Key Takeaways

- A contingency is a potentially negative event that may occur in the future, such as an economic recession, natural disaster, or fraudulent activity.

- Companies and investors plan for various contingencies through analysis and implementing protective measures.

- A thorough contingency plan minimizes loss and damage caused by an unforeseen negative event.

What are examples of contingencies?

- The risk of loss or damage to property by fire, explosion, or other hazards;

- The threat of expropriation of assets;

- Actual or possible claims and assessments.

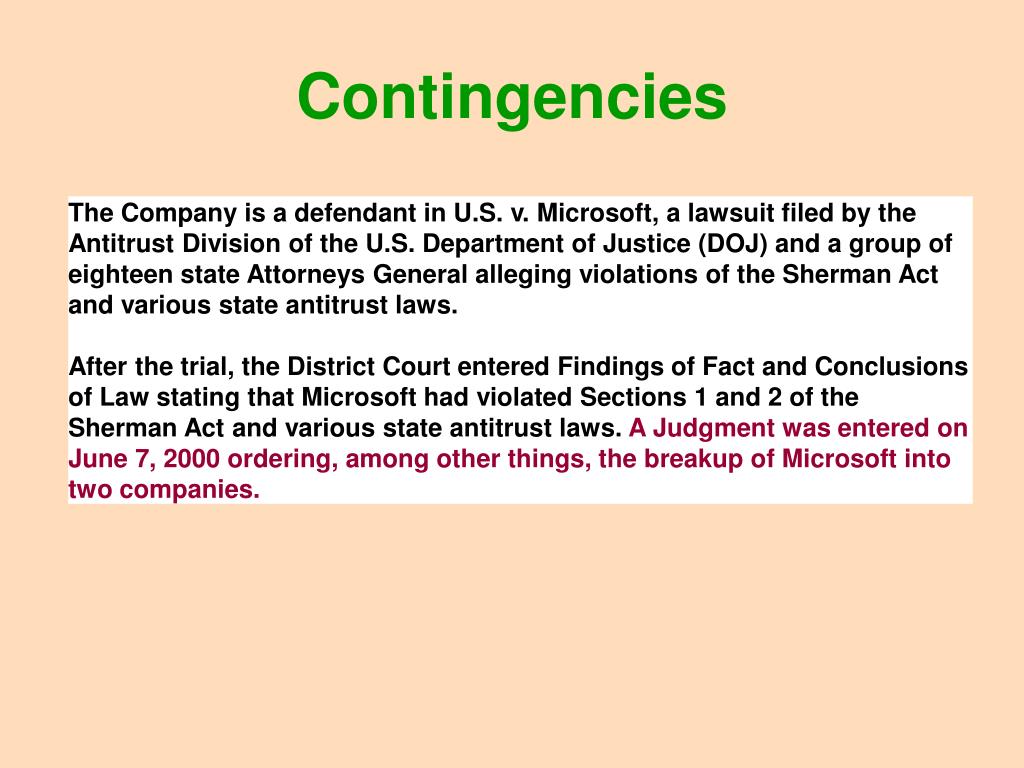

- Pending or threatened litigation.

- Obligation related to product warranties and product defects;

What is the Golden Rule in accounting?

The Top 3 Golden Accounting Rules are:

- Debit the “Receiver” and Credit the “Giver” (Personal Accounts)

- Debit – What Comes IN and Credit – What Goes OUT (Real Accounts)

- Debit – Expenses and Losses and Credit – Incomes and Gains (Nominal Accounts)

What is the LCM in accounting?

Lower of cost or market (LCM) is an inventory valuation method required for companies that follow U.S. GAAP. Cost refers to the purchase cost of inventory, and market value refers to the replacement cost of inventory. The replacement cost cannot exceed the net realizable value or be lower than the net realizable value less a normal profit margin.

What is a closing account in accounting?

Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. This is commonly referred to as closing the books.

What is an example of a contingency?

Contingency means something that could happen or come up depending on other occurrences. An example of a contingency is the unexpected need for a bandage on a hike. The definition of a contingency is something that depends on something else in order to happen.

What are contingencies in balance sheet?

Contingencies refer to potential or contingent liabilities and losses. These are reported in the notes to the financial statements (instead of a general ledger account) because the amount might not be determinable or the liability is possible but not probable. Generally, gain contingencies are not disclosed.

Is contingent liability a current liability?

Current and contingent liabilities are both important financial matters for a business. The primary difference between the two is that a current liability is an amount that you already owe, whereas a contingent liability refers to an amount that you could potentially owe depending on how certain events transpire.

Are contingencies debt?

A contingent debt is an unusual kind of debt that is dependent on uncertain future developments. A contigent debt is not a definitive liability as it is based on the outcome of a future event (for example, such as a court verdict).

Where is contingencies on the balance sheet?

Contingent liabilities are shown as liabilities on the balance sheet and as expenses on the income statement.

What is contingent assets with examples?

An example of a contingent asset (and its related contingent gain) is a lawsuit filed by Company A against a competitor for infringing on Company A's patent. Even if it is probable (but not certain) that Company A will win the lawsuit, it is a contingent asset and a contingent gain.

Where is contingent liability shown in balance sheet?

A contingent liability is recorded first as an expense in the Profit & Loss Account and then on the liabilities side in the Balance sheet.

How contingent liabilities are treated?

Contingent liabilities are never recorded in the financial statements of a company. These obligations have not occurred yet but there is a possibility of them occurring in the future. So a contingent liability has no accounting treatment as such. Now such contingent liabilities have to be reviewed on a yearly basis.

What are contingencies in accounting?

Entities often make commitments that are future obligations that do not yet qualify as liabilities that must be reported. For accounting purposes, they are only described in the notes to financial statements. Contingencies are potential liabilities that might result because of a past event. The likelihood of loss or the actual amount of the loss is still uncertain. Loss contingencies are recognized when their likelihood is probable and this loss is subject to a reasonable estimation. Reasonably possible losses are only described in the notes and remote contingencies can be omitted entirely from financial statements. Estimations of such losses often prove to be incorrect and normally are simply fixed in the period discovered. However, if fraud, either purposely or through gross negligence, has occurred, amounts reported in prior years are restated. Contingent gains are only reported to decision makers through disclosure within the notes to the financial statements.

When is contingent loss recognized?

Question: According to U.S. GAAP, a contingent loss must be recognized when it is probable that it will occur and a reasonable estimation of the amount can be made. That rule has been in place now for over thirty years and is well understood in this country. Are contingent losses handled in the same way by IFRS?

Why are structured guidelines needed for reporting contingencies?

Because companies prefer to avoid (or at least minimize) the recognition of losses and liabilities, it is not surprising that structured guidelines are needed for reporting contingencies. Otherwise, few if any contingencies would ever be reported. U.S. GAAP in this area was established in 1975 when FASB issued its Statement Number Five, “Accounting for Contingencies.” This pronouncement requires the recognition of a loss contingency if

Why did Wysocki Corporation lose $800,000 in the first year?

For example, Wysocki Corporation recognized an estimated loss of $800,000 in Year One because of a lawsuit involving environmental damage. Assume the case is eventually settled in Year Two for $900,000. How is the additional loss of $100,000 reported? It relates to an action taken in Year One but the actual amount is not finalized until Year Two. The difference is not apparent until the later period.

What is a probable loss?

“Probable” is described in Statement Number Five as likely to occur and “remote” is a situation where the chance of occurrence is slight.

What is a commitment in business?

Commitments. Commitments represent unexecuted contracts. For example, assume that a business places an order with a truck company for the purchase of a large truck. The business has made a commitment to pay for this new vehicle but only after it has been delivered. Although cash may be needed in the future, no event (delivery of the truck) has yet created a present obligation. There is not yet a liability to report; no journal entry is appropriate.

Can a company report future adverse effects from all loss contingencies?

Not surprisingly, many companies contend that future adverse effects from all loss contingencies are only reasonably possible so that no actual amounts are reported. Practical application of official accounting standards is not always theoretically pure, especially when the guidelines are nebulous.

What is contingency in business?

On the other hand, a contingency is an obligation of a company, which is dependent on the occurrence or non-occurrence of a future event. A contingency may not result in an outflow of funds for an entity.

What is loss contingency?

A loss contingency refers to a charge or expense to an entity for a potential probable future event. A gain contingency refers to a potential gain or inflow of funds for an entity, resulting from an uncertain scenario that is likely to be resolved at a future time.

What is disclosure and acknowledgment of commitments and contingencies?

The disclosure and acknowledgment of commitments and contingencies allow for overall organizational transparency, resulting in an increase in faith by relevant stakeholders.

Why are all commitments and contingencies recorded in the footnotes?

Generally, all commitments and contingencies are to be recorded in the footnotes to allow for compliance with relevant accounting principles and disclosure obligations.

Why do investors need to disclose commitments and contingencies?

Also, the disclosure and acknowledgment of commitments and contingencies attract investors as they will be able to access future cash flows based on expected future transactions.

When are commitments recorded in GAAP?

Following the Generally Accepted Accounting Principles#N#GAAP GAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial#N#, commitments are recorded when they occur, while contingencies (should they relate to a liability or future fund outflow) are at a minimum disclosed in the notes to the Statement of Financial Position (Balance Sheet) in the financial statements of a business. If the contingency is probable (>75% likely to occur) and the amount is reasonably estimable, it should be recorded in the financial statements.

What is a commitment and contingency?

What are Commitments and Contingencies? In accounting and finance, Commitments and Contingencies can be defined as follows: A commitment is a promise made by a company to external stakeholders. Stakeholder In business, a stakeholder is any individual, group, or party that has an interest in an organization and the outcomes of its actions.

What Is a Contingency?

A contingency is a potential occurrence of a negative event in the future, such as an economic recession, natural disaster, fraudulent activity, terrorist attack, or a pandemic. In 2020, businesses were hit with the coronavirus pandemic forcing many employees to have to work remotely. As a result, companies needed to implement a remote work strategy. However, for some businesses, working remotely wasn't an option, which led to the implementation of enhanced safety measures for employees and customers to prevent the spread of the virus.

What is contingency in business?

What Is a Contingency? A contingency is a potential occurrence of a negative event in the future, such as an economic recession, natural disaster, fraudulent activity, terrorist attack, or a pandemic. In 2020, businesses were hit with the coronavirus pandemic forcing many employees to have to work remotely.

What are the types of contingency plans?

Types of Contingency Plans. Contingency plans are utilized by corporations, governments, investors, and by central banks, such as the Fed. Contingencies can involve real estate transactions, commodities, investments, currency exchange rates, and geopolitical risks.

What is a contingency plan called?

This type of contingency plan is often called a business continuity plan (BCP) or a business recovery plan.

Why is contingency planning important?

A contingency plan can also reduce the risk of a public relations disaster. A company that effectively communicates how negative events are to be navigated and responded to is less likely to suffer reputation damage. A contingency plan often allows a company affected by a negative event to keep operating.

How to reorganize a company after a negative event?

How a company is reorganized after a negative event should be included in a contingency plan. It should have procedures outlining what needs to be done to return the company to normal operations and limit any further damage from the event. For example, financial services firm Cantor Fitzgerald was able to resume operation in just two days after being crippled by the 9/11 terrorist attacks due to having a comprehensive contingency plan in place.

Why do businesses need contingency plans?

As a result, businesses need to have contingency plans established to help minimize the lost revenue and increased costs that are involved when business operations have been disrupted. Typically, business consultants are hired to ensure contingency plans take a large number of possible scenarios into consideration and provide advice on how to best execute the plan.

What is contingent liability?

A contingent liability is a potential liability that may or may not occur, depending on the result of an uncertain future event. The relevance of a contingent liability depends on the probability of the contingency becoming an actual liability, its timing, and the accuracy with which the amount associated with it can be estimated. ...

How does contingent liability affect financial performance?

A contingent liability can negatively impact a company’s financial performance and health; clearly, the knowledge of it might influence the decision-making of different users of the company’s financial statements. 3. Prudence Principle. Prudence is a key accounting concept that makes sure that assets and income are not overstated, ...

How does knowledge of a contingent liability affect an investor?

Since a contingent liability can potentially reduce a company’s assets and negatively impact a company’s future net profitability and cash flow, knowledge of a contingent liability can influence the decision of an investor.

What is the importance of Prudence in accounting?

Prudence is a key accounting concept that makes sure that assets and income are not overstated, and liabilities and expenses are not understated. Since the outcome of contingent liabilities cannot be known for certain, the probability of the occurrence of the contingent event is estimated and, if it is greater than 50%, then a liability and a corresponding expense are recorded. The recording of contingent liabilities prevents the understating of liabilities and expenses.

What is the difference between IFRS and GAAP?

Both GAAP (Generally Accepted Accounting Principles) and IFRS. IFRS Standards IFRS standards are International Financial Reporting Standards (IFRS) that consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in financial statements.

When should contingent liabilities be incorporated into a financial model?

As a general guideline, the impact of contingent liabilities on cash flow should be incorporated in a financial model if the probability of the contingent liability turning into an actual liability is greater than 50%. In some cases, an analyst might show two scenarios in a financial model, one which incorporates the cash flow impact of contingent liabilities and another which does not.

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy.

What is contingency in business?

In business and project management, contingency is often described as a cover (financial or otherwise) that insulates a commercial or non-commercial entity in the event of an unforeseen or uncertain occurrence. Hence, the expenditure incurred when that unforeseen contingency actually occurs becomes an event occurring by chance.

What is the purpose of a contingency plan?

Its sole purpose is to provide a safety net or insurance to enable an organization to survive the potentially negative effects with as little harm (or cost) as possible . Contingency plans in business are often known as business continuity plans.

Why is contingency planning important?

Planning is crucial for contingencies, especially in business. Contingency planning normally involves the assignment of cash or capital reserves by a company to meet unforeseen events. It boils down to the ability to withstand shocks from the occurrence of an unexpected event through access to liquidity.

How to create a contingency policy?

1. Create a contingency policy. A contingency policy statement should be created to communicate clear guidelines to be followed when handling disaster events. The statement should be communicated to all relevant employees to optimize the quality of the response. 2.

Why is it important to review and update a contingency plan?

Review and update the plan. The plan can be rendered less effective or ineffective over time due to changes in the environmental landscape and technology. Hence, it is paramount to review, update and maintain the contingency plan from time to time as warranted.

How much of a contract can be included as a contingency?

About 5% to 10% of contract value can be included as a contingency in the cost plan.

What is an inventory of resources?

An inventory of resources that the organization possesses and those that it can access should be prepared beforehand. They are resources that help to mitigate the effects of a disaster or negative eventuality.

When is ASC 606 effective?

This publication reflects guidance that is effective for public business entities for annual reporting periods beginning on or after January 1, 2019, including the guidance in ASC 606, ASC 842, and ASC 326 on revenue, leases, and credit losses, respectively.

Does ASC 450 change?

Although the guidance in ASC 450 has not changed significantly for decades, the application of the existing framework remains challenging at times because an entity may be required to use significant judgment in applying this guidance (e.g., legal interpretations are likely to be needed).

Is ASC 460 still challenging?

Similarly, although the guidance in ASC 460 has not changed significantly for two decades, it may remain challenging to apply given the complexity of determining whether a guarantee is within the scope of ASC 460 as well as how guarantees should be accounted for in periods after their initial recognition and measurement.

What is Construction Contingency?

A construction contingency is an amount of money set aside to cover any unexpected costs that can arise throughout a construction project. This money is on reserve and is not allocated to any specific area of work. Essentially, the contingency acts as insurance against other, unforeseen costs.

What should a contingency budget include?

The list could include anything from incomplete designs, construction project delays, substitute subcontractors, price increases, and any other number of unexpected costs. This is generally referred to as the contingency budget.

What are the two types of construction contingency funds?

There are two main types of construction contingency funds: contractor contingency and owner contingency.

What is retainage in construction?

However, retainage represents an amount of the contract price that has been earned but remains withheld. It serves a purpose, but at the end of the day, it’s payment owed that’s being withheld. Construction contingency, on the other hand, is actual inflation of the contract price to plan for the unexpected. That, or it’s funding set aside by the owner for the unexpected issues.

Is a construction contingency fund the same as retainage?

A construction contingency fund is not the same as retainage, but the concepts are similar. Both retainage and contingency provide what are essentially “emergency” funds. When something on the project goes awry and costs some extra money, paying to fix the issue may come from the contingency fund, or it may come from the retainage being withheld ...

Treatment of Commitments and Contingencies as Per GAAP

- Following the Generally Accepted Accounting Principles, commitments are recorded when they occur, while contingencies (should they relate to a liability or future fund outflow) are at a minimum disclosed in the notes to the Statement of Financial Position (Balance Sheet) in the financial statements of a business. If the contingency is probable (>75...

Treatment of Commitments and Contingencies as Per IFRS

- Following the IFRSprinciples and guidelines, commitments must be recorded as a liability for an entity for the accounting period they occur In, and they must be disclosed in the notes to the financial statements. It is for the business to show that it is efficiently fulfilling its commitments. If an entity is unable to meet its commitments, a justification needs to be disclosed in the notes …

Loss Contingencies and Gain Contingencies

- Contingencies and how they are recorded depends on the nature of such contingencies. A loss contingency refers to a charge or expense to an entity for a potential probable future event. The disclosure of a loss contingency allows relevant stakeholders to be aware of potential imminent payments related to an expected obligation. Regardless of whether or not the value of the loss c…

Advantages of Commitments and Contingencies

- The disclosure and acknowledgment of commitments and contingencies allow for overall organizational transparency, resulting in an increase in faith by relevant stakeholders. The disclosures allow for an organization to remain compliant with legal andfinancial reporting requirements. Also, the disclosure and acknowledgment of commitments and contingencies att…

Related Readings

- CFI offers the Commercial Banking & Credit Analyst (CBCA)™certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below: 1. Accounting Standard 2. Full Disclosure Principle 3. IFRS vs. US GAAP 4. Fiduciary Duty