What is an a donation agreement?

A donation agreement, also called a charitable gift agreement, is a document that established proof of a donation or gift to a charitable organization. It is an important record for both the charitable organization (the receiver) and the person or entity donating (the donor) because it supports internal record-keeping and aids with tax preparation.

What is a gift agreement and do I need one?

Gift agreements, often referred to as Letters of Intent, are expressly for the purpose of fulfilling both objectives. At PW, we feel that any gift that reaches the level of major gift status at your charity should require a gift agreement.

What is a memorandum of agreement?

This memorandum is an appendix of the Donation Agreement entered into by both parties on , 2017. This memorandum, taking effect from the date of signing by both parties, has four originals and each party keeps two originals. All the originals enjoy the same legal effectiveness as the Donation Agreement.

Are donation agreements legally binding?

Under traditional contract law principles, a charitable pledge is enforceable if it meets the requirements for a legally binding contract. There must be an agreement between the donor and the charity -- in effect, the donor must promise to make a gift and the charity must promise to accept it.

What is a donor contract?

A Donor Agreement is a written contract clearly defining the rights and responsibilities of both the donor and the intended recipient(s), during all stages of conception. Without having a valid Donor Agreement, issues such as custody claims and financial obligations may arise.

How do I write a donation agreement?

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

Can a donor ask for money back?

There are several reasons donors commonly ask for their gifts back. For example, a donor may simply have a change of heart. Or the donor may believe your charitable organization is misusing or “wasting” donated funds or that it's no longer fulfilling its charitable mission.

Is a donation agreement a contract?

What is the donation contract? By means of this agreement, a person (donor) transfers a part or all of his/her present property free of charge to another (grantee). Unlike the transfer by sale, the only requirement to transfer the property is the acceptation of the grantee (who receives the property).

What are the three types of donors?

The four different types are: living donation, deceased donation, tissue donation and pediatric donation.Living donation. ... Deceased donation. ... Tissue donation. ... Pediatric donation. ... The importance of all types of organ, eye and tissue donation.

What are the 5 types of donation?

A Guide to Types of Donations to NonprofitsOne-Time Donation.Recurring Gifts.Stock Donations.Planned Gifts.In-Kind Donations.

What should be included in a donor proposal?

How to Write a Proposal for FundingExplain your project. Why are you raising money? ... Convey the importance of your cause. People want to see their donations as significant and important. ... Put a name to the face. Before making a donation, people need to empathize with your cause. ... Introduce yourself.

What should you not do when asking for a donation?

Here are 3 keys to nailing it when you ask for donations: Keep it simple and easy to understand. Don't make your donor or prospect try to figure out what you're trying to say. Avoid jargon, acronyms, and insider language.

What disqualifies you from being a living donor?

There are some medical conditions that could prevent you from being a living donor . These include having uncontrolled high blood pressure, diabetes, cancer, HIV, hepatitis, or acute infections . Having a serious mental health condition that requires treatment may also prevent you from being a donor .

What happens if you dont get fully funded on donors choose?

DonorsChoose cannot make any purchases until funding is 100% complete. If your project doesn't reach its funding goal or is removed after receiving any donations, the donations from your friends and family will be sent to you as DonorsChoose.org gift codes that you can use toward your next project.

Do you get all your money back from donations?

As long as your donation is $2 or more, and you make it to a deductible gift recipient charity, you can claim the full amount of money that you donated on your tax return.

How does the donor process work?

The donor is taken to an operating room, where organs are surgically removed. After that, the organs are sent to the transplant hospitals where candidates are waiting for them. The donor is treated with honor and respect throughout the donation.

What is the difference between a grantor and a donor?

The person giving the power is usually referred to as the donor, principal or grantor. The person on whom the power is conferred is typically referred to as the attorney or donee.

What does a donor mean in law?

The person who appoints you is called the 'donor'. You're their 'attorney'. You do not need any legal experience to act as someone's attorney.

What is the difference between a member and a donor?

Members join for the benefits and are motivated by the value of what they get for their support: free admission, access to parking, guest admission, etc. Donors are more philanthropically inclined and give because they support your organization's mission.

What is a Donor Agreement?

A donor agreement is a legally binding document that illustrates the legal relationship between a known sperm or egg donor and the resulting child. Most donor contracts include language which excludes a donor from parental rights along with the responsibility of child support.

What Issues Can a Donor Agreement Address?

Creating a legally binding donor agreement can help ensure that all parties involved are on the same page. When a child is conceived through an informal donation process, outside of a doctor’s office and without legal documentation, custody rights can become murky. A formal donor agreement can help clarify expectations regarding:

Beware of DIY Donor Agreements

Some couples or individuals step into informal agreements with their donors with the best intentions; however, the outcomes of these relationships are unpredictable. While there are many online donor agreement templates available online, these are best treated as a jumping off point for conversations about the key issues.

Second-Parent Adoption & Donor Agreements

It is advisable for LGBT non-biological parents to undergo a second-parent adoption following the birth of their child. This is because having your name on your child’s birth certificate alone does not guarantee full and equal legal rights as a parent.

Working With an LGBT Family Law Attorney in Chicago

If you’re researching donor agreements in Chicago, chances are you care deeply about the future of your new or growing family. Our attorneys are qualified to handle donor agreement conversations with professionalism and sensitivity. Contact us today to schedule an appointment where we can discuss your options.

What is a donor agreement?

A donor contract or donor agreement is a contract in which the agreements between the intended parent (s) and a sperm donor are recorded. Since 2014, two types of donorship have been distinguished in the Netherlands: B and C donorship.

Legal rights and obligations regarding the child

When it comes to the conceived child, an unknown donor usually has no legal role. For example, a donor cannot enforce that he legally becomes the parent of the conceived child. This does not alter the fact that under certain circumstances it remains possible for the donor to legally become a parent of the child.

Drafting, checking or adjusting a donor agreement

Do you already have a donor agreement and are there circumstances that have changed for you or for the donor? Then it may be wise to adjust the donor agreement. Think of a move that has consequences for the visiting arrangement. Or a change in income, which necessitates a review of alimony.

What is a 501c3 form?

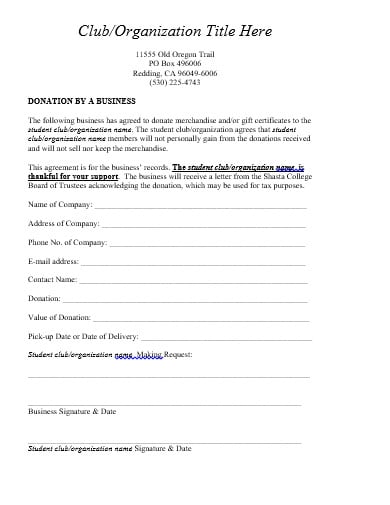

This document can be used for a company or person who is getting ready to donate to a charitable organization, organized under Section 501 (c) (3) of the Internal Revenue Code. In this document, the form-filler will be able to enter pertinent identifying details, such as whether the parties are individuals or businesses, their contact information, and, of course, all of the details of the donation, including its monetary value.

What is a donation agreement?

A Donation Agreement, also sometimes called a Charitable Gift Agreement, provides written proof for a donation, or gift, that has been given to a charitable organization in the United States. A Donation Agreement is important for both parties to the contract: the charitable organization (often called the receiver) and the person or entity donating ...

What is the most important detail in a donation agreement?

In a Donation Agreement, the most important details of the parties' relationship will be entered: things such as the parties' identities, a description of the donation, and, if desired, things like the form of the receipt that was given and the intended use for the donation.

Do charitable organizations keep records?

The charitable organization must keep accurate records of donations received, but so must the donor keep records of the donations they have given. Having accurate financial records on file will help both parties in their internal record-keeping and also when it comes to tax time.

Can you reuse a Word document?

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.