What Is A Conditional Approval?

- It is a preliminary approval

- There are no guarantees that it will be issued a clear to close

- Mortgage loan application needs to be processed and underwritten by an underwriter for a conditional approval

- Conditional approval turns into a final approval and clear to close once all the conditions have been met

What factors go into a mortgage loan approval?

Feb 02, 2022 · It is a level of approval from the underwriter that tells you where you are in the mortgage application process. Conditional approval is a higher level of approval than prequalification, but not as high as final or verified approval. At that point, you are ready to buy your new home.

What does conditionally approved mean for mortgage?

Mar 13, 2022 · A conditional approval, also known as pre-approval, is a lender’s estimate of how much you could afford to borrow for a home loan, provided you meet certain conditions. Conditional approval is not a guarantee that you will qualify for a home loan, but it can be an important step in the process. And a conditional approval is a close second.

What does a mortgage approval really mean?

Oct 30, 2016 · In a lending context, a conditional approval is when the mortgage underwriter is mostly satisfied with the loan application file, but there are still one or more issues that need to resolved before the deal can close. In mortgage lingo, these remaining issues or items are commonly referred to as “conditions.” Hence the term conditional approval.

What exactly does conditional approval mean?

Apr 01, 2022 · A conditional approval means the bank is likely to approve your mortgage — but only on specific terms — as long as pending conditions are met. For example, you might receive conditional approval...

Does conditional approval mean approved?

Conditional approval is a higher level of approval than prequalification, but not as high as final or verified approval. At that point, you are ready to buy your new home. When you receive conditional approval, you are usually given some conditions you must meet before you can get final approval.Feb 2, 2022

Can you get denied after conditional approval?

In short, yes, a loan can be denied after receiving conditional approval. This usually happens when the borrower doesn't provide the documents that are required. In addition, the loan may be denied if the borrower doesn't meet the underwriting requirements.Jan 5, 2022

Is conditional approval a good thing?

Things that are looked at during the first screening phase include your credit history, your personal debt, and your income. As your application moves on to the next phase, it will be looked at in more detail. Getting a conditional approval is definitely good news but you should not start to celebrate just yet.Mar 14, 2022

What happens after a conditional approval?

Steps After Conditional Approval First, the loan coordinator will contact you to discuss the conditional approval and conditions you must meet. Then, you must submit the information to meet the conditions. Once the loan coordinator gets those conditions, they will send the file back to the underwriter for final review.

How long does underwriting take after conditional approval?

Depending on these factors, mortgage underwriting can take a day or two, or it can take weeks. Under normal circumstances, initial underwriting approval happens within 72 hours of submitting your full loan file. In extreme scenarios, this process could take as long as a month.Mar 3, 2021

How long does final approval take?

Final Approval & Closing Disclosure Issued: Approximately 5 Days, Including a Mandatory 3 Day Cooling Off Period. Your appraisal and any loan conditions will go back through underwriting for a review and final sign off.Apr 15, 2019

How long does conditional approval last?

Conditional approvals and formal approvals don't last indefinitely. They typically have a timeframe of three months but even then, nothing is set in stone prior to settlement.Sep 29, 2020

What is the next step after mortgage approval?

Once your mortgage has been approved and the searches have been completed by your conveyancing solicitor you will now be able to sign and exchange contracts which legally commits you to the purchase of the property. You will then be asked to pay the deposit, which is usually 10% of the property's value.

What happens after final approval from underwriter?

What happens after final approval? After you receive final mortgage approval, you'll attend the loan closing (signing). You'll need to bring a cashier's or certified check for your cash-to-close or arrange in advance for a wire transfer.Jun 24, 2021

How long does it take underwriter to clear to close?

Clear To Close: At Least 3 Days Once the underwriter has determined that your loan is fit for approval, you'll be cleared to close. At this point, you'll receive a Closing Disclosure.Feb 27, 2022

How long does it take to close after appraisal?

So when the appraisal comes in, the lender should be more or less ready to go. It shouldn't take longer than two weeks to close on your mortgage after the appraisal is done. It shouldn't take longer than two weeks to close after the appraisal is done.May 20, 2021

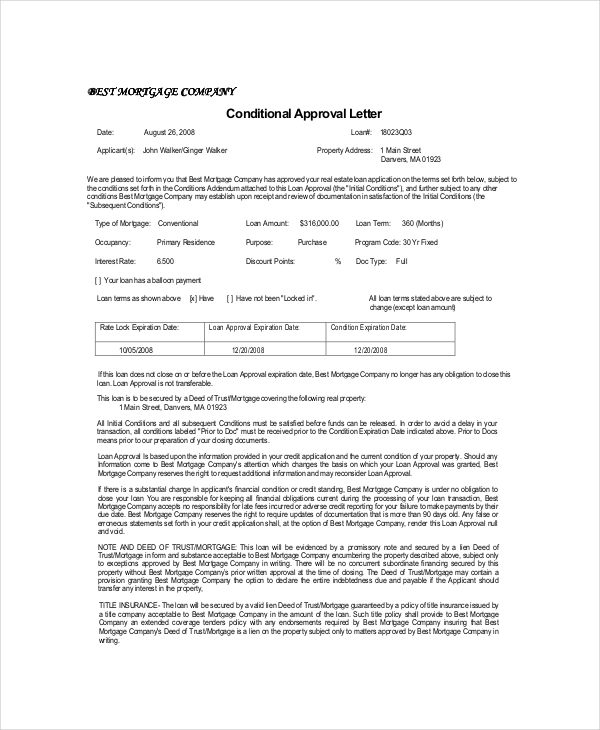

What is conditional loan approval?

Conditional loan approval is a letter or notice from a mortgage lender stating that your assets and documentation have been reviewed, and that you'...

What's the difference between a pre-approval and conditional approval?

With mortgage pre-approval, an underwriter doesn't review your financial documentation. In contrast, with conditional loan approval, an underwriter...

How long does conditional approval take?

The underwriting process can take anywhere from a few days to over a week, depending on your lender and underwriter. Providing accurate documentati...

What is conditional approval?

Conditional approval is a statement from a mortgage lender indicating a mortgage will get approved provided specific conditions are met at the time of closing. Conditional loan approval does not guarantee a mortgage will actually be approved. Rather, it means the lender willing to loan a specific amount of money, ...

What happens if you get your mortgage conditionally approved?

If your mortgage is conditionally approved, your lender will generally outline the conditions that will need to be met so there are no surprises.

How to get a conditional loan?

Here are the steps to applying for conditional loan approval: 1 Shop around with the best mortgage lenders to find the best home loan offer. 2 Provide the lender you choose with all of the financial information it requests. 3 Tell your lender you want a notice of conditional loan approval once your loan reaches that stage. 4 Wait for an underwriter to review your information to determine whether you're eligible for conditional approval for a home loan. 5 If you're conditionally approved, you'll receive a notice or letter to that effect.

What do you need to close a mortgage?

For any mortgage to close, you'll need to provide the right documentation to your lender and have that loan go through underwriting. Conditional mortgage approval simply involves getting a letter proving this part of the process is complete.

What do I need to apply for a mortgage if I am self employed?

If you're self-employed and applying for a mortgage, you may need to provide additional information, including: Complying with your lender's requests will help make the underwriting process go smoothly. When the process is finished, you can get a letter or notice of conditional loan approval.

How long does it take to get a mortgage underwritten?

Keep in mind that underwriting could take just a few days, or it could take over a week. Your lender may be able to give you an estimate as to how long the process will take so you know what to expect.

What is a letter from an accountant?

A letter from an accountant verifying how long you've been in business. Complying with your lender's requests will help make the underwriting process go smoothly. When the process is finished, you can get a letter or notice of conditional loan approval.

What is conditional approval?

In a lending context, a conditional approval is when the mortgage underwriter is mostly satisfied with the loan application file, but there are still one or more issues that need to resolved before the deal can close. In mortgage lingo, these remaining issues or items are commonly referred to as “conditions.”. Hence the term conditional approval.

How many stages of approval are there in a mortgage?

There are various stages of “approval” during the mortgage lending process. But there’s only one final approval, and that’s when the loan is actually funded (at or before closing). It’s important to realize that things can go wrong at any stage of this process, right up to the final closing.

What does the underwriter decide?

The underwriter decides that the borrowers are qualified for a loan, and that the file contains everything needed to satisfy requirements. With one exception. A large deposit was made into the borrowers’ bank account within the last couple of weeks, and the underwriter is unable to determine where that money came from.

What is mortgage underwriting?

Learn more about underwriting. You can think of the mortgage underwriter as a kind of paperwork detective whose job it is to make sure everything is in order. And it’s a fairly detailed job, because there are a lot of documents and paperwork associated with the average home loan. If the underwriter determines that the loan looks good in most ...

What does John and Jane do with their home loan?

John and Jane have applied for a home loan, and they’ve provided all of the documents their lender has requested thus far. Their loan file then moves on to the underwriter, who reviews it for completeness and accuracy. He also checks the file to make sure all loan requirements have been met.

Why is pre-approval important?

Being pre-approved has its own benefits. It helps you narrow your housing search and could make sellers more inclined to accept your offer. But it’s not a guarantee that the deal will go through. There are many issues and conditions that might occur between pre-approval and funding.

Who reviews the loan file and all documents contained within it?

Hence the term conditional approval. Did you know: The underwriter is the person who reviews the loan file, and all documents contained within it, to ensure that it meets the lender’s guidelines as well as any secondary guidelines (from FHA, Freddie Mac, etc.). Learn more about underwriting.

Get one step closer to homeownership

Getting a mortgage involves several steps, including pre-qualification and preapproval, but applying for conditional approval can help move along the process significantly. This type of approval comes later in the process and requires more documentation. It can also give you more leverage in the negotiation phase.

What does conditional approval mean?

A conditional approval means the bank is likely to approve your mortgage — but only on specific terms — as long as pending conditions are met.

Conditional approval vs. pre-qualification vs. preapproval

It’s easy to confuse conditional approval with other types of approvals. Basically, conditional approval is a step beyond pre-qualification and preapproval and comes just before verified approval.

Benefits of a conditional approval

Conditional approval can speed up the homebuying process, but it also offers other benefits. Once you have this approval, you’ve completed the mortgage application and provided all the required documents. The lender has also verified your information and is comfortable with offering approval as long as you meet their criteria.

How to apply for conditional approval

The mortgage process starts with finding suitable lenders for your individual situation. For example, if you’re unable to offer a down payment, you might consider lenders that offer USDA loans.

Bottom line

Conditional approval is a normal part of the mortgage application process, and it’s a good sign if your lender extends this type of approval. It’s a step beyond preapproval and can take a week or two before you have a decision from the bank.

Conditional approval mortgage: What it means

There isn’t a “conditional approval mortgage,” but conditional approval is a level of verification used by a lender to signify that a borrower is likely to get approved for a loan if they meet certain circumstances.

Types of loan approvals

A lender has the option to provide a variety of types of approvals, each of which means something slightly different. Lenders can provide prequalification, preapproval, unconditional approval, conditional approval or verified approval.

Conditional loan approval vs. preapproval

Conditional loan approval and preapproval are both ways that a lender can give you some amount of assurance that you’ll be able to borrow a given amount when it comes time to finalize your mortgage.

Conditional loan approval vs. final approval

Conditional loan approval and final approval are both methods by which a lender confirms that you have enough resources to take out a certain size of mortgage and approves you to do so.

Examples of mortgage loan conditions

A conditional loan approval may stipulate a variety of things you need to provide to achieve final approval. The list below includes some of these elements, though there are likely to be others that may come up, depending on your situation.

How long does underwriting take after conditional approval?

Once you have received conditional approval for a mortgage, it usually takes a week or two for the underwriter to verify that you have met all the conditions. Once you’ve met all the conditions, the underwriter can move on to final approval.

What happens if a mortgage is approved with conditions and then denied?

Since conditional approval is exactly that—conditional—there’s no guarantee that you’ll end up approved for a mortgage in the end. There’s a high likelihood, but no guarantee.

What Does Conditional Loan Approval Mean?

A conditional loan approval is a status assigned to applications requiring clarification or missing information. It’s neither an approval nor a denial, nor does it indicate whether you’ll receive final approval or not.

Conditional Loan Approval vs. Pre-approval

When first researching how to apply for a home loan, it’s common for buyers to mistake the conditional approval process with the pre-approval process. Both involve submitting a lot of the same paperwork, after all. The main difference between the two is that pre-approval comes first.

What Happens after a Conditional Approval?

Once you’ve been offered a conditional approval, you’ll want to submit the information the underwriter needs to finalize their decision. The items that they ask for are known as “ conditions .” These conditions can include:

How Long Does Conditional Approval Take?

The conditional approval process moves quickly. Much of the time, the process takes about a week or two to complete. The best way to speed up the process is to carefully complete all paperwork and submit additional documents promptly when asked.

What is a mortgage consultant?

The Mortgage Consultant collects and verifies all documents necessary to prepare the loan file for underwriting. These documents provide us with everything that we need to know about you (the borrower), and the property you are financing.

What to do if you don't receive a mortgage statement?

If you did not receive the statement or cannot find it, you can reach out to your Mortgage Professional for a copy. Final step: You'll receive correspondence in the mail from the final servicer (the company to which you will make all subsequent payments).

How long does a rescission last on a home loan?

Refinance: Depending on local laws, an agent from the title company will explain each document to be signed. If refinancing a primary residence, the loan will fund once the 3-day right of rescission has expired (on the fourth day). Once the rescission period has expired, the loan can no longer be cancelled.

Do mortgage underwriters have to submit documentation?

While the Loan Officer and Mortgage Consultant will do their best to submit a complete file during loan underwriting, an Underwriter may still have questions and/or require additional documentation to satisfy any conditions for a final approval.

Is the mortgage loan process simple?

The mortgage loan process may seem far from simple. There’s a lot that happens between your initial consultation to your loan being funded. But we’ll walk you through it—and with full transparency.