What happens when the oscillator is positive?

What is a DMI oscillator?

When is trend continuation identified?

Who wrote the DMI stochastic?

See 1 more

About this website

What does DMI indicate?

Description. The Directional Movement Index (DMI) assists in determining if a security is trending and attempts to measure the strength of the trend. The DMI disregards the direction of the security. It only attempts to determine if there is a trend and that trends strength.

Is DMI a good indicator?

The DMI is especially useful for trend trading strategies because it differentiates between strong and weak trends, allowing the trader to enter only the ones with real momentum.

What is the difference between DMI and ADX?

The DMI is a collection of indicators including +DI, -DI, and ADX. Both +DI and -DI measure up and down price movement, and crossovers of these lines can be used as trade signals. ADX measures the strength of the trend, either up or down; a reading above 25 indicates a strong trend.

How do you use a DMI indicator?

In general, when the +DI line is above the -DI line, the market is moving in an uptrend, and when the -DI line is above the +DI line, the market is moving in a downtrend. Therefore, when trading a trending strategy, favor long positions when the +DI is above the -DI line.

What is the most profitable indicator?

Best trading indicatorsStochastic oscillator.Moving average convergence divergence (MACD)Bollinger bands.Relative strength index (RSI)Fibonacci retracement.Ichimoku cloud.Standard deviation.Average directional index.More items...

Which indicator has highest accuracy?

The STC indicator is a forward-looking, leading indicator, that generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time (cycles) and moving averages.

What indicator is better than ADX?

Alternatives to the ADX Indicator One of the other most commonly used forex indicators aside from the ADX is the Aroon oscillator. The Aroon oscillator works on similar concepts with two lines indicating whether the uptrend or the downtrend is higher.

What type of indicator is DMI?

Key Takeaways. The directional movement index (DMI) is a technical indicator that measures both the strength and direction of a price movement and is intended to reduce false signals.

What are the best settings for DMI indicator?

Historically, it seems like the best settings for the ADX DMI-crossover system have been: 12 for DMIplus. 9 for DMI-minus. 14 for ADX, and only taking trades when ADX is below 25.

What is the best directional indicator?

Top 5 Trend Indicators that identify the Direction of the Price MovementsMoving Average:Supertrend:Parabolic SAR:On-Balance Volume:MACD (Moving Average Convergence, Divergence):

Is ADX a good indicator?

Trading in the direction of a strong trend reduces risk and increases profit potential. The average directional index (ADX) is used to determine when the price is trending strongly. In many cases, it is the ultimate trend indicator....Quantifying Trend Strength.ADX ValueTrend Strength75-100Extremely Strong Trend3 more rows

How do you trade in ADX DMI?

A simple and effective strategy that is used by many traders is a crossover strategy that uses the ADX in combination with the +DMI and –DMI lines. In this trading strategy an order is placed whenever the +DMI and –DMI lines cross, as long as the ADX is also above 25, indicating a strong trend.

What's the best indicator for divergence?

Commonly used indicators include the relative strength index (RSI), stochastic oscillator, Awesome Oscillator (AO), and moving average convergence divergence (MACD).

What is the best directional indicator?

Top 5 Trend Indicators that identify the Direction of the Price MovementsMoving Average:Supertrend:Parabolic SAR:On-Balance Volume:MACD (Moving Average Convergence, Divergence):

How accurate is ADX indicator?

We need to be very careful about how we read and interpret the ADX indicator. It is not a bullish and bearish indicator. ADX's moving average only measures the strength of the trend. So, if the price is going UP, and the ADX indicator is also going UP, then we have the case for a strong bullish case.

What are the best settings for DMI indicator?

Historically, it seems like the best settings for the ADX DMI-crossover system have been: 12 for DMIplus. 9 for DMI-minus. 14 for ADX, and only taking trades when ADX is below 25.

What is the +DMI in Figure 3?

In Figure 3, the +DMI crosses above 25 at Point 1 and remains above the -DMI as the uptrend develops. Note the absence of any crossover by -DMI during the uptrend. Here, the buyers are strong (+DMI >25) and the sellers are weak (-DMI <25).

How does price trend work?

The ability of price to trend depends on continued strength in the dominant DMI. A strong uptrend will show a series of rising +DMI peaks that remain above the -DMI for extended periods of time (Figure 3). The opposite is true for strong downtrends. When both DMI lines are below 25 and moving sideways, there is no dominant force, and trend trades are not appropriate. However, the best trends begin after long periods where the DMI lines cross back and forth under the 25 level. A low-risk trade setup will occur after DMI expands above the 25 level and price penetrates support/resistance.

How does DMI peak analysis work?

DMI peak analysis fits well with trend principles. An asset 's price is trending up when there are higher pivot highs and higher pivot lows. When higher highs in price are accompanied by higher highs in +DMI, the trend is intact and the bulls are getting stronger. Lower pivot highs and lower pivot lows signify a downtrend. When the -DMI peaks make higher highs, the bears are in control and selling pressure is getting stronger. Looking to the DMI for momentum convergence/divergence gives you the confidence to stay with the trend when price and DMI agree and manage risk when they disagree.

What is a good reference for price volatility?

The DMI lines are a good reference for price volatility. Price goes through repeated cycles of volatility in which a trend enters a period of consolidation and then consolidation enters a trend period. When price enters consolidation, the volatility decreases.

How to identify volatility?

Volatility cycles can be identified by comparing the slopes of the DMI lines that move in opposite directions whenever range expansion or contraction occurs (Figure 4) . Many short-term traders will look for periods when the DMI lines move away from one another and volatility increases. The farther the lines separate, the stronger the volatility. Contractions occur when the lines move toward one another and volatility decreases. Contractions precede retracements, consolidations, or reversals.

What is crossover DMI?

A crossover occurs when the DMI on bottom crosses up through the dominant DMI on top. Crossovers may seem like an obvious signal to go long/short, but many short-term traders will wait for other indicators to confirm the entry or exit signals to increase their chances of making a profitable trade.

How to tell which DMI is stronger?

First, look to see which of the two DMI lines is on top. Some short-term traders refer to this as the dominant DMI. The dominant DMI is stronger and more likely to predict the direction of price. For the buyers and sellers to change dominance, the lines must cross over.

What Is the Directional Movement Index (DMI)?

The directional movement index (DMI) is an indicator developed by J. Welles Wilder in 1978 that identifies in which direction the price of an asset is moving. The indicator does this by comparing prior highs and lows and drawing two lines: a positive directional movement line (+DI) and a negative directional movement line (-DI). An optional third line, called the average directional index (ADX), can also be used to gauge the strength of the uptrend or downtrend.

What does ADX mean?

ADX measures the strength of the trend, either up or down; a reading above 25 indicates a strong trend.

What is the purpose of DMI?

The DMI is primarily used to help assess trend direction and provide trade signals .

How many lines are there in DMI?

The DMI indicator is composed of two lines, with an optional third line. The Aroon indicator also has two lines. The two indicators both show positive and negative movement, helping to identify trend direction.

What is a DMI?

The directional movement index (DMI) is an indicator developed by J. Welles Wilder in 1978 that identifies in which direction the price of an asset is moving. The indicator does this by comparing prior highs and lows and drawing two lines: a positive directional movement line (+DI) and a negative directional movement line (-DI).

What happens when the +DI is above the +DI?

When +DI is above -DI, there is more upward pressure than downward pressure in the price. Conversely, if -DI is above +DI, then there is more downward pressure on the price. This indicator may help traders assess the trend direction. Crossovers between the lines are also sometimes used as trade signals to buy or sell.

What is the first 14TR?

First 14TR = Sum of first 14 TR readings.

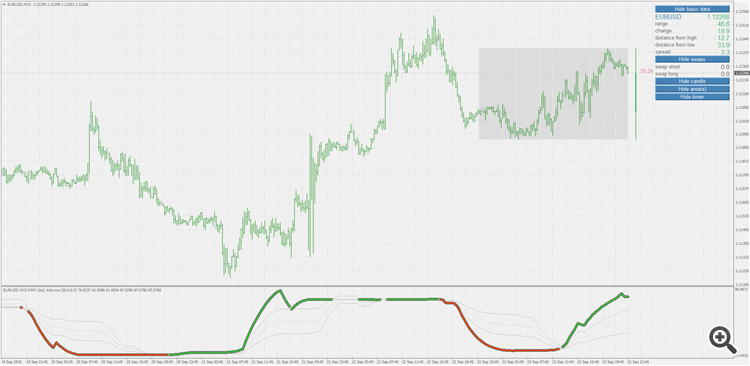

Introduction to the DMI ADX Histogram Oscillator Indicator

The DMI ADX Histogram Oscillator Indicator is, as the name suggests, a combination of the Average Directional Index (ADX) and the Directional Movement Index (DMI). As you probably know, the ADX measures the trend strength of an asset, and DMI defines its market direction. In the result, the indicator provides complex information about the trend.

How to set up the DMI ADX Histogram Oscillator indicator in MT4?

Download the DMI ADX Histogram Oscillator.rar archive at the bottom of this post, unpack it, then copy and paste the DMI ADX Histogram Oscillator.ex4 or DMI ADX Histogram Oscillator.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

Bottom Line

The DMI ADX Histogram Oscillator indicator is well worth adding to your trading collection. A good forex indicator will most probably enhance your chance of success. Nonetheless, remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time.

What happens when the oscillator is positive?

When the oscillator is positive and decreasing, a consolidation or pullback might take place. When price is in uptrend and the oscillator is positive but makes lower highs, a bearish divergence might be identified.

What is a DMI oscillator?

The DMI Oscillator is a technical indicator which uses values of DMI in order to predict miscellaneous sides of market behavior.

When is trend continuation identified?

Trend continuation might be identified when the oscillator moves to the zero line and then rebounds from it.

Who wrote the DMI stochastic?

1. "The DMI Stochastic" by Barbara Star, PhD. Technical Analysis of Stocks & Commodities, January 2013.

Overview

DMI Trend Lines

- DMI is a moving average of range expansion over a given period (the default is 14 days). The po…

Each DMI is represented by a separate line (see Figure 1). First, look to see which of the two DMI lines is on top. Some short-term traders refer to this as the dominant DMI. The dominant DMI is stronger and more likely to predict the direction of price. For the buyers and sellers to change do…

DMI Directional Signals

- DMI is used to confirm price action (see Figure 2). The +DMI generally moves in sync with price, …

Reading directional signals is easy. When the +DMI is dominant and rising, price direction is up. When the -DMI is dominant and rising, price direction is down. But the strength of price must also be considered. DMI strength ranges from a low of 0 to a high of 100. The higher the DMI value, t…

DMI Momentum

- The great feature of DMI is the ability to see buying and selling pressure at the same time, allowi…

The ability of price to trend depends on continued strength in the dominant DMI. A strong uptrend will show a series of rising +DMI peaks that remain above the -DMI for extended periods of time (Figure 3). The opposite is true for strong downtrends. When both DMI lines are below 25 and m…

DMI Pivots

- DMI lines pivot, or change direction, when price changes direction. An important concept of DMI …

The correlation between DMI pivots and price pivots is important for reading price momentum. Many short-term traders watch for the price and the indicator to move together in the same direction or for times they diverge. One method of confirming an asset's uptrend is to find scena…

DMI and Price Volatility

- The DMI lines are a good reference for price volatility. Price goes through repeated cycles of vol…

Volatility cycles can be identified by comparing the slopes of the DMI lines that move in opposite directions whenever range expansion or contraction occurs (Figure 4). Many short-term traders will look for periods when the DMI lines move away from one another and volatility increases. Th…

The Bottom Line

- DMI peak analysis fits well with trend principles. An asset's price is trending up when there are hi…

The best trading decisions are made on objective signals and not emotion. Let price and DMI tell you whether to go long, go short, or just stand aside. You can use DMI to gauge the strength of price movement and see periods of high and low volatility. DMI contains a wealth of informatio…

What Is The Directional Movement Index (DMI)?

The Formulas For The Directional Movement Index (DMI) Are

Calculating The Directional Movement Index

What Does The Directional Movement Index Tell You

The Directional Movement Index vs. The Aroon Indicator

- The DMI indicator is composed of two lines, with an optional third line. The Aroon indicatoralso has two lines. The two indicators both show positive and negative movement, helping to identify trend direction. The calculations are different, though, so crossovers on each of the indicators will occur at different times.

Limitations of The Directional Movement Index