How to analyze and improve asset turnover ratio?

- optimize the amount of assets by selling part of unused non-current assets (if the increase in workload is not planned)

- reduce the amount of inventories (if their volume is excessive)

- improve the receivable turnover, etc.

What does as ideal ratio for total asset turnover?

The total asset turnover ratio compares the sales of a company to its asset base. The ratio measures the ability of an organization to efficiently produce sales, and is typically used by third parties to evaluate the operations of a business. Ideally, a company with a high total asset turnover ratio can operate with fewer assets than a less ...

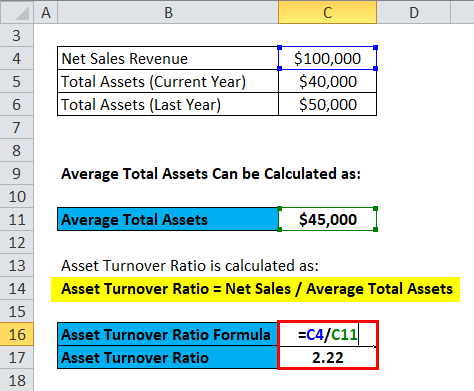

How to calculate the total asset turnover?

Total asset turnover formula

- Firstly, find the worth of the company’s assets on the balance sheet at the beginning of the year.

- Find the final balance or worth of the company’s assets at the conclusion of the fiscal year.

- Divide the sum of the starting and ending asset values by two to get the average value of the assets for the year.

What does the company's asset turnover ratio mean?

Asset turnover ratio is the ratio between the net sales of a company and total average assets a company holds over a period of time; this helps in deciding whether the company is creating enough revenues to make sure it is worth it to hold a heavy amount of assets under the company's balance sheet.

What is a good fixed asset turnover ratio?

If the ratio is greater than 1, it's always good. Because that means the company can generate enough revenue for itself.

What does fixed asset turnover ratio tell you about a company?

What Does Fixed Asset Turnover Tell You? Fixed Asset Turnover is an efficiency ratio. It tells you how well a company is using its fixed assets to generate income, also known as a return on assets.

How do you calculate fixed asset turnover ratio?

We can now calculate the fixed asset turnover ratio by dividing the net revenue for the year by the average fixed asset balance, which is equal to the sum of the current and prior period balance divided by two.

Is a high fixed asset turnover ratio good?

The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales.

Why is fixed asset turnover so important?

Put simply, the fixed asset turnover ratio helps determine how effectively a company is using its assets to generate sales. Therefore, the higher a fixed asset turnover ratio, the stronger the indication that a given company has been able to effectively use it's asset investments to generate sales.

What does an asset turnover ratio of 1.2 mean?

If the industry average total asset turnover ratio is 1.2, we can conclude that the company has used its assets more effectively in generating revenue.

How do you interpret asset turnover ratio?

Interpretation of the Asset Turnover Ratio The ratio measures the efficiency of how well a company uses assets to produce sales. A higher ratio is favorable, as it indicates a more efficient use of assets. Conversely, a lower ratio indicates the company is not using its assets as efficiently.

Does fixed asset turnover include depreciation?

The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation.

What does a fixed asset turnover ratio of 4 times represent?

Your fixed asset turnover ratio equals 4, or $800,000 divided by $200,000. This means you generated $4 of sales for every $1 invested in fixed assets.

What causes a low asset turnover ratio?

The asset turnover ratio can be calculated by dividing the net sales value by the average of total assets. Generally, a low asset turnover ratio suggests problems with surplus production capacity, poor inventory management and bad tax collection methods.

What does a low total asset turnover ratio mean?

A low fixed asset turnover ratio indicates that a business is over-invested in fixed assets. A low ratio may also indicate that a business needs to issue new products to revive its sales. Alternatively, it may have made a large investment in fixed assets, with a time delay before the new assets start to generate sales.

Why does fixed asset turnover decrease?

Interpretation: If the fixed asset turnover ratio is low as compared to the industry or past years of data for the firm, it means that sales are low or the investment in plant and equipment is too high.

What does a low fixed asset turnover ratio indicate?

A low fixed asset turnover ratio indicates that a business is over-invested in fixed assets. A low ratio may also indicate that a business needs to issue new products to revive its sales. Alternatively, it may have made a large investment in fixed assets, with a time delay before the new assets start to generate sales.

Which of the following phrases best describes the interpretation of the fixed asset turnover ratio?

Which of the following phrases best describes the interpretation of the fixed asset turnover ratio? It measures how efficiently sales are generated with a given amount of fixed assets.

What does a current ratio of 2.5 times represent?

For example, a company with total debt and other liabilities of £2 million and total assets of £5 million would have a current ratio of 2.5. This means its total assets would pay off its liabilities 2.5 times.

Which ratios indicate how efficiently the company generates sales from its assets?

The asset turnover ratio measures a company's ability to efficiently generate revenues from its assets. In other words, the asset turnover ratio calculates sales as a percentage of the company's assets. The ratio is effective in showing how many sales are generated from each dollar of assets a company owns.

Fixed Asset Turnover Ratio Formula

To determine the Fixed Asset Turnover ratio, the following formula is used:Fixed Asset Turnover = Net Sales / Average Fixed Assets

Indications of High / Low Fixed Asset Turnover Ratio

When the business is underperforming in sales and has a relative amount of fixed assets invested, the FAT ratio may be low.The return on fixed asse...

How Useful Is Fixed Asset Turnover Ratio to Investors?

Investors who are looking for investment opportunities in an industry with capital intensive businesses may find FAT useful in evaluating and measu...

What is fixed asset?

Fixed assets are tangible long-term or non-current assets used in the course of business to aid in generating revenue. These include real properties, such as land and buildings, machinery and equipment, furniture and fixtures, and vehicles. They are subject to periodic depreciation, impairments.

What is inventory turnover?

Inventory Turnover Inventory turnover, or the inventory turnover ratio, is the number of times a business sells and replaces its stock of goods during a given period. It considers the cost of goods sold, relative to its average inventory for a year or in any a set period of time.

Why is a high ratio important?

A high ratio, on the other hand, is preferred for most businesses. It indicates that there is greater efficiency in regards to managing fixed assets; therefore, it gives higher returns on asset investments.

How to determine whether a company is efficient at generating revenue on such assets?

There is no exact ratio or range to determine whether or not a company is efficient at generating revenue on such assets. This can only be discovered if a comparison is made between a company’s most recent ratio and previous periods or ratios of other similar businesses or industry standards.

What is ROA in business?

Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets.

Why is fixed asset turnover important?

It is important to understand the concept of the fixed asset turnover ratio as it was helpful in assessing the operational efficiency of a company. This ratio is primarily applicable for manufacturing-based companies as they have huge investments in plant, machinery, and equipment and as such fixed assets’ utilization is critical for their business well-being. The ratio can be used by investors and analysts to compare the performances of companies operating in similar industries.

Is depreciation charge better than ratio?

Although it is a very useful metric, one of the major flaws with this ratio is that it can be influenced by manipulating the depreciation charge as the ratio is calculated based on the net value of fixed assets. So, the higher the depreciation charge, the better will be the ratio and vice versa.

What is Fixed asset turnover ratio?

As part of Financial Ratio Analysis, activity ratios help in understanding the efficiency with which a company utilizes its resources.

What is the ratio of fixed assets?

As the name suggests, the ratio calculates the amount of revenue generated from each dollar of Fixed assets employed by the company.

What does a lower turnover ratio mean?

On the other hand, a lower turnover ratio indicates that the company is inefficient in managing its Fixed Assets.

What happens if fixed assets are utilized more efficiently?

If the Fixed Assets are utilized more efficiently, these companies will have room for major improvement.

What companies have ratios in lower single digits?

When you calculate the ratio for tech-based companies like Apple, Facebook, Google (Alphabet) and Microsoft, you will observe that the ratios are in lower single digits.

Which companies need to manage their fixed assets?

Being in the retail sector, companies like Walmart and Home Depot need to manage their Fixed Assets in the most efficient manner.

Is Facebook's turnover rate falling?

As already discussed as part of Trend Analysis, the turnover ratio for Facebook is falling.

Why is fixed asset turnover ratio important?

The fixed asset turnover ratio is important from the point of view of an investor and creditor who use this to assess how well a company is utilizing its machines and equipment to generate sales. This concept is important for investors because it can be used to measure the approximate return on their investment in fixed assets.

What is net fixed asset 2018?

Net fixed asset for 2018 = Gross fixed assets (2018) – Accumulated depreciation Accumulated Depreciation The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. It is a contra-account, the difference between the asset's purchase price and its carrying value on the balance sheet. read more (2018)

How to check year on year trend?

It can be done by comparing the ratio of the company to that of other companies in the same industry and analyze how much others have invested in similar assets. Further, the company can also track how much they have invested in each asset every year and draw a pattern to check the year-on-year trend.

Why do creditors use a cash flow ratio?

On the other hand, the creditors use the ratio to check if the company has the potential to generate adequate cash flow from the newly purchased equipment in order to pay back the loan that has been used to purchase it. This ratio is typically useful in the case of the manufacturing industry, where companies have large and expensive equipment purchases.

What happens if a company has too much capital?

Otherwise, if the company does not have enough invested in its assets, then the company might end up losing sales, which will hurt its profitability, free cash flow.

What is asset turnover?

Asset turnover is the ratio of total sales or revenue to average assets. This metric helps investors understand how effectively companies are using their assets to generate sales. Investors use the asset turnover ratio to compare similar companies in the same sector or group.

What does it mean when a company has a low asset turnover ratio?

Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales.

What is asset turnover measuring?

The asset turnover ratio measures the efficiency of a company's assets in generating revenue or sales. It compares the dollar amount of sales (revenues) to its total assets as an annualized percentage. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets. One variation on this metric considers only a company's fixed assets (the FAT ratio) instead of total assets.

How can a company improve its asset turnover ratio?

A company may attempt to raise a low asset turnover ratio by stocking its shelves with highly salable items, replenishing inventory only when necessary, and augmenting its hours of operation to increase customer foot traffic and spike sales. Just-in-time (JIT) inventory management, for instance, is a system whereby a firm receives inputs as close as possible to when they are actually needed. So, if a car assembly plant needs to install airbags, it does not keep a stock of airbags on its shelves, but receives them as those cars come onto the assembly line.

Can asset turnover be gamed by a company?

Like many other accounting figures, a company's management can attempt to make its efficiency seem better on paper than it actually is. Selling off assets to prepare for declining growth, for instance, has the effect of artificially inflating the ratio. Changing depreciation methods for fixed assets can have a similar effect as it will change the accounting value of the firm's assets.

Why is asset turnover deflated?

The asset turnover ratio may be artificially deflated when a company makes large asset purchases in anticipation of higher growth. Likewise, selling off assets to prepare for declining growth will artificially inflate the ratio. Also, many other factors (such as seasonality) can affect a company's asset turnover ratio during periods shorter than a year.

Why is asset turnover ratio higher?

The higher the asset turnover ratio, the better the company is performing, since higher ratios imply that the company is generating more revenue per dollar of assets. The asset turnover ratio tends to be higher for companies in certain sectors than in others.

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Example of Fixed Asset Turnover Ratio Formula

Explanation

- The formula for Fixed Asset Turnover Ratio can be calculated by using the following steps: Step 1:Firstly, determine the value of the net sales recognized by the company in its income statement for the given period. Step 2:Next, the value of net fixed assets of the company at the beginning of the period (opening) and at the end of the period (closing). Now, compute the average net fixed …

Relevance and Use of Fixed Asset Turnover Ratio Formula

- It is important to understand the concept of the fixed asset turnover ratio as it was helpful in assessing the operational efficiency of a company. This ratio is primarily applicable for manufacturing-based companies as they have huge investments in plant, machinery, and equipment and as such fixed assets’ utilization is critical for their business...

Recommended Articles

- This is a guide to Fixed Asset Turnover Ratio Formula. Here we discuss how to calculate the Fixed Asset Turnover Ratio along with practical examples. We also provide a Fixed Asset Turnover Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more – 1. Pearson Correlation Coefficient Formula 2. Accounting Formula 3. Cost-Benefit Analy…