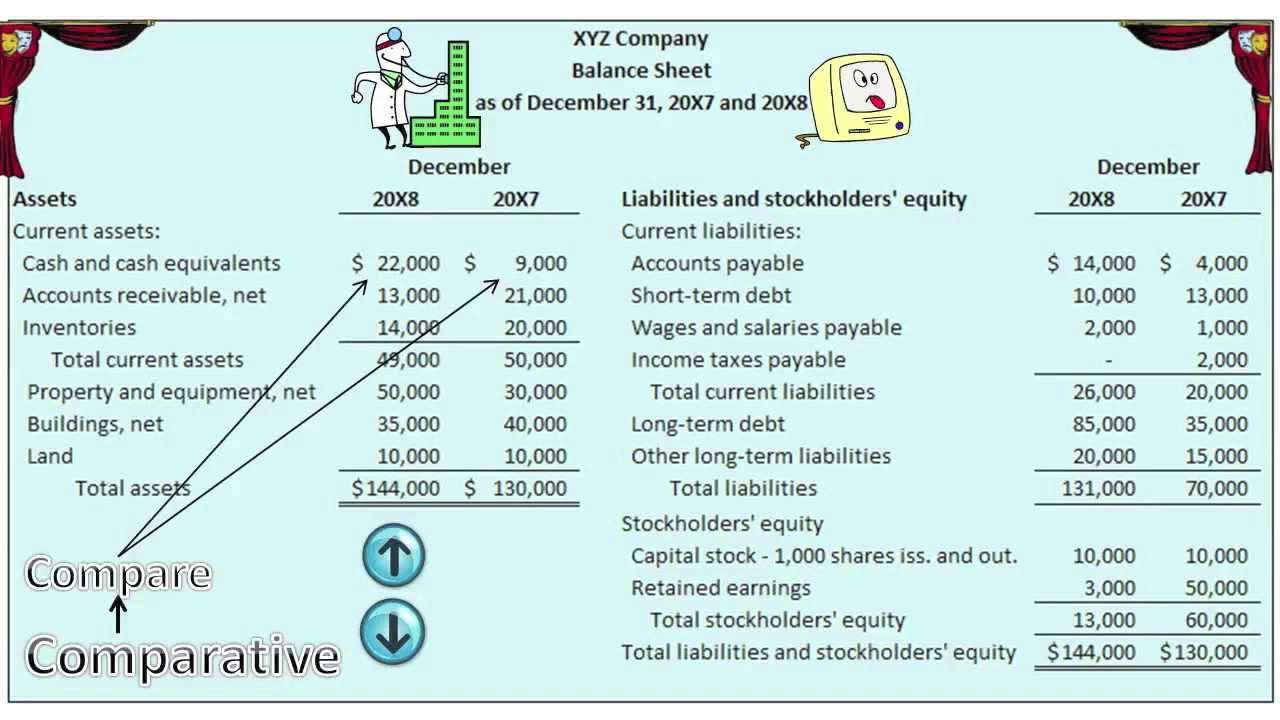

Comparative Balance Sheet

- The present financial and liquidity position (study working capital)

- The financial position of the business in the long term

- The profitability of the business

What are the main features of a balance sheet?

Features of Balance Sheet: The features of a balance sheet are as follows: It is regarded as the last step in final accounts creation; It is a statement and not an account; It consists of transactions recorded under two sides namely, assets and liabilities. Assets are placed in the left hand side, while the liabilities are placed on the right ...

What is the purpose of creating a balance sheet?

The features of a balance sheet are as follows:

- It is regarded as the last step in final accounts creation

- It is a statement and not an account

- It consists of transactions recorded under two sides namely, assets and liabilities. ...

- The total of both side should always be equal

- The balance sheet discloses financial position of the business

What is included on a balance sheet?

What’s included in a balance sheet?

- Assets. These are items belonging to the business, which we split into the categories current and non-current.

- Liabilities. A liability is money you owe to another person or organisation. ...

- Equity. The equity section is what you might call the balancing figure and it represents the ultimate value of the business to its owners.

- Specific Date. ...

What are the disadvantages of balance sheets?

Disadvantages with balance sheets can be due to value discrepancies. These make it difficult to know the real value of assets within a balance sheet or financial statement and this, in turn, can translate into unreliable ratios. A bigger disadvantage with balance sheets is the transparency of them.

What is comparative balance sheet what are its advantages?

A Comparative Balance Sheet is a balance sheet of “two or more years” or “two or more companies,” which helps investors and other stakeholders. read more analyze the company's performance and trend. It additionally assists them in making decisions and forecasting.

How do you create a comparative balance sheet?

Steps To Prepare a Comparative Balance SheetFirstly, specify absolute figures of assets and liabilities relating to the accounting periods considered for analysis. ... Find out the absolute change in the items mentioned in the balance sheet.More items...•

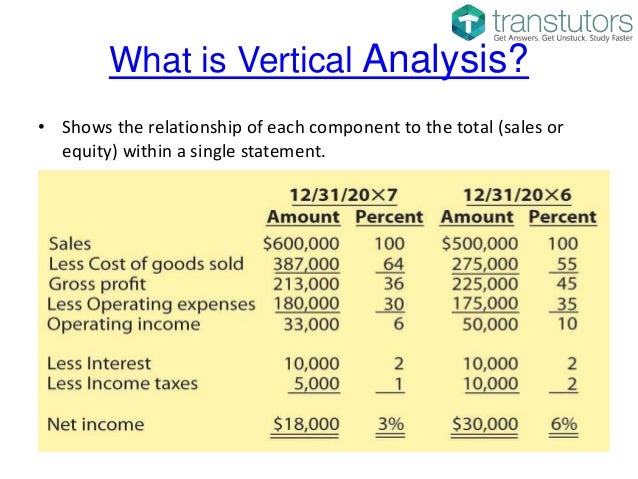

What is the difference between comparative and common size balance sheet?

In the comparative statement, the absolute value of assets and liabilities are shown side by side but in the common size statement, the percentage of individual assets and liabilities on the basis of balance total.

What do you mean by comparative financial statements?

A comparative statement is a document used to compare a particular financial statement with prior period statements. Previous financials are presented alongside the latest figures in side-by-side columns, enabling investors to identify trends, track a company's progress and compare it with industry rivals.

How do two companies compare balance sheets?

How to make comparing balance sheetsChoose your reporting dates. ... Record the assets for each reporting date. ... Record the liabilities for each reporting date. ... Record the shareholders' equity for each reporting date. ... Balance your sums.

What is the importance of comparative financial statement?

Comparative financial statements are quite useful for the following reasons: Provides a comparison of an entity's financial performance over multiple periods, so that you can determine trends. The statements may also reveal unusual spikes in the reported information that can indicate the presence of accounting errors.

Is comparative statement and common size statement same?

Common-size financial statements present all the financial items under their head in percentage terms. While the Comparative financial statements present the financial data for numerous years side by side. This data is to be presented in the form of absolute values, percentages, or both.

What is the objective of comparative statements?

Objectives of Comparative Financial Statements are :To make the Data Simpler and More Understandable : The main aim of preparing Comparative Financial Statements is to put the Data for a number of years in Simpler and Comparable Form .

What is comparative statement also known as?

Comparative statements are the form of horizontal analysis. Common size statement shows the profitability and financial position of a firm for different periods of time in a comparative form to give an idea about position of two or more periods.

What are the types of comparative statement?

The types are: 1. Comparative Income Statement 2. Comparative Expenses Statement 3. Comparative Balance Sheet.

How do you do a comparative analysis of two companies?

It's calculated by dividing a company's net income by its revenues. Instead of dissecting financial statements to compare how profitable companies are, an investor can use this ratio instead. For example, suppose company ABC and company DEF are in the same sector. They have profit margins of 50% and 10%, respectively.

How do you compare two years on a balance sheet?

How to Compare Balance Sheet Equities From Year to YearFind the amount of total stockholders' equity on your annual balance sheets for any two consecutive years. ... Subtract the equity in the previous year from the amount in the most recent year to determine the dollar amount by which your equity changed.More items...

How do I run a comparative balance sheet in netsuite?

Go to Reports > Financial > Comparative Balance Sheet. A message appears indicating that your report is loading. The status bar in the footer of the report indicates the progress as your report loads.

What is comparative balance sheet?

Comparative Balance Sheet is a balance sheet of “two or more than two years” or “two or more than two company” which helps investors and other stakeholders to analyze the company performance & trend of the company, which helps them to make the decision and forecasting. At the same time, there are some limitations of this comparative balance sheet like uniformity in accounting practices, the inflationary factors which need to be taken care of at the time of analyzing the balance sheet.

How many columns are there in a comparative balance sheet?

The comparative balance sheet has two-colum n of amount against each balance sheet items; one column shows the current year financial position, whereas another column will show the previous year’s financial position so that investors or other stakeholders can easily understand and analyze the company’s financial performance against last year.

What is financial ratio?

Ratio Analysis – Financial ratio Financial Ratio Financial ratios are indications of a company's financial performance. There are several forms of financial ratios that indicate the company's results, financial risks, and operational efficiency, such as the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratio, stability ratios, and so on. read more is to derive from the balance sheet items, and the comparative balance sheet financial ratio of two years of two companies can be derived and analysis the financial status of the company. Like the current ratio is derived by the help of current assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations, sold for immediate cash or liquidated within a year. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. read more and current liabilities Current Liabilities Current Liabilities are the payables which are likely to settled within twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc. read more, if the current ratio of the current year is more than the last year, it shows the company liabilities have been reduced from last year against the current assets.

What is current ratio?

On analyzing the current ratio Current Ratio The current ratio is a liquidity ratio that measures how efficiently a company can repay it' short-term loans within a year. Current ratio = current assets/current liabilities read more, we found the current ratio has been increased by $0.04 as compared to last year, which means the company has given a good performance this year as compared to the previous year.

What does it mean when the current ratio of the current year is more than the last year?

, if the current ratio of the current year is more than the last year, it shows the company liabilities have been reduced from last year against the current assets.

What is a trade receivable?

Inventory has been reduced by $ 9000, and Trade receivable Trade Receivable Trade receivable is the amount owed to the business or company by its customers. It is also known as account receivables and is represented as current liabilities in balance sheet. read more has been increased by $ 10000, which means the company has sold his stock to customers, and the amount is yet to receive.

What are fixed assets?

Fixed Assets Fixed Assets Fixed assets are assets that are held for the long term and are not expected to be converted into cash in a short period of time. Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples. read more have been reduced by $ 10000 because of depreciation.

How to do comparative balance sheet analysis?

The first step to complete a comparative balance sheet analysis is to get organized. Locate the company's balance sheet data and arrange it in a table such that each account is shown side by side over time. Make sure the data is in regular time intervals for consistency . In its most basic form, this could be as simple as two quarterly snapshots, side by side. In other cases, it may be more informative to compare more snapshots over time. A farming company with distinct seasonal activities, for example, may require that you review 12 consecutive monthly balance sheets in order to understand how its seasonality impacts the balance sheet's inventory, accounts receivable, and accounts payable.

What is comparative analysis?

A comparative balance sheet analysis is a method of analyzing a company's balance sheet over time to identify changes and trends. Public companies are required to include the information needed for a comparative balance sheet analysis in their quarterly and annual reports to the SEC, though it can be useful to pull together more data on your own for a longer-term analysis.

What is the leveraged ratio of a company in year one?

The common-sized numbers on this side of the balance sheet are even more informative, here. In year one, the company was considerably leveraged with liabilities at 86% of total assets. In year two, that number is much lower, at just 68%.

Is a company's balance sheet a snapshot?

Remember, though, that the company's balance sheet is just a snapshot in time. It's equally important to consider its income statement and statement of cash flow. And, at the end of the day, the company's financial statements are just a report of how the company has performed over time. Always take the time to take what you've learned from the numbers and apply it to what's actually happening at the company. That last step is the key to taking a financial analysis and translating it into an actionable investment decision.

How to analyze comparative balance sheets?

In order to analyze your comparative balance sheets and develop your Statement of Cash Flows, you first consider any increases or decreases in your current asset and current liability accounts between the two years of balance sheet information. Here's the rule you should always remember when developing your Statement of Cash Flows: ...

How to analyze financial statements?

In order to analyze the financial statements for a business, information is needed from the balance sheets. The owner must look at the last two years of the firm's balance sheets and compare the differences between the two in order to develop the Statement of Cash Flows. The table below gives you sample Comparative Balance Sheets for a firm. With sample information from an income statement and the information from these comparative balance sheets, you can develop your Statement of Cash Flows.

How to write a statement of cash flows?

Here's the rule you should always remember when developing your Statement of Cash Flows: 1 Increases in current asset accounts, decrease cash 2 Decreases in current asset accounts, increase cash 3 Increases in current liability accounts, increase cash 4 Decreases in current liability accounts, decrease cash

What is the next section of a cash flow statement?

The next section of the cash flow statement is Cash Flows from Investing Activities. Usually, this section includes any long-term investments the firm makes plus any investment in fixed assets, such as plant and equipment. The firm invested $30,000 more in long-term investments in 2009. That shows up as a negative number as it was a use of assets. The firm also spent $100,000 for more plant and equipment.

Example Format of Comparative Balance Sheet

Advantages of Comparative Balance Sheet

- Comparison – It is effortless to compare the figures for the current year with the previous years as it gives both the years’ figures in one place. It also assists in analyzing the data of two or m...

- Trend Indicator – It shows the company’s trend by putting several years’ financial figures in one place like an Increase or Decrease in profit, current assets, current liabilities, loans, reser…

- Comparison – It is effortless to compare the figures for the current year with the previous years as it gives both the years’ figures in one place. It also assists in analyzing the data of two or m...

- Trend Indicator – It shows the company’s trend by putting several years’ financial figures in one place like an Increase or Decrease in profit, current assets, current liabilities, loans, reserves...

- Ratio Analysis – Financial ratioFinancial RatioFinancial ratios are indications of a company's financial performance. There are several forms of financial ratios that indicate the company's results...

- Compare performance with the Industry Performance – Helps to compare one company’s pe…

Limitation/Disadvantages

- Uniformity in Policy and Principles – Comparative balance sheets will not give the correct comparison if two companies have adopted different policies and accounting principles while preparing the...

- Inflationary Effect is not Considered – While preparing the comparative balance sheet, the inflation effect is not considered. Therefore, only a comparison with other balance sheets wil…

- Uniformity in Policy and Principles – Comparative balance sheets will not give the correct comparison if two companies have adopted different policies and accounting principles while preparing the...

- Inflationary Effect is not Considered – While preparing the comparative balance sheet, the inflation effect is not considered. Therefore, only a comparison with other balance sheets will not give t...

- Market Situation and Political Conditions not Considered – While preparing the comparative balance sheet, marketing conditions, political environment, or any factor affecting the company’s business...

- Misleading Information – Sometimes, it gives misleading information, thus, misguiding the p…

Conclusion

- A Comparative Balance Sheet is a balance sheet of “two or more years” or “two or more companies,” which helps investors and other stakeholdersStakeholdersA stakeholder in business refers to anyone, including a person, group, organization, government, or any other entity with a direct or indirect interest in its operations, actions, and outcomes.rea...

Recommended Articles

- This article has been a guide to what is Comparative Balance Sheet and its meaning. Here we discuss its format and example along with its advantages and disadvantages. You can learn more from the following articles – 1. How to Analyze a Balance Sheet? 2. How to Read a Balance Sheet? 3. Common Size of the Balance Sheet Formula 4. Classified Balance Sheet