- Dwelling coverage is the part of a homeowners insurance policy that covers the physical structure of your home, including other structures on the property.

- Use a replacement cost calculator to enter your information and easily determine how much dwelling coverage you need.

- Experts recommend dwelling coverage equal to 100% of the replacement cost of your home.

How do you calculate dwelling coverage?

How do you calculate dwelling coverage? To calculate a quick estimate, call a local home construction company or real estate agent to find out the current rebuilding costs and multiply that number by the square footage of your home. Even with the best estimate, your dwelling coverage limit may still fall short if you file a claim to rebuild your home.

What does dwelling mean in insurance terms?

Your dwelling is the building you live in. As far as your homeowners insurance policy is concerned, the definition of a dwelling extends to all structures attached to your home (like a garage, fence or deck) as well as built-in appliances (such as a furnace or water heater).

How much dwelling coverage do I need for a condo?

This means that if your condo costs $500,000 you would need to cover $100,000 of that under your dwelling coverage. Other companies do the insurance requirements based on square foot of the living space making the insurance $100 per square foot. If your condo is 1,000 square feet, then your dwelling coverage must cover $100,000.

What does dwelling home insurance cover?

The most common perils covered under your homeowners insurance policy are:

- Damage from aircraft

- Damage from vehicle

- Damage from the weight of ice, sleet, or snow

- Explosions

- Falling objects

- Fire/smoke

- Hail

- Lightning

- Theft

- Vandalism

What is a dwelling fire policy?

What to do if you have questions about your dwelling policy?

What are the perils of extended coverage?

What is an open perils policy?

What is DP-1 fire insurance?

What is DP-1 coverage?

What is DP-2 form?

See 4 more

About this website

What is the purpose of a dwelling policy?

Dwelling coverage is the part of a homeowners insurance policy that may help pay to rebuild or repair the physical structure of your home if it's damaged by a covered hazard. Your house and connected structures, such as an attached garage, are typically protected by dwelling coverage.

What coverage is excluded by a dwelling policy?

What's Not Covered by Dwelling Insurance? Despite providing fairly comprehensive coverage, most dwelling insurance policies exclude flooding, earthquakes, sinkholes and sewage backups. They also don't cover damage caused by your failure to carry out routine maintenance, such as a dry-rot problem you ignored.

Which of the following is covered under a dwelling policy?

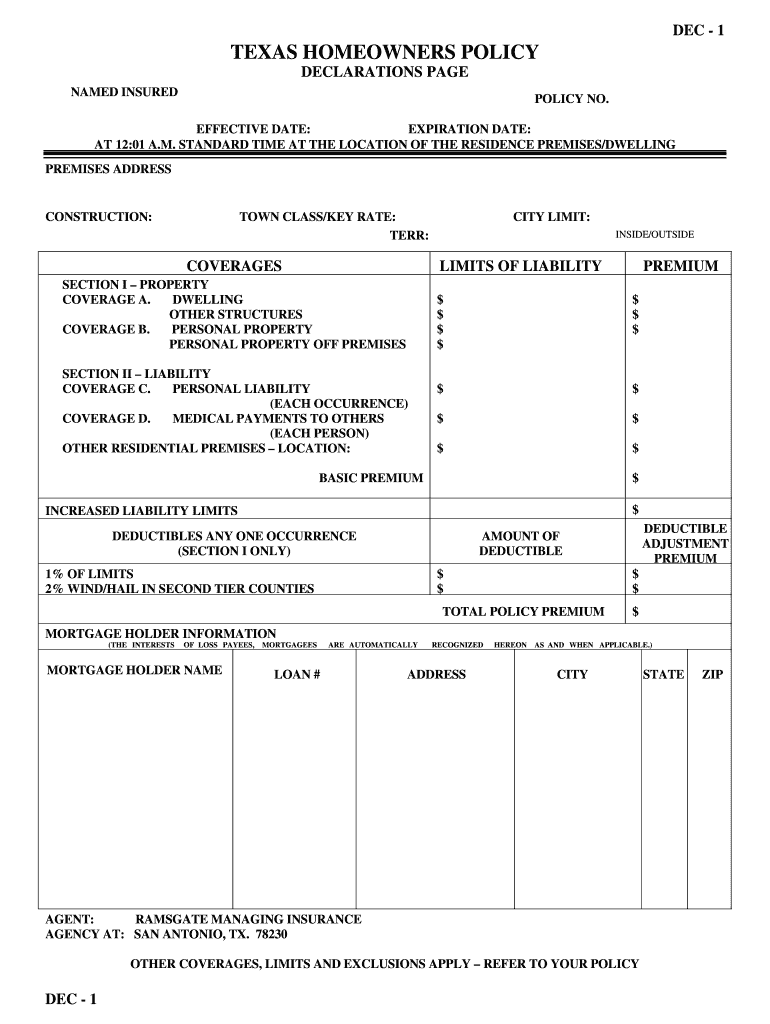

Coverage A (Dwelling): Covers the main dwelling, including attached garages or carports. Coverage B (Other Structures): Covers detached structures on the property. Coverage C (Personal Property): Covers personal belongings. If the covered dwelling is used as a rental, the tenant's property is not covered.

What is the difference between dwelling and replacement cost?

With a replacement cost value policy, your dwelling coverage is for the full replacement amount without any depreciation. Actual cash value coverage looks at the cost to rebuild your home and then reduces the amount based on depreciation according to the home's age and wear and tear.

What is the difference between a dwelling policy and homeowners policy?

Dwelling coverage is one part of your overall home insurance policy. It covers your home's structure —not its contents or land. Features like installed fixtures and permanently attached appliances are also covered. You can select enough dwelling coverage to rebuild your home at today's prices.

What are 2 things not covered in homeowners insurance?

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

What are the three covered perils in a basic form dwelling policy?

The basic form covers only damage from fire, lightning, and internal explosion, but additional perils can be covered by endorsement.

What are three 3 examples of what is covered under homeowners insurance coverage?

Homeowners insurance typically helps cover:Your dwelling.Other structures on your property.Personal property.Liability for injuries or damage to someone else's property.

What are the 4 types of coverage in a homeowner's insurance policy?

Generally, a homeowners insurance policy includes at least six different coverage parts. The names of the parts may vary by insurance company, but they typically are referred to as Dwelling, Other Structures, Personal Property, Loss of Use, Personal Liability and Medical Payments coverages.

Is the roof part of the dwelling?

Dwelling coverage is the part of a homeowners policy that pays to repair damage to the structure of your home, or to rebuild it if it's destroyed. Dwelling insurance will cover you up to the limit of your policy. Your home's structure comprises the roof, foundation, floors, doors, windows and walls.

What is the difference between a house and a dwelling house?

A dwelling is a home — where someone lives. Houses, apartments, and condos are all dwellings. If you know that to dwell means to live somewhere, then the meaning of dwelling won't be a surprise: it's an abode, domicile, or home. Your dwelling might be a house or an apartment.

What does 80% replacement cost mean?

The 80% rule means that an insurer will only fully cover the cost of damage to a house if the owner has purchased insurance coverage equal to at least 80% of the house's total replacement value.

What are some items typically excluded from property insurance?

Home insurance exclusionsFloods. Damage caused by floods is almost always a homeowners exclusion. ... Earthquakes and earth movement. Just like flood damage, damage caused by earth movement is a common homeowners insurance exclusion. ... Maintenance. ... Pests. ... Home-based businesses. ... Mold. ... The full cost of high-value items.

What is excluded under Coverage B?

Coverage B excludes the same perils as your dwelling insurance. These perils would include earthquakes, normal wear and tear, negligence, or flooding just to name a few. Remember, flooding is not included within your standard homeowners policy, for flood coverage, you will need flood insurance.

What is excluded from insurance?

Exclusion — a provision of an insurance policy or bond referring to hazards, perils, circumstances, or property not covered by the policy. Exclusions are usually contained in the coverage form or causes of loss form used to construct the insurance policy.

What do most homeowners policies exclude coverage for?

Some common home insurance exclusions include floods, earthquakes, and sewer backups. If you need to protect your home against something your insurance doesn't cover, you can add coverage for certain perils to your existing policy or purchase a separate policy.

Does dwelling insurance cover water damage?

Dwelling insurance covers some forms of water damage but not others. For example, if a pipe bursts, your policy likely will cover the event. But th...

Why is my dwelling coverage so high?

The cost of dwelling coverage may seem high at first blush. But remember, this insurance coverage can make you whole if you experience a major loss...

How much dwelling coverage do I need for a condo?

How much dwelling coverage you need for a condo depends on several factors, including the size of your condo and your belongings. Most important...

Dwelling Property Coverage Forms - IRMI.com

Looking for information on Dwelling Property Coverage Forms? IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Click to go to the #1 insurance dictionary on the web.

Rental Dwelling Policies – DP1, DP2, DP3

The DP3 policy is very similar to the standard home insurance package, with a few exceptions. First, the similarities. Dwelling, Other Structures, Liability, and Medical

COVERAGE COMPARISON DP 1 DP 2 DP 3 HO 2 HO 3 HO 5 HO 8 HO 4 HO 6 Basic ...

DP 1 DP 2 DP 3 HO 2 HO 3 HO 5 HO 8 HO 4 HO 6 Basic Broad Special Broad Form Special Form Comp. Form Modified Form Contents Unit Owners

8 Types of Homeowners Insurance Policies | Policygenius

Types of homeowners insurance. HO-1: The most basic and limited type of policy for single-family homes, HO-1s are all but nonexistent nowadays HO-2: A more commonly used policy and a slight upgrade from the HO-1 HO-3: The most common type of homeowners insurance policy, with broader coverage than the HO-2 HO-4: A policy type that is specifically for renters (usually called renters insurance)

DWELLING PROPERTY 1 – BASIC FORM - Illinois FAIR Plan

DWELLING DP 00 01 12 02 DP 00 01 12 02 © ISO Properties, Inc., 2002 Page 1 of 8 DWELLING PROPERTY 1 – BASIC FORM AGREEMENT We will provide the insurance described ...

What is dwelling insurance?

Dwelling insurance is a highly significant portion of your homeowners insurance policy that protects the physical structure of your home. This type of coverage reimburses you for damage to things such as your: Walls. Electrical wiring. Plumbing.

What is not covered under dwelling insurance?

While dwelling coverage will protect you from damages associated with a host of events and natural disasters, some losses are not covered.

How much dwelling coverage do I need on my homeowners insurance?

Wondering how to calculate dwelling coverage? The National Association of Insurance Commissioners urges you to talk to your insurance agent to arrive at an appropriate amount of dwelling coverage.

What is extended dwelling coverage?

In some cases, you may want to purchase coverage beyond the full replacement cost of your home. This is known as extended dwelling coverage.

What happens if your home insurance falls below 80% of the replacement cost?

The NAIC notes that if your dwelling coverage falls below 80% of the home's full replacement cost, your insurer may refuse to pay out your claim in full. It is also possible to get an inflation guard endorsement that will increase your dwelling coverage limit annually to keep it in line with inflation.

What structures are not covered by dwelling insurance?

These include a detached garage, a fence or a shed. Instead, the other structures coverage portion of your policy might cover these structures.

Does dwelling insurance cover fire damage?

Dwelling insurance will cover your home if it suffers damage due to a slew of typical perils. If lightning from a summer storm strikes your house and starts a fire, you will be covered. If a winter storm piles up snow that causes your roof to collapse, dwelling coverage can help make you whole.

What Does Dwelling Insurance Mean?

Dwelling insurance is a policy that provides coverage to the physical structure of a home and any structure attached to it, including sheds, garages, and patios . Under this coverage, the insurance company shall pay for the expenses of rebuilding or repairing the damaged structure if a covered peril causes the damage.

What is a B coverage?

Coverage B: similar to Coverage A; dwelling must not be used for business purposes except when permitted as incidental occupancy or when rented as private garage.

What does dwelling insurance cover?

Detached garages or other stand-alone buildings, however, are covered as a part of your other structures coverage. The specific perils that your dwelling insurance covers are based on the homeowners policy type that you choose. One of the more common homeowners policies in the United States is what’s known as an HO-3 policy. It is what’s known as an open peril policy, meaning that it covers against most types of damages unless they are specifically excluded on your homeowners policy.

How is a dwelling policy different from a homeowners policy?

It is often used to cover a house or dwelling not occupied by its owner. Dwelling policies don’t go as far to cover you or your property as do typical homeowners policies, which have greater levels of built-in coverage. Dwelling insurance policies are typically designed for those who own properties other than where they live. Dwelling insurance may also be a good option for a landlord who owns rental properties.

How much dwelling coverage do I need?

One of the biggest factors in determining how much coverage you need is your home’s value. However, there are a number of other factors in play that could influence your home’s coverage limit. It’s likely that your insurance company will have its own calculation and will suggest a coverage level for your dwelling. Some may base this limit on your mortgage, but this isn’t always enough to fully replace your home. For this reason, it’s important to be informed so that you can get the appropriate amount of coverage for your needs.

What is extended dwelling coverage?

The cost to rebuild your home can increase over time. Inflation can drive up the costs of building materials and labor costs. Also, certain events — natural disasters, such as hurricanes, tornadoes or wildfires — can drive up the costs of materials due to demand. As such, your current level of coverage may not be enough to fully cover the cost of rebuilding your home.

What kinds of buildings are eligible for a dwelling policy?

The following structures are those most commonly insured via dwelling policy:

What are the different types of dwelling policies?

These include DP-1 (basic), DP-2 (broad) and DP-3 (special), with DP-3 providing the most coverage .

What is the most important part of a homeowners policy?

One of the most important parts of a homeowners insurance policy is dwelling coverage. Also known as Coverage A, this portion of your policy covers the main structure of a home as well as any attached structures.

What is a dwelling fire policy?

The coverage is very similar to a homeowners policy, with one significant difference – a dwelling fire policy is typically used for someone that does not make the property their primary residence. Dwelling policies typically do not provide liability coverage, like some homeowners policy forms, but they can provide other similar coverages ...

What to do if you have questions about your dwelling policy?

If you have questions about Dwelling policies, talk with your insurance agent or insurance company.

What are the perils of extended coverage?

When a Premium for Extended Coverage is shown in the Declarations, perils such as Windstorm or Hail, Explosion, Riot or Civil Commotion, Aircraft, Vehicles, Smoke, and Volcanic Eruption can also be included (subject to exclusions). You also may be able to include Vandalism or Malicious Mischief.

What is an open perils policy?

It is an “open perils” or “all risk” policy, which means real property (dwelling and other structures) will be covered for all types of damage, except exclusions named in the policy. However, damaged personal property (all the items inside the dwelling and other structures) is covered on a “named perils” basis.

What is DP-1 fire insurance?

Just like homeowners insurance, there are several different types of dwelling fire policies. DP-1 is known as the basic form, DP-2 is known as the broad form and DP-3 is known as the special form. Each provides a significantly different level of coverage.

What is DP-1 coverage?

A DP-1 can also provide coverage for your other structures on the property, personal property usual to the occupancy dwelling, fair rental value, debris removal, and improvements, alterations and additions.

What is DP-2 form?

Unlike the DP-1 form, the DP-2 form typically settles claims on a replacement cost basis.