Insert your cash into an envelope if one is provided, and write any information indicated on the envelope. ...

- Wait for your receipt. ...

How much cash deposit in saving account possible?

- You can deposit as much as you can

- You have to provide pan card number

- Statement of your income for any quieries .

Can anyone deposit cash into my checking account?

Whether someone else can deposit money into your account depends on the policies of the bank involved. Some banks no longer allow deposits into someone else's account. If the bank allows it, the person making the deposit would need your name and account number. A better option may be to send money electronically through a service like Zelle.

Do banks charge for cash deposits?

To make a profit and pay operating expenses, banks typically charge for the services they provide. When a bank lends you money, it charges interest on the loan. When you open a deposit account, such as a checking or savings account, there are fees for that as well.

What does cash deposit mean?

To deposit cash means to add money to your bank account. The traditional way to deposit money is by visiting the nearest bank branch. You can also deposit money through an ATM-cum-cash deposit machine. You can deposit cash at ATMs even if you do not have an ATM card.

Is deposit account same as savings account?

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

What is the difference between bank deposit and cash deposit?

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited. When someone opens a bank account and makes a cash deposit, he surrenders the legal title to the cash, and it becomes an asset of the bank.

What does deposit account mean?

: a bank account in which people keep money that they want to save : savings account.

What are the types of deposit account?

Types of Account DepositsSavings Accounts. A Savings Account is a basic bank account that most of us have. ... Current Accounts. ... Salary Accounts. ... Fixed Deposit Accounts. ... Recurring Deposit Accounts.

What are the 4 types of bank accounts?

Different Types of Bank AccountsCurrent account. A current account is a deposit account for traders, business owners, and entrepreneurs, who need to make and receive payments more often than others. ... Savings account. ... Salary account. ... Fixed deposit account. ... Recurring deposit account. ... NRI accounts.

Are cash deposits reported to the IRS?

Banks and financial institutions must report any cash deposit exceeding $10,000 to the IRS, and they must do it within 15 days of receipt.

What is the limit for cash deposit in bank?

$10,000If you deposit more than $10,000 cash in your bank account, your bank has to report the deposit to the government.

How much cash deposit is suspicious?

$10,000The $10,000 Rule Ever wondered how much cash deposit is suspicious? The Rule, as created by the Bank Secrecy Act, declares that any individual or business receiving more than $10 000 in a single or multiple cash transactions is legally obligated to report this to the Internal Revenue Service (IRS).

Is deposit account same as debit card?

Savings Accounts Don't Offer Debit Cards Savings accounts are not designed to serve as a transaction account. They're designed to be long-term storage for your excess cash. For this reason, savings accounts do not offer debit cards or the ability to write check against them.

How do deposits work?

How Does a Deposit Work? When you deposit your money in a bank, you are safeguarding it. The bank promises to pay this money back to you as and when you need it. The deposit is your asset, and the bank owes you the amount you save and pays interest on it.

What is the purpose of deposit?

A deposit is a financial term that means money held at a bank. A deposit is a transaction involving a transfer of money to another party for safekeeping. However, a deposit can refer to a portion of money used as security or collateral for the delivery of a good.

What are the 3 types of savings?

The 3 common savings account types are regular deposit, money market, and CDs. Each one works a little different regarding accessibility and amount of interest. Besides these accounts, there are other savings options too.

Which is better time deposit or savings account?

In short, a time deposit gives you higher returns than a regular savings account with significantly less risk than an investment. And because your money will be locked-in for a certain period, it's even protected from yourself (and your sudden urges to spend).

What is an example of a savings account?

There are different types of savings accounts to choose from, and they're not all alike. The options include traditional savings accounts, high-yield savings accounts, money market accounts, certificates of deposit, cash management accounts and specialty savings accounts.

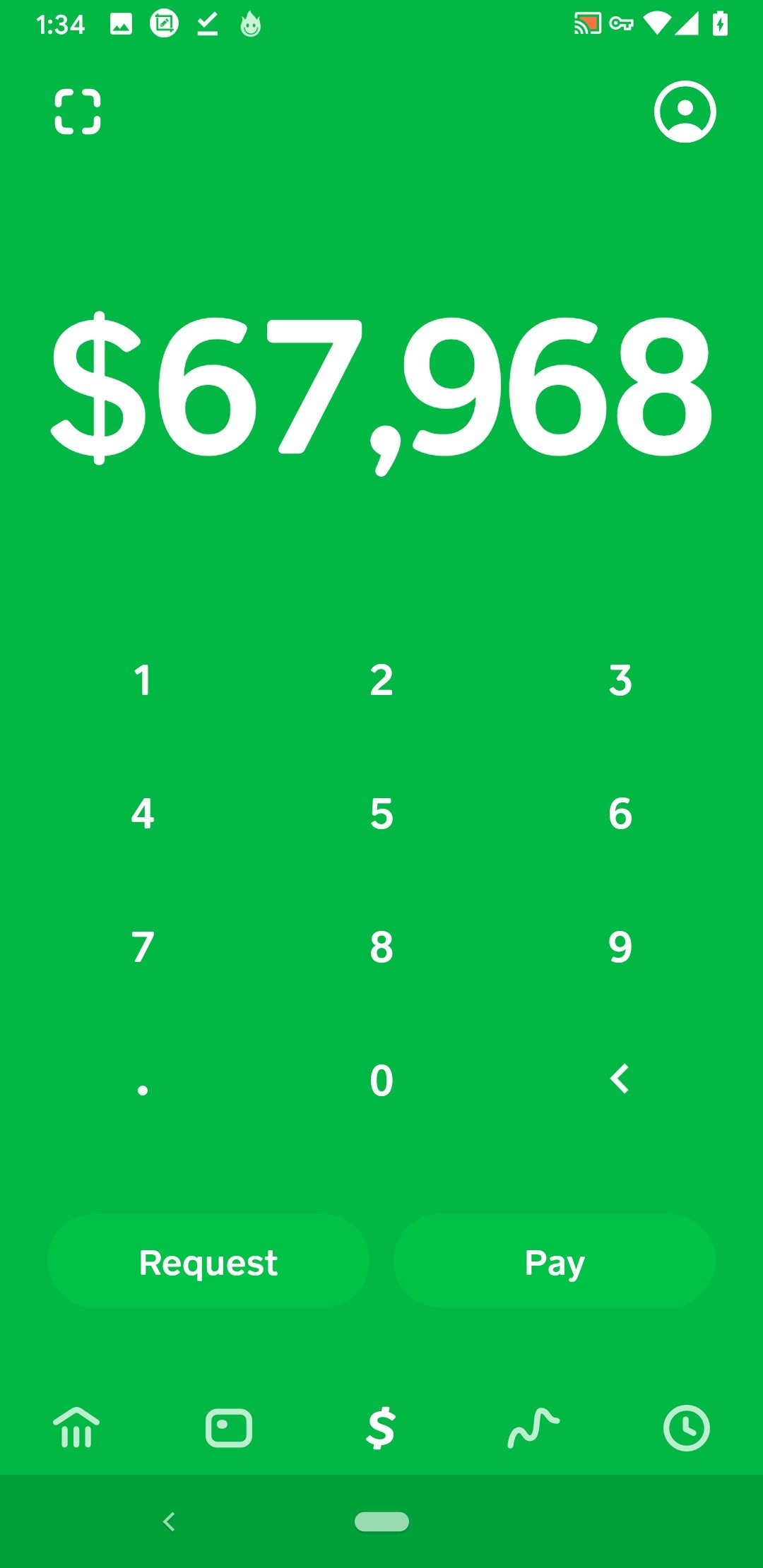

What is a Cash Deposit Account?

A Cash Deposit Account (CDA) is the all in one investment solution which gives you a choice of investment alternatives within the one account.

Interest rate

This is the standard interest rate applicable on CDA At Call. For further information on how interest rates are determined, refer to the CDA Terms and Conditions (PDF).

What is the regulation for cash accounts?

The Federal Reserve's Regulation T governs cash accounts and the purchase of securities on margin. This regulation gives investors two business days to pay for security. It's known as T+2. In accounting, a cash account, or cash book, may refer to a ledger in which all cash transactions are recorded.

What is margin account?

Unlike a cash account, a margin account allows an investor to borrow against the value of the assets in an account in order to purchase new positions or sell short. Investors can use margin to leverage their positions and profit from both bullish and bearish moves in the market.

What is a cash liquidation violation?

There would be no cash available in the account to cover the trade. This is known as a "cash liquidation violation.". An active investor with a cash account and zero cash available must also not buy security and then quickly sell it before a previous sale has settled to provide the necessary cash.

Can you short sell on margin in a cash account?

Unlike margin accounts, cash accounts do not allow short selling or trading on margin.

What happens if you deposit more than $10,000 in your bank account?

If you deposit more than $10,000 cash in your bank account, your bank has to report the deposit to the government. The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act, also known as the Currency and Foreign Transactions Reporting Act. The goal is to prevent money laundering by criminals ...

How long does it take to report a deposit to the IRS?

However, when a customer makes multiple smaller cash payments in a 12-month period, the 15 days countdown for reporting to the IRS starts as soon as the total paid exceeds $10,000. The IRS may also look at suspected "structured" deposits ...

What form do I use to report a cash payment?

If your business receives a cash payment over $10,000, you also have to report the transaction. To do so, you’ll use Form 8300, which offers valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network (FinCEN). It helps the agencies combat money laundering that is used to facilitate various criminal activities such as drug dealing and terrorist financing.

How long do you have to file a tax return after receiving cash?

You have to file the form within 15 days after receiving the cash. You can file the form electronically or mail it to the IRS. A copy of this form is sent to the Financial Crimes Enforcement Network (FinCEN). Businesses that fail to report these transactions can have severe penalties imposed on them.

Call Deposit Account Explained

Ashley Donohoe is an expert in personal finance, lending, and credit management with nearly a decade of experience writing and editing content in those areas. Professionally, she is a certified bookkeeper with the National Bookkeepers Association and served in an advisory role with Zacks Personal Finance.

Definition and Examples of a Call Deposit Account

A call deposit account is a bank account that allows you to deposit money, earn interest, and still be able to freely withdraw your money when you need it.

How a Call Deposit Account Works

Call deposit accounts function much like other interest-bearing bank accounts in that the bank pays you interest in exchange for your depositing money they can use to extend credit to others. The interest you earn on these accounts may depend on what your balance is.

Pros and Cons of a Call Deposit Account

Flexible access to your cash: Since it works much like a basic checking account, a call deposit account usually gives you the freedom to use your money whenever you need it. This helps if you need to make several transactions that might otherwise be limited and avoids hassles that come with CDs.

Call Deposit Account vs. Time Deposit Account

Call deposit accounts contrast with time deposit accounts, also known as certificates of deposit (CDs). While call deposits don’t have a maturity date, CDs commonly have a maturity of anywhere from weeks to months or years. You usually need to invest a minimum amount in a CD and can’t add to it like you could with a call deposit account.

How To Get a Call Deposit Account

You can usually find call deposit accounts such as advantage checking accounts through banks and credit unions. However, you may consult international banks if you’re interested in investing in foreign currencies.

What is a call deposit account?

Additionally, call deposit accounts do allow investors to deposit and withdraw funds in several currencies, which commonly include the U.S. dollar, the euro, and the British pound. This flexibility reduces investors' exposure ...

What is call deposit?

A call deposit account is a bank account for investment funds that offers the advantages of both a savings and a checking account. Like a checking account, a call deposit account has no fixed deposit period, provides instant access to funds, and allows unlimited withdrawals and deposits. The call deposit also provides the benefits ...

How many withdrawals can you make from a high interest savings account?

Regulation D, a regulation in place at the federal level, provides restrictions on the number of withdrawals that can be made from interest-bearing accounts, such as high-interest savings accounts and money market accounts, generally placing the limit at six withdrawals per month.

Do you need prior notice for a direct deposit?

Most withdrawals from call deposit accounts do not require prior notice unless they are over a certain amount.

Do you need notice for large cash withdrawals?

Based on the amount of funds an institution must maintain as a reserve, notice may be required for large cash withdrawals. Depositors may have to meet a minimum balance threshold before they earn any interest, and different currencies may earn at different interest rates.

Can you withdraw money from a call deposit account?

Call deposit accounts have no limits on the number of withdrawals and can be accessed at any time. Call deposit accounts allow investors to deposit and withdraw funds in several currencies, including the U.S. dollar, the euro, and the British pound.

What does it mean when a bank deposits $10,000?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002. RELATED CONTENT. Pay Attention to Your Bank Statement.

Does a cashier's check have to be reported to the government?

However, for individual cashier's checks, money orders or traveler's checks that exceed $10,000, the institution that issues the check in exchange for currency is required to report the transaction to the government, so the bank where the check is being deposited doesn't need to.

Does the IRS report suspicious deposits?

The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, he says. "Suspicious activity in excess of $5,000 detected by the bank or an institution is also required to be reported," Castaneda says. The federal law extends to businesses that receive funds to purchase more expensive items, such as cars, ...

What happens if you deposit over $10,000 in cash?

It could be with one $10,000 bill, or 10,000 $1 bills. Once you make a $10,000 cash deposit and the bank files its report , the IRS will then share it with officials from your local and state jurisdictions, up to the national level, to monitor where the money ends up.

How much was seized from 600 depositors in 2016?

Fact: According to the IRS, in 2016, $43 million was seized from 600 depositors under suspicion of structuring large deposits. It’s not just large deposits over $10,000 structured into small amounts that count.

What is the law behind bank deposits?

The Law Behind Bank Deposits Over $10,000. It’s called the Bank Secrecy Act (aka. The $10,000 Rule), and while that might seem like a big secret to you right now, it’s important to know about this law if you’re looking to make a large bank deposit over five figures.

What does it mean when your bank says your card is stolen?

It could mean your card was stolen and someone went on a spree; or, you might just be on vacation and spending more than usual. The bank will sometimes put a temporary freeze on your account until the activity can be verified. If not, you and your money are good to go.

When did the Bank Secrecy Act start?

The Bank Secrecy Act is officially called the Currency and Foreign Transactions Reporting Act, started in 1970 . It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service. For this, they’ll fill out IRS Form 8300.

Can you deposit cash into someone else's account?

In the case of Chase Bank, for example, you can’t make cash deposits into someone else’s account anymore -- the bank’s customary way of reducing illegal activity.

Do you have to fill out a deposit slip?

You’ll fill out a deposit slip as usual, and the money is deposited into your account. Their reporting to the IRS happens after you make the deposit. Depending on the banking institution, you should have immediate access to your funds. You won’t be kept in the dark about it.