The charge-to-cost ratio is calculated as a hospital’s total gross charges divided by its total Medicare-allowable cost. 1 We obtained the gross charge data from line 202 in column 5 of Form CSM-2552-10, Worksheet C, part I, “Calculation of Ratio of Costs to Charges,” submitted by the hospitals.

What is the cost-to-charge ratio for hospitals?

The cost-to-charge ratio is the ratio between a hospital’s expenses and what they charge. The closer the cost-to-charge ratio is to 1, the less difference there is between the actual costs incurred and the hospital’s charges.

What is cost-to-charge (CCR)?

Cost-to-Charge Definitions A ratio of the cost divided by the charges. Generally used with acute inpatient or outpatient hospital services. The following CCRs can be calculated from the Hospital cost reports

How do hospitals compare their total charges to their cost?

Instead, hospitals typically compare their total charges to their cost using a cost-to-charge ratio determination. Here is how it works. The cost-to-charge ratio is the ratio between a hospital’s expenses and what they charge.

What is an annual cost report for Medicare?

Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data.

What is the minimum fixed charge ratio?

What is fixed charge coverage ratio?

What is required daily deposit target finance charge?

What is cash flow coverage ratio?

What is the current realized loss ratio?

What is consolidated depreciation and amortization charge?

What is interest expense coverage ratio?

See 4 more

About this website

Should the CCR method use charges or revenues as the metric?

Answer and Explanation: Yes, the cost-to-charge ratio uses chargers or revenues as the metric. It is a ratio that connects the expenses of a hospital and what they levied. It computes the cost of certain procedures and costs are allocated on a patient by patient basis.

What is the fixed dollar threshold for outlier payments for 2022?

++ The fixed dollar loss threshold amount from $16,040 to $24,630 to maintain estimated outlier payments at 2 percent of total estimated aggregate IPF PPS payments. We did not propose any changes to the IPFQR Program and are not finalizing any changes to the IPFQR Program.

What is a Medicare cost outlier?

Outlier Claim Information and Submission Instructions. To qualify as an outlier, the claim must have costs above a fixed loss threshold amount. The Centers for Medicare & Medicaid Services (CMS) publishes the amount in the annual Inpatient Prospective Payment System (IPPS) Final Rule.

What is a high cost outlier?

High cost outlier payments are made in addition to the applicable short-stay outlier or full LTC-DRG payment established for the case. A high cost outlier payment is equal to 80 percent of the difference between the estimated cost of the case and the outlier threshold.

What is cost charge ratio?

The total amount of money required to operate a hospital, divided by the sum of the revenues received from patient care and all other operating revenues.

How are Medicare outlier payments calculated?

Finally, the outlier payment is based on a marginal cost factor equal to 80 percent of the combined operating and capital costs in excess of the fixed-loss threshold (90 percent for burn DRGs).

What is a cost outlier amount?

Prior to coding an inpatient cost outlier claim, first determine the diagnosis related group (DRG) cutoff date, by using the example timetable. Definitions. • Cost outlier -- an inpatient hospital discharge that is extraordinarily costly. Hospitals may be eligible to receive additional payment for the discharge.

What is a 70 occurrence code?

The SNF must complete occurrence span code “70” to indicate the qualifying stay dates for a hospital stay of at least 3 days which qualifies the patient for payment of the SNF level of care services billed on the claim.

What is day outlier amount?

Day outlier payments are an additional payment made for exceptionally long lengths of stay on services provided to children under six at disproportionate share hospitals and children under age one at non-disproportionate share hospitals.

What is a 50 occurrence code?

These codes are claim-related occurrences that are related to a time period (span of dates). Tips: Inpatient Rehabilitation Facility (IRF) Prospective Payment System (PPS) will use occurrence code 50 to report the date on which assessment data was transmitted to the CMS National Assessment Collection Database.

When would you use condition code 61?

61 Operating cost outlier which is not reported by provider. Pricer indicates this bill is a cost outlier and MAC indicates the operating cost outlier portion paid in value code 17. 62 PIP bill not reported by providers. Bill was paid under PIP and recorded by system.

What does occurrence code A3 mean?

Benefits Exhausted - PayerA3. Benefits Exhausted - Payer A. Last date benefits are available and no payment can be made by Payer A.

What is a cost outlier amount?

Prior to coding an inpatient cost outlier claim, first determine the diagnosis related group (DRG) cutoff date, by using the example timetable. Definitions. • Cost outlier -- an inpatient hospital discharge that is extraordinarily costly. Hospitals may be eligible to receive additional payment for the discharge.

What is a pass through payment?

Starting February 1, 2021, a person who receives Temporary Assistance for Needy Families through the Department of Social and Health Services (DSHS) for one or more children may receive a portion of child support paid on their case, called a pass-through payment.

What is Rbrvs fee schedule?

Resource-based relative value scale (RBRVS) is a schema used to determine how much money medical providers should be paid. It is partially used by Medicare in the United States and by nearly all health maintenance organizations (HMOs).

What are outliers in healthcare?

A medical outlier is a hospital inpatient who is classified as a medical patient for an episode within a spell of care and has at least one non-medical ward placement within that spell.

Cost to Charge Ratio - DOL

Cost to Charge Ratio . OWCP applies a Cost to Charge Ratio (CCR) formula that is based on CMS case-weighted data for hospital operating and capital costs per state.

The ratio of costs to charges: how good a basis for estimating ... - PubMed

This study evaluates the accuracy of costs derived from the ratio of costs to charges (RCCs), using costs based on relative value units (RVUs) as the "gold standard." We found that RCC-calculated costs were not a good basis for determining the costs of individual patients. However, when examining av …

IS YOUR COST-TO-CHARGE FORMULA DRIVING YOUR POLICY RESULTS?

September 27, 2006 Page 4 of 21 reimbursement amounts to determine the size of the hospital’s subsidy3 (i.e., unreimbursed amounts). Using a cost-to-charge ratio is common practice within the field.

Calculating Cost: Cost-to-Charge Ratios | ResDAC

This presentation defines the different types of cost-to-charge ratios (CCRs), how to use these CCRs, and the locations of the CCRs in the data files. The segment walks through an example of how to apply CCRs to adjust charges in order to arrive at an estimated "cost".

Calculating “Cost”: Cost-to-Charge Ratios - ResDAC

Cost-to-Charge Formulas Detailed formula found in the Internet Only Manuals 100-04 Claims Processing, Chapter 3, Section 20.1.2.1 – Cost to Charge Ratios, Section A –

What is the Medicare outlier payment?

Section 1886 (d) (5) (A) of the Act provides for Medicare payments to Medicare-participating hospitals in addition to the basic prospective payments for cases incurring extraordinarily high costs. To qualify for outlier payments, a case must have costs above a fixed-loss cost threshold amount ...

When are outlier payments adjusted?

Effective for discharges occurring on or after August 8, 2003, at the time of any reconciliation, outlier payments may be adjusted to account for the time value of any underpayments of overpayments. Any adjustment will be based upon a widely available index to be established in advance by the Secretary, and will be applied from the midpoint of the cost reporting period to the date of reconciliation.

What is a Medicare cost report?

Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data.

How many zipped files are there in CMHC?

For the Hospice, Renal, Health Clinic and CMHC cost reports, there is one zipped file each that contains all data for all the fiscal years. The links to these can be found on their section pages.

Can a hospital cost report be loaded into Excel?

The Hospital and Skilled Nursing Facility cost report data cannot be loaded into Microsoft Excel. The numeric data file for these cost reports is too large for the application.

Is CMS accurate?

These reports are a true and accurate representation of the data on file at CMS. Authenticated information is only accurate as of the point in time of validation and verification. CMS is not responsible for data that is misrepresented, misinterpreted or altered in any way. Derived conclusions and analysis generated from this data are not to be considered attributable to CMS or HCRIS.

What is CCR for inpatient files?

CCR for Inpatient Files facilitate estimating resource costs of inpatient care for NIS, KID, NRD, and SID beginning with data year 2001.

What is CCR for ED files?

CCR for ED Files facilitate estimating resource costs of emergency department care for SEDD beginning with data year 2017.

What is hospital billed charge?

Hospital billed charges are list prices similar to what medical equipment manufacturers provide as a suggested list price. GPOs, IDNs, hospital systems and individual hospitals typically negotiate from this suggested list price to something below it. In the end, different customers pay different amounts for the same product.

How much does Medicare pay for a procedure?

Medicare only pays $10,000 for the procedure so the contractual adjustment is $8,000 while Payer A pays $13,500 with a contractual adjustment of $4,500. With Medicare the patient pays zero (this assumes they have a supplemental policy that pays the difference) and the hospital receives $10,000.

What is it called when insurance companies pay different amounts to a hospital?

This is called a contractual adjustment .

Why is there confusion with hospital pricing?

This simple example illustrates why there is confusion with hospital pricing because the pricing is the same but the allowed amount differs based on the negotiated rates with various carriers. To the hospital the price for the procedure is $18,000. To the insurer it is $10,000 for Medicare and for Payer A it is $13,500. For the Medicare patient it is zero and for Payer A it is $3,375.

How much does a hospital receive from Medicare?

With Medicare the patient pays zero (this assumes they have a supplemental policy that pays the difference) and the hospital receives $10,000 . With Payer A, the hospital receives $10,125 but of that they must collect $3,375 from the patient. As you can imagine this is often difficult for many individuals and it often necessitates a payment plan.

What is price transparency?

Price transparency initiatives are being pushed from the federal government, state governments, employers, consumers, and other stakeholders. 1 Consumers, whether they be individuals, corporations or insurers want to understand the costs of inpatient and outpatient care in order to make better and more informed purchasing decisions. “The Center for Medicare and Medicaid Services (“CMS”) took steps in the fiscal year (“FY”) 2015 Inpatient Prospective Payment System (“IPPS”) final rule to implement the Affordable Care Act’s (“ACA”) provision requiring hospitals to establish and make public a list of its standard charges for items and services. In the final rule, CMS reminded hospitals of this requirement and reiterated that they encourage providers to move beyond just the required charge transparency and assist consumers in understanding their ultimate financial responsibility.” 2

What is a chargemaster in a hospital?

A hospital has a price list as well. It is called a “Chargemaster” or Charge Description Master (CDM). It includes medical procedures, lab tests , supplies, medications etc.

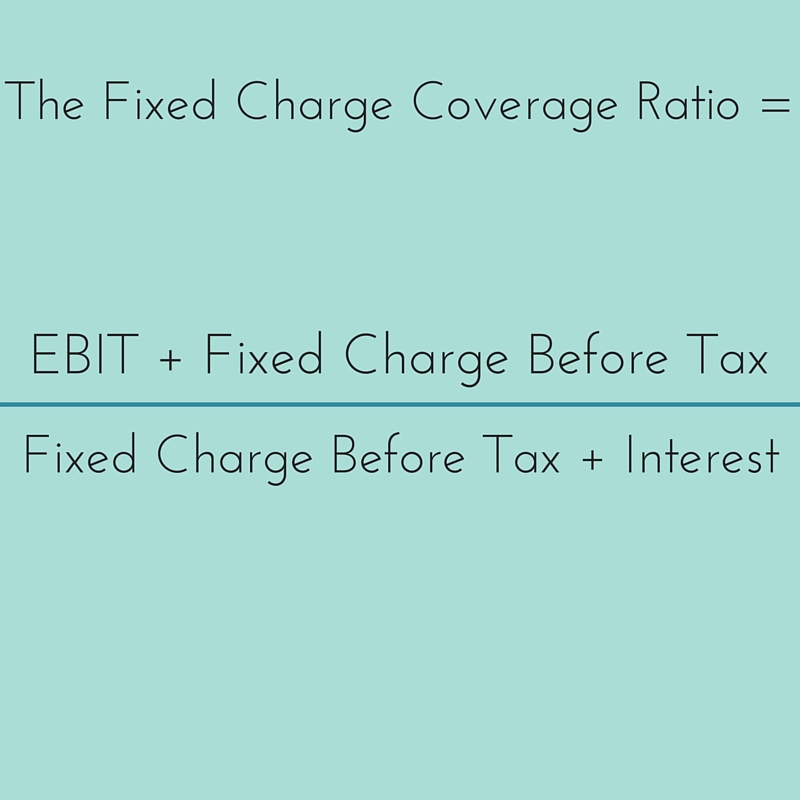

What is the minimum fixed charge ratio?

Minimum Fixed Charge Coverage Ratio means the sum of EBITDA and rent (lease) expense, including without limitation rent payments in connection with the Sale/Leaseback and the Operating Lease, for a given period, divided by the sum of (A) interest expense (which shall not include interest on the Subordinated Debt which is deferred and not paid), (B) rent (lease) expense, including without limitation rent payments in connection with the Sale/Leaseback and Operating Lease, (C) principal payments on the Subordinated Debt, the Bonds and any other permitted debt, and (D) Unfunded Capital Expenditures in the amounts disclosed by Borrower in its financial statements, for such period.

What is fixed charge coverage ratio?

Fixed Charge Coverage Ratio means with respect to any specified Person for any period, the ratio of the Consolidated EBITDA of such Person for such period to the Fixed Charges of such Person for such period. In the event that the specified Person or any of its Restricted Subsidiaries incurs, assumes, guarantees, repays, repurchases, redeems, defeases or otherwise discharges any Indebtedness (other than ordinary working capital borrowings) or issues, repurchases or redeems preferred stock subsequent to the commencement of the period for which the Fixed Charge Coverage Ratio is being calculated and on or prior to the date on which the event for which the calculation of the Fixed Charge Coverage Ratio is made (the “Calculation Date”), then the Fixed Charge Coverage Ratio will be calculated giving pro forma effect (in accordance with Regulation S-X under the Securities Act) to such incurrence, assumption, Guarantee, repayment, repurchase, redemption, defeasance or other discharge of Indebtedness, or such issuance, repurchase or redemption of preferred stock, and the use of the proceeds therefrom, as if the same had occurred at the beginning of the applicable four-quarter reference period. In addition, for purposes of calculating the Fixed Charge Coverage Ratio:

What is required daily deposit target finance charge?

Required Daily Deposit Target Finance Charge Amount means, for any day in a Due Period, an amount equal to the Class C Tranche Interest Allocation for the related Distribution Date ; provided, however, that for purposes of determining the Required Daily Deposit Target Finance Charge Amount on any day on which the Class C Tranche Interest Allocation cannot be determined because the LIBOR Determination Date for the applicable Interest Accrual Period has not yet occurred, the Required Daily Deposit Target Finance Charge Amount shall be the Class C Tranche Interest Allocation determined based on a pro forma calculation made on the assumption that LIBOR will be LIBOR for the applicable period determined on the first day of such calendar month, multiplied by 1.25.

What is cash flow coverage ratio?

Cash Flow Coverage Ratio means, for any given period and Person, the ratio of: (i) Cash Flow, divided by (ii) the sum of Consolidated Interest Expense and the amount of all dividend payments on any series of preferred stock of such Person (except dividends paid or payable in additional shares of Capital Stock (other than Disqualified Stock)), in each case, without duplication; provided, however, that if any such calculation includes any period during which an acquisition or sale of a Person or the incurrence or repayment of Indebtedness occurred, then such calculation for such period shall be made on a Pro Forma Basis.

What is the current realized loss ratio?

Current Realized Loss Ratio With respect to any Distribution Date, the annualized percentage derived from the fraction, the numerator of which is the sum of the aggregate Realized Losses for the three preceding Prepayment Periods and the denominator of which is the arithmetic average of the Pool Scheduled Principal Balances for such Distribution Date and the preceding two Distribution Dates.

What is consolidated depreciation and amortization charge?

Consolidated Depreciation and Amortization Charges means, for any period, the aggregate of all depreciation and amortization charges for fixed assets, leasehold improvements and general intangibles (specifically including goodwill) of the Borrower for such period, as determined on a Consolidated basis.

What is interest expense coverage ratio?

Interest Expense Coverage Ratio means, for any period, the ratio of (a) Consolidated EBITDA for such period to (b) Consolidated Interest Expense for such period.

HCRIS Data Disclaimer

- The Centers for Medicare & Medicaid Services (CMS) has made a reasonable effort to ensure that the provided data/records/reports are up-to-date, accurate, complete, and comprehensive at the time of disclosure. This information reflects data as reported to the Healthcare Cost Report Information System (HCRIS). These reports are a true and accurate r...

General Information

- Medicare-certified institutional providers are required to submit an annual cost report to a Medicare Administrative Contractor (MAC). The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in t…

New Cost Report Data Available

- * Due to being replaced by newer forms and an absence of updates, the HOSPICE-1999, SNF-1996 and RNL-1994 data files will no longer be updated.

Frequently Asked Questions

- There is a document available at the bottom of this page, the HCRIS FAQ, which answers some questions about HCRIS, the data files, and the cost reporting process.

Technical Assistance

- Free assistance to academic, government and non-profit researchers interested in using HCRIS data is available at : ResDAC, the Research Data Assistance Center.

Freedom of Information Act

- Individual cost reports may be requested from the Medicare Administrative contractors via the Freedom of Information Act (FOIA). For more information on this process, visit the FOIApage. Organization of data files: For the Hospital Form 2552-1996, Hospital Form 2552-2010 , SNF Form 2540-1996, SNF Form 2540-2010, HHA Form 1728-1994 and HHA Form 1728-2020cost reports, …