What is modified life insurance and should you buy it?

What is modified whole life insurance? Also known as modified premium whole life, a modified whole life policy comes with low introductory premiums.The premium goes up only once after the introductory period and then remains the same the rest of the time the policy is in force.Buying a modified premium policy is a way to obtain a higher death benefit sooner, before you’d normally be able to ...

Can You cash out modified premium whole life insurance policies?

With whole life insurance policies, a cash value is accrued, which means that policyholders are able to take a loan out against the cash value or “cash out” (terminate) their policy altogether. Since policyholders can take cash from their existing policy, it is not exempt from Medicaid’s asset limit.

What are disadvantages of whole life insurance?

Disadvantages. Higher Premiums. Because a whole life policy covers you for your entire life span, given you pay premiums on time, they typically have higher premiums associated with them. …. Cash Value May Not Accrue Quickly. As we’ve talked about, whole life policies can have a cash value. …. Complex Structure.

What is the difference of universal vs whole life insurance?

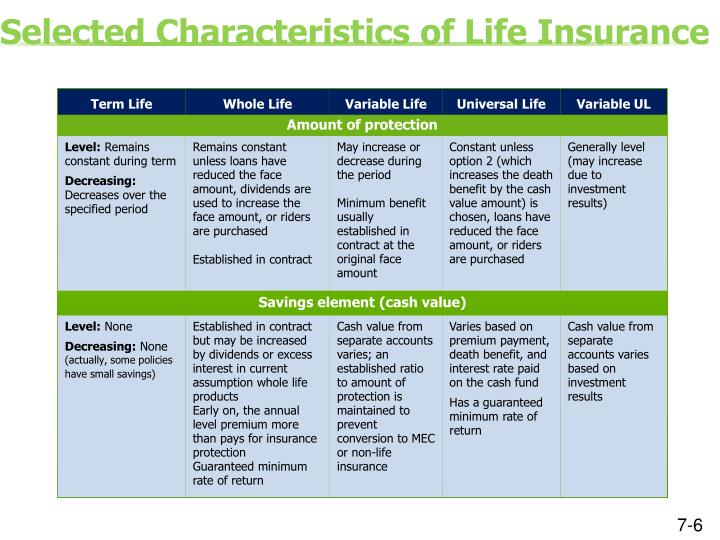

- All permanent life insurance lasts forever and has a cash value, but there are three main varieties.

- Whole life insurance has a guaranteed premium rate over the lifetime of the policy.

- Universal life insurance lets you change the death benefit, while guaranteed universal is a combination of whole and universal.

What's the difference between whole life insurance and modified whole life insurance?

Modified whole life insurance is permanent life insurance in which premiums increase after a specific period. Usually, after five or 10 years, the premiums increase but remain constant thereafter. Traditional whole life insurance premiums, in contrast, remain the same throughout the life of the policy.

How does modified whole life insurance work?

Modified whole life insurance is a policy where there is a waiting period during the first 2-3 years. During the waiting period, the insurance company will only refund all your premium payments plus interest for any non-accidental death. After the waiting period is over, the full benefit is payable for any reason.

Does modified whole life insurance have cash value?

Delayed cash value accumulation: Whole life insurance policies typically include a cash value component. However, because modified whole life plans have lower initial premiums, a cash value may not begin to accumulate until the premiums increase.

What is a modified premium policy?

With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. This period of lower premiums usually lasts through the first five to ten years of a policy's life, depending upon the issuing company.

What happens to cash value in whole life policy at death?

A permanent or whole life policyholder may take out loans or withdrawals against the cash value of the policy while he or she is still alive4. After the insured passes away the whole life insurance death benefit is distributed to beneficiaries, but any excess cash value may be retained by the insurance company.

Is modified whole life interest sensitive?

Is modified benefit whole life insurance interest-sensitive? No, a modified whole life policy isn't interest sensitive. The cash value will increase as you make 'full' premium payments, but not during the introductory period.

What is to be expected of a modified life policy?

Modified Life Insurance — an ordinary life insurance policy with premiums adjusted so that, during the first 3 to 5 years, the premiums are lower than a standard policy, and, in subsequent years, the premiums are higher than a standard policy.

How does a whole life policy work?

Whole life insurance works as a permanent policy that builds cash value over time. As long as the premiums are current, the policy remains active for the entire life of the policyholder, and beneficiaries will receive a set death benefit upon the insured's death.

What is a modified benefit?

The Modified Benefit Option (MBO) provides full-time employees in eligible classifications the opportunity to earn a higher hourly rate of pay (above base pay). For more information about the MBO and/or to determine if you are in an MBO eligible classification, please refer to your MOU.

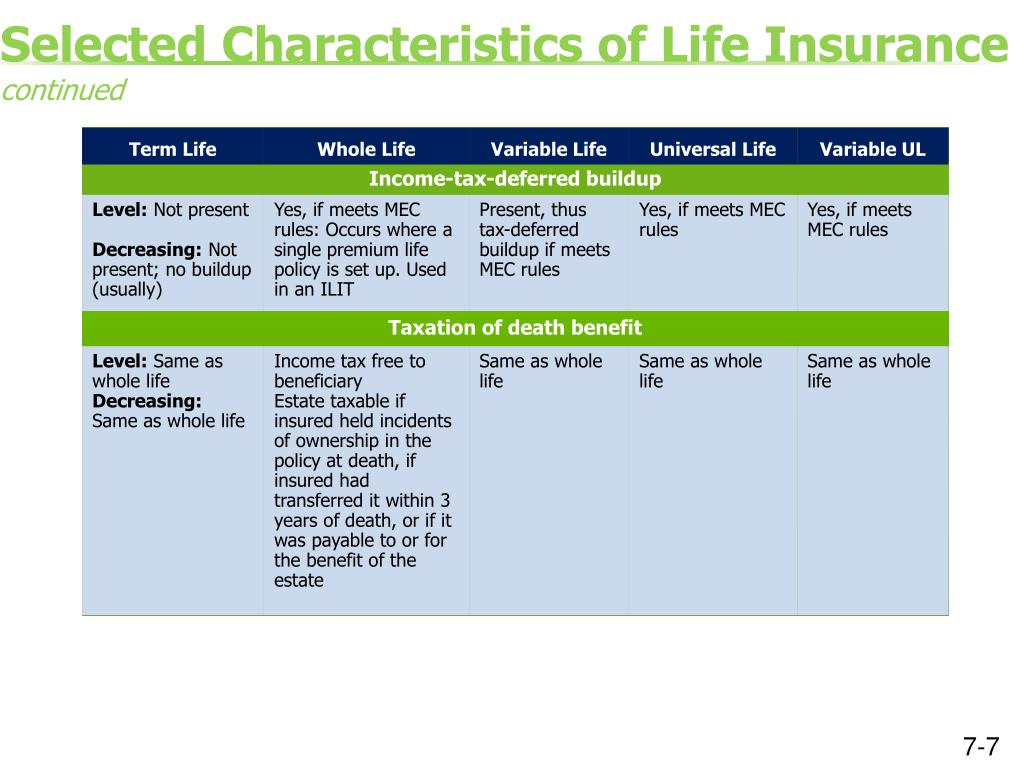

How does a life insurance policy become a MEC?

Policies become MECs when the premiums paid to the policy are more than what was needed to be paid within that seven-year time frame. Life insurance policies entered into before June 20, 1988, are not subject to the payment of premiums over the money allowed under federal laws.

Are whole life insurance premiums locked in?

When you purchase the policy, the premiums will be locked in for the life of the policy as long as you pay them. They will be higher than the premiums of a term life insurance policy because your entire lifetime is built into the calculation. Unlike term insurance, whole life policies don't expire.

What is a modified death benefit?

Modified Policies Modified policy benefits usually have a 2-year waiting period before the entire death benefit is paid to a beneficiary. If non-accidental death occurs before two years, the policy will only pay a return of premiums plus a percentage.

What is to be expected of a modified life policy?

Modified Life Insurance — an ordinary life insurance policy with premiums adjusted so that, during the first 3 to 5 years, the premiums are lower than a standard policy, and, in subsequent years, the premiums are higher than a standard policy.

What is a modified premium term to age 90 product?

Policy Description: This is a modified premium term-to-age-90 product. The initial term period can either be 1, 2, 3, 4, or 5 years in duration, depending upon issue age. All renewal term periods begin at a 5-year plus one age (i.e. 21, 26, 31, 36 … 86) and will be 5 years in length except for the final term period.

What is a modified benefit?

The Modified Benefit Option (MBO) provides full-time employees in eligible classifications the opportunity to earn a higher hourly rate of pay (above base pay). For more information about the MBO and/or to determine if you are in an MBO eligible classification, please refer to your MOU.

How does a life insurance policy become a MEC?

Policies become MECs when the premiums paid to the policy are more than what was needed to be paid within that seven-year time frame. Life insurance policies entered into before June 20, 1988, are not subject to the payment of premiums over the money allowed under federal laws.

What is modified whole life insurance?

Modified whole life insurance, also known as modified premium whole life, offers low premiums for an introductory period, after which your premiums increase significantly.

Why is modified whole life insurance less common?

Modified whole life insurance is less common because there’s little upside for the life insurance company or insurance buyers. If you can afford the initial lower premium offered under a modified policy but can’t make payments once your premium increases, you lose out on coverage and your provider loses a customer.

How often does a whole life insurance premium go up?

The premium goes up only once and then remains the same as long as the policy stays in force. Many modified whole life policies don’t allow you to contribute to your policy’s cash value during that introductory period.

What happens if you can't pay your insurance premiums?

If your premiums go up and you can’t pay them, your policy will lapse and you could be liable for high surrender fees. More importantly, your family will lose out on your policy’s financial protection.

What to do if you are considering a modified whole life policy?

If you are seriously considering a modified whole life policy, carefully review your budget and consult with a financial advisor to ensure it’s the best choice for you and your family.

Can you contribute to cash value on modified insurance?

Modified policies differ in their lower initial premiums, and you’re usually barred from contributing to your cash value during the modified premium period.

Does cash value grow with insurance?

No. Your cash value will grow based on an interest rate set by your insurance provider.

Who and What Is Modified Whole Life Insurance Good For?

Modified whole life insurance policies are typically only a good choice for individuals who want a permanent policy with a substantial death benefit and who anticipate an improved financial situation that should allow them to afford higher premiums at a future time.

Why are modified whole life insurance plans more complex than standard plans?

Increased complexity: Because modified whole life insurance plans use alternative premium payment structures, contracts may be more complex than those of standard plans.

Is modified whole life more expensive than traditional?

Overall expense: Modified whole life plans may appear to be more affordable than traditional plans, but the steep increase in premiums that occurs later in the life of these plans may make them more expensive overall.

Does death benefit change over life of modified policy?

Uniform value: Despite lower initial premiums, the death benefit doesn’t change over the life of a modified policy.

Do modified life insurance policies expire?

However, unlike whole life policies, which last for the lifetime of the insured, term policies expire after a predetermined amount of time, as specified in the contract. Term policies also don’t typically include a cash value component.

What is the difference between whole life and modified whole life insurance?

The main difference between these types of life insurance is the change in premium amounts.

What are the advantages of modified life insurance?

Modified life insurance premiums may have lower premiums than other types of life insurance in the early years of the policy, which can make them more affordable for younger people who are in the earlier stages of their career.

How is modified life insurance different from convertible life insurance?

Convertible life insurance is a type of term life insurance that allows the policyholder to convert their term policy to a whole life policy after a certain number of years. The premium will be adjusted when the conversion is made.

What is a modified death benefit?

Modified death benefits are more commonly referred to as “increasing” or “rising” death benefits.

How long does it take for a modified life insurance policy to pay out?

A second drawback of modified life insurance is that there is often a waiting period of 2-3 years upon the start of the policy. That means the policy may not pay out any death benefits for an accidental death that occurs during that waiting period.

How long does modified life insurance last?

This fixed period generally lasts 5-10 years. Premiums typically increase only one time, after which they usually remain consistent for the rest of the policy’s term.

Why does a death benefit stay the same?

Because the policy’s death benefit (also called the payout) stays the same, so the policy will pay the same benefit if the insured person passed away during the lower premium years of the policy as it would during the higher premium years.

What Is Modified Premium Whole Life Insurance?

Modified whole life insurance works the same as an ordinary whole life insurance policy except in how it is funded. These policies have premiums that are lower than those of typical whole life policies during the first few years, then increases afterward.

How Is The Premium Modified?

The coverage and premium are based as if it was a term life policy during this time. After the term is complete, the premiums increase. The increased premium is higher than that of a typical whole life policy.

Find The Best Whole Life Insurance Coverage At The Cheapest Cost!

Compare whole life insurance quotes from 25 companies in seconds. Then, apply for coverage in less than 10 minutes.

What is modified benefit whole life insurance?

With these modified-benefit whole life insurance policies, the premiums are fixed, but the benefit amount changes.

Why Buy Modified Whole Life Insurance?

Modified premium whole life may be a good option for younger applicants who anticipate having more disposable income down the road.

Why are life insurance companies hesitant to cover applicants with certain health problems?

Life insurance companies are hesitant to cover applicants with certain health problems out of fear that the insured will die early and the company will have to pay out a big death benefit on a policy that hasn’t contributed much premium.

What is whole life insurance?

“Whole life” is permanent life insurance guaranteed to retain the same death benefit for the entire life of the insured person. A whole life policy won’t expire or lapse (other than for failure to pay premiums), and, in most cases the premiums are fixed.

What is modified premium?

Modified (or “modified premium”) whole life insurance is whole life insurance with a twist.

What happens if you no longer need life insurance?

And if you decide you no longer require life insurance, you can surrender the policy, and the insurance company will hand you a check for the cash surrender value.

Is modified whole life a good choice?

In those scenarios, the policyholder pays less premium for the same death benefit, so modified whole life was a great choice.

What Is Modified Whole Life Insurance?

Modified whole life insurance is a policy where there is a waiting period during the first 2-3 years. During the waiting period, the insurance company will only refund all your premium payments plus interest for any non-accidental death.

What is a modified life insurance plan?

A modified plan is just a type of final expense insurance.

How long do you have to wait to get a whole life insurance policy?

A whole life insurance policy is very straightforward. Here’s the fine print you need to know: For modified premium whole life, some companies have a 2-year waiting period and some make you wait 3 years.

What is the term for full immediate coverage?

Insurance companies will often use the words “level”, “preferred” or “standard” to describe this type of plan.

How long does it take for a partial coverage plan to pay out?

As a short recap, there are partial coverage plans that payout a portion of the death benefit during the first two years and there are plans that will pay out 100% of the benefit right away.

What is the most important thing about life insurance?

The most important thing you must understand about life insurance is that it’s impossible for any one company to be the best option for every person.

What are the drawbacks of modified benefit whole life plans?

The bad: Modified benefit whole life plans have two major drawbacks which are the waiting period & the premiums. These plans accept applicants who have very serious health issues. For that reason, the insurance company takes on a lot of risk.

What is a benefit of buying a Modified Whole Life Insurance policy?

Though modified premium whole life’s monthly premiums are lower than a whole life policy during the early years, the face amount remains the same throughout the life of the policy. This is of value to a policy owner who needs a set face amount for a lower premium early in life and can comfortably pay the higher premium in upcoming years.

Can Modified Premium Whole Life Insurance be used for my business?

Businesses that are start-ups or are in their early stages will also find modified premium whole life beneficial. These businesses often need to use life insurance to fund key-person policies or buy- sell agreements. Because of limited cash flow, modified premium policies allow these needs to be met now, and be affordable in the future.

What is modified whole life?

Modified Premium Whole Life Policies are permanent life insurance contracts with level death benefits where the initial premiums that are much lower than regular straight whole life insurance during the first few years of the contract (usually five.) As a matter of fact, during the initial period, premiums for modified whole life are only slightly higher than a term life insurance policy.

What is graded whole life insurance?

Graded premium whole life insurance is similar to modified whole life insurance in that premiums are in the first few years when compared to straight whole life insurance. However, instead of the premium “jumping up” all at once, a graded premium whole life contract “steps up” periodically so that they are higher than those of a straight whole life insurance policy.

Does a modified whole life contract require higher premiums?

However, after these first few years of lower premiums, a modified whole life contract requires higher premiums when compared to straight whole life as the policy owner has to “make up” those years to fund the contract correctly.

Can you convert a term life insurance contract to a permanent life insurance contract?

For those who only want to keep premiums low while having immediate death benefit protection, Term Life Insurance can be used. Most term life insurance contracts have a “convertibility” feature that allows a policy owner to convert the contract to a permanent life insurance contract in the future without having to show evidence of insurability.

What Is Whole Life Insurance?

Whole life insurance is the most common permanent life insurance policy. As the name suggests, it’s suitable for your entire life as long as you make the premium payments.

What is Modified Whole Life Insurance?

Modified whole life insurance is like whole life, but with a different premium structure. It has the same benefits – a death benefit and cash value, but it differs how you pay for it.

Final Thoughts

Whole life and modified whole life insurance sound similar, but they have a significant cost difference. Don’t fall for the advertising of modified whole life insurance. Make sure you understand it, how it works, and what it will cost to assure it’s right for you.