What are deposits in transit accounting?

- it is a normal business practice to transfer the surplus assets at certain location to the location where the resources are scare

- assets are considered to be in transit when they do not belong to any location

- the deposits in transit are required to be accounted for at the end of the reporting period

How to complete a bank reconciliation step by step?

Step 1: Tick off items that appear on the bank statement as well as the cash book (known as 'matched' items)Step 2: Update the cash book for all items that a...

What are deposits in transit?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it.

What are the steps in bank reconciliation?

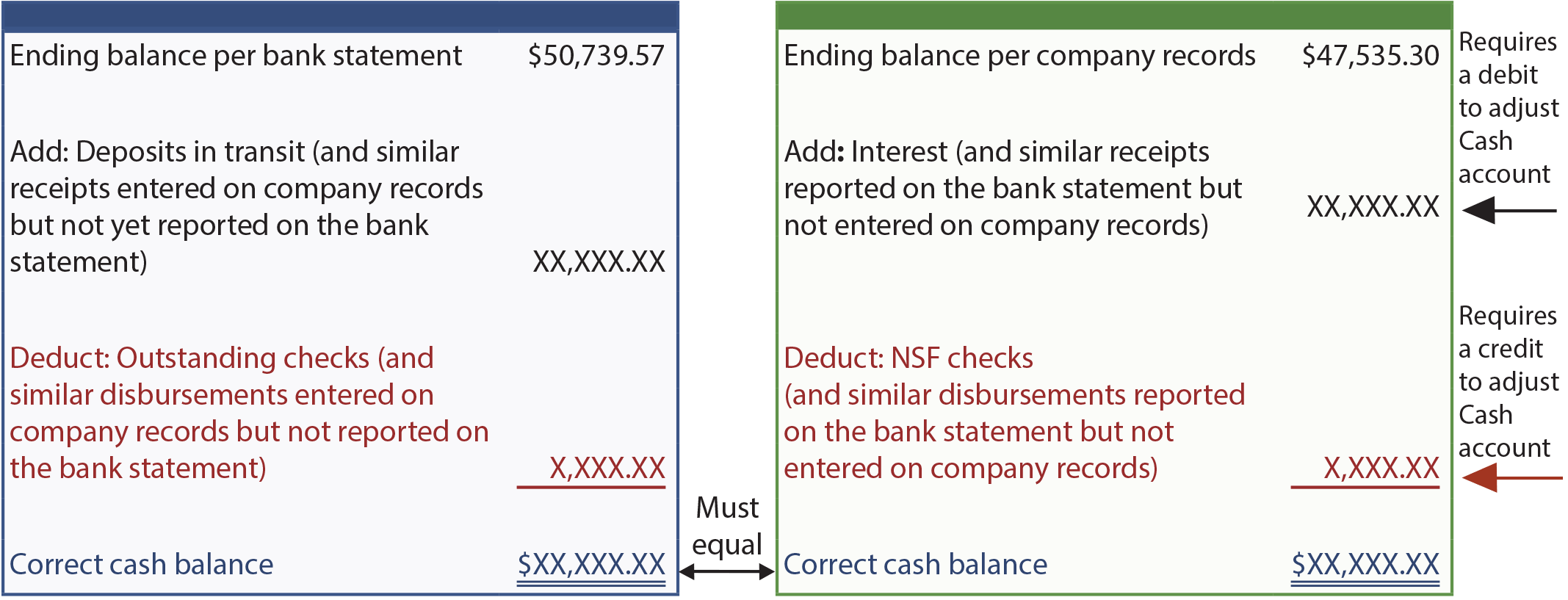

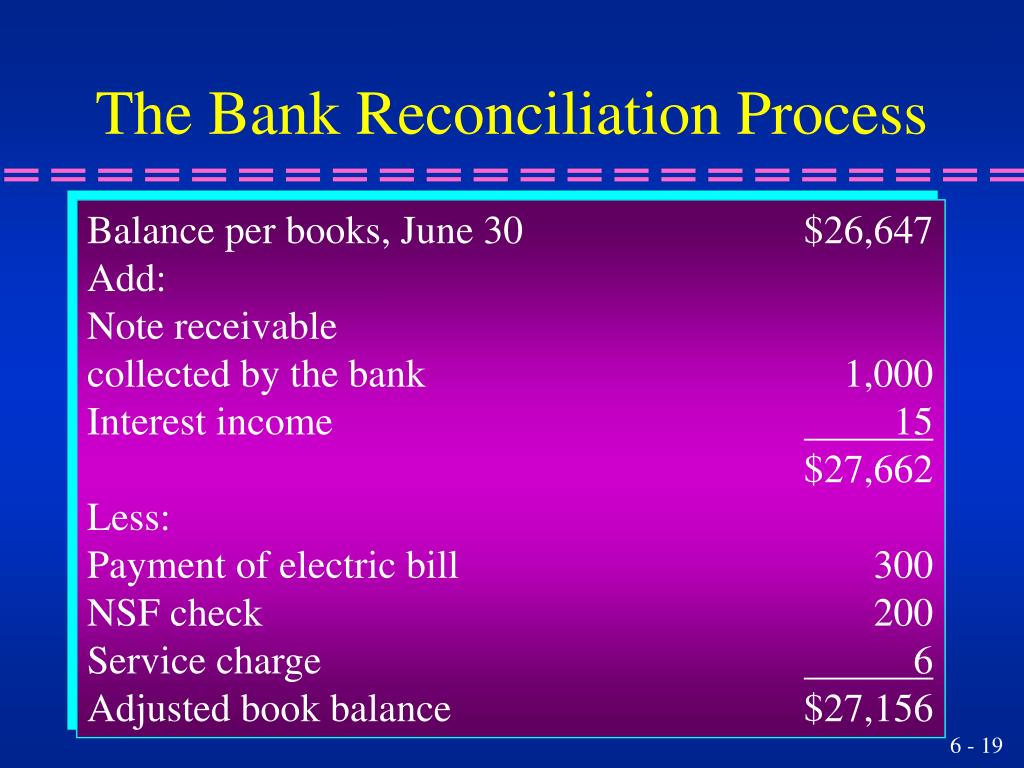

Steps in a Bank Reconciliation

- Add unrecorded deposits to the balance shown on the bank statement. ...

- Subtract outstanding checks from the balance shown on the bank statement. ...

- Deduct all service fees and printing charges from your company ledger. ...

- Add interest earned from the account to the company ledger. ...

What Is a Deposit in Transit?

What does "in transit" mean?

What happens when you receive a check from ABC?

What happens if a transit item is not cleared?

Why is it possible to clear transit items faster?

How long does it take for a transit item to clear?

How long is a transit check held?

See 4 more

About this website

Where do deposits in transit go on bank reconciliation?

Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. They must be added to the bank statement.

How is deposit in transit treated in the bank reconciliation statement?

Deposits in transit. These deposits are called deposits in transit and cause the bank statement balance to understate the company's actual cash balance. Since deposits in transit have already been recorded in the company's books as cash receipts, they must be added to the bank statement balance.

How do you record deposit in transit in bank reconciliation?

How to account for or handle a deposit in transitCreate a bank adjustment in the bank register during the reconciliation month for the amount that still needs to be cleared to bring the out of balance back to $0. ... Post to the General Ledger if desired or set the post status to do not post.More items...

What is deposit in transit example?

A company's receipts that appear on the company's records but do not yet appear on the bank statement. For example, a retail store's receipts of March 31 are deposited after banking hours on March 31 or on the morning of April 1.

What is deposit in transit in bank reconciliation added or subtracted?

1. Adjust the balance per the bank statement. This involves adding any deposits in transit, subtracting any outstanding checks, and then adding or subtracting any bank errors. Deposits in transit are amounts recorded by the company, but not yet on the bank's books.

Which will be performed to reconcile a deposit in transit?

Bank Reconciliation Process Flow The essential process flow for a bank reconciliation is to start with the bank's ending cash balance, add to it any deposits in transit from the company to the bank, subtract any checks that have not yet cleared the bank, and either add or deduct any other items.

How should a deposit in transit be treated on a bank reconciliation quizlet?

Deposits in transit are deducted from the balance per the bank statement, and outstanding checks are added to the balance per the bank statement during the bank reconciliation process.

Does a deposit in transit need a adjusting entry?

Interest on balance would require an adjusting entry if appearing on a bank reconciliation, because outstanding cheques and deposits in transit are merely time differences which would get cleared automatically and adjusted cash balance is already taken care for the errors.

How should a deposit in transit be treated on a bank reconciliation quizlet?

Deposits in transit are deducted from the balance per the bank statement, and outstanding checks are added to the balance per the bank statement during the bank reconciliation process.

Does deposit in transit is a reconciling item added to the unadjusted book balance?

The items that are added to the balance per bank when doing a bank reconciliation include: Deposits in transit which include the cash and checks that were received by a company as of the date of the bank statement, but were not deposited in time for them to appear on the bank statement.

What is deposit in transit in bank reconciliation quizlet?

Deposits in transit represent deposits recorded on the books, which have not yet been recorded on the bank statement. They are therefore added to the bank statement balance. Linetech Company's bank statement showed an ending balance of $8,000.

Can an incoming wire transfer be considered a deposit in transit?

A customer initiated a wire transfer on 12/30/11 but it did not post to our bank account until 1/03/12 (first banking day of 2012). Could this be considered constructive receipt and therefore included in 12/31 cash balance as a deposit in transit?

What is a deposit in transit? | AccountingCoach

Definition of Deposit in Transit A company's deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received, and the amount will not appear on the company's bank statement until a later date. A deposit in transit is also k...

What are Deposits in Transit? - Definition | Meaning | Example

Definition: A deposit in transit, or un-cleared deposit, is cash or check deposit that is recorded in a company’s accounting system but not in the bank’s records. A deposit in transit usually occurs because there is a time lapse between when the company records the deposit in their accounting software and when the deposit makes it to the bank and is recorded in the account.

Deposit in Transit Journal Entry | Example - Accountinginside

This transaction moves the cash $ 1,000 from cash on hand to cash at bank even the bank statement does not yet show this amount yet. On the same date, the balance in the bank is $ 1,000 less than the company record.

Deposits In Transit | Bank Reconciliation - Accounting Simplified

Deposits in transit are those deposits that are not reflected in the bank statement on the reconciliation date due to time lag between when a company deposits cash or cheque in its account and when the bank credits it. Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower ...

Deposit in transit definition — AccountingTools

A deposit in transit is cash and checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the funds are deposited. If this occurs at month-end, the deposit will not appear in the bank statement issued by the bank, and so becomes a reconciling item in the bank reconciliation prepared by the entity.

What is outstanding deposit in transit?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it. Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower than the balance as per cash book until the deposit is processed by the bank. Therefore, any outstanding deposits must be subtracted from the balance as per cash book in the bank reconciliation statement.

When did $1000 of deposits in transit appear in bank reconciliation?

Therefore, $1000 of deposits in transit should appear in the bank reconciliation on 31 December 2010 because the bank had not accounted for the transaction by that date even though ABC & Co. had recorded the receipt in its cash book on the date of deposit.

Does a bank statement have to be lower than a cash book?

Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower than the balance as per cash book until the deposit is processed by the bank. Therefore, any outstanding deposits must be subtracted from the balance as per cash book in ...

What is a deposit in transit?

A company's deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received, and the amount will not appear on the company's bank statement until a later date. A deposit in transit is also known as an outstanding deposit.

When there is a deposit in transit, should the amount be listed on the company's bank reconciliation?

When there is a deposit in transit, the amount should be listed on the company's bank reconciliation as an addition to the balance per bank.

When is $4,600 reported on bank statement?

However, the bank statement will report the $4,600 as a deposit on Monday, July 1, when the bank processes the items from its night depository. When preparing a bank reconciliation as of June 30, the company needs to adjust the balance on the bank statement by adding $4,600 for the deposit in transit. This is done because the $4,600 is rightfully ...

Who is Harold Averkamp?

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Read more about the author.

How many entries are required for a perpetual inventory system?

In a perpetual inventory system, two entries are normally made to record each sales transaction. The purpose of these entries is best described as follows:

What is one entry record?

B. One entry records the purchase of merchandise and the other records the sale.

What is a deposit in transit?

C. Deposits in transit represent deposits recorded on the books, which have not yet been recorded on the bank statement. They are therefore added to the bank statement balance.

Is income tax expense higher under FIFO or LIFO?

A. Income tax expense will be higher under FIFO than under LIFO.

When is revenue recorded?

C. Revenue is recorded when title and risks of ownership transfer to the buyer.

What Is a Deposit in Transit?

A deposit in transit is money that has been received by a company and recorded in the company's accounting system. The deposit has already been sent to the bank, but it has yet to be processed and posted to the bank account. In financial accounting, these funds are reflected in the company's cash balance on the day the deposit is received, even though it may take the bank several days to process the deposit and post it to the bank balance.

What does "in transit" mean?

Transit refers to payments that take place between parties of different banks. The payment is then in transit from the payor's bank to the payee's. Because the recipient's bank cannot see the financial accounts of the sender's bank, they will hold the deposit until it clears and is reconciled.

What happens when you receive a check from ABC?

When the check is received, ABC Company will record a debit to cash and a credit to accounts receivable. This will decrease the customer's accounts receivable balance and increase its cash and cash equivalent line item on the company's balance sheet.

What happens if a transit item is not cleared?

In some cases, a bank may agree to cash a transit item before it has cleared, but if it does not clear, the bank will then debit the amount from the depositor's account to cover the discrepancy.

Why is it possible to clear transit items faster?

This is possible because electronic check conversion and other forms of electronic bank draft conversion make it possible to clear transit items faster. If there are insufficient funds in the account on which it's drawn, the transit item will not clear. When this happens, the funds will not be deposited as planned.

How long does it take for a transit item to clear?

Most banks will place a hold on a transit item long enough for the item to clear the account on which it's drawn. Because the item is drawn on an account at a different bank from the one where it's been deposited, this can take a few days.

How long is a transit check held?

Most banks will place a hold on a deposited transit check, as allowed by Federal Reserve Regulation CC. Regulation CC allows banks to place a hold of up to nine days on transit items.

Example 1

Example 2

Example 3

Example 4

Example 5

What to Do with A Deposit in Transit?

- A deposit in transit is added to the bank reconciling items when preparing a bank reconciliation statement. It is added when the reconciliation method used is the adjusted method mostly preferred because it shows the actual Cash in Bank balance of the depositor. Moreover, the addition reconciles the accounting records with the bank statement balanc...