Full Answer

What is interchange-plus pricing?

There are two main components of interchange-plus pricing: Interchange – First is the interchange, which is the fee that comes directly from the card networks. In other words, these are the fees charged by companies like Visa and Mastercard. Payment processors do not control these rates, and every merchant is required to pay the interchange.

What is interchange rate?

Interchange Rate. An interchange rate is a fee charged by banks that covers the cost of handling and credit risk inherent in a bank credit or debit card transaction.

How do you calculate interchange plus percentage?

You’ll need to take your info from B and figure out your dollar amount. To do this, multiply your total sales times the decimal value of your total interchange plus percentage. The average interchange rate is 1.5%, so whatever the “plus” that they’re offering is added to the 1.5%.

What is the average interchange rate?

Interchange Fees FAQs The average interchange rate for credit card transactions is 1.81% and around 0.3% for debit cards.

Is interchange plus the best?

Interchange plus is the best type of merchant account pricing for merchants. It is the most transparent and allows for the lowest fees. This is the key reason Clearly Payments focuses on Interchange Plus.

What is interchange plus rates?

Interchange-plus is a pricing model used by credit card processors to determine the per-transaction cost paid by merchants. The model consists of two components — the interchange fee determined by the card networks and a markup set by the credit card processor itself.

Is interchange plus better than flat rate?

Overall, interchange plus pricing is the better option for most businesses as it allows merchants to take advantage of fluctuating interchange rates and keeps the payment processor's margin as low as possible.

How do you calculate interchange rate?

The calculation is simple; the total dollar value of the sale is multiplied by an Interchange Fee set by Visa or MasterCard. For example: $100 sale X 1.54% results in an Interchange Fee of $1.54. This fee of $1.54 is paid by the Processor to the Bank.

Who sets the interchange fee?

Interchange rates are set by credit card companies such as Visa, MasterCard, Discover, and American Express. With Visa and MasterCard, the rate is set on a semiannual basis, usually in April and then in October. Other credit card companies might set their rates annually.

What is the difference between Interchange Plus and Interchange Plus Plus?

Interchange fee: Cost that the card issuer charges the acquirer while a transaction is processed. Scheme fee (first “plus”): Cost that the card scheme charges the acquirer for processing a transaction. Acquirer fee (second “plus”): Cost that the acquirer itself charges for processing the card.

What is the interchange rate for debit cards?

By contrast, the average interchange fee per exempt transaction changed significantly for the first time since Regulation II took effect, increasing from $0.44 in 2019 to $0.48 in 2020.

How much does credit card processing cost?

According to industry analysts, the average credit card processing fees range from 1.5 percent to 3.5 percent of each transaction, although the final percentage depends on a host of factors. Also, be aware that credit card processing fees are entirely different from the fees consumers pay for carrying a credit card.

How does toast POS make money?

Every time a customer pays for their order, that transaction is securely processed through Toast and Toast collects a processing fee from your restaurant for its services. Below, you can see an interactive breakdown of interchange and network costs alongside Toast's fees based on check size.

What is flat rate credit card?

Flat Rate pricing simply means that the credit card processor is charging you one flat rate for all of your credit card transactions, regardless of the fluctuating interchange rate (interchange rate = set by card brands and based on card type, i.e. Visa Gold vs. Amex OptBlue).

What is plus transaction?

You may already know what Interchange is—the fees set by Visa, MasterCard and Discover— but the “Plus” refers to a per-transaction fee charged by your processor in exchange for eliminating excess markup on interchange. No hidden fees, and a per-item charge instead.

How does interchange work?

Definition: Interchange fees are transaction fees that the merchant's bank account must pay whenever a customer uses a credit/debit card to make a purchase from their store. The fees are paid to the card-issuing bank to cover handling costs, fraud and bad debt costs and the risk involved in approving the payment.

What are interchange and scheme fees?

Interchange fee: paid to the customer's bank, the issuer. Scheme fee: paid to the card schemes like Visa or Mastercard.

What are the core components of interchange?

There are two main components of interchange-plus pricing:Interchange – First is the interchange, which is the fee that comes directly from the card networks. ... Plus – The “plus” in interchange-plus pricing is the markup that your credit card processor is charging on top of the interchange fee.

What is interchange plus?

Interchange-plus is a pricing model used by credit card processors to determine the per-transaction cost paid by merchants. The model consists of two components — the interchange fee determined by the card networks and a markup set by the credit card processor itself. Interchange-plus pricing is one of the most fair and balanced pricing schemes used in the payment processing industry, largely due to how transparent it is. On average, interchange-plus pricing will cost business owners somewhere around 2.2% + $0.22.

How Does Interchange-Plus Pricing Compare To Other Fees?

Small business owners shopping for credit card processing will usually be presented with three options when it comes to how transactions are priced — interchange-plus, tiered, or fixed pricing. In this section we develop a framework for how you should go about deciding which works best for your firm.

How does tiered pricing work?

Tiered pricing gets its name from the way it operates. Your processing fees are broken out into one of three tiers — qualified, mid-qualified, and non-qualified. These can range from as low as 1.4% to 4%+. It can sometimes be difficult to discern between a tiered price and a fixed price, which we discuss in greater detail below. Processors using tiered pricing will typically display the qualified transaction fee in a big font, and include a disclaimer somewhere on that same page that this refers to qualified purchases only. This tactic is a bait and switch, since business owners are usually lured in with the seemingly low rates, but may in reality have most of their purchases fall into the costlier mid-qualified and non-qualified tiers.

What is fixed pricing?

As its name suggests, fixed pricing charges one single fee for all your transactions , no matter whether your customers use debit, credit or premium rewards cards. Square is arguably one of the most well-know credit card processors to use fixed pricing, making it a great example. It charges businesses 2.75% for all swiped, dipped or tapped payments. While fixed pricing doesn't discriminate between card types, it can charge different fees based on the way a payment is accepted. In the case of Square, we noted that the 2.75% fee applies to swiped transactions only. If you were to key-in a payment, the fee goes up to 3.5% + $0.15. Note that this is a similar trend among interchange-plus pricing as well, since the interchange rates on keyed-in transactions are much higher than those on swiped ones.

How much does a Mastercard World Elite card cost?

A Mastercard World Elite credit card, on the other hand, will cost your business 2.3% + $0.10 per transaction — an increase of over 186%. Generally, the more premium a card is, the more it expensive its interchange fee will be. Here are a few interchange fees from some of the most popular credit card types.

What is the difference between Discover and American Express?

There is also a 0.40% fee that applies to any cards accepted from outside of the United States. Discover charges 0.13% + $0.0185 per transaction as an assessment fee, a $0.025 network authorization fee, and a 0.95% international fee.

Is interchange plus cheaper than fixed pricing?

Interchange-plus pricing is generally cheaper to accept than fixed pricing, especially for companies whose customers predominantly use debit card payments. Because the interchange and assessment fees are so much lower on debit cards, fixed pricing typically overcharges for these transactions.

What is interchange plus pricing?

There are two main components of interchange-plus pricing: Interchange – First is the interchange, which is the fee that comes directly from the card networks.

What is the average interchange rate?

The average interchange rate is 1.5%, so whatever the “plus” that they’re offering is added to the 1.5% . Don’t forget to make the percent a decimal when you multiply it by your sales.

Why is interchange plus better than other merchant accounts?

Compared with other merchant account pricing models (which we’ll touch on later), interchange-plus offers more transparency because the credit card processor outlines the markup that it charges on top of the credit card issuer’s fees.

What is tier pricing?

Tiered pricing is the most common pricing model when it comes to credit card processing. This model simplifies your fees by breaking them down into three main tiers — qualified, mid-qualified, and non-qualified.

How to calculate the total amount of credit card fees?

Step 1. Identify the total amount of fees charged by your credit card processor. Step 2. Find your total amount of credit and debit card transactions. Step 3. Divide the total number of fees charged by the total amount of credit/debit sales. Once you get the answer, move the decimal two places to the right.

What is membership based pricing?

Similarly, companies that provide membership-based pricing offer members wholesale credit card processing rates — i.e., fees that are charged by the credit card issuers. Instead of taking a percentage out of a merchant’s sales, these companies earn revenue through flat membership fees.

What does it mean to know your effective rate?

Figuring out your effective rate shows you how much you’re actually paying overall. Once you know your effective rate, you’ll be able to make an informed decision about which interchange plus deal is actually the best one.

What is interchange plus pricing?

Interchange plus pricing is a credit card processing pricing structure that separates the components of processing costs allowing for transparent reporting and interchange optimization often leading to lower costs when compared with other forms of pricing such as tiered or bundled.

What is exchange plus?

Interchange plus = Base credit card processing rates with a fixed markup typically consisting of basis points and an authorization fee.

What is plus markup?

The word “ Plus ” refers to the processor’s markup that’s applied to each credit card transaction. The markup is typically expressed as basis points (explained below) accompanied by an authorization fee. Basis Points. A basis point is equal to 1/100th of a percentage point.

Can you get gouged in Interchange Plus?

Interchange-plus: You can still get gouged!

Is interchange plus a guarantee?

This is a dangerous misconception. As noted above, interchange plus has the potential to yield competitive processing fees. It’s by no means a guarantee. As we’ve explained in the following two articles, it’s just as easy for a processor to gouge a business via interchange plus as it is with other pricing models, such as bundled/tiered:

What Is an Interchange Rate?

An interchange rate is a fee that a merchant is required to pay with every credit card and debit card transaction. Also known as "swipe fees," financial companies charge this fee in return for accepting the credit risk and handling charges inherent in credit card transactions.

How is interchange rate calculated?

The interchange rate is calculated based on authorization costs, losses due to fraud and credit, and the average bank cost of funds.

Do credit card companies charge interchange fees?

Other credit card companies might set their rates annually. Each credit card company sets its interchange rates, but the fees are paid by every merchant bank or institution that conducts a transaction with a cardholding consumer. In addition to the interchange rate, credit card processing companies might include another fee ...

Do retailers charge interchange rates?

Even higher fees may be incurred dependent on the type of transaction. Retailers are not the only ones who face charges from interchange rates. Almost any entity that accepts credit or debit card payments will see such fees. This can even include charities that accept donations via debit or credit.

Can different credit cards have different interchange rates?

Different types of cards that come from the same credit card company may be assigned different interchange rates. How the transaction is completed can also influence the rate that is charged.

What Is Interchange-Plus Pricing?

The pricing model consists of two elements: an “interchange” and a “plus.” The interchange is the percentage of the transaction that must be paid to both the issuing bank and the credit card association. Because your processor has to pay this charge, they’ll pass it on to you. The plus is the amount over and above the interchange costs that you’ll also have to pay to your processor. It’s their markup for processing your transaction, and it’s designed to cover their costs of doing business – and also to generate a profit.

How Will Interchange-Plus Pricing Save Me Money?

By consolidating a wide variety of rates into a smaller number of tiers, processors can essentially “round up” to the highest rate in each tier. While this may make your monthly statement a lot easier to read, it also means you’ll be paying higher rates for a lot of transactions – and you probably won’t be able to tell which transactions are being charged abnormally high rates.

What Types of Pricing Models Are There?

Obviously, you’ll want to get the lowest processing rates you can get, right? In theory, lower processing rates should lead to less of the money from your sales going to your processor and more of it staying with you. In actual practice, it’s much more complicated than that.

Why do credit card processors use interchange plus?

By showing you the actual interchange costs, interchange-plus pricing allows you to more easily see what the markup is. This in turn encourages processors to set more reasonable markups. The credit card processing industry is highly competitive, and processors know that many merchants will sign up with the company that offers them the lowest rates. This transparency in separating out interchange and markup costs generally results in lower overall rates, and most interchange-plus pricing plans will cost you less money than a tiered-pricing plan. However, you should be aware that there’s nothing stopping a processor from charging you an unreasonably high markup. The difference is that it will be a lot easier to spot, especially if you shop around.

What is tier pricing?

Tiered pricing is, unfortunately, still the most common pricing model available, and the one most processors offer to their merchants. We don’t like it. Tiered pricing simplifies a huge number of processing rates into three basic tiers: qualified, mid-qualified, and non-qualified.

What is interchange charge?

The interchange is the percentage of the transaction that must be paid to both the issuing bank and the credit card association. Because your processor has to pay this charge, they’ll pass it on to you. The plus is the amount over and above the interchange costs that you’ll also have to pay to your processor.

Why are there different rates for debit cards?

Card-present and card-not-present transactions also have different rates, as they reflect the level of risk the issuing bank is taking in extending credit for a given transaction.

How many interchange rates are there?

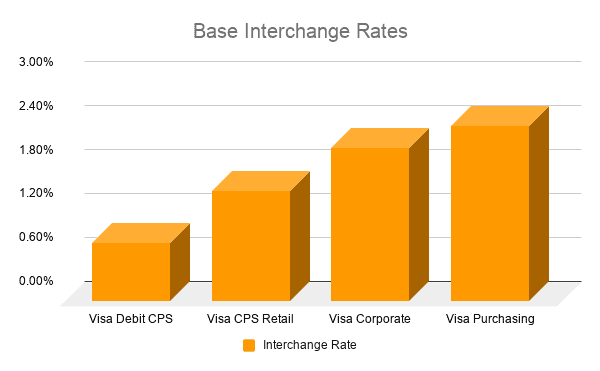

As you can see, there are dozens of interchange rates (and many more that aren't listed here). The rates vary based on the type of card, transaction method, and even type of business.

Which credit card has the highest interchange fee?

Premium rewards credit cards have among the highest interchange fees because some of that is used to cover the cost of the rewards. Same goes for business credit cards. In-Person vs. Online Transactions. In-person swipe and chip transactions have the lowest interchange fees since the risk of fraud is lowest.

What Are Interchange Fees?

When a customer pays with a debit or credit card, the bank that issued the card gets a cut of the transaction. This is called the interchange fee (or "wholesale" processing fee). It's meant to cover the banks' operation costs and risk of fraud.

How much is Square processing fee?

The interchange fee and markup are blended into the flat rate. An example is Square, which charges 2.6% + 10¢ per swipe.

What is the largest portion of credit card processing costs?

Interchange fees are the largest portion of your credit card processing costs. Unfortunately, these fees are mandatory, and they're set by credit card networks. But that doesn't mean there aren't ways to save.

What determines the interchange rate for Amex?

For the other three networks, it's mostly the type of card and payment method that determines the interchange rate. But for Amex cards, it's the transaction size and merchant category that determine the interchange rate. A lot of people use Amex credit cards for dining and travel.

Why are online transactions higher interchange fees?

Online and keyed-in transactions have higher interchange fees because it's easier to use a stolen card. Type of Business. All merchants receive a merchant category code (MCC) from their processor. These codes are based on your industry and may also come with different interchange rates.