A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure.

What is general aggregate in insurance terms?

In insurance terms, aggregate refers to thelimit a policy will pay during aspecified timeframe. The policy contract defines your coverage limits, parameters, and policy period. Most policy periods are one year. Aggregate also is referred to as an aggregate limit orgeneral aggregate limit.

What is an aggregate limit in business insurance?

The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The aggregate limits are part of commercial general liability (CGL) and professional general liability insurance policies.

What is an aggregate limit of indemnity?

What is an aggregate limit of indemnity? 'Aggregate' limit of indemnity is a term used to describe the type of indemnity limit provided by the professional indemnity policy. 'Aggregate' means that the total amount of financial cover provided is limited to the amount specified in the policy schedule, arising within the specified period of insurance.

What is PCO aggregate?

What does PCO aggregate mean? Definition. General Aggregate Limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Click to see full answer. Correspondingly, what does policy aggregate mean?

What is included in the general aggregate limit?

The general aggregate limit places a ceiling on the insurer's obligation to pay for property damage, bodily injury, medical expenses, lawsuits, and so on, which may arise during the tenure of the insurance policy.

Is General Aggregate the same as umbrella?

The umbrella insurance policy becomes active as soon as the liability limit on other insurance policies is exhausted. A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy.

What is aggregate insurance amount?

The aggregate insurance definition is the highest amount of money the insurer will pay for all of your losses during a policy period—this period typically lasts for one year. On certain types of insurance coverage, an aggregate limit is put in place.

What does 2000000 aggregate mean?

In the case of our example, the roofing business may have a $2,000,000 aggregate limit with a $1,000,000 per occurrence limit. This means that the insurance company will only pay up to $1,000,000 for the damage for that incident.

What does per occurrence and aggregate mean?

Per-occurrence limits define how much a policy will pay for any one incident or claim. Aggregate limits define how much a policy will pay over the policy's duration. (Most general liability policies have durations of 6 months or 1 year.)

What does per location aggregate mean?

If the general aggregate limit is on a “per location” basis, that means it will apply to each location of the policyholder. This typically is used by owners of buildings and retail stores since they have many different locations and they want aggregate limits for each location.

What does the term in aggregate mean?

phrase. If a number of different things or amounts are considered in aggregate, or in the aggregate, they are considered as a single thing or amount. [formal] The world's biggest pension funds were worth $14 trillion in aggregate last year.

What does it mean if an insurance policy has an aggregate limit of $1 million?

So the per occurrence limit is how much your insurance company will pay out for anyone loss. If you have a $1 million dollar per occurrence limit, the maximum amount available for any one occurrence is $1 million dollars. The maximum amount available for all occurrences combined is $2 million dollars.

What does aggregate premium mean?

Related Definitions Aggregate Premium means the Premium required for all Members. Aggregate Premiums are shown on all Premium Statements. Application means the Employer enrollment form. It serves as the signature page of this Policy.

What is a general aggregate?

The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Unlike a per-occurrence limit, which limits the amount per claim, a general aggregate limit can be exhausted through either two claims, fifty claims, or anywhere in between.

What is an umbrella aggregate?

Separate aggregate limits mean more limits of insurance available to pay covered losses. A key feature of the Chubb Commercial Excess & Umbrella Insurance policy is the provision of separate aggregate limits of insurance which do not impair or erode each other.

What is an umbrella policy for car insurance?

What is umbrella insurance? Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. Umbrella insurance can provide coverage for injuries, property damage, certain lawsuits, and personal liability situations.

Do umbrella policies have aggregate limits?

General liability policies have per occurrence limits and aggregate limits. Umbrella liability policies have a per occurrence limit equal to the aggregate limit.

What does "general aggregate" mean in insurance?

What Does General Aggregate Mean in Insurance Policy? A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand.

What is the general aggregate limit?

The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuit, etc. which may arise during the tenure of the insurance policy. As it happens with the other insurance coverages, the higher the commercial general liability insurance coverage, ...

What is the objective of insurance companies?

Their objective is to offer you the protection you need for your business while curtailing their risks. Here the general aggregate can help in balancing the insurer risks with the help of insured protection.

What happens to commercial general liability insurance?

As it happens with the other insurance coverages, the higher the commercial general liability insurance coverage, the higher would be the premium. Under this, the coverage will pay for any claim, loss and lawsuit in which a policyholder is involved, until it reaches the aggregate limit. That might happen in case of a single large claim ...

What is a policy?

"Policy" means this document of Policy describing the terms and conditions of this contract of insurance, including the company's covering letter to the insured if any, the Schedule attached to and forming part of this Policy, the Insured's Proposer form and any applicable endorsement thereon.

When does the aggregate limit reset?

Once the aggregate limit has crossed the maximum limit under the current policy tenure, it usually doesn’t reset until the next policy renewal. However, some insurance companies facilitate reinstatement of the aggregate limit once it has been exhausted.

Can you go with a high coverage limit?

If you are in the business where lawsuits may bring the high costs, you might consider going with high coverage limit at the time of applying for the policy. Keep this in mind, by opting for the insurance policy which comes with a higher aggregate limit; you can actually curtail your risks.

What is general aggregate?

The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Unlike a per-occurrence limit, which limits the amount per claim, a general aggregate limit can be exhausted through either two claims, fifty claims, or anywhere in between. We know that general aggregates can be confusing, ...

What insurance policies do not have an aggregate limit?

Not every insurance policy has an aggregate limit. If a policy is required by the government, for example, it likely doesn’t have an aggregate limit.

Why is the general aggregate important?

Without going any further into the metaphor, the general aggregate is very important to your business. If you have a worst-case scenario claim, you will still have insurance after that claim occurs, because one claim won’t wipe out your entire insurance policy.

What is a per-project aggregate?

This is a common requirement for certain type of businesses, usually in the construction industry. In fact, it’s so common that we thought we needed to mention it in this post.

How does excess liability work?

With an excess liability policy, you can increase not only your "per occurrence" limit, but also your general aggregate limit. Here’s how it works: As you can see, the excess policy sits on top of both the occurrence and the aggregate limit to increase both. A $5,000,000 excess liability policy results in $6,000,000 for any one occurrence ...

What is aggregate limit?

The general aggregate limit plays a critical role in how liability insurance policies function. If you need additional limits, you can take steps like purchasing an excess liability insurance policy or even getting a project aggregate limit.

Why do companies give additional insured?

The problem: now your insurance policy is not just providing indemnification for you, it is insuring 200 other businesses, too. This could create a situation where you need much higher limits so there is enough money to cover all the parties your insurance company is defending.

What is the average aggregate limit for a general liability policy?

The typical aggregate limit for a general liability policy is $1 million. However, many insurance companies may offer a higher general aggregate limit amount. The aggregate limit also comes with a per occurrence limit that is typically $1 million. The per occurrence limit is the most that a general liability insurance policy will pay ...

What is the aggregate limit on a CGL policy?

The general aggregate limit on a CGL insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit. That might represent a single large claim, or multiple smaller ones. However, the general aggregate limit can be reinstated in certain circumstances.

What happens when you push the aggregate limits?

Pushing the Limits. Once the general aggregate limit has been reached for a policy, the benefits will end for the current policy term. This means that any litigation costs that occur or claims that are made after the aggregate limits have been exhausted will need to be paid by the policyholder.

When does the aggregate limit reset?

Once the aggregate limit has been reached for the current policy term , it typically doesn't reset until after the next renewal. However, some insurance companies may offer an optional endorsement which can reinstate the aggregate limit once it has been exhausted. This endorsement increases the cost of your policy premium, whether you use it or not, but can provide a useful safety net.

What is CGL insurance?

Your commercial general liability insurance , or CGL, is designed to protect you while limiting the insurer's risk in worst-case scenarios. The general aggregate limit in your CGL insurance is an example of that balancing act. It places a ceiling on the insurer's obligation to pay for bodily injury, property damage, medical expenses and lawsuits that may occur to a business during the policy's term. As with other kinds of insurance, the higher the coverage the greater the premium.

What happens to aggregate coverage once the aggregate limit is paid out?

In other words, once the general aggregate limit is paid out, the only coverage remaining under the policy would be for products-completed operations claims—which are paid out of a separate aggregate.

What Is a General Aggregate Limit?

A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Under some commercial general liability (CGL) policies, the general aggregate limit applies to all covered bodily injury (BI) and property damage (PD) (except for injury or damage arising out of the products-completed operations hazard) and all covered personal and advertising injury. When paid losses in these categories reach the specified general aggregate limit, that limit is exhausted and no more losses in any of those categories will be paid under the policy. In other words, once the general aggregate limit is paid out, the only coverage remaining under the policy would be for products-completed operations claims—which are paid out of a separate aggregate.

What is aligned insurance?

ALIGNED specializes in delivering insurance and risk management solutions exclusively to Canadian businesses. Through our 18 points of differentiation and expertise, we deliver unmatched value to our growing portfolio of clients from all industries that range from small to large organizations.

Where is aligned insurance located?

ALIGNED’s offices in Toronto, Calgary and Vancouver are supported by a national operations centre in Cambridge, Ontario. Uniquely within the industry, ALIGNED creates, negotiates and delivers the best business insurance and risk management strategies/solutions to organizations like yours.

What is the aggregate limit on insurance?

The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuits, and so on, which may arise during the tenure of the insurance policy. The coverage will also pay for any claim, loss, and lawsuit in which a policyholder is involved until it reaches the aggregate limit.

What is general aggregate limit?

The general aggregate limit liability refers to the most money that an insurer can be obligated to pay to an insured party during a specified period. The contracts of commercial general liability (CGL) and professional general liability insurers cite these general aggregate limits in detail.

How Does the Aggregate Limit of Liability Work?

Suppose a doctor’s professional liability insurance policy has limits of $1 million per incident and $2 million aggregate limit of liability per year. If this doctor gets sued twice in one policy year and loses both times, and each time, the plaintiff receives $1 million in damages, then the doctor will have to hope that there isn't a third time as their policy’s annual $2 million aggregate limit of liability has been exhausted.

Why is liability insurance important?

In this way, even though liability insurance protects policyholders, it gives them an incentive to avoid being sued, since there are limits to their coverage. These limits also protect insurance companies against unlimited losses, which in turn helps them to stay in business.

Why add umbrella coverage to a business?

The challenge for many companies is having enough capital to purchase adequate limits. So, if you're insuring a business with a number of employees, it could make sense to add additional umbrella coverage. Like other business entities, insurance companies also face risks. An insurance company's goal is to offer you the protection you need for your business while limiting your risks. Here, the general aggregate can help in balancing the insurer risks with the help of insured protection.

What is the goal of insurance companies?

An insurance company's goal is to offer you the protection you need for your business while limiting your risks. Here, the general aggregate can help in balancing the insurer risks with the help of insured protection. If you're a business owner, ...

Does CGL have to pay for losses?

Once the policyholder has crossed the general aggregate limit, the CGL company is not obligated to compensate for losses, litigation costs, or claims. For a business seeking to purchase insurance, the question becomes how much insurance is enough.

What happens to aggregate coverage after the aggregate limit is paid out?

In other words, once the general aggregate limit is paid out, the only coverage remaining under the policy will be for products-completed operations claims—which are paid out of a separate aggregate .

What is aggregate limit?

General Aggregate Limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Under the standard commercial general liability (CGL) policy, the general aggregate limit applies to all covered bodily injury (BI) and property damage (PD) (except for injury or damage arising out of the products-completed operations hazard) and all covered personal and advertising injury. When paid losses in these categories reach the specified aggregate limit, that limit is exhausted and no more losses in any of those categories will be paid under the policy. In other words, once the general aggregate limit is paid out, the only coverage remaining under the policy will be for products-completed operations claims—which are paid out of a separate aggregate.

What is general aggregate?

Your general aggregate is the maximum limit of coverage supplied by your general liability policy within the term. Hence, your general aggregate is an element of your general liability policy.

What Is General Aggregate Limit in Commercial Insurance?

The aggregate limit in your commercial insurance policy is the maximum amount your insurer will reimburse you for all covered losses within the term of your policy. When you reach your aggregate limit, your insurer will pay no additional claims during the policy period. The general aggregate limit in your commercial insurance policy refers to the maximum amount your insurer will pay for covered liability claims during your insurance term. Thus, if you’ve exhausted your general aggregate limit, your insurer is no longer responsible for covering property damage, bodily injury, medical expenses, or lawsuits.

What is the difference between aggregate and per claim?

Per claim or per occurrence describe the limit your insurer will pay for a single covered claim. Aggregate is the limit your insurer will pay for all claims within the life of the insurance policy. There is usually a distinct difference in these amounts since your policy is designed to cover multiple claims if necessary.

What is aggregate limit insurance?

An occurrence limit is the maximum amount your insurer will reimburse you for one covered incident or claim. The aggregate limit is the maximum amount your insurer pays for all covered claims over the term of your policy. Depending on your policy limits, one claim or multiple claims reach your aggregate limit.

What is aggregate limit?

Policy Aggregate: Also called the general aggregate, your policy aggregate limit defines the limit of coverage for all covered claims within the policy’s term.

What is umbrella insurance?

Reaching your general aggregate limit can seem like a catastrophe, but there are ways to put a failsafe in place. Commercial umbrella insurance is a policy designed to be used as a supplemental policy to provide coverage when your primary policy limit is exhausted. Thus, when you exceed your general aggregate limit, a commercial umbrella policy acts as an additional layer of liability coverage to protect you against liabilities that would otherwise be paid out-of-pocket.

What is a product complete aggregate?

Products-Completed Aggregate: Often separate from your policy aggregate, your products-completed aggregate is the limit your policy will pay out on covered claims when your product or completed service injures people or property.

What is general aggregate?

General aggregate represents the maximum amount a policy pays out across all claims. After paying $1 million for the example claim above, the policy still has $1 million remaining to cover any additional claims during the coverage term.

What is the maximum amount a policy pays for an individual claim?

Each occurrence is the maximum amount a policy pays for an individual claim. Using our example limits, this policy pays up to $1 million for a single claim but cannot exceed that amount. Overages must go toward an umbrella or excess insurance policy or result in out-of-pocket costs.

What is CGL liability?

CGL insurance policies carry liability limits, which means that during the term of coverage, the insurance will pay only up to a certain amount. Once the policy reaches those thresholds, its financial resources are exhausted. Two important limits include “each occurrence” and “general aggregate”:

How long does a CGL policy last?

Beware CGL policy extensions – Policyholders sometimes seek to extend their policies for longer than the standard 12 months but less than an additional full term.

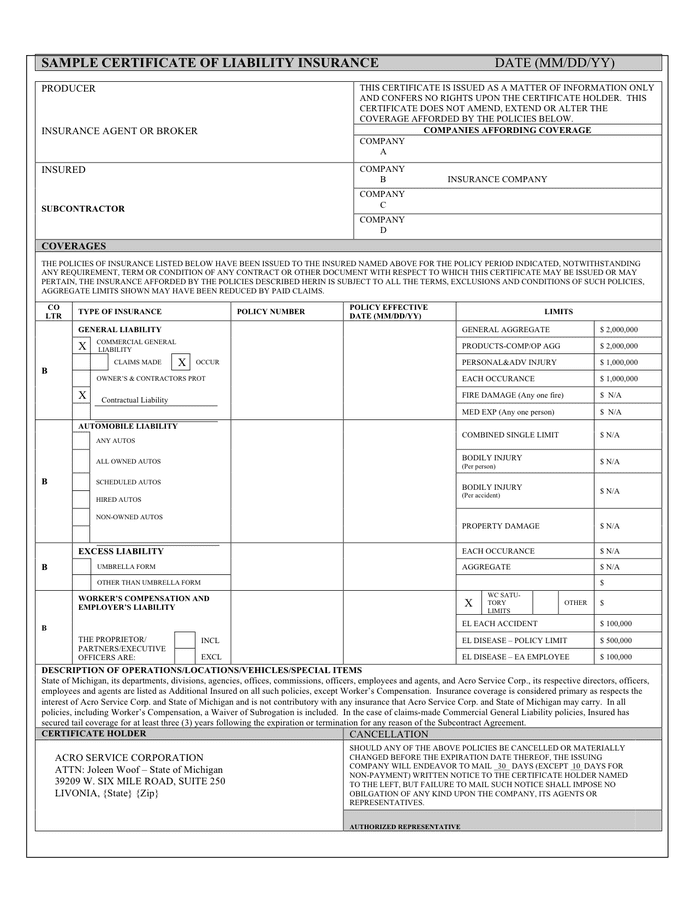

Does CGL require a per project aggregate endorsement?

Check for project aggregate endorsements – Simply checking the project aggregate limit box on the COI does not mean the coverage exists. Per project is not standard and often comes with an additional premium cost. The CGL policy requires a per-project aggregate endorsement that should be attached to the COI upon submission to verify accurate coverage.