A cash disbursement is the outflow of cash paid in exchange for the provision of goods or services. A cash disbursement can also be made to refund a customer, which is recorded as a reduction of sales. Yet another type of cash disbursement is a dividend payment, which is recorded as a reduction in corporate equity.

How do I record a disbursement to a rental owner?

Record an owner draw by check. Save time! Access this feature from any screen using the shortcuts menu. Navigate to Rentals > Rental owners. Click Owner draw. You can select to initiate a disbursement for all owners, or individually. Select which properties you'd like to include in the disbursements. Buildium calculates the available balance ...

What is a disbursement from LLC?

What Is a Disbursement From LLC?

- LLC Disbursements. An LLC's operating agreement defines the percentages by which the company's profits are allocated to its members.

- Improper Disbursements. In most states, an LLC must have enough money to pay its bills before it's permitted to make disbursements to members.

- Taxing Disbursements. ...

- Dissolution and Disbursements. ...

What does dispursement mean?

disbursement. Disbursement means the payment of money from a fund or account. If the disbursement of paychecks at your job was delayed because your boss forgot to fill out some paperwork, you'd probably be furious. Disbursement is a noun that describes the spending or distributing of money.

What is controlled disbursement?

Controlled disbursement is a type of cash management service that is only available to companies. The name comes from its function: it allows a bank's corporate clients to see their expenditures, or disbursements, on a daily basis, which is a controlled period of time.

What are examples of cash disbursements?

Business loan payment: Any business loan payment is a cash disbursement. Rent on physical locations: Rent payments made with cash, checks, or other equivalents are recorded as cash disbursements. Employee salary payments: Payroll payments to employees are cash disbursements.

What is meant by cash disbursement?

A cash disbursement is a payout of funds in cash. In the payments industry, the term typically refers to a withdrawal made from an ATM or a cash back transaction. These transactions can typically only be made with debit cards, not credit, and are often subject to different rules than ordinary purchases.

How do you get cash disbursement?

A cash disbursement can be made with bills or coins, a check, or an electronic funds transfer. If a payment is made with a check, there is typically a delay of a few days before the funds are withdrawn from the company's checking account, due to the impact of mail float and processing float.

What is a cash disbursement fee?

Cash Disbursement means a service through which Card holders can swipe their card on Point-of-Sale (POS) terminals provided by financial institutions or BANK Branch Terminal. Such transactions incur higher fee on the amount being swiped for transferring funds. ( Customer can refer schedule of charges for more details)

Why did I get a disbursement check?

What is a disbursement check? A disbursement check is a check that the recipient can bring to a bank to cash or deposit to their bank account. Businesses frequently use disbursement checks for transactions like paying employees or suppliers, sending dividends or shareholders, or distributing profits to owners.

Is a disbursement a refund?

A disbursement is not a synonym for a refund.

What is the difference between a payment and a disbursement?

A payment is the agreed value of a product or service. A disbursement is a payment from a dedicated fund. We'll cover the differences between payments and disbursements and how they're used. We've always found a way to exchange goods: raw materials, services, labor.

Why cash disbursement is important?

Every small business needs a cash disbursement system that efficiently and securely handles a company's cash payments. Accounts payable, or A/P, is closely tied to cash disbursements, and most transactions are processed through A/P when a cash payment is made.

What does it mean when your loan has been disbursed?

The disbursement date is the date your school disburses (pays out) your Direct Loan by applying the loan funds to your school account, paying you directly, or both. Direct Loans are usually disbursed in more than one installment.

Is cash payment and cash disbursement the same?

Cash Disbursement Cash disbursements (also called cash payments) are made by a business during a specific period (like a quarter or year). It's the cash outflow from a company to settle obligations like operating expenses, interest payments, and accounts receivables.

What are disbursements used for?

The term "disbursement" refers to a payment that has been completed. That is, on the payer's side, it has been legally recorded as a debit and on the payee's side, it has been properly recorded as a credit.

How long does the disbursement process take?

Disbursements can take anywhere from one day to five days. Three days is a common term for electronic transfers from one consumer's bank account to another's.

Is cash payment and cash disbursement the same?

Cash Disbursement Cash disbursements (also called cash payments) are made by a business during a specific period (like a quarter or year). It's the cash outflow from a company to settle obligations like operating expenses, interest payments, and accounts receivables.

What is the difference between a payment and a disbursement?

A payment is the agreed value of a product or service. A disbursement is a payment from a dedicated fund. We'll cover the differences between payments and disbursements and how they're used. We've always found a way to exchange goods: raw materials, services, labor.

What is the difference between cash receipts and cash disbursements?

Cash disbursements are monies paid out to individuals for the purchase of items that are needed and used by a company. This can be anything from purchasing inventory, raw materials, or even utilities. Cash receipts are money received from consumers for the sale of goods or services.

Why cash disbursement is important?

Every small business needs a cash disbursement system that efficiently and securely handles a company's cash payments. Accounts payable, or A/P, is closely tied to cash disbursements, and most transactions are processed through A/P when a cash payment is made.

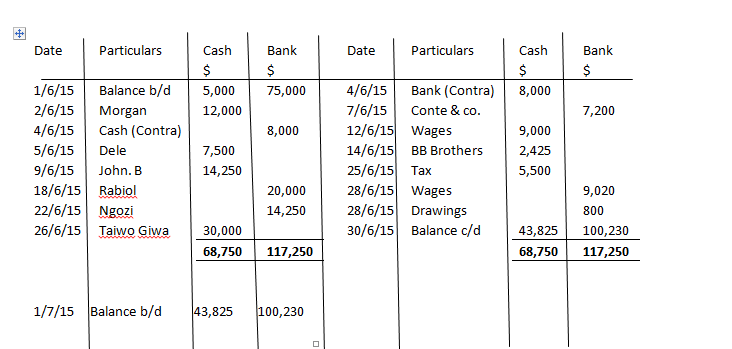

What Is a Cash Disbursement Journal?

A cash disbursement journal is a record kept by a company's internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger. On a monthly basis, these journals are reconciled with general ledger accounts, which are then used to create financial statements for regular accounting periods.

What information is included in a cash disbursement journal?

The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information. Cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses.

Why do we need a journal for cash disbursement?

Furthermore, cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses. This data can be crucial to making sound business decisions moving forward.

What is a Cash Disbursement?

In accounting, a cash disbursement is a payment made by one party to another. Also called cash payments or disbursements, they can be made by check, e-check, Automated Clearing House (ACH), digital payment, and all formats of payments recorded with an immediate deduction.

How to do a Cash Disbursement

To perform a cash disbursement, an employee issues a check, pays cash, or initiates an ACH or other funds transfer. That cash (or cash equivalent) payout gets recorded in a cash disbursement journal. The journal entry records:

Types of Cash Disbursements

Any money paid in cash (or equivalents) is a cash disbursement. So — there are as many types of cash disbursements as there are different kinds of payments. Here are several cash disbursement examples.

Other Kinds of Disbursements

Disbursements can be controlled, delayed, positive, or negative. Here’s a little more info on the other disbursement types you might encounter.

What is a Drawdown?

A drawdown is a measurement of a decline in the value of an account resulting from a disbursement. When you’ve actioned a disbursement, the consequence of that transaction is a drawdown. The term “drawdown” is mostly used to discuss disbursement from a large account, like a retirement fund.

What is cash disbursement?

Cash disbursement does not only mean physical cash but it also includes other cash resources, like line of credits and cheques. Let’s explore more details about cash disbursement.

What is the process through which a business or any commercial company buys different items with cash resources called?

The process through which a business or any commercial company buys different items with cash resources is called a cash disbursement. These items can range from a simple raw material needed for manufacturing things to huge machines needed for industrial purposes as well as consumer goods.

How often are federal loans disbursed?

The loans of both federal and private students are disbursed twice or more in one year. Once the credit goes in the student’s account, he is liable to pay for his tuition fees.

How does a purchase order work?

Now, the purchase team creates a purchase order and sends it to the accounting department for approval. The accounting team checks for the available cash resources and then approves on its basis. Then, the receiving team takes the order on credit from the supplier.

Why is a cash report important?

The report helps in keeping better internal controls over cash. For instance, when the cash got out of the company to ensure it is in the right hands at all times.

Is it necessary to have a positive disbursement?

It is not necessary that disbursement should be positive. It can be negative too. The difference between positive and negative cash disbursement is very small. The outcome of a negative cash disbursement is in the form of account debit, whereas the results of positive cash disbursement comes in the form of account credit. Advertisement.

When a loan proceeds are paid to a borrower who is a student, then this type of loan is?

When a loan proceeds are paid to a borrower who is a student, then this type of loan is called as student loan disbursement.

What is cash disbursement?

Cash disbursement is a process by which a business pays out money to a person or organization, typically related to operating expenses for that business. While the name implies this type of payment is made out in cash, which is possible, it is common for payments to be made as checks or credit transactions, too.

How do businesses make cash disbursements?

The use of credit cards and similar methods has become increasingly popular, as credit cards have become more commonly accepted and allow a business to track disbursements and expenses more easily. A company can also use direct money transfers for cash disbursement purposes, usually through the transfer of funds directly from the account of the business into the account of a person or organization.

What is direct money transfer?

A company can also use direct money transfers for cash disbursement purposes , usually through the transfer of funds directly from the account of the business into the account of a person or organization. One of the most common purposes of a cash disbursement is for payment to employees for salary. Many businesses with physical locations also incur ...

Why do businesses use checks?

Checks are often used to allow such disbursements to be more easily tracked and recorded by a business . The use of credit cards and similar methods has become increasingly popular, as credit cards have become more commonly accepted and allow a business to track disbursements and expenses more easily. A company can also use direct money transfers ...

What Is a Cash Disbursement?

Cash disbursements represent the individual expense transactions that make up the expense totals shown on a company’s income statement. This includes payments for wages and salaries, inventory, outside legal services, the building rent and every other expense that the company incurs. When the company pays invoices, it records the payments to a cash disbursements journal in its accounting software system.

Why is a cash disbursement report important?

One of the most important uses for a cash disbursement report is to assist in maintaining tight internal controls over the cash that leaves the company so that it doesn’t end up in the wrong hands.

What is profit and loss statement?

The company’s profit and loss statement shows the cash disbursements at a high level, and the expenses are shown in different time periods depending on whether the company uses cash- or accrual-basis accounting.

When a company disburses cash, should it always use a preprinted, numbered check?

When the company disburses cash, it should always use a preprinted, numbered check and have policies in place on who in the company can authorize check payments. Also, when a company pays invoices, it should mark them as paid to prevent unscrupulous or erroneous double payments.

What is journal in accounting?

In accounting, the term “journal” is used to describe a list of recorded transactions that have been segregated by type. A business typically uses several journals in its accounting system, such as a journal for sales, cash receipts, cash disbursements and a general journal.

What is disbursement in accounting?

A disbursement is the actual delivery of funds from one party's bank account to another. In business accounting, a disbursement is a payment in cash during a specific time period and is recorded in the general ledger of the business. This record of disbursements shows how the business is spending cash over time.

What is disbursement in business?

What Is Disbursement? Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.

Why is it important to record disbursements?

In business, the regular recording of all disbursements of cash is a crucial method of keeping tabs on the expenditures of the business. In the wider world, the word disbursement is used in a variety of contexts, from the crediting of student loan money to the finalization of a withdrawal from a retirement account.

What is delayed disbursement?

Delayed disbursement, also called remote disbursement, is deliberately dragging out the payment process by paying with a check drawn on a bank located in a remote region. In the days when a bank could process a payment only when the original paper check was received, this could delay the debit to the payer's account by up to five business days.

When is a loan disbursed?

A loan is disbursed when the agreed-upon amount is actually paid into the borrower's account and is available for use. The cash has been debited from the lender's account and credited to the borrower's account.

Is a drawdown a disbursement?

As noted above, a disbursement is a payment. A drawdown, however, is a consequence of a particular type of disbursement. If you take money out of a retirement account, you receive a disbursement of money. That disbursement represents a drawdown on the balance in your account.

What is internal control for cash disbursements?

The objectives of internal controls for cash disbursements are to ensure that cash is disbursed only upon proper authorization of management, for valid business purposes, and that all disbursements are properly recorded. Grantees will find this resource useful when maintaining internal control for cash disbursements.

What is restricted contribution?

Restricted contributions are a form of revenue unique to the nonprofit sector. Money which has been restricted by the donor for a specific use (such as buying a new building, starting a new program, building an endowment, etc.) should only be used for the purpose for which it has been given. However, most nonprofits find themselves tempted to borrow against restricted monies when facing a cash shortage. In cases where the funder clearly prohibits such borrowing, such action clearly violates the funder's trust and instructions and may lead to revocation of the grant. In other cases, donors allow temporary borrowing as long as the money is replaced within a certain period of time, usually within the grant year.

What is the role of the board in a restricted fund?

Ultimately, it is the role of the board to ensure that the organization fulfills its obligations to donors. Therefore, in cases where borrowing against restricted funds is permitted, the board should establish policies which describe the circumstances under which such borrowing is allowed.

Can a nonprofit borrow against restricted funds?

However, most nonprofits find themselves tempted to borrow against restricted monies when facing a cash shortage. In cases where the funder clearly prohibits such borrowing, such action clearly violates the funder's trust and instructions and may lead to revocation of the grant.

Can a check signer pay bills?

The check signer is allowed to pay bills until that amount is substantially depleted. At that time, the treasurer or other board members may review the disbursements and make sure that they are within the guidelines established by the board.