What Is a Continuation Pattern?

Continuation patterns in technical analysis are, as the name suggests, chart patterns that show that an asset’s price trend will continue once the pattern has finished. Thus, continuation patterns are understood as a pause in an asset’s trend; a period of consolidation, or price acceptance, before the trend continues its journey.

How to Use Continuation Patterns

Continuation candlestick patterns, being that they are usually spotted during technical analysis on an asset’s candlestick pattern, can indicate stronger or weaker price breakouts, as well as being signs of increased volatility. The different intensity of these trends can usually be noted in the following ways:

Bullish and Bearish Continuation Patterns

Continuation patterns are quite easy to spot, but they do exist in many different forms, with different responses required for each one. Some of the major ones to look out for are the following:

Conclusion

Continuation patterns are a great way for traders to locate powerful breakout trends before they happen, thereby maximising their chances of making large returns and minimising risk.

What happens when a continuation pattern forms?

Once the continuation pattern forms, you’re looking for price action to confirm the continuation. The signal improves your odds of success.

How Do You Trade Continuation Patterns?

You’re looking for a trend. You want to see the stock moving in a clear direction.

What is bearish continuation candlestick?

Bearish continuation candlestick patterns are like their bullish cousins. The only real difference is the price is going down. You’ve got bear flags, bear pennants, and rectangles. On the bearish side, triangle continuation patterns work a little differently.

What is continuation signal?

A continuation signal is the confirmation part of a continuation pattern. It’s one thing to know how to identify patterns in stocks. Knowing how to play them is another thing. The signal is the trigger part of your trading plan .

What is the first swing of a triangle?

With triangles, the first swing — high or low — is your key level. A break of the key level with volume will be your continuation signal. If it breaks past the opposing swing, that’s a reversal signal.

What are the basic chart patterns?

The basic chart patterns are the same. I’m talking about flags, pennants, triangles, and rectangles. Once you identify the trend, these patterns signal continuation.

What does a pennant look like?

A pennant looks like something between a triangle and a flag. It’s a tight little triangle that follows strong directional movement.

What is continuation pattern?

A continuation pattern is one which shows a slight tendency for the trend to continue in the same direction after a continuation pattern as it did before. Not all continuation patterns will result in a continuation of the trend. Many will result in reversals. By waiting for the breakout, traders can see which it will be.

Why is a continuation pattern labeled as such?

A continuation pattern is labeled as such because there is a slight tendency for the trend to continue after the pattern completes, assuming the right context of price action. Not all continuation patterns will result in a continuation of the trend, though. For example, the price may reverse the trend after forming a triangle or pennant.

How many swing highs and lows to draw a triangle?

This creates a descending and rising trendline which converge toward each other. It takes at least two swing highs and two swing lows to create the trendlines necessary to draw a triangle. A third, and sometimes even a fourth, swing high and/or swing low is common before a breakout occurs.

What is a rectangle pattern?

Rectangles are a common continuation pattern that show a pause in the price trend with price action moving sideways. The price action is bound between horizontal support and resistance levels.

What is a descending triangle?

In a descending triangle, the swing highs are declining, forming a downward sloping trendline when they are connected. The swing lows reach similar levels, forming a horizontal trendline when connected.

How are flags and pennants similar?

Flags are very similar to pennants. They form a narrow trading range after a strong price increase or decrease. The difference is that flags move between parallel lines, either ascending, descending, or sideways, while a pennant takes on a triangle shape.

What is a stop loss order?

A stop loss order is placed just outside the pattern on the opposite side from the breakout. A profit target can be established based on the height of the continuation pattern.

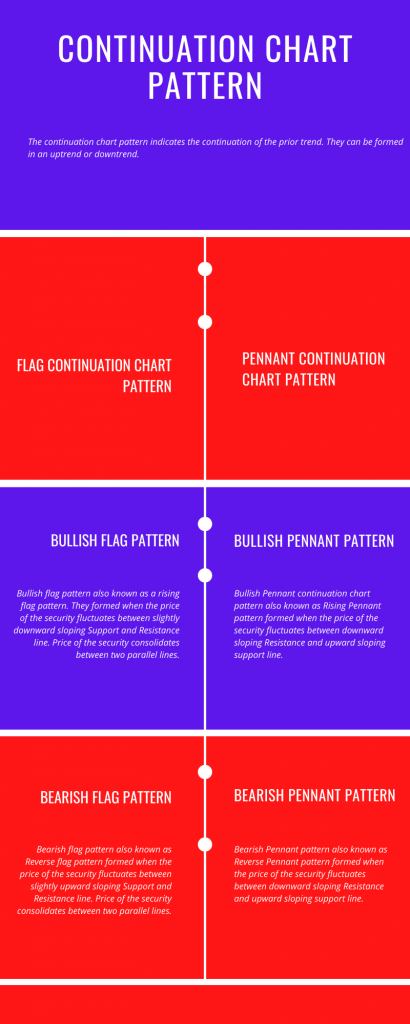

WHAT IS FLAG CONTINUATION CHART PATTER?

Flag is one of the most popular chart patterns forms by the price action of the security occurs in all markets (equity, commodity, futures, etc) in a short time frame as they move in the opposite direction of the prevailing trend.

BULLISH FLAG PATTERN

Bullish flag pattern also known as a rising flag pattern. They formed when the price of the security fluctuates between slightly downward sloping Support and Resistance line. Price of the security consolidates between two parallel lines.

BEARISH FLAG PATTERN

Bearish flag pattern also known as Reverse flag pattern formed when the price of the security fluctuates between slightly upward sloping Support and Resistance line. Price of the security consolidates between two parallel lines.

WHAT IS PENNANT CONTINUATION CHART PATTERN?

Same as Flag, Pennant is also one of the most popular chart pattern forms by the price action of the security occurs in all markets (equity, commodity, futures, etc) in a short time frame.

BULLISH PENNANT PATTERN

Bullish Pennant continuation chart pattern also known as Rising Pennant pattern formed when the price of the security fluctuates between downward sloping Resistance and upward sloping support line.

BEARISH PENNANT PATTERN

Bearish Pennant pattern also known as Reverse Pennant pattern formed when the price of the security fluctuates between downward sloping Resistance and upward sloping support line.

What is a continuation chart pattern?

Continuation chart patterns indicate that the market trend will be continued once the pattern is finished. These are also called consolidation patterns because they determine how traders take a quick break before moving further in the same path as the previous trend.

What does it mean when a stock is in a continuation pattern?

Continuation patterns can be bullish as well as bearish. When a continuation pattern (example flag pattern) is formed after an uptrend, it indicates that consolidation is over and not stock is ready to continue its original uptrend. When a continuation pattern (example flag pattern) is formed after a downtrend, it indicates that consolidation is over and not stock is ready to fall further now.

What is Chart Pattern?

Chart patterns are representation of traders psychology and trading behavior. Chart patterns are certain Shapes or patterns formed due to movement of stock prices

What is the advantage of analyzing chart patterns?

One of the most significant advantages of analyzing chart patterns is that they can usually tell us the possibility of the stock movement (continuation chart pattern or reversal chart pattern). After analyzing chart patterns, traders can know whether a stock is in Bullish move or Bearish move

What are the two types of chart patterns?

There are two main types of chart patterns that you are likely to know: Reversal, continuation pattern.

Why do traders use chart patterns?

One of the main reasons for traders to use chart patterns is to find out what the various market shareholders are doing. Just like a doctor that studies the patient’s medical report and concludes the problem of the patient, in the same way, the trader will use chart patterns to know the market movement. The shareholder’s buying and selling are ...

How many categories of chart patterns are there?

There are two broad categories of a chart pattern.

What are continuation patterns?

Continuation Patterns are recognizable chart patterns that signify a period of temporary consolidation before continuing in the direction of the original trend. Consolidation appears in the form of sideways price movement. The pattern completes itself upon a strong breakout of the consolidation zone, resulting in the continuation of the preceding trend. Continuation patterns usually play out over the short to intermediate term.

What is a triangular pattern called?

The triangular pattern is called a Pennant, which is made up of numerous forex candlesticks and is not to be confused with the larger, symmetrical triangle pattern. 3. Bullish Flag. The bullish flag pattern is a great pattern for traders to master.

What is ascending triangle?

An ascending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. The pattern is formed by drawing two converging trendlines (flat upper trendline and rising lower trendline), as price temporarily moves in a sideways direction. Traders look for a subsequent breakout, in the direction of the preceding trend, as a cue to enter a trade.

What is bullish pennant?

A bullish Pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. It develops during a period of brief consolidation, before price continues to move in the direction of the trend with the same initial momentum.

Is continuation pattern good?

Continuation patterns tend to be goodindicators of future price movement ,provided traders adhere to the following tips:

Is continuation the same as stock?

Yes, continuation patterns are the same for forex and stock trading. While there are noticeable differences when comparing forex vs stocks, continuation patterns can be applied with the same conviction. It’s not about the market itself, but is more about what the pattern reveals about price action.

What are Bearish Continuation Chart Patterns?

When the price of a security falls, it is said that it’s a bearish movement. Price doesn’t move in a single direction, it always takes a small reversal or pauses. After small reversals or pauses price continues it’s direction.

Chart Patterns

First, you will see a strong downside movement, which shows the selling pressure. Then you will see, stock will trade sideways for some time. The portion between black lines. Here traders are booking their profit.

Final Thoughts

If you have read both previous articles, you will trade continuation patterns easily. If you want to get good and bigger moves, then learning about the continuation patterns must for you.

What are Bullish Continuation Chart Patterns?

When the price of a security rises, it is said that it’s a bullish movement. Price doesn’t move in a single direction, it always takes a small reversal or pauses. After small reversals or pauses price continues it’s direction.

What happens if there is no strong move in a continuation pattern?

These are the continuation patterns, first there must be a strong move and then a pattern. If there will be no strong move, then your pattern may not work.

What are the patterns of triangles?

There are many triangle patterns such as symmetrical, ascending, etc. But they all works the same way.

What Is A Continuation Pattern?

- Continuation patterns in technical analysis are, as the name suggests, chart patterns that show that an asset’s price trend will continue once the pattern has finished. Thus, continuation patterns are understood as a pause in an asset’s trend; a period of consolidation, or price acceptance, before the trend continues its journey. They can be both b...

How to Use Continuation Patterns

- Continuation candlestick patterns, being that they are usually spotted during technical analysis on an asset’s candlestick pattern, can indicate stronger or weaker price breakouts, as well as being signs of increased volatility. The different intensity of these trends can usually be noted in the following ways: 1. Strong trend followed by small continuation pattern:When the waves on the c…

Bullish and Bearish Continuation Patterns

- Continuation patterns are quite easy to spot, but they do exist in many different forms, with different responses required for each one. Some of the major ones to look out for are the following:

Conclusion

- Continuation patterns are a great way for traders to locate powerful breakout trends before they happen, thereby maximising their chances of making large returns and minimising risk. As with any technical analysis pattern, tool, or indicator, however, these patterns should not be employed alone, instead being paired with multiple others to verify predictions. Continuation patterns are s…

What Is A Continuation Pattern?

Understanding The Continuation Pattern

- A continuation pattern is labeled as such because there is a slight tendency for the trend to continue after the pattern completes, assuming the right context of price action. Not all continuation patterns will result in a continuation of the trend, though. For example, the price may reverse the trend after forming a triangle or pennant. Continuati...

Types of Continuation Patterns

- Some common continuation patterns include triangles, pennants, flags, and rectangles. Below are descriptions of these continuation patterns.

Trading A Continuation Pattern

- There are several steps involved in trading a continuation pattern. The first step is to identify the prior trend direction. For example, was the price increasing or decreasing before it formed a triangle pattern? The next steps are to identify the continuation pattern and find the breakout point. Some traders will only take trades if the breakout occurs in the same direction as the prev…

Example of A Continuation Pattern in The Stock Market

- The chart of Amazon Inc. (AMZN) shows three pennant/flag patterns. The first is a pennant, and the next two are flags. The first two patterns show the measurement technique for coming up with an estimated profit target. The profit target is just an estimate. It does not mean the price will reach that level, or that it will stall out at that level and not proceed further. The third example sh…