Monthly Profit and Loss statements, also known as income statements, are financial statements prepared by a company to assess its financial performance. They are always prepared over a period of time - monthly, quarterly, yearly, etc.

How to prepare a profit and loss statement?

Preparing a Pro Forma (Projected Profit and Loss Statement

- List all possible expenses, over-estimating so you aren't surprised. Don't forget to add a category for "miscellaneous" and an amount.

- Estimate sales for each month. Under-estimate sales, both in timing and amount.

- The difference between expenses and sales is usually negative for some period of time. ...

How to create a profit and loss statement?

What Is the Difference between Your P&L Statement and a Balance Sheet?

- Expand your business within a specific geographic area

- Explore a new market or launch a side project

- Grow your production capacity

- Hire more employees or contractors

- Stop selling a product with low revenue and high costs

- Invest more in a new department or product line

How to understand a profit and loss statement?

This statement is important for assessing:

- The company’s ability to generate cash from operations

- Free Cash Flow Free Cash Flow (FCF) Free Cash Flow (FCF) measures a company’s ability to produce what investors care most about: cash that's available be distributed in a discretionary ...

- How much money has been raised (debt and or equity)

- The net change in cash position over the period

What is a profit and loss statement?

The term profit and loss (P&L) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. These records provide information about a company's ability or inability to generate profit by increasing revenue, reducing costs, or both.

What is monthly P&L?

What is a monthly income statement? Your income statement, also known as the profit and loss statement (P&L), summarizes your business revenue and operating expenses over a period of time.

What is a profit and loss statement example?

The profit and loss statement (P&L), also referred to as the income statement, is one of three financial statements companies regularly produce....Example of a P&L Statement.Total Revenue$1,000,000Gross Profit$621,300Gross Profit Margin62.13%Less ExpensesAccounting/Legal Fees$15,50013 more rows

How do you get a profit and loss statement?

How to Write a Profit and Loss StatementHow to Create a P&L Statement. ... Step 1 – Track Your Revenue. ... Step 2 – Determine the Cost of Sales. ... Step 3 – Figure Out Your Gross Profit. ... Step 4 – Add Up Your Overhead. ... Step 5 – Calculate Your Operating Income. ... Step 6 – Adjust for Other Income and/or Expenses.More items...

What is a profit and loss statement for self employed?

A profit and loss (P&L) statement, which may also be called an income statement or income and expense statement, allows a business owner to see in one quick view how much money they are bringing in and spending—and how.

Is profit and loss account same as income statement?

An income statement is the same thing as a profit and loss statement, with the two terms used interchangeably. A profit and loss statement shows a company's total income, summing up revenue and business costs in order to find their net profit for a given period of time.

What is a profit and loss statement for a business?

A profit and loss (or income) statement lists your sales and expenses. It tells you how much profit you're making, or how much you're losing. You usually complete a profit and loss statement every month, quarter or year.

Can an accountant do a profit and loss statement?

The primary functions of a CPA who performs an audit on a profit-&-loss statement are to generate an independent opinion of the income and expense items reported and to express his opinion in a written statement. CPAs who perform audits are third-party reviewers of profit and loss information.

Do you need a profit and loss statement for self-employed?

The IRS requires sole proprietors to use Profit or Loss From Business (Sole Proprietorship) (Schedule C (Form 1040)), to report either income or loss from their businesses.

Why do I need a profit and loss statement?

P&L statements are important, because many companies are required by law or association membership to complete them. A P&L statement also helps a company's management team (including its board of directors) to understand the business's net income, which may be helpful in decision-making processes.

Is a profit and loss statement the same as Schedule C?

You will need the following information to complete your Schedule C: A profit and loss statement, sometimes called an income statement, for the tax year. A balance sheet for the tax year. Statements relating to the purchase of any business assets during the tax year, including vehicles, equipment, and property.

How do I fill out a Centrelink profit and loss statement?

0:001:31How to Fill Out a Profit and Loss Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipUse field 2 to fill in your business's. Total income then use fields 3 through 17 to fill in yourMoreUse field 2 to fill in your business's. Total income then use fields 3 through 17 to fill in your business expenses specify your total operating expenses in field 18.

How do you calculate profit and loss on a balance sheet?

To calculate the accounting profit or loss you will:add up all your income for the month.add up all your expenses for the month.calculate the difference by subtracting total expenses away from total income.and the result is your profit or loss.

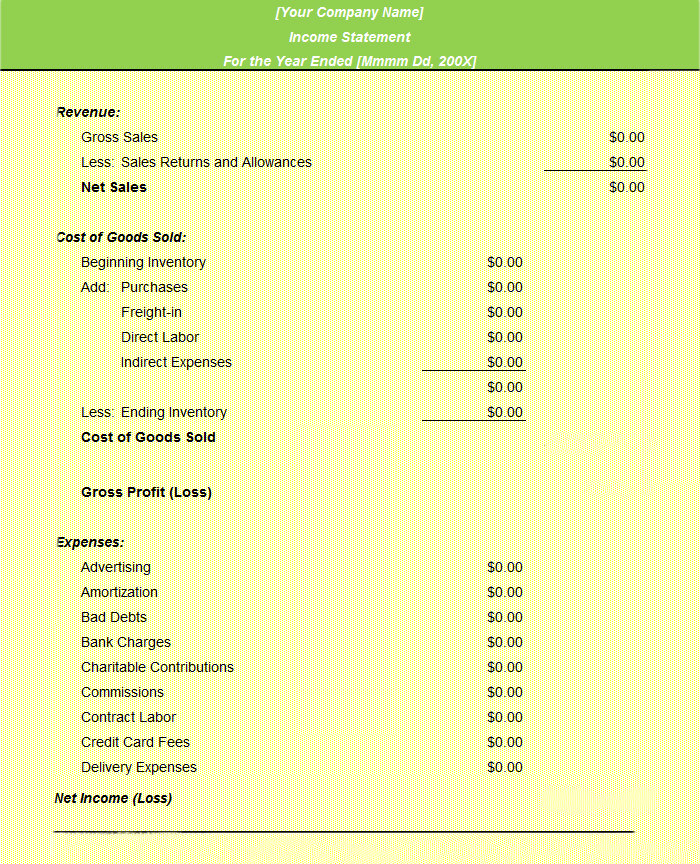

How do you create a profit and loss statement in Excel?

How to Create a Profit and Loss Statement in ExcelDownload, Open, and Save the Excel Template.Input Your Company and Statement Dates.Calculate Gross Profit.Input Sales Revenue to Calculate Gross Revenue.Input the Cost of Goods Sold (COGS)Calculate the Net Income.Input Your Business Expenses.More items...•

Does QuickBooks do profit/loss statements?

QuickBooks Online makes it easy to generate an accurate profit and loss statement. The profit and loss statement is one of the most important tools for business owners. It details whether the business is operating at a profit or a loss for a specific period of time.

What is a P&L statement?

What is the Profit and Loss Statement (P&L)? A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The P&L statement shows a company’s ability to generate sales, manage expenses, ...

What is the purpose of statement of cash flow?

The statement of cash flow shows how much cash a company generated and consumed over a period of time. It consists of three parts: cash from operations, cash used in investing, and cash from financing. This statement is important for assessing:

How to assess a business?

To properly assess a business, it’s critical to also look at the balance sheet and the cash flow statement. 1. Analyzing the Balance Sheet. The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time.

What is profit and loss statement?

Profit and Loss Statement is prepared to ascertain the net profit or net loss made by the company during the accounting period#N#Accounting Period Accounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. This might be quarterly, semi-annually, or annually, depending on the period for which you want to create the financial statements to be presented to investors so that they can track and compare the company's overall performance. read more#N#. This is one of the most important objectives of the business. This is also important to various other parties. It also summarizes our revenue and expenses, thus analyzing how money has come and how it goes out.

What are the two formats of P&L statements?

In India, there are basically two formats of P&L statements. The horizontal format of P&L Account. The vertical format of P&L Account. In a horizontal format, the “T shaped structure” for preparing the P&L account is used. It has two sides – Debit & Credit.

What is GAAP accounting?

GAAP Generally accepted accounting principles (GAAP) are the minimum standards and uniform guidelines for the accounting and reporting. These standards prohibit firms from engaging in unethical business activities and enable for a more accurate comparison of financial reports to investors. read more.

Why is it important to monitor profit and loss?

The importance of monitoring your business’s profit and loss statement are: When complete breakdown of monthly revenue and expenditure is available, you can make better financial decisions with respect to continuance or discontinuance of certain products or curtailing of any specific expenditure.

What is a P&L statement?

Profit and loss (P&L) statements (aka, income statements) provide an overview of the revenues and expenses your business incurs over a certain period. Monthly profit and loss statements provide better insights about the operating position of a company than an annual profit and loss statement, which only shows the yearly results.

What is amortization in profit and loss?

Depreciation and amortization are non-cash expenditures in the profit and loss statement . It refers to the amount of wear and tear on fixed assets over a period of time. The same is calculated based on a number of factors including the life of the asset, its nature, depreciation rate, and depreciation method.

What is operating expense?

Operating Expenses are the costs associated with products or services that are not directly linked to the production of goods or the provision of services. They include administration and marketing overheads.

What is interest expense?

Interest expense is of a non-operating nature, and is incurred for borrowing long-term debt, bonds, loans or any other form of credit. You have to populate the template with the amount of accrued interest and not just the amount actually paid out.

Why do we need a profit and loss report?

Another reason to generate a profit and loss report is because it’s required by the IRS to assess taxes on the business profits.

What is a P&L report?

The profit and loss ( (P&L) report is a financial statement that summarizes the total income and total expenses of a business in a specific period of time . It is also known as the income statement or the statement of operations.

What is gross profit?

Gross Profit: Also known as gross income or gross margin, the gross profit is net revenue excluding costs of sales. 4. Operating Expenses: Operating expenses are administrative, general and selling expenses that are related to running the business for a specific period of time.

What is included in operating income?

This includes rental expenses, payroll, utilities and any other expense required to operate the business. Also included are non-cash expenses such as depreciation. 5. Operating income: It refers to earnings before taxes, depreciation, interest and authorization.

How does the single step method work?

Primarily used by service-based industries and small businesses, the single-step method determines net income by subtracting expenses and losses from revenue and gains. It uses a single subtotal for all revenue line items and single subtotal for all expense items. The net gain or loss appears at the bottom of the report.

What is the bottom line of a profit and loss statement?

The bottom line of the profit and loss statement is your net earnings—the total profit for your business, taking into account all internal and external expenses.

What is a P&L statement?

What is a profit and loss statement? A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. It shows your revenue, minus expenses and losses. The result is either your final profit (if things went well) or loss.

Why do small businesses need a P&L statement?

One of the most common reasons small businesses start producing profit and loss statements is to show banks and investors how profitable their business is.

What does gross profit mean?

Gross profit. When you subtract COGS from your sales revenue, you get gross profit. This number tells you how profitable your business is after taking into account direct costs, but before taking into account overhead costs. You can consider it a rough measure of how your business is performing.

What are general expenses?

Also referred to as “operating expenses,” general expenses include rent, bank & ATM fees, equipment expenses, the cost of marketing & advertising, merchant fees, and any other expenses you incur in order to keep your business running.

What is operating earnings?

It’s a measure of how profitable your business is, without taking into account external costs, like interest payments, taxes, depreciation, and amortization.

What is cost of goods sold?

Cost of goods sold. Abbreviated as “ COGS ,” this is the cost of producing the goods or services you sold to your customers during the reporting period. COGS involves only direct expenses: Raw materials, labor, and shipping costs.

What is a P&L statement?

Most importantly, a P&L statement can help you make key decisions about where to cut costs and how to up profits. You don’t have to prepare a P&L statement on your own. Plenty of accounting software will do it for you. But if you don’t want to invest in accounting software or you just want to draw up your own statement, ...

How to figure out your profit?

To figure out your profit, you can’t just add up your revenue, but you also have to account for expenses like rent, employee paychecks, damaged inventory, bank fees, business internet and phone plans, and a host of other possible revenue-draining activities. Enter the profit and loss (P&L) statement, or income statement.

How to calculate gross margin?

You can also calculate your gross margin, which represents your gross profit as a percentage. Just subtract your direct costs from your gross revenue, and then divide that number by the gross revenue. Then simply multiply that number by 100.

What is non operating expense?

Non-operating expenses are (hopefully) one-time expenses like legal fees, tax penalties, or interest on a business loan. Here’s where things get a little confusing. There are multiple terms for operating expenses that mostly mean the same thing but that can be split into separate categories on your P&L statement.

What is the meaning of depreciation?

Depreciation refers to the constantly lowering value of your business’s physical assets, like a company car or office building. The more you drive the car, the more its value depreciates.

What is EBIT in accounting?

Earnings before interest and taxes (EBIT): The total of your business’s net income without accounting for income taxes and loan interest . Earnings before tax (EBT): The total of your business’s net income plus the taxes you expect to pay (based on your business’s projected tax liabilities).

How to see how profitable your business is?

Now that you’ve totaled your revenue, it’s time to see just how profitable your business is by adding up your direct costs, or costs that relate directly to the production of the goods you sell. If you sell a physical product, direct costs can also be called COGS, or cost of goods sold —in other words, how much it costs to make the goods you sell.

What is a monthly P&L template?

The monthly P&L template is perfect for businesses that require regular reporting and detail. By showing all of the information in a series of monthly columns, much more detail is visible than if only the annual figures were shown.

What is the purpose of income statement?

Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or. ) summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period.

What is gross profit?

Gross Profit. Gross Profit Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross profit margin. Advertising & Promotion.

How long is a fiscal year?

Fiscal Year (FY) A fiscal year (FY) is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. or year-to-date.

What is accounting for income tax?

Accounting For Income Taxes Income taxes and its accounting is a key area of corporate finance. Having a conceptual understanding of accounting for income taxes enables. Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements.