Full Answer

How to get the best interest rates for your mortgage?

- Drop “mortgage rates” into your favorite search engine and watch the results pile up: Wade past the advertisements to find the sites that don’t ask for personal information but do ...

- Contact banks (national and local), credit unions and mortgage brokers. ...

- Ask friends, neighbors and relatives for recommendations. ...

What is the best interest rate for a home loan?

Today, rates sit between 5 and 6-percent for most buyers with good credit. "While the rate hikes seem high and they happened very quickly, they are still where they were prior to the pandemic," Shanon Schinkel, a loan originator with NFM Lending said.

How to negotiate a better mortgage interest rate?

How to negotiate a better mortgage rate

- Compare multiple lenders and loan rates. One personal finance tip shared all the time is to shop around for mortgage rates. ...

- Ask a bank or lender to match other mortgage offers. It's important to note that those rate quotes can also serve a secondary purpose. ...

- Use discount points. ...

- Build up your credit card history and score. ...

- Make a bigger down payment. ...

Can you pay for a better rate on a mortgage?

There’s a direct relationship between mortgage rates and fees, meaning that you can elect to pay higher fees for a lower rate. This is known as “buying your rate down” or “paying points.”

How to find a good mortgage rate?

What is the best mortgage rate for 2021?

What is FICO mortgage?

What is the biggest factor in determining mortgage rates?

What is APR in finance?

How to drive down closing costs?

How much does a 620-639 credit score cost?

See 2 more

What is considered a good mortgage rate right now?

Right now, good mortgage rates for a 15-year fixed loan start in the 5% range, while good rates for a 30-year mortgage generally start in the 6% range. At the time this was written in Oct. 2022, the average 30-year fixed rate was 7.08% according to Freddie Mac's weekly survey.

Is 3.5% a high mortgage rate?

Is a 3.5% interest rate good? In today's climate, 3.5 percent interest on a mortgage is below average. In 2020 and 2021, during the record low rates of the pandemic, 3.5 percent was above average for a new 30-year mortgage.

Is 4.75 a good interest rate for mortgage?

If you're shopping for an FHA 30 year fixed mortgage, 4.75% is your "Best Execution" target. If you're shopping for a 15 year fixed mortgage rate, we see a sweet spot at 4.25%. On 5-year ARMs, we've heard of very well qualified borrowers being quoted rates as low as 3.50%.

What is the average 30 year mortgage interest rate right now?

NerdWallet's mortgage rate insight On Friday, October 28th, 2022, the average APR on a 30-year fixed-rate mortgage rose 4 basis points to 6.941%.

Are interest rates going up in 2022?

Mortgage rates have risen throughout most of 2022, spurred by the Federal Reserve's unprecedented campaign of hiking interest rates in order to tame soaring inflation.

Will interest rates drop in 2022?

If spreads gradually return closer to historical averages, then mortgage rates will decline modestly over the next year. This is reflected in our forecast which has rates dropping from an average of 6.8% in the fourth quarter of 2022 to 6.2% in the fourth quarter of 2023.

What will mortgage rates be at the end of 2022?

Mortgage rate predictions for late 2022 The National Association of Home Builders and the National Association of Realtors sit at the low end of the group, estimating the average 30-year fixed interest rate will settle at 5.39% and 6.6% for Q4.

Is 4% a good interest rate for a house?

Right now, an interest rate around 4 percent is considered good, says Tim Milauskas, a loan officer at First Home Mortgage in Millersville, Maryland. When you shop for mortgages, the rates you're offered will be driven mostly by your credit, Milauskas says.

Is 3.75 a high interest rate on a mortgage?

In a market where rates are 3% on average, 3.75% is a little high. In a market where rates are 5% on average, it's a phenomenal rate.

What were 30-year mortgage rates in March 2022?

30-year mortgage rates dip even further below 20-year rates | March 29, 202230-year fixed-rate refinance: 5.000%, unchanged.20-year fixed-rate refinance: 4.875%, unchanged.15-year fixed-rate refinance: 4.000%, down from 4.125%, -0.125.10-year fixed-rate refinance: 3.875%, unchanged.

What was the 30-year mortgage rate in 2022?

As of November 8, 2022, the 30-year fixed mortgage rate is 7.39%, the FHA 30-year fixed rate is 7.33%, the VA 30-year fixed rate is 7.46% and the jumbo 30-year fixed rate is 6.15%.

What is the lowest mortgage rate ever?

2021: The lowest 30-year mortgage rates ever And it kept falling to a new record low of just 2.65% in January 2021. However, record-low rates were largely dependent on accommodating, Covid-era policies from the Federal Reserve.

Is 3.75 a high interest rate on a mortgage?

In a market where rates are 3% on average, 3.75% is a little high. In a market where rates are 5% on average, it's a phenomenal rate.

Is 3.25 interest rate on home good?

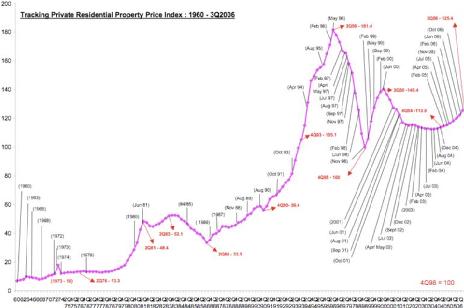

That graph shows the mortgage rates since 1972. A 3.25% interest rate is near the all time low. So yes, you have a good rate, assuming you are talking about a 30 year fixed rate loan. Is a 4% mortgage rate high?

What is 3.5 percent for a house?

In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is expressed as a percentage of the purchase price. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000.

Is 5% considered a high interest rate?

A 5% APR is good for pretty much all types of borrowing, except for mortgages. On personal loans, credit cards, student loans, and auto loans, 5% is much cheaper than the average rate.

What are today's mortgage rates?

For today, Friday, August 19, 2022, the benchmark 30-year fixed mortgage rate is 5.660% with an APR of 5.680%. The average 15-year fixed mortgage r...

What is a mortgage?

A mortgage is a type of loan designed for buying a home. Mortgage loans allow buyers to break up their payments over a set number of years, paying...

What is the difference between APR and interest rate?

The difference between APR and interest rate is that the APR (annual percentage rate) is the total cost of the loan including interest rate and all...

How much mortgage can I afford?

The amount you can borrow depends on a variety of factors, including how much you’re qualified for (depending on your income, among other factors)...

What are the different types of mortgages?

There are many different types of mortgages and it’s important to understand your options so you can select the loan that’s best for you: conventio...

How do I choose a mortgage lender?

Mortgage lenders come in all shapes and sizes, from online companies to brick-and-mortar banks — and some are a mix of both. Decide what type of se...

How does the Federal Reserve affect mortgage rates?

The Federal Reserve does not set mortgage rates, and the central bank’s decisions don’t drive mortgage rates as directly as they do other products,...

How do I find and compare current mortgage rates?

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-...

What are mortgage points?

Mortgage points, also referred to as discount points, help homebuyers reduce their monthly mortgage payments and interest rates. A mortgage point i...

What is a mortgage rate lock?

A mortgage rate lock freezes the interest rate. The lender guarantees (with a few exceptions) that the mortgage rate offered to a borrower will rem...

What is the best type of mortgage loan?

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own. For example,...

What’s the difference between APR and interest rate?

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses asso...

When will mortgage rates go up?

Mortgage rates are expected to rise in 2022 through 2023 as inflation remains elevated and the Federal Reserve continues to implement its monetary...

When should you lock in your mortgage rate?

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lo...

How long can you lock in a mortgage rate?

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesn’t process the loan before t...

How do you shop for mortgage rates?

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. You’ll also want to compare lender...

How do you get preapproved for a mortgage?

Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. Differe...

How do you calculate a mortgage payment?

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance (PMI...

How much house can I afford?

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford. However, it also depends on how...

How do lenders calculate my DTI?

At a minimum, lenders will total up all the monthly debt payments you’ll be making for at least the next 10 months Sometimes they will even include...

Is a 3.25 mortgage interest rate insanely good or just ... - reddit

My credit hit an all time high lately and I have 100% on time everything. Banks have been calling me and sending me stuff. My bank I use for checking and have one of my two credit cards with called me recently asking if I'd be interested in a mortgage.

10-year 2.39% fix mortgage – should you grab it? - MoneySavingExpert.com

The newspapers are full of stories about the Coventry Building Society's 10 year fixed rate mortgage deal, at 2.39%

MORTGAGE INTEREST RATES FORECAST 2022, 2023, 2024, 2025 AND 2026

Mortgage Interest Rate forecast for December 2023. Maximum interest rate 11.71%, minimum 11.03%. The average for the month 11.37%. The 30 Year Mortgage Rate forecast at the end of the month 11.37%.

Compare Today's Current Mortgage Rates | Zillow

Compare lender fees. Along with mortgage interest rates, each lender has fees and closing costs that factor into the overall cost of the home loan. When choosing a lender, compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR.

What is interest rate?

The interest rate is just the amount of interest the lender will charge you for the loan, not including any of the administrative costs. By capturing points and fees, the APR is a more accurate picture of how much the loan will cost you, and allows you to compare loan offers with differing interest rates and fees.

What is the average APR for a 30 year mortgage?

For today, Wednesday, November 10, 2021, the average 30-year fixed-mortgage APR is 3.24%, a decrease of 9 basis points from a week ago. If you're in the market for a mortgage refinance, the national average 30-year fixed refinance APR is 3.16%, a decrease of 11 basis points over the last week. Meanwhile, the national average 15-year fixed refinance APR is 2.54%, down 17 basis points from a week ago. Whether you're buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less.

What is the average mortgage rate for 2021?

Today's national mortgage rate trends. For today, Thursday, July 15, 2021, the average 30-year fixed-mortgage APR is 3.26%, a decrease of 2 basis points over the last week. If you're looking to refinance, the national average 30-year fixed refinance APR is 3.27%, a decrease of 2 basis points over the last seven days.

What is fixed rate mortgage?

A fixed-rate mortgage has an interest rate that doesn’t change throughout the life of the loan. In that way, borrowers are not exposed to rate fluctuations. For example, if you have a fixed-rate mortgage with a 3.5 percent interest rate and prevailing rates shoot up to 5 percent the next week, year or decade, your interest rate is locked in, so you don’t ever have to worry about paying more. Of course if rates fall, you’ll be stuck with your higher rate. Keep in mind, fixed-rate only refers to the rates, but there are many types of fixed-rate mortgages, such as 15-year fixed rate, jumbo fixed-rate and 30-year fixed rate mortgages

What is a mortgage loan?

A mortgage is a type of loan designed for buying a home. Mortgage loans allow buyers to break up their payments over a set number of years, paying an agreed amount of interest. Mortgages are also legal documents that allow the mortgage holder to (re)claim the property if the buyer doesn’t make their payments. It also protects the buyer by forbidding the mortgage holder from taking the property while regular payments are being made. In this way, mortgages protect both the mortgage holder and the buyer.

Why is it important to prepare for the mortgage application process?

It is important to prepare for the mortgage application process to ensure you get the best rate and monthly payments within your budget.

How are mortgage rates influenced?

It’s not an exact science, but mortgage rates are influenced by a variety of factors, including Federal Reserve policy, Treasury bond yields, supply and demand in the housing market and even inflation. Lending institutions have a range of rates they offer each day ( mortgage rates can change daily ), but the specific interest quoted to any single borrower is determined partly by the applicant’s personal financial situation.

How to get a better rate with a lender?

If you’re hoping to get the most competitive rate your lender offers , talk to them about what you can do to improve your chances of getting a better rate . This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

What is the average APR for a 30 year mortgage?

The average APR for the benchmark 30-year fixed-rate mortgage fell to 3.34% today from 3.35% yesterday. This time last week, the 30-year fixed APR was 3.38%. Meanwhile, the average APR on the 15-year fixed mortgage is 2.73%. This same time last week, the 15-year fixed-rate mortgage APR was at 2.74%. Rates are quoted as APR.

What is mortgage rate lock?

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

What is APR in mortgage?

The APR is the total cost of your loan, which is the best number to look at when you’re comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders (with higher rates and lower fees), so you’ll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

What are the advantages of going with a broker?

The advantage of going with a broker is you do less of the work and you’ll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender who’s suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Why lock in a mortgage rate?

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

What factors affect mortgage rates?

Likewise, different lenders charge different mortgage rates for a variety of reasons, including varying operating costs , risk tolerance and even how much they want new business. Your personal financial information—including credit score, debt-to-income ratio and income history—also have a significant impact on interest rates.

What is the best mortgage rate?

Anything at or below 3% is an excellent mortgage rate. And the lower, your mortgage rate, the more money you can save over the life of the loan. For example, if you get a $250,000 mortgage with a fixed 2.8% interest rate on a 30-year term, you could be paying around $1,027 per month and $119,805 interest over the life of your loan.

How to get a lower interest rate on a mortgage?

2. Improve your credit. Once you’ve checked your credit, see if you can improve your score to ensure you get a lower interest rate on your mortgage. This may involve paying off debt, lowering your credit card spending, or waiting until certain credit inquiries or negative marks fall off your report. 3.

What to do when buying a home?

One of the best things to do when home buying is to compare offers from mortgage lenders and shop around for lower rates. Check out Credible to compare mortgage and refinance rates across multiple lenders.

What was the mortgage rate 30 years ago?

However, just 30 years ago, rates were as high as 9% and 10%. Getting a good interest rate on your mortgage relies on a variety of factors, but it's important to determine what a good mortgage rate really means. You can explore mortgage rates across multiple lenders on Credible without affecting your credit score.

What factors affect mortgage interest rate?

Other factors that could impact your individual mortgage interest rate include: 1 Your credit score 2 The types of loans you apply for (conventional loans, VA loans, FHA loans, USDA loans) 3 Where you live and how the housing market is in that area 4 Whether you have a fixed or adjustable-rate mortgage

Why do mortgage rates go down?

One of the factors that you have little control over is the economy. If people are losing jobs and the economy needs to be stimulated, national mortgage rates might go down. In a growing economy where spending is increasing and more people are buying homes, this can increase the demand for mortgages as well as rates.

When is the best time to apply for a mortgage?

Generally, the best time to apply for a mortgage or mortgage refinance is when national interest rates are low.

How to find a good mortgage rate?

The trick is knowing what a good mortgage rate looks like for you. And that will depend on a few different factors, including: 1 How strong your finances are — Lenders look at your credit score, down payment, existing debt burden, and the consistency of your income. A credit score above 720 and a down payment of 20% typically earn you the best rates, but you can qualify for a home loan with far less 2 Which mortgage lender you choose — Only by shopping around and getting rate quotes from several lenders can you be sure you’re getting the best possible deal 3 What type of mortgage you want — Each type of mortgage comes with a different average rate: conventional, conforming, FHA, VA, USDA, and jumbo loans 4 Your loan term — The length of your loan makes a difference, too. Shorter-term loans (for instance, a 15-year mortgage) typically have lower interest rates than 30-year loans 5 Your loan’s purpose — You’ll likely pay a slightly higher rate to refinance your existing loan than if you were buying a home

What is the best mortgage rate for 2021?

Throughout the first half of 2021, the best mortgage rates have been in the high-2% range. And a ‘good’ mortgage rate has been around 3% to 3.25% . Of course, these numbers vary a lot from one borrower to the next, as we explain below.

What is FICO mortgage?

FICO has a tool to estimate mortgage rates based on credit, and it shows how big a difference your score can make when it comes to your interest rate.

What is the biggest factor in determining mortgage rates?

Your credit score is one of the biggest factors in determining your mortgage rate, especially if you use a conventional loan. FICO has a tool to estimate mortgage rates based on credit, and it shows how big a difference your score can make when it comes to your interest rate.

What is APR in finance?

Annual percentage rate (APR) looks at all your costs of borrowing (including interest) and spreads them over the potential life of your loan. So APRs are higher than straight rates. And they can tell you about what you’re actually going to pay.

How to drive down closing costs?

You may well find you can drive down your rate or closing costs by showing your preferred lender a better offer and asking them to match it.

How much does a 620-639 credit score cost?

But someone whose score is in the 620-639 range would pay closer to $153,800. So over time, what might look like a relatively small rate difference can add up to huge savings. Remember, FICO is looking only at the difference your credit score makes.