Key Takeaways

- If you are taking out a mortgage loan, commitment fees may be wrapped into closing costs.

- The percentage of a commitment fee generally varies between 0.25% and 1%, according to the Corporate Finance Institute.

- Lenders use commitment fees to ensure they are compensated for guaranteed financial service.

What is a loan commitment fee?

- If the commitment period was too short to be reasonable, given market conditions.

- If the lender decides not to move forward with the loan because the property intended to secure the loan doesn’t appraise for enough money.

- If the lender decides not to move forward with the loan because of the applicants lack of .

What is Bank commitment fee?

DALLAS, June 21, 2021 (GLOBE NEWSWIRE) -- Texas Capital Bank, N.A., and its parent company Texas Capital ... Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

Are commitment fees interest expense?

While Revenue Ruling 81-160 is not explicit on the point, the IRS has held in other contexts that the commitment fees should not be treated as interest expense. Commitment fees, as a cost of acquiring the loan, are amortized over the term of the loan. Click to see full answer. Regarding this, what are commitment fees?

What is an unused commitment fee?

Unused Commitment Fee. The Borrower agrees to pay a fee on any difference between the Revolving Commitment and the amount of credit it actually uses, determined by the weighted average credit outstanding during the specified period. The fee will be calculated at 0.25% per year.

Do I have to pay a commitment fee?

In the case of mortgage, the lender does not disburse the credit at one go to the builder. In most of the cases, the loan disbursal is linked to the project completion stage. Normally the borrower needs to pay a charge for accessing the loan in future from the lender. This is called the commitment fee.

What is a commitment fee when buying a house?

What Is a Commitment Fee? A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend. Commitment fees typically are associated with unused credit lines or undisbursed loans.

What is a commitment in mortgage?

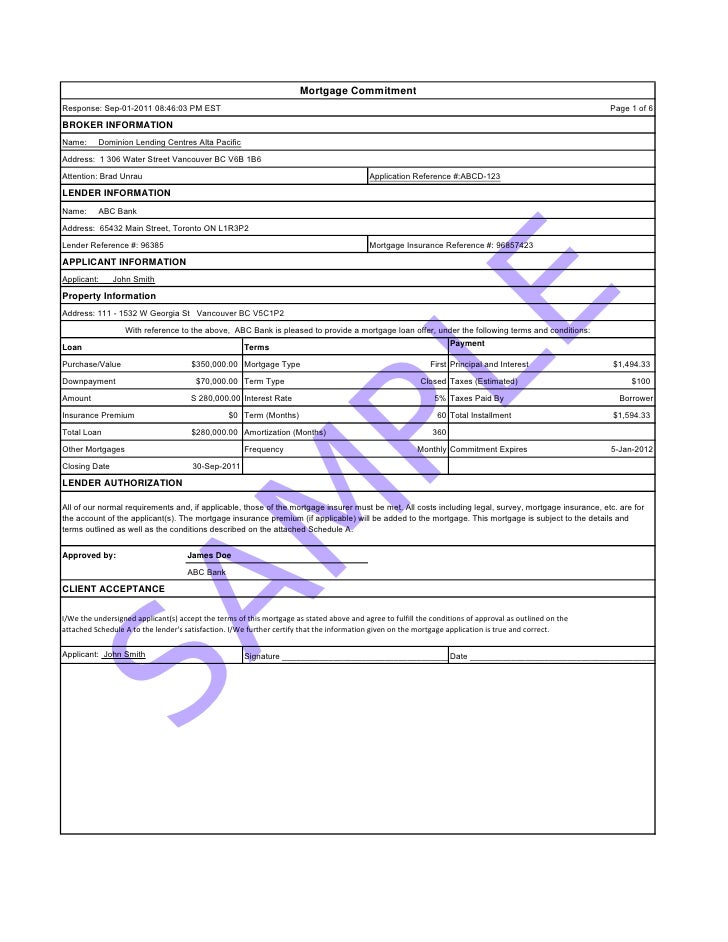

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

How much is a commitment fee?

a 0.25% to 1.0%Financial institutions, such as corporate banks, charge commitment fees as compensation for keeping the line of credit open and available to be drawn down. The standard commitment fee typically ranges between a 0.25% to 1.0% annual fee paid to the lender.

How are commitment fees paid?

Commitment fee can be paid through KMTC mpesa paybill.

Are commitment fees the same as points?

Depending on how a specific lender handles points, the commitment fee may serve as points paid. In this situation, the commitment lies in the terms of the interest rate on the loan. Generally, this can take place when the commitment fee charged equals a percentage of the loan amount rather than a flat rate.

How long does a mortgage commitment last?

30 daysAs mentioned above, mortgage commitment letters have expiration dates specified by the lender, after which your approval and any rate lock you had are rendered void. The length of commitment can vary between lenders, but a mortgage commitment letter typically expires after 30 days.

What happens after mortgage commitment?

You will sign paperwork that indicates that you accept the terms of the mortgage loan. The funds for the home purchase will be transferred once you have received and signed all of the paperwork. The deed, which is proof of the ownership to your home, should be transferred to your name.

How long does a mortgage commitment take?

30-45 daysIt can vary based on all the conditions being met. Assuming that the documentation supplied meets the bank's criteria for a mortgage, expect a commitment to take 30-45 days from the time the paperwork is submitted.

Are commitment fees tax deductible?

The 2017 Tax Act (known as the “Tax Cuts and Jobs Act”) created substantial limitations on the ability of US taxpayers to deduct interest expense, most notably in Section 163(j) of the Tax Code.

How do loan Commitments work?

A loan commitment is a formal letter from a lender stating that the applicant has met all of the qualifications for receiving a loan, and that the lender promises a specific amount of money to the borrower.

Are commitment fees capitalized?

That's because FASB views the commitment fee as representing the benefit of being able to tap the revolver in the future as opposed to a third-part related fee with no discernible long term benefit. That means that commitment fees continue to be capitalized and amortized as they have been in the past.

What is mortgage commitment fee?

Generally, you can pay this fee in return for the lender making a written promise to fund the loan. Some lenders may consider the commitment money as a more general fee for processing the loan and paying for the underwriting process. Other lenders accept this fee on the condition to keep a line of credit open for future use.

What is commitment money?

Some lenders may consider the commitment money as a more general fee for processing the loan and paying for the underwriting process. Other lenders accept this fee on the condition to keep a line of credit open for future use.

What are closing costs?

Most commonly are loan origination charges, underwriting fees, document preparation costs, and appraisal fees. Additionally, lenders generally require borrowers to pay application fees and a fee to run their credit report.

What is a mortgage point?

Mortgage points are another type of fee paid by the borrower to lock in a lower interest rate. Depending on how a specific lender handles points, the commitment fee may serve as points paid. In this situation, the commitment lies in the terms of the interest rate on the loan. Generally, this can take place when the commitment fee charged equals ...

What is default mortgage?

Default Mortgage. Mortgage companies lend money to credit worthy borrowers to purchase homes. In addition to the interest charged on the loan amount, the lender charges certain fees up front when the loan originates. These fees are generally lumped together in “closing costs” paid by borrowers on the date the loan closes.

Is a mortgage commitment fee a closing cost?

These fees are generally lumped together in “closing costs” paid by borrowers on the date the loan closes. The mortgage commitment fee is generally a closing cost, but may not always be a necessary expense.

Can you negotiate closing costs with a lender?

It may be possible to negotiate closing costs with a lender. However, each situation is unique and lenders do not all operate the same way. It is important for borrowers to consider how the upfront charges will offset later costs. For example, paying a commitment fee in the form of points to lower the interest rate may be a wise choice if the borrower intends to remain in the home for an extended period.

How is a commitment fee calculated?

The key distinction between the two is that a commitment fee is calculated on the undisbursed loan amount while interest charges are calculated by applying an interest rate on the amount of the loan that has been disbursed and not yet repaid.

When are commitment fees paid?

They can be paid when the borrower agrees to take the future loan; when the lender agrees to provide the funds; or at the time when the loan money is actually disbursed.

What is origination fee?

A mortgage origination fee is a fee charged by the lender in exchange for processing a loan. It is typically between 0.5% and 1% of the total loan amount.;You’ll also see other origination charges on your;Loan Estimate and Closing Disclosure in the event that there are prepaid interest points associated with getting a particular interest rate.

How much does a lender charge for a mortgage?

Lender fees amount to an average of $1,387 based on our results from the four largest banks. These include the origination fee and the cost of any discount points required on your mortgage rate, which moves down according to the number of points you purchase. Not all banks provided estimates for all fees.

What is prepaid interest?

Also called mortgage points or discount points, prepaid interest points are points paid in exchange for getting a lower interest rate . One point is equal to 1% of the loan amount, but you can buy the points in increments down to 0.125%.If you’re trying to keep closing costs at bay, you can also take a lender credit, which amounts to negative points. Here, you get a slightly higher rate in exchange for lower closing costs. Rather than paying up front, you effectively build some or all costs into the life of the loan.

What is the loan to value ratio?

Your loan-to-value ratio is the amount of debt you owe on your mortgage divided by your homes market value. Most lenders want you to have a loan-to-value ratio of less than 80% to refinance your mortgage.

What is title commitment?

A title commitment is categorized into five different portions. Who is being insured, the amount of insurance, what is being insured, what is required to insure the title, and what is not insured. The parties being insured may include you as the buyer and your lender. The amount of insurance should cover your mortgage loan amount and the property owners sales price.

What is a commitment fee?

A commitment fee is a fee that lenders charge in exchange for providing a guarantee to lend money in the future. Commitment fees may be charged on many different kinds of loans, such as consumer mortgage loans, as well as in the case of commercial mortgages or small business financing. If you are borrowing, you may be asked to pay a commitment fee.

Why do lenders charge commitment fees?

Lenders charge commitment fees in exchange for processing a loan and guaranteeing the ability to borrow in the future.

How Much Do Commitment Fees Cost?

Commitment fees can vary by lender and type of loan. As mentioned, the commitment fee on a commercial loan typically ranges from .25% to 1% of the amount to be borrowed in the future. 1

Why are commitment fees common?

Commitment fees are common in mortgage loans because it can take a long time for a loan to close and for the lender to provide funding that the borrower applied for. Many states regulate commitment fees and have various requirements on the fee’s amount and purpose.

How long does it take to get a home loan in 2021?

According to an April 2021 Loan Origination Report from ICE Mortgage Technology, it takes an average of 51 days to get to the closing stage of the home buying process. 2.

What is lock in fee?

A lock-in fee, or a fee to guarantee the future loan rate, may be charged as part of a commitment fee. Or in some cases, it may account for the entire commitment fee. Be sure to review the commitment agreement ahead of time to identify all costs involved.

What does it mean to lock in a specific interest rate?

That means a borrower is guaranteed to borrow at the specified interest rate for a period of time, regardless of whether prevailing interest rates go up or down in the future. 6

What is a commitment fee?

A commitment fee is a fee that a lender may charge a borrower to whom it has agreed to extend credit. Generally charged for lines of credit not yet used, the commitment fee is a way of guaranteeing the bank will keep the funds available.

How often do banks charge for keeping a line of credit open?

Some lenders charge a flat fee for keeping a line of credit open, while others charge a percentage of the total loan amount. Banks may charge the commitment fee only once, when the agreement is finalized, or they may charge it periodically, as long as the line of credit remains open.

What is commitment fee?

What is a Commitment Fee? A commitment fee is a fee that is charged by a lender to a borrower to compensate the lender. Top Banks in the USA According to the US Federal Deposit Insurance Corporation, there were 6,799 FDIC-insured commercial banks in the USA as of February 2014. for keeping a credit line open.

How is commitment fee calculated?

Generally, the fee is calculated periodically based on the average unused credit line balance, multiplied by the fee rate and by the number of days in the period.

What is the difference between a commitment fee and interest?

Although there are similarities between the two, there is a significant difference between them. A commitment fee is charged on the undistributed or future loan, while interest is calculated on the amount that has already been distributed.

When is the fee paid on a credit card?

The fee is usually paid after the credit agreement’s been finalized. However, the amount can be charged periodically if it is charged on the undistributed loan. In such cases, the fee is based on the average balance of the undisbursed loan amount.

What is commitment fee?

A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend. Commitment fees typically are associated with unused credit lines or undisbursed loans.

How to calculate a loan fee?

The fee is then calculated by multiplying the average unused commitment by the agreed-upon commitment fee rate and again by the number of days in the reference period.

What is front end fee?

Just as the name implies, front end fees are the fees paid by a borrower to a lender at the beginning of a loan transaction. These fees are not limited to borrowers in a loan transaction. They also are charged to investors who invest in equity or property trusts and some types of mutual funds.

What are the costs associated with a loan?

There are certain costs related to the loan other than the principal amount. The two most common fees are loan or origination fees and the interest charged on the outstanding principal itself. In these cases, the origination fees associated with the loan can be capitalized and amortized over the life of the loan.

What is underwriting fee?

In the securities industry, underwriting fees are the fees earned by an investment bank to help bring a company public or to conduct some other offering. In the mortgage business, an underwriting fee is often a fee charged by a mortgage lender for preparing the loan and associated paperwork.

What does "unused fee" mean?

Unused Feemeans, collectively, the Holder Unused Feeand the Lender Unused Fee. Unused Feemeans the feepayable by the Borrower pursuant to Section 2.11(a).

What is a revolver commitment?

Revolver Commitment means the commitment of Bank, subject to the terms and conditions herein, to make Loans and issue Letters of Credit in accordance with the provisions of Section 2 hereof in an aggregate amount not to exceed $15,000,000 at any one time.

What is a Commitment Fee?

The Commitment Fee is a fee charged by lenders to borrowers on the unused portion (i.e. undrawn portion) of a line of credit facility.

Commitment Fee Definition

The commitment letter for a financing arrangement contains a section outlining the specifics regarding the lending terms and conditional provisions.

Revolver Commitment Fee

The commitment fee is most often associated with a revolver – a line of credit packaged alongside senior loans and meant to be drawn down if the borrower requires immediate short-term liquidity (i.e. “emergency credit card” for companies).

Commitment Fee Example

For example, let’s say that a bank and a company have agreed on a $100m term loan financing package that comes alongside a revolver with the following:

Commitment Fee vs Interest Expense

Financial models often combine the commitment fee of a revolver into the total interest expense calculation, which is done for simplicity.

Definition and Examples of Commitment Fees

How Commitment Fees Work

- Lenders typically must disclose commitment fees up front. Often, they will provide a commitment letter specifying the amount of future funding they've agreed to provide as well as the commitment fee that will be charged. Depending on the lender, commitment fees may be paid at different points in the process. They can be paid when the borrower agrees to take the future loa…

Commitment Fees vs. Lock-In Fees

- In some cases, lenders are willing to provide not only a commitment to lend in the future, but also a commitment to lock in a specific interest rate. That means a borrower is guaranteed to borrow at the specified interest rate for a period of time, regardless of whether prevailing interest rates go up or down in the future.5

How Much Do Commitment Fees Cost?

- Commitment fees can vary by lender and type of loan. As mentioned, the commitment fee on a commercial loan typically ranges from .25% to 1% of the amount to be borrowed in the future.1 Commitment fees are generally included when the annual percentage rate(APR) of a loan is calculated. APR is a broader measure of the cost of borrowing money than the...