- Definition and Examples of a Guaranteed Loan. A guaranteed loan means a third party promises to repay the loan if the borrower defaults on it. ...

- Guaranteed Loans vs. Secured Loans. ...

- Types of Guaranteed Loans. Mortgages are not the only type of guaranteed loan program available. ...

How to get a guaranteed loan?

Some of the most popular include:

- Dependents

- Child and dependent care credit

- Earned income tax credit

How do I get a guaranteed personal loan?

There are three main types of loans you may be able to get which are:

- Installment Loans: These are unsecured personal loans. You pay it back monthly from more than six months up to six years. ...

- Short Term Loans: This loan is expected to be paid in full, as a lump sum, with interest after a short, agreed upon term.

- Credit Card Loans: You have probably heard of the dangers of credit card debt. ...

What does a guaranteed loan mean?

The federal government offers several repayment plans for low-income borrowers like the:

- Income Based Repayment Plan (IBR)

- Income Sensitive Repayment Plan

- Income Contingent Repayment Plan

- Pay As You Earn (PAYE), and

- Pay As You Earn Repayment Plan (REPAYE).

Can one with bad credit get a guaranteed loan?

We looked into the lending market and compiled a list of reputable lenders who can help you with bad credit loans with guaranteed approval to make it easier for you. These companies have been assisting other people in receiving loans and achieving better credit scores for decades, with guaranteed approval rates.

Is there any such thing as a guaranteed loan?

There is no way you can get a guaranteed approval loan, no matter how fast the approval process is, what kind of personal loan it is and how good your credit score is. There is no such thing as "guaranteed personal loans".

What is the difference between a guaranteed loan and a direct loan?

The primary difference between USDA direct loans and USDA guaranteed loans is who funds the actual loan. With the USDA direct loan, the USDA acts as the lender. Conversely, with the guaranteed loan program, private lenders fund the loan while the USDA backs each loan against default.

What type of loan is guaranteed by the government?

A government-backed mortgage is a loan insured by one of three federal government agencies: the Federal Housing Administration (FHA), the U.S. Department of Agriculture (USDA) or the Department of Veterans Affairs (VA).

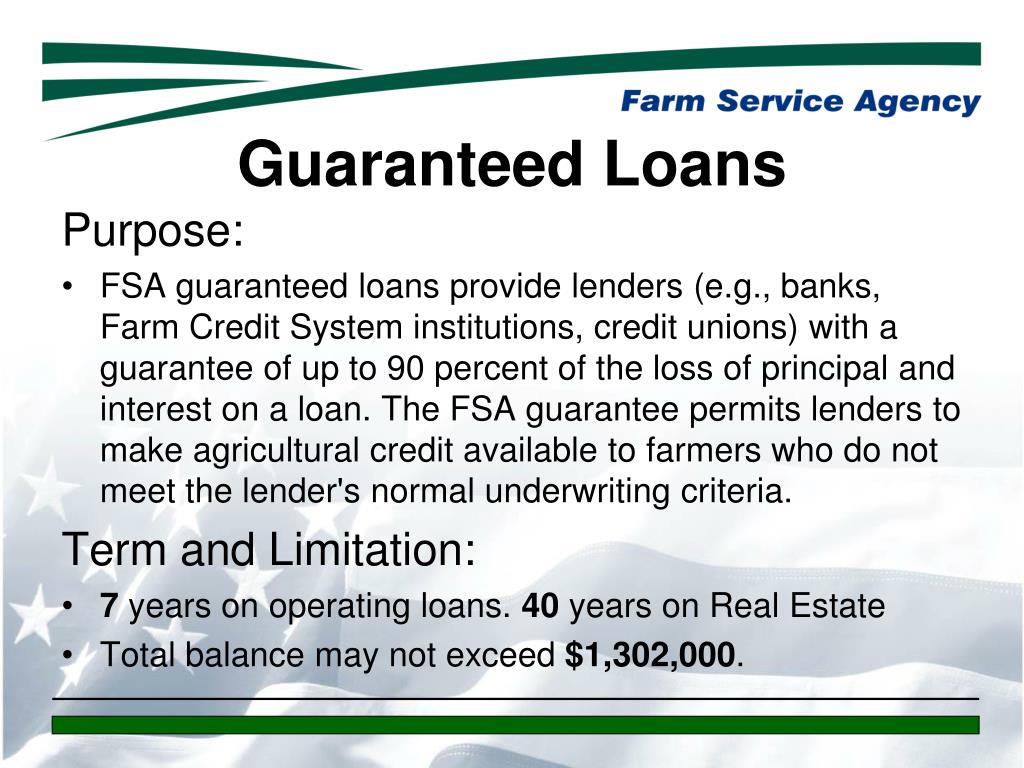

How do FSA guaranteed loans work?

FSA Guaranteed loans are made and serviced by commercial lenders, such as banks, Farm Credit System institutions, or credit unions. FSA guarantees up to 95 percent of the loss of principal and interest on a loan. Farmers and ranchers apply to an agricultural lender, which then arranges for the guarantee.

What credit score do you need for USDA loan?

640Approved USDA loan lenders typically require a minimum credit score of at least 640 to get a USDA home loan. However, the USDA doesn't have a minimum credit score, so borrowers with scores below 640 may still be eligible for a USDA-backed mortgage. If your credit score is below 640, there's still hope.

Can I get a USDA loan with a 500 credit score?

USDA Loan Credit Benchmarks The USDA does not set a minimum credit score requirement, but most USDA lenders typically look for a credit score of at least 640, which is the lowest score allowed for the USDA's Guaranteed Underwriting System (GUS).

What is the easiest government loan to get?

Education Loans If you need help paying for school, federal student loans (under the Direct Loan program) are probably your best option. They are easy to qualify for, they have competitive rates, and they offer flexibility when you're getting on your feet (and when you face financial hardships in life).

What is the easiest loan to get approved for?

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

How can I get free money?

10 ways to get free money from the government:Temporary Assistance for Needy Families.Supplemental Nutrition Assistance Program.Emergency Rental Assistance.Low-Income Home Energy Assistance.The Lifeline Program.Child Care and Development Fund.Down Payment Assistance.Pell Grant.More items...•

Is it hard to get an FSA loan?

Like any business, it is hard to get financed when you don't have a track record of sales. Luckily, we are seeing a number of options that can help you get qualified. Loan financing can be a powerful tool when used properly. USDA farm loans come with low interest rates, backed by the federal government.

Who qualifies for FSA?

Direct Loans – To be eligible for a direct loan from FSA, a farmer must demonstrate sufficient education, training, and experience in managing or operating a farm. For all direct farm ownership loans, an applicant must have participated in the operation of a farm or ranch for at least 3 out of the past 10 years.

How much can I borrow from FSA?

Maximum Loan Limits FSA can guarantee standard Operating loans, Farm Ownership loans, and Conservation loans up to $1,825,000; this amount is adjusted annually each Fiscal Year based on inflation. The maximum loan limit for Land Contract Guarantees is $500,000.

How does a USDA direct loan work?

A USDA direct loan — also known as the Section 502 Direct Loan Program — is a mortgage made straight from the USDA. This home loan program is for low- to very-low income borrowers who wouldn't qualify for an affordable mortgage from other sources and otherwise wouldn't have access to quality housing in rural areas.

Is it hard to get a USDA direct loan?

Qualification is easier than for many other loan types, since the loan doesn't require a down payment or a high credit score. Homebuyers should make sure they are looking at homes within USDA-eligible geographic areas, because the property location is the most important factor for this loan type.

What is a Section 502 Direct loan?

Also known as the Section 502 Direct Loan Program, this program helps low- and very-low-income applicants buy decent, safe, and sanitary housing in eligible rural areas by providing payment assistance to increase their applicant's repayment ability.

What is a Section 502 guaranteed loan?

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas.

What is a guaranteed loan?

A guaranteed loan is a loan backed by a third party that will pay back the loan if you default on it. The third party can be an individual, corporation, or federal organization. Sometimes the government backs the loan, and other times, the borrower’s own paycheck serves as the guarantor.

How Does a Guaranteed Loan Work?

Borrowers who would like to purchase a home may not always meet the credit or down-payment criteria to qualify for a conventional mortgage. For instance, their credit scores may not be high enough or they may not be able to pay the 20% down payment.

What is payday loan?

Payday loans are typically small loans of $500 or less, and the balance is due on your next payday. You’ll use your upcoming paycheck to guarantee the loan, and your lender will electronically debit your account on the agreed-upon date. But payday loans can come with APRs that approach 400%, which is why they are banned in certain states. 1

What is the USDA guarantee?

The VA, FHA, and USDA offer various types of guaranteed mortgages designed to make homeownership affordable. The USDA guarantee for single-family-home mortgages, for example, covers 90% of the money the lender gives the borrower. 2

What happens if you default on a secured loan?

For instance, if you take out an auto loan, the vehicle is used as collateral. If you default on the loan, your lender will seize your vehicle.

Who backs the mortgage?

For instance, the federal government offers guaranteed mortgages to borrowers who may otherwise not be able to get a home loan. Borrowers apply for a mortgage through a private lender, and the government backs the loan. These mortgages are typically backed by the Department of Veteran Affairs (VA), Federal Housing Administration (FHA), and the U.S. Department of Agriculture (USDA).

Is a secured loan the same as a guaranteed loan?

It’s easy to confuse guaranteed loans with secured loans, but they aren’t the same thing. Both types of loans are less risky to the lender, but the loans operate in different ways.

What is a guarantee on a loan?

A loan guarantee is a legally binding promise to a lender that a third party will pay off a loan balance if the borrower misses payments or defaults. The third party is called a guarantor. The most common types of guarantors are the government and individuals.

Do you have to back a business loan with a personal guarantee?

Most guaranteed loans are backed by the government. But if you take out a business loan, you’re usually required to back it with a personal guarantee — even if you’re putting down collateral.

What is a guaranteed mortgage?

A guaranteed mortgage is a home loan that a third party guarantees, or agrees to be responsible for, if the borrower defaults. These kinds of mortgages are most often guaranteed by the government, and serve to protect the lender when granting a loan to a borrower who isn’t making a substantial down payment or otherwise might present more risk.

What percentage of down do you need for a guaranteed loan?

Guaranteed loans are a critical part of the mortgage marketplace, and it’s easy to see why. Generally, lenders prefer homebuyers purchase a home with 20 percent down, but many borrowers simply don’t have the cash to meet that threshold with today’s home prices.

How much insurance does an FHA loan have?

However, because FHA loans are insured by the government, borrowers pay two insurance premiums: one premium, paid upfront, equal to 1.75 percent of the loan principal; and an annual premium ranging from 0.45 percent to 1.05 percent of the balance, paid monthly.

Why do lenders look for a down payment?

While lenders look for a down payment to protect themselves in the event of default, they also want something else: to originate as many loans as possible. Many borrowers, simply put, don’t have the down payment funds necessary to qualify them for a loan.

When was Bankrate founded?

Founded in 1976 , Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Is the USDA loan a guarantee?

The Department of Agriculture also guarantees USDA loans in eligible areas. One point of distinction: The VA loan program is generally considered a “guarantee,” while the FHA loan program is viewed more as “insurance.”.

Is Bankrate a strict editorial policy?

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

What is SFHGLP 7 CFR?

7 CFR, Part 3555 - This part sets forth policies for the Single-Family Housing Guaranteed Loan Program (SFHGLP) administered by USDA Rural Development. It addresses the requirements of section 502 (h) of the Housing Act of 1949, as amended, and includes policies regarding originating, servicing, holding and liquidating SFHGLP loans.

What is Section 502 loan?

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural homebuyers – so no money down for those who qualify!

Is the list of active lenders searchable by state?

This list of active lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

What is a guaranteed farm loan?

With a guaranteed farm loan, the lender is FSA's customer, not the loan applicant. Guaranteed loans are the property and responsibility of the lender. The lender and loan applicant complete the Application for Guarantee and submit it to the FSA Service Center in their lending area. The Service Center works with the commercial lender to process the guarantee. The Farm Loan Officer reviews the application for applicant eligibility, repayment ability, adequacy of collateral, and compliance with other regulations, and if the applicant meets those requirements, the request is approved. The Service Center issues the lender a conditional commitment outlining the terms of the loan guarantee and indicating that the loan may be closed. The lender closes the loan and advances funds to the applicant, after which the Service Center staff issues the guarantee. The lender makes the loan and services it to conclusion. In the event the lender suffers a loss, FSA will reimburse the lender according to the terms and conditions specified in the guarantee.

How much does the FSA guarantee farm loans?

FSA will guarantee farm loans through a commercial lender up to $1,825,000. Financial institutions receive additional loan business as well as benefit from the safety net the FSA provides by guaranteeing farm loans up to 95 percent against possible financial loss of principal and interest.

What is EZ Guarantee?

This program provides a simplified Guaranteed Loan application process to help small, new or underserved family farmers with early financial assistance. The EZ Guarantee is available for loan applications up to $100,000 for farm operating or farm ownership purposes. Streamlined financial underwriting is available for these loans, allowing all approved lenders to analyze the request in the same manner in which they would analyze a nonguaranteed loan request of the same size and type. All existing eligibility, loan purpose, security, and other requirements remain the same.

How long does it take to repay a farm loan?

Operating Loans are normally repaid within 7 years and Farm Ownership loans cannot exceed 40 years. Operating Lines of Credit may be advanced for up to five years and all advances must be repaid within 7 years of the date of the loan guarantee.

What is a farm ownership loan?

FARM OWNERSHIP loans may be used to purchase farmland, construct or repair buildings and other fixtures, develop farmland to promote soil and water conservation, or to refinance debt. FARM OPERATING loans may be used to purchase livestock, farm equipment, feed, seed, fuel, farm chemicals, insurance, and other operating expenses.

What is operating loan?

Operating loans also may be used to pay for minor improvements to buildings, costs associated with land and water development, family living expenses, and to refinance debt under certain conditions. These loans may be structured as term loans or lines of credit depending upon the purpose and intended term of the loan.

Where does the money for a direct loan come from?

A direct loan is funded directly by the Agency. The money used for direct loans comes from annual Congressional appropriations received as part of the USDA budget. The Agency is responsible for making and servicing the loan.

What is a guaranteed student loan?

Under the guaranteed student loan program, private lenders like Sallie Mae and commercial banks issued student loans that the federal government guaranteed. Guaranteed loans are also called Federal Family Education Loans (FFELs). Here's how the "guarantee" works: If a borrower defaults on a guaranteed loan, the federal government pays ...

How does a guaranteed loan work?

Here's how the "guarantee" works: If a borrower defaults on a guaranteed loan, the federal government pays the bank and takes over the loan. The federal government pays approximately 97% of the principal balance to the lender. At that point, the federal government owns the loan and the right to collect payments on the loan.

What is the difference between a guaranteed loan and a direct loan?

The most important difference between guaranteed and direct loans is the availability of repayment programs. The federal government offers several repayment plans for low-income borrowers like the:

When did student loans start being guaranteed?

Prior to June 30, 2010, lenders issued federal student loans either as guaranteed student loans or as "direct" student loans. Direct loans are issued directly by the federal government. Whether you received guaranteed or direct loans depended on which loan program your school signed up for.

When did the student loan program stop?

As of June 30, 2010, Congress stopped the guaranteed student loan program for newly issued loans. But many people are still paying on their federally guaranteed student loans that were issued before June 30, 2010, so they'll be around for a while.

Do schools still offer guaranteed student loans?

Although schools no longer offer guaranteed student loans, the guaranteed student loan system will be in place for many years to come. That's because millions of borrowers still owe money on FFEL guaranteed loans.

When will student loans be exempt from tax?

The American Rescue Plan Act of 2021, which President Joe Biden signed into law on March 11, 2021, includes a provision exempting all student loan forgiveness after December 31, 2020, and before January 1, 2026, from federal taxation.