Full partners means persons or entities who play an active role in the development, implementation, and maintenance of activities under the T.R. v. Birch and Strange (originally Dreyfus and Porter) Settlement Agreement.

What is a full service partnership?

Full Service Partnerships embrace client driven services and supports with each client choosing services based on individual needs. Unique to FSP programs are a low staff to client ratio, a 24/7 crisis availability and a team approach that is a partnership between mental health staff and consumers.

What is a partnership and how does it work?

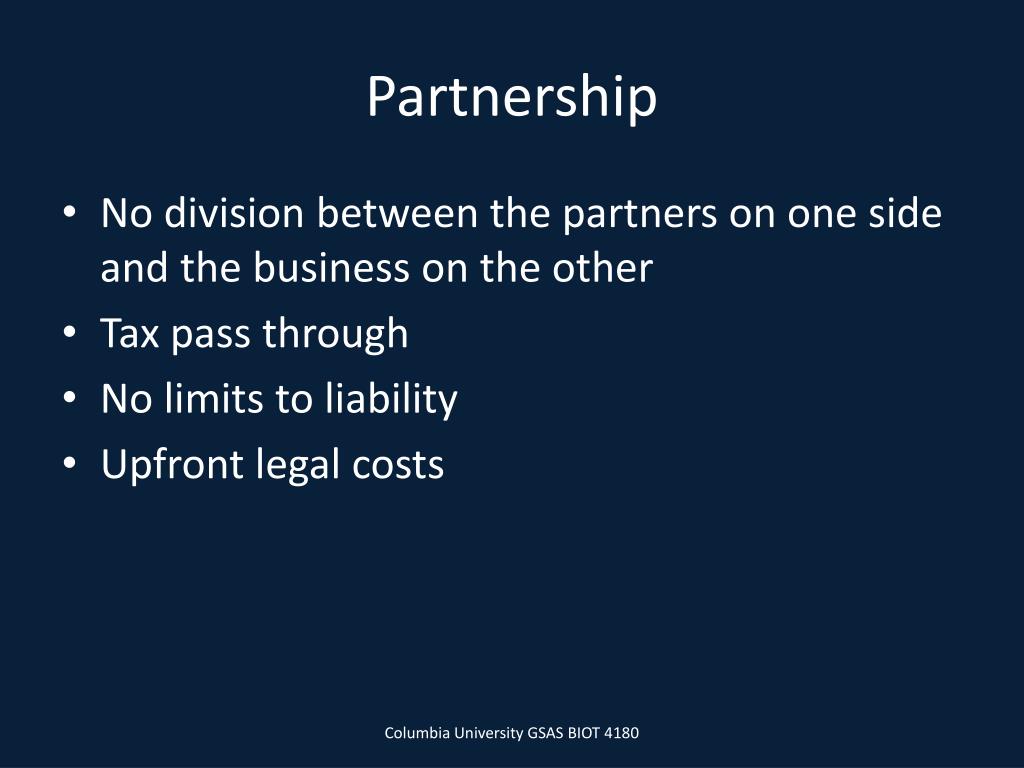

A partnership is a form of business where two or more people share ownership, as well as the responsibility for managing the company and the income or losses the business generates. That income is paid to partners, who then claim it on their personal tax returns – the business is not taxed separately, as corporations are, on its profits or losses.

Why is this purchase considered a full partnership relationship?

The reasoning behind why this purchase can be considered a Full Partnership Relationship is because there is a lasting connection between the customers and company because people use their phones everyday basically having a cell phone in general a necessity rather than just the Iphone.

What is a general partnership in business law?

It is one of the most common legal entities to form a business. All partners in a general partnership are responsible for the business and are subject to unlimited liability for business debts. , limited partnerships (LP), and limited liability partnerships (LLP).

What does full partnership mean?

Related Definitions Full Partner means a Partner or Member not an Associate Partner or Associate Member.

What is the difference between a full partnership and a limited partnership?

General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

What are the 3 types of partnerships?

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

What are the four levels of partnership?

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership. ... Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state. ... Limited liability partnership. ... Limited liability limited partnership.

Can a partnership have one owner?

A sole trader can only be one individual. If two or more individuals agree to join together in business, then they shall form a partnership. The individual is responsible for all decision making....Comparison.PartnershipOwnersThere is no upper limited on the number of partners, but you must have a minimum of two.4 more rows•Jul 19, 2021

Can a limited partnership have only one owner?

A limited partnership has at least one general partner and at least one limited partner. The general partner has the same role as in a general partnership: controlling the company's day-to-day operations and being personally liable for business debts.

What is a 50/50 partnership called?

A 50/50 partnership contract is held between two or more business partners. Under this type of contract, each partner has an equal share in any profits or losses that the business generates.

What is the most common type of partnership?

General partnershipsGeneral partnerships, the most common form.

Do partners get salary?

The maximum amount of salary, bonus, commission or other remuneration to all the partners during the previous year should not exceed the limits given below: On first 3 lakhs of book profit or in case of loss – ₹ 1, 50,000 or 90% of book profits (whichever is higher). On the balance book profit 60% of book profit.

What do you call the owner of a partnership?

An LLC partnership can have two or more owners, called members.

What are the 2 types of partnership?

The best way to start talking about a partnership business is to talk about the two types of partners: general partners and limited partners.

Is a partner the same as an owner?

Tip. Co-ownership involves owning a stock in the company (say, in the form of actual stocks), while partnerships include more obligations. Partners contribute money, property or personal labor or skill, with the expectation of sharing in an organization's business profits and losses.

What are the two types of partnership?

Partnerships come in two varieties: general partnerships and limited partnerships.

What is the difference between a general partnership and a limited partnership quizlet?

The difference between a general partnership and a limited partnership, a general partnership means the same for everyone meaning they share the business profits, debts, running business. Limited partnership is like an investor. Invests money in the business but down not have any management responsibilities.

What is an example of a limited partnership?

For example, let's say that Ben, Bob and Brandi are partners in owning and running a bookstore. They own The Book Nook. Per their partnership agreement, Ben and Bob are limited partners. They are investors in the store.

Which is one important difference between a general partnership and a limited partnership quizlet?

Which describes an important difference between general partnerships and limited partnerships? A general partnership has unlimited liability for all partners while a limited partnership has limited liability.

What are the 3 types of partnership

The three different types of partnership are: General partnership Limited partnership Limited liability partnerships

What are 5 characteristics of a partnership?

The following are the five characteristics of a partnership: Sharing of profits and losses Mutual agency Unlimited liability Lawful business Contra...

What are 3 disadvantages of a partnership?

The following are the disadvantages of a partnership: Unlimited liability Risk of disagreement between partners Instability of the partnership

What is the most important element of partnership?

The most important element in a partnership is the mutual agency, which states that every partner must be an agent and principal of himself and oth...

What is a partnership?

A partnership is a type of business where two or more people establish and run a business together. There are three main types of partnerships: general partnerships (GP) General Partnership A General Partnership (GP) is an agreement between partners to establish and run a business together. It is one of the most common legal entities ...

What is a limited partnership?

Limited partnerships (LP) are a form of partnership that provides more protection for partners. In an LP, there is at least one general partner that manages operations and takes on unlimited liability. The remaining partners are limited partners, who hold financial stakes in the business but are not personally liable for the business.

What is liability in general partnership?

Liability A liability is a financial obligation of a company that results in the company’s future sacrifices of economic benefits to other entities or businesses. A liability can be an alternative to equity as a source of a company’s financing.

What is an LLC?

Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. , and corporations. Learn more about running a business with CFI’s Corporate & Business Strategy Course!

What are the two types of partners?

Types of Partners. There are two different types of partners that exist in these business arrangements: general partners and limited partners . General Partner: a partner that holds management responsibility. They are responsible for the operations of the business. Furthermore, general partners face unlimited liability.

How many types of partnerships are there?

As mentioned, there are three main types of partnerships. Each type has its own advantages and disadvantages.

What is a shareholder in a company?

Shareholder A shareholder can be a person, company, or organization that holds stock (s) in a given company. A shareholder must own a minimum of one share in a company’s stock or mutual fund to make them a partial owner. of a corporation.

What is a Partnership?

A partnership is a form of business where two or more people share ownership, as well as the responsibility for managing the company and the income or losses the business generates. That income is paid to partners, who then claim it on their personal tax returns – the business is not taxed separately, as corporations are, on its profits or losses.

What is a general partnership?

General Partnership. In a general partnership, each partner shares equally in the workload, liability, and profits generated and paid out to the partners. All partners are actively involved in the business’s operations.

What happens if more than one owner of a business exists?

Where more than one owner exists, there are bound to be differences of opinion that could threaten the business. Although partners split any profits the business generates, if the payout is not in sync with each partner’s contribution to the company, disagreements can erupt.

What is short term partnership?

Short-term projects or alliances that bring together multiple partners for a project are typically structured as joint ventures. If the venture performs well, it can be continued as a general partnership. Otherwise, it can be shuttered.

Why do you need a partnership for a business?

There are several advantages of choosing to structure a business as a partnership, which include: Fairly easy to set up and maintain over time. Partners can pool their resources to fund the company’s start-up. Partners can share the workload and the rewards of the business’s success.

Do partnerships have joint liability?

Unlike corporations, which help to shield owners from liability, partnerships have both joint and individual liability. That is, all partners are liable for their own actions on behalf of the company as well as the actions of the other partners.

What is Partnership?

A partnership is a kind of business where a formal agreement between two or more people is made who agree to be the co-owners, distribute responsibilities for running an organization and share the income or losses that the business generates.

What are the features of a partnership?

Features of Partnership: Following are the few features of a partnership: Agreement between Partners: It is an association of two or more individuals , and a partnership arises from an agreement or a contract. The agreement (accord) becomes the basis of the association between the partners. Such an agreement is in the written form.

Why is sharing of gains and losses important?

Hence, sharing of gains and losses is vital. 4.Business Motive: It is important for a firm to carry some kind of business and should have a profit gaining motive. 5. Mutual Business: The partners are the owners as well as the agent of their firm. Any act performed by one partner can affect other partners and the firm.

What is the sharing of profit?

Sharing of Profit: Another significant component of the partnership is, the accord between partners has to share gains and losses of a trading concern. However, the definition held in the Partnership Act elucidates – partnership as an association between people who have consented to share the gains of a business, the sharing of loss is implicit.

What is a limited liability partnership?

In Limited Liability Partnership (LLP), all the partners have limited liability. Each partner is guarded against other partners legal and financial mistakes. A limited liability partnership is almost similar to a Limited Liability Company (LLC) but different from a limited partnership or a general partnership.

What is equal right in a partnership?

In this partnership, each partner represents the firm with equal right. All partners can participate in management activities, decision making, and have the right to control the business. Similarly, profits, debts, and liabilities are equally shared and divided equally.

What happens if one partner is sued?

If one partner is sued, all the other partners are considered accountable. The creditor or court will hold the partner’s personal assets. Therefore, most of the partners do not opt for this partnership. Limited Partnership. In this partnership, includes both the general and limited partners.

What Is a Business Partnership?

A business partnership is a legal relationship that is most often formed by a written agreement between two or more individuals or companies. The partners invest their money in the business, and each partner benefits from any profits and sustains part of any losses.

What is a partnership before you start?

Before you start a partnership, you will need to decide what type of partnership you want. There are three different kinds that are commonly set up. A general partnership (GP) consists of partners who participate in the day-to-day operations of the partnership and who have liability as owners for debts and lawsuits. 5 .

How are partners paid?

Partners are owners, not employees, so they don't generally get a regular paycheck. Each partner receives a distributive share of the profits and losses of the business each year. Payments are made based on the partnership agreement, and the partners are taxed individually on these payments. 4 .

What is a general partner?

General partners and limited partners: General partners participate in managing the partnership and often have liability for partnership debts and obligations. Limited partners invest but do not participate in management. 10 . Different levels of partners: For example, there may be junior and senior partners.

What are the types of partners in a partnership?

1 Depending on the type of partnership and the levels of partnership hierarchy, a partnership can have different types of partners . General partners and limited partners: General partners participate in managing ...

What is a strong partnership agreement?

A strong partnership agreement addresses how decision-making power will be allocated and how disputes will be resolved. It should answer all the "what if" questions about what happens in a number of typical situations. For example, it should spell out what happens when a partner wants to leave the partnership.

What are the different levels of partners?

These partnership types may have different duties, responsibilities, and levels of input and investment requirements.

Basic or full partnership relationship

This is a full customer relationship because this is not an inexpensive item and if i ever need to get my iPod fixed or need an accessory, i'm going to engage in an employee- customer interaction.

product

The Subway sandwich gives people an affordable, tasty sandwich without a long wait.

price

The cost of the subway sandwich ranges from $5 to $8 depending on what kind of meat you enjoy.

target customers

The target customer of Subway are people who need a good breakfast or lunch in a fast time.

How A Partnership Works

- In a broad sense, a partnership can be any endeavor undertaken jointly by multiple parties. The parties may be governments, non-profits enterprises, businesses, or private individuals. The goals of a partnership also vary widely. Within the narrow sense of a for-profit venture undertaken by t…

Taxes and Partnerships

- There is no federal statute defining partnerships, but nevertheless, the Internal Revenue Code (Chapter 1, Subchapter K) includes detailed rules on their federal tax treatment.3 Partnerships do not pay income tax. The tax responsibility passes through to the partners, who are not considered employees for tax purposes.3 Individuals in partnerships may receive more favorable tax treatm…

Special Considerations

- The basic varieties of partnerships can be found throughout common law jurisdictions, such as the United States, the UK, and the Commonwealth nations. There are, however, differences in the laws governing them in each jurisdiction. The U.S. has no federal statute that defines the various forms of partnership. However, every state except Louisiana has adopted one form or another o…

Types of Partners

Types of Partnerships

- As mentioned, there are three main types of partnerships. Each type has its own advantages and disadvantages.

Partnership Agreement

- The partnership agreement is a fundamental part of this business type. This agreement outlines how the business will operate in terms of such things as conflict resolution or allocation of profits. It is one of the most important documents for the business and can mitigate many of the potential negatives that have been discussed. For example, as pr...

Additional Resources

- Proper financial management is the backbone of any business. Corporate Finance Institute has resources that will help you expand your knowledge, advance your career, and manage the financials of your company! Check out the informative CFI resources below: 1. Financial Modeling & Valuation Analyst (FMVA)® Certification Program 2. Corporate & Business Strategy 3. Three Fi…

What Is A Partnership?

- A partnership is a form of business where two or more people share ownership, as well as the responsibility for managing the company and the income or losses the business generates. That income is paid to partners, who then claim it on their personal tax returns – the business is not taxed separately, as corporations are, on its profits or losses. ...

General Partnership

- In a general partnership, each partner shares equally in the workload, liability, and profits generated and paid out to the partners. All partners are actively involved in the business’s operations.

Limited Partnership

- Limited partnerships allow outside investors to buy into a business but maintain limited liability and involvement, based on their contributions. This is a more complicated form of partnership, which also has more flexibility in terms of ownership and decision-making.

Joint Venture

- Short-term projects or alliances that bring together multiple partners for a project are typically structured as joint ventures. If the venture performs well, it can be continued as a general partnership. Otherwise, it can be shuttered.

Pros

- There are several advantages of choosing to structure a business as a partnership, which include: 1. Fairly easy to set up and maintain over time 2. Partners can pool their resources to fund the company’s start-up 3. Partners can share the workload and the rewards of the business’s success 4. Being able to offer key employees the potential to one day become a partner in the business c…

Cons

- Of course, where there are advantages, there are also disadvantages to forming a partnership: 1. Where more than one owner exists, there are bound to be differences of opinion that could threaten the business 2. Although partners split any profits the business generates, if the payout is not in sync with each partner’s contribution to the company, disagreements can erupt 3. Unlik…

Filings

- There are no annual taxes to be paid, but the partnership does need to issue a K-1 form to all partners to be included in their personal income tax filings. The takeaway here? Be careful who you go into business with, because you could be liable for their actions as they relate to the business.