Key Takeaways

- Derivatives are financial contracts, set between two or more parties, that derive their value from an underlying asset, group of assets, or benchmark.

- A derivative can trade on an exchange or over-the-counter.

- Prices for derivatives derive from fluctuations in the underlying asset.

What is the difference between securities and derivatives?

What Is the Difference Between a Derivative and a Future?

- Primer on Derivatives. ...

- Types of Derivatives. ...

- Characteristics of Derivatives. ...

- Understanding Futures Contracts. ...

- Margin on Futures. ...

- Daily Cash Settlement. ...

- Futures Vs. ...

- Closing Out a Futures Contract. ...

- Traders and the Closing Process. ...

- The Importance of Derivatives. ...

What does derivatives mean in finance?

Types of Derivatives

- Futures Contracts. Futures contracts are used mostly in commodities markets. ...

- Forward Contracts. Forward contracts function much like futures. ...

- Options. Options give a trader just that. ...

- Swaps. Companies, banks, financial institutions, and other organizations routinely enter into derivative contracts known as interest rate swaps or currency swaps.

What are the types of financial derivatives?

Types of Derivatives

- Options. An options contract gives the buyer the right, but not the obligation, to buy or sell something at a specific price on or before a specific date.

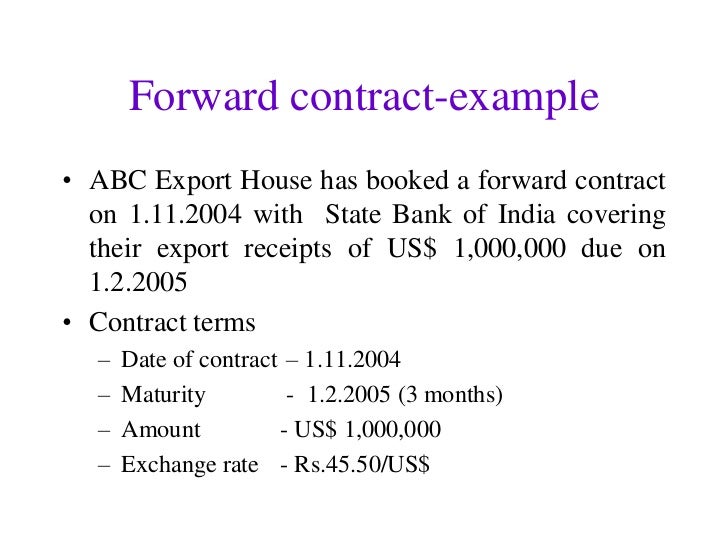

- Forward Contract. A forward contract is where a buyer agrees to purchase the underlying asset from the seller at a specific price on a specific date.

- Futures Contract. ...

- Swaps. ...

Are derivatives assets or liabilities?

Derivative financial instruments are stated at their market value in the balance sheet and are classified as current assets or liabilities, unless they form part of a hedging relationship, where their classification follows the classification of the hedged financial asset or liability. From: IFRS: A Quick Reference Guide, 2009.

What is the purpose of a derivative in finance?

Financial derivatives are used for two main purposes to speculate and to hedge investments. A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. The derivative itself is a contract between two or more parties based upon the asset or assets.

What is a derivative in banking?

A derivative is a financial contract whose value is derived from the performance of underlying market factors, such as interest rates, currency exchange rates, and commodity, credit, and equity prices.

What are the 4 main types of derivatives?

The four major types of derivative contracts are options, forwards, futures and swaps.

What is derivative example?

A derivative is an instrument whose value is derived from the value of one or more underlying, which can be commodities, precious metals, currency, bonds, stocks, stocks indices, etc. Four most common examples of derivative instruments are Forwards, Futures, Options and Swaps.

How do you profit from derivatives?

By making a calculated bet on the future value of the underlying asset, such financial instruments can help derivatives traders earn a profit. Hence, their value is thereby derived from that asset, which is why they are referred to as 'Derivatives'. Underlying assets change their value every now and then.

What are the best derivatives to invest in?

Five of the more popular derivatives are options, single stock futures, warrants, a contract for difference, and index return swaps. Options let investors hedge risk or speculate by taking on more risk. A single stock future is a contract to deliver 100 shares of a certain stock on a specified expiration date.

How do derivatives work?

Derivatives are financial contracts, set between two or more parties, that derive their value from an underlying asset, group of assets, or benchmark. A derivative can trade on an exchange or over-the-counter. Prices for derivatives derive from fluctuations in the underlying asset.

Is a mortgage a derivative?

Mortgage derivatives are a type of financial investment instrument that depend on the underlying value of home mortgages. Investors buy and sell shares of these derivatives, which share many characteristics with traditional stocks and mutual funds.

What is a derivative?

A derivative is a contractual agreement between two parties, a buyer and a seller, used by a financial institution, a corporation, or an individual...

How are derivatives traded?

Derivatives are traded either on an exchange or over-the-counter (OTC), commonly used by two different investor types: institutional investors to l...

What are different types of derivatives?

The most common types of derivatives include futures, options, swaps, and forwards. Futures are used by hedgers to lock in prices of commodities or...

What are the pros and cons of derivative trading?

The main advantages of derivatives are that they offer exposure to various types of assets that can’t trade otherwise. Also standard is the use of...

What is derivative in finance?

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index). Common underlying instruments include bonds, commodities, currencies, interest rates, market indexes, and stocks.

What Is a Derivative?

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index). Common underlying instruments include bonds, commodities, currencies, interest rates, market indexes, and stocks.

What is futures contract?

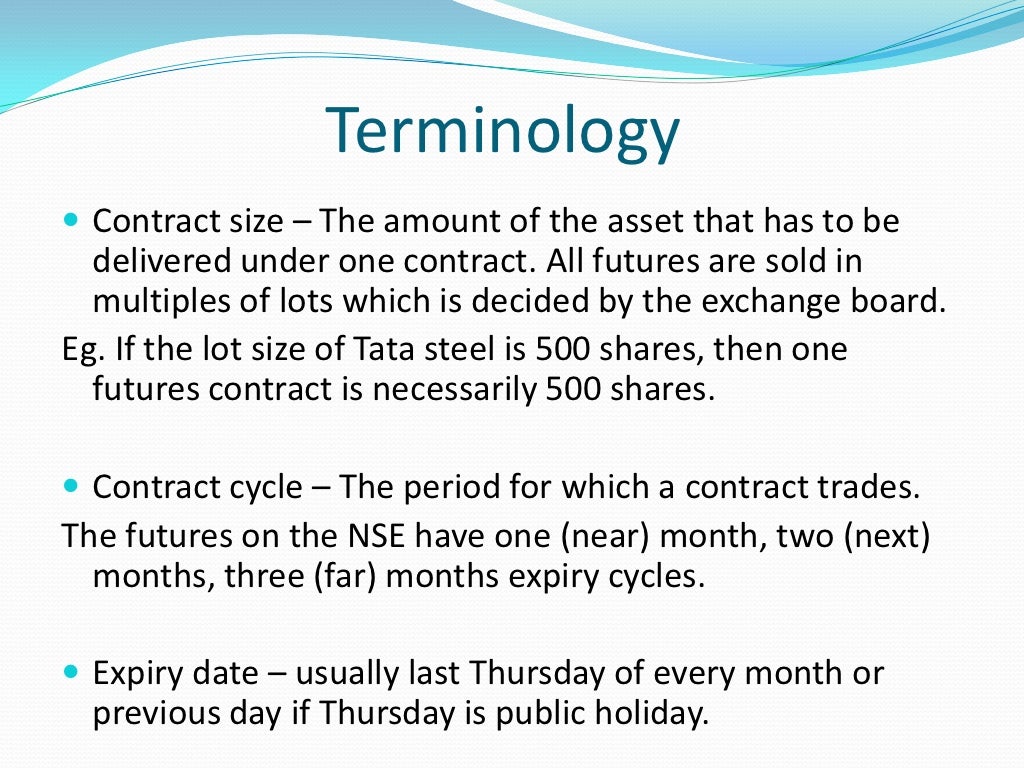

A futures contract is a contract to buy or sell a commodity or security at a predetermined price and at a preset date in the future. Futures contracts are standardized by specific quantity sizes ...

What is an equity option?

An equity or stock option is a type of derivative because its value is "derived" from that of the underlying stock. Options come in forms: calls and puts. A call option gives the holder the right to buy the underlying stock at a preset price (called the strike price) and by a predetermined date outlined in the contract (called the expiration date). A put option gives the holder the right to sell the stock at the preset price and date outlined in the contract. There's an upfront cost to an option called the option premium.

Why does Gail want to convert her loan to a variable rate?

Sam has a fixed-rate loan about the same size as Gail's, and he wants to convert it to a variable-rate loan because he hopes interest rates will decline in the future.

What are derivatives used for?

Derivatives are often used for commodities, such as oil, gasoline, or gold. Another asset class is currencies, often the U.S. dollar. There are derivatives based on stocks or bonds. Others use interest rates, such as the yield on the 10-year Treasury note. The contract's seller doesn't have to own the underlying asset.

Why are derivatives important?

Derivatives make future cash flows more predictable. They allow companies to forecast their earnings more accurately. That predictability boosts stock prices, and businesses then need a lower amount of cash on hand to cover emergencies. That means they can reinvest more into their business.

What are crypto derivatives?

Crypto derivatives offer a way to speculate or hedge cryptocurrency exposure. These derivatives include bitcoin futures traded alongside equities and commodities with the CME Group. 8 There is also an ETF that contains bitcoin futures ( BITO ), and traders can trade options on BITO as another type of crypto derivative. 9 10

What is derivative agreement?

The most common type of derivative is a swap. This is an agreement to exchange one asset or debt for a similar one. The purpose is to lower risk for both parties. Most of them are either currency swaps or interest rate swaps.

How many derivatives are traded in 2019?

Derivatives Trading. In 2019, 32 billion derivative contracts were traded. 1 Most of the world's 500 largest companies use derivatives to lower risk. For example, a futures contract promises the delivery of raw materials at an agreed-upon price. This way, the company is protected if prices rise.

What is forwarding in OTC?

Forwards are another OTC derivative. They are agreements to buy or sell an asset at an agreed-upon price at a specific date in the future. The two parties can customize their forward a lot. Forwards are used to hedge risk in commodities, interest rates, exchange rates, or equities.

What is derivative contract?

A derivative is a financial contract that derives its value from an underlying asset. The buyer agrees to purchase the asset on a specific date at a specific price.

What is derivative in finance?

Derivatives in finance are financial instruments that derive their value from the value of the underlying asset. The underlying asset can be bonds, stocks, currency, commodities, etc.

How does a forward contract work?

A forward contract works in the same way as the futures, the only difference being, it is traded over the counter. So there is a benefit of customization.

Is a futures contract the same as a forward?

However, the futures contract has some major Differences as compared to forwards. Futures are Exchange-traded. Therefore they are governed and regulated by the exchange. Unlike forwards, which can be customized and structured as per the parties’ needs. Which is why there is much less credit, counterparty risk in forwards as they are designed according to the parties’ needs.

What is derivative in finance?

e. In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the " underlying ".

What are derivatives in accounting?

Derivatives are contracts between two parties that specify conditions (especially the dates, resulting values and definitions of the underlying variables, the parties' contractual obligations, and the notional amount) under which payments are to be made between the parties. The assets include commodities, stocks, bonds, interest rates and currencies, but they can also be other derivatives, which adds another layer of complexity to proper valuation. The components of a firm's capital structure, e.g., bonds and stock, can also be considered derivatives, more precisely options, with the underlying being the firm's assets, but this is unusual outside of technical contexts.

Why are derivatives important?

Under US law and the laws of most other developed countries, derivatives have special legal exemptions that make them a particularly attractive legal form to extend credit. The strong creditor protections afforded to derivatives counterparties, in combination with their complexity and lack of transparency however, can cause capital markets to underprice credit risk. This can contribute to credit booms, and increase systemic risks. Indeed, the use of derivatives to conceal credit risk from third parties while protecting derivative counterparties contributed to the financial crisis of 2008 in the United States.

Why do derivatives cause losses?

The use of derivatives can result in large losses because of the use of leverage, or borrowing. Derivatives allow investors to earn large returns from small movements in the underlying asset's price. However, investors could lose large amounts if the price of the underlying moves against them significantly. There have been several instances of massive losses in derivative markets, such as the following:

What is swap in finance?

A swap is a derivative in which two counterparties exchange cash flows of one party's financial instrument for those of the other party's financial instrument . The benefits in question depend on the type of financial instruments involved. For example, in the case of a swap involving two bonds, the benefits in question can be the periodic interest ( coupon) payments associated with such bonds. Specifically, two counterparties agree to the exchange one stream of cash flows against another stream. These streams are called the swap's "legs". The swap agreement defines the dates when the cash flows are to be paid and the way they are accrued and calculated. Usually at the time when the contract is initiated, at least one of these series of cash flows is determined by an uncertain variable such as a floating interest rate, foreign exchange rate, equity price, or commodity price.

Why do people use derivatives?

Derivatives can be used to acquire risk, rather than to hedge against risk. Thus, some individuals and institutions will enter into a derivative contract to speculate on the value of the underlying asset, betting that the party seeking insurance will be wrong about the future value of the underlying asset. Speculators look to buy an asset in the future at a low price according to a derivative contract when the future market price is high, or to sell an asset in the future at a high price according to a derivative contract when the future market price is less.

What is forward contract?

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or to sell an asset at a specified future time at an amount agreed upon today, making it a type of derivative instrument . This is in contrast to a spot contract, which is an agreement to buy or sell an asset on its spot date, which may vary depending on the instrument, for example most of the FX contracts have Spot Date two business days from today. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged.

What is derivative asset?

Derivatives are a financial asset based on a contract and an underlying asset. The value of the derivative is derived from the underlying asset.

Why trade financial derivatives?

Billions, if not trillions, of dollars in derivatives are traded annually. Investment accounts ranging from teenagers-on-an-app-with-birthday-money level to mega-corporations use derivatives for each of the reasons we'll discuss.

What is futures contract?

A futures contract is an agreement to buy or sell an asset at a future date. Let's say you're a corn farmer and know you will have 5,000 bushels of corn available to sell in October. Right now, it's May, and you need to set your price for financial planning.

How do stock options differ from futures?

Stock options differ from futures because they give the contract holder the right to buy or sell the stock, but there is no obligation.

Why do investors sell derivatives?

Many investors sell derivatives to gain income. For example, if you own a stock and don't think its price will significantly increase in the near future, you could sell an option on it to someone who does. If the stock doesn't go up, you keep the price of the option. This is the covered call strategy.

Do derivatives expire?

Time restriction: Derivatives inherently expire on a certain date. If you buy a call option and the price of the underlying stock hits the moon one day after the option expires, you're out of luck.

Do superinvestors use derivatives?

Most of the derivatives trading on exchanges are just as homogenous as stocks, but superinvestors and corporations often go to investment banks to create customized derivatives to use for specific trades. Many of the famous investors who bet on the housing market crashing in 2007 used derivatives created just for them by investment banks.

What is derivative in finance?

A financial derivative is a security whose value depends on, or is derived from, an underlying asset or assets. The derivative represents a contract between two or more parties and its price fluctuates according to the value of the asset from which it is derived. The most common underlying assets used by financial derivative products are ...

Who Invented Financial Derivatives?

To gain a complete understanding of financial derivatives, it's important to understand how they came about.

How Did Financial Derivatives Cause the Financial Crisis of 2008?

The proliferation of unregulated financial derivatives back in the years leading up to the 2008 financial crisis played a major role in that crisis.

Why are CFDs active?

The contract usually remains active until it is closed by the trader, or by the broker due to insufficient equity in the trading account. CFDs provide traders with most of the advantages of a real investment, but without physical ownership of the underlying asset.

What happens to over the counter derivatives?

Since over-the-counter derivatives are traded between two individual private parties, there is a counterparty risk involved in their use. For example, if one of the parties went bankrupt before the contract was settled, they would be unable to fulfil their obligations to the other party.

Which is the best platform to trade derivatives?

If you want to start trading using financial derivatives on thousands of markets, MetaTrader 5 is widely regarded as one of the best available platforms for doing so.

Where did the concept of contracting for the future delivery of some commodity come from?

The concept of having a contract for the future delivery of some commodity grew from Mesopotamia outward into Hellenistic Egypt and then into the Roman world. This all occurred before the collapse of the Roman Empire. After their collapse, the Byzantine Empire continued to use contracts for future delivery. Importantly, they did not end with a canon law from western Europe and continued to be used.

What is derivatives in finance?

Derivatives are complex financial contracts based on the value of an underlying asset, group of assets or benchmark. These underlying assets can include stocks, bonds, commodities, currencies, interest rates, market indexes or even cryptocurrencies.

What is derivative investment?

A derivative is a financial instrument that derives its value from something else. Because the value of derivatives comes from other assets, professional traders tend to buy and sell them to offset risk. For less experienced investors, however, derivatives can have the opposite effect, making their investment portfolios much riskier.

How Are Derivatives Used?

Because they involve significant complexity, derivatives aren’t generally used as simple buy-low-sell-high or buy-and-hold investments. The parties involved in a derivative transaction may instead be using the derivative to:

Why do investors use derivatives?

Hedge a financial position. If an investor is concerned about where the value of a particular asset will go, they can use a derivative to protect themselves from potential losses.

Why are futures bought and sold on an exchange?

Because futures are bought and sold on an exchange, there’s much less risk one of the parties will default on the contract.

What are the different types of derivatives?

You’re most likely to encounter four main types of derivatives: futures, forwards, options and swaps. As an everyday investor, you’ll probably only ever deal directly with futures and options, though.

Why do futures contracts bind?

Because futures contracts bind parties to a particular price , they can be used to offset the risk that an asset’s price rises or falls , leaving someone to sell goods at a massive loss or to buy them at a large markup. Instead, futures lock in an acceptable rate for both parties based on the information they currently have.

Understanding Derivatives

- A derivative is a complex type of financial security that is set between two or more parties. Traders use derivatives to access specific markets and trade different assets. The most common underlying assets for derivatives are stocks, bonds, commodities, currencies, interest rates, and …

Special Considerations

- Derivatives were originally used to ensure balanced exchange rates for internationally traded goods. International traders needed a system to account for the differing values of national currencies. Assume a European investor has investment accounts that are all denominated in euros (EUR). Let's say they purchase shares of a U.S. company through a U.S. exchange using U.…

Types of Derivatives

- Derivatives are now based on a wide variety of transactionsand have many more uses. There are even derivatives based on weather data, such as the amount of rain or the number of sunny days in a region. There are many different types of derivatives that can be used for risk management, speculation, and leveraging a position. The derivatives market is one that continues to grow, off…

Advantages and Disadvantages of Derivatives

- Advantages

As the above examples illustrate, derivatives can be a useful tool for businesses and investors alike. They provide a way to do the following: 1. Lock in prices 2. Hedge against unfavorable movements in rates 3. Mitigate risks These pluses can often come for a limited cost. Derivative… - Disadvantages

Derivatives are difficult to value because they are based on the price of another asset. The risks for OTC derivatives include counterparty risks that are difficult to predict or value. Most derivatives are also sensitive to the following: 1. Changes in the amount of time to expiration 2. …

What Is A derivative?

Understanding Derivatives

- Derivatives are secondary securities whose value is solely based (derived) on the value of the primary security that they are linked to–called the underlying. Typically, derivatives are considered advanced investing. There are two classes of derivative products: "lock" and "option." Lock products (e.g. swaps, futures, or forwards) bind the respective parties from the outset to the agr…

Derivative Exchanges and Regulations

- Some derivatives are traded on national securities exchanges and are regulated by the U.S. Securities and Exchange Commission(SEC). Other derivatives are traded over-the-counter (OTC), which involve individually negotiated agreements between parties.

Two-Party Derivatives

- A commodity futures contract is a contract to buy or sell a predetermined amount of a commodityat a preset price on a date in the future. Commodity futures are often used to hedge or protect investors and businesses from adverse movements in the price of the commodity. For example, commodity derivatives are used by farmers and millers to provide a degree of "insuran…

Benefits of Derivatives

- Let's use the story of a fictional farm to explore the mechanics of several varieties of derivatives. Gail, the owner of Healthy Hen Farms, is worried about the recent fluctuations in chicken prices or volatilitywithin the chicken market due to reports of bird flu. Gail wants to protect her business against another spell of bad news. So she meets with an investor who enters into a futures contr…

Derivative Swap

- Derivatives can also be used with interest-rate products. Interest rate derivatives are most often used to hedge against interest rate risk. Interest rate riskcan occur when a change in interest rates causes the value of the underlying asset's price to change. Loans, for example, can be issued as fixed-rate loans, (same interest rate through the life of the loan), while others might b…

Credit Derivative

- A credit derivativeis a contract between two parties and allows a creditor or lender to transfer the risk of default to a third party. The contract transfers the credit risk that the borrower might not pay back the loan. However, the loan remains on the lender's books, but the risk is transferred to another party. Lenders, such as banks, use credit derivatives to remove or reduce the risk of loa…

Options Contracts

- Years later, Healthy Hen Farms is a publicly-traded corporation (HEN) and is America's largest poultry producer. Gail and Sam are both looking forward to retirement. Over the years, Sam bought quite a few shares of HEN. In fact, he has more than $100,000 invested in the company. Sam is getting nervous because he is worried that another shock, perhaps another outbreak of b…

The Bottom Line

- This tale illustrates how derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers. Although Warren Buffett once called derivatives "financial weapons of mass destruction," derivatives can be very useful tools, provided they are used properly.2 Like all other financial instruments, derivatives have their own set of pros and cons, but they also hold u…

Derivatives Trading

Exchanges

- A small percentage of the world's derivatives are traded on exchanges. These public exchanges set standardized contract terms. They specify the premiums or discounts on the contract price. This standardization improves the liquidity of derivatives. It makes them more or less exchangeable, thus making them more useful for hedging. Exchanges can also be a clearinghou…

Types of Financial Derivatives

- The most notorious derivatives are collateralized debt obligations. CDOs were a primary cause of the 2008 financial crisis.4These bundle debt, such as auto loans, credit card debt, or mortgages, into a security that is valued based on the promised repayment of the loans. There are two major types: Asset-backed commercial paper is based on corporate...

Four Risks of Derivatives

- Derivatives have four large risks. The most dangerous is that it's almost impossible to know any derivative's real value. It's based on the value of one or more underlying assets. Their complexity makes them difficult to price. That's the reason mortgage-backed securities were so deadly to the economy. No one, not even the computer programmers who created them, knew what their pric…

Most Common Derivatives in Finance

Use of Derivatives in Finance

- #1 – Forward Contract

Suppose a company from the United States is going to receive payment of €15M in 3 months. The company is worried that the euro will depreciate and is thinking of using a forward contractForward ContractA forward contract is a customized agreement between two parties to … - #2 – Future Contract

To keep it simple and clear, the same example as above can be taken to explain the futures contract. However, the futures contract has some major Differences as compared to forwards. Futures are Exchange-traded. Therefore they are governed and regulated by the exchange. Unlik…

Calculation Mechanism of Derivatives Instruments in Finance

- The payoff for a forward derivative contract in finance is calculated as the difference between the spot priceSpot PriceA spot price is the current market price of a commodity, financial product, o...

- The payoff for a futures contract is calculated as the difference between the closing price of yesterday and the closing price of today. Based on the difference, it is determined who has g…

- The payoff for a forward derivative contract in finance is calculated as the difference between the spot priceSpot PriceA spot price is the current market price of a commodity, financial product, o...

- The payoff for a futures contract is calculated as the difference between the closing price of yesterday and the closing price of today. Based on the difference, it is determined who has gained, th...

- The payoff schedule for options is a little more complicated.

- The payoff for swap contracts is calculated by netting the cash flow for both the counterparties. An example of a simple vanilla swap will help solidify the concept.

Advantages of Derivatives

- It allows the parties to take ownership of the underlying asset through minimum investment.

- It allows them to play around in the market and transfer the riskTransfer The RiskRisk transfer is a risk-management mechanism that involves the transfer of future risks from one person to another....

- It allows for speculating in the market. As such, anyone having an opinion or intuition with so…

- It allows the parties to take ownership of the underlying asset through minimum investment.

- It allows them to play around in the market and transfer the riskTransfer The RiskRisk transfer is a risk-management mechanism that involves the transfer of future risks from one person to another....

- It allows for speculating in the market. As such, anyone having an opinion or intuition with some amount to invest can take positions in the market with the possibility of reaping high rewards.

- In case of options, one can buy OTC over the counterOver The CounterOver the counter (OTC) is the process of stock trading for the companies that don't hold a place on formal exchange listings. The...

Disadvantages of Derivatives

- The underlying assets in the contracts are exposed to high risk due to various factors like volatility in the market, economic instability, political inefficiency, etc. Therefore as much as they pr...

- Dealing in derivatives contracts in financeDerivatives Contracts In FinanceDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who ac…

- The underlying assets in the contracts are exposed to high risk due to various factors like volatility in the market, economic instability, political inefficiency, etc. Therefore as much as they pr...

- Dealing in derivatives contracts in financeDerivatives Contracts In FinanceDerivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Cou...

- Famous investor and philanthropist Warren Buffet once called derivatives’ weapons of mass destruction’ because of its inextricable link to other assets/product classes.

Conclusion

- The bottom line is although it gives exposure to high-value investment, in the real sense, it is very risky and requires a great level of expertise and juggling techniques to avoid and shift the risk. The number of risks it exposes you to is multiple. Therefore unless one can measure and sustain the risk involved, investing in a big position is not advisable. Conversely, a well-calibrated approach …

Recommended Articles

- This has been a guide to what are Derivatives in Finance & its definition. Here we discuss the most common derivatives in finance along with its advantages and disadvantages. You can learn more about accounting from the following articles – 1. Advantages & Disadvantages of Equity Swaps 2. Put Option Payoff 3. Embedded Derivatives Meaning 4. Interest Rate Derivatives Meani…