A mortgage note is a legal document in which borrowers agree to terms with the lender, or mortgagee A mortgage is a security interest in real property held by a lender as a security for a debt, usually a loan of money. A mortgage in itself is not a debt, it is the lender's security for a debt.Mortgage law

What kind of information does a mortgage note contain?

The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment. Although the home loan process involves both a mortgage and a mortgage promissory note, the note can be used singularly in a lending relationship between two individuals.

What does a mortgage loan note look like?

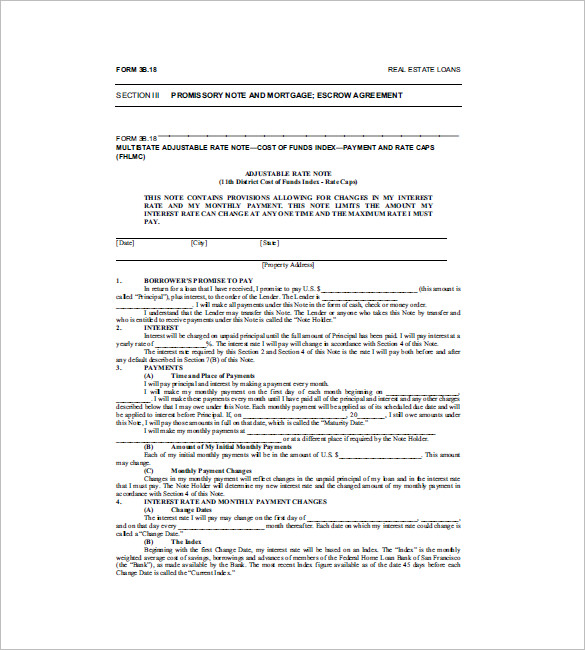

The mortgage note consists of a promissory note, and a mortgage or deed of trust. The mortgage note contains key details about your loan ... promissory note looks like. When taken together ...

What is the best description of a mortgage note?

- A mortgage note is the legal contract between you and your lender that requires you to pay off the mortgage

- Also called a promissory note, the document should refer to the amount you're borrowing as well as the interest rate

- The mortgage note will state what happens if you fall behind on your loan payments or default

How to find my mortgage note?

- You can check your monthly mortgage billing statement. Your servicer is the company that sends you the bill for your payment.

- Look at your payment coupon book if you have one. ...

- If you have a Mortgage Electronic Registration System ( MERS) loan, call the MERS Servicer Identification System toll-free at 888-679-6377 or visit the MERS website. ...

How do I find my mortgage note?

The mortgage note is signed during the home closing, and you can get a copy of it from the lender, your broker, and even from the county recorder.

What is another name for a mortgage note?

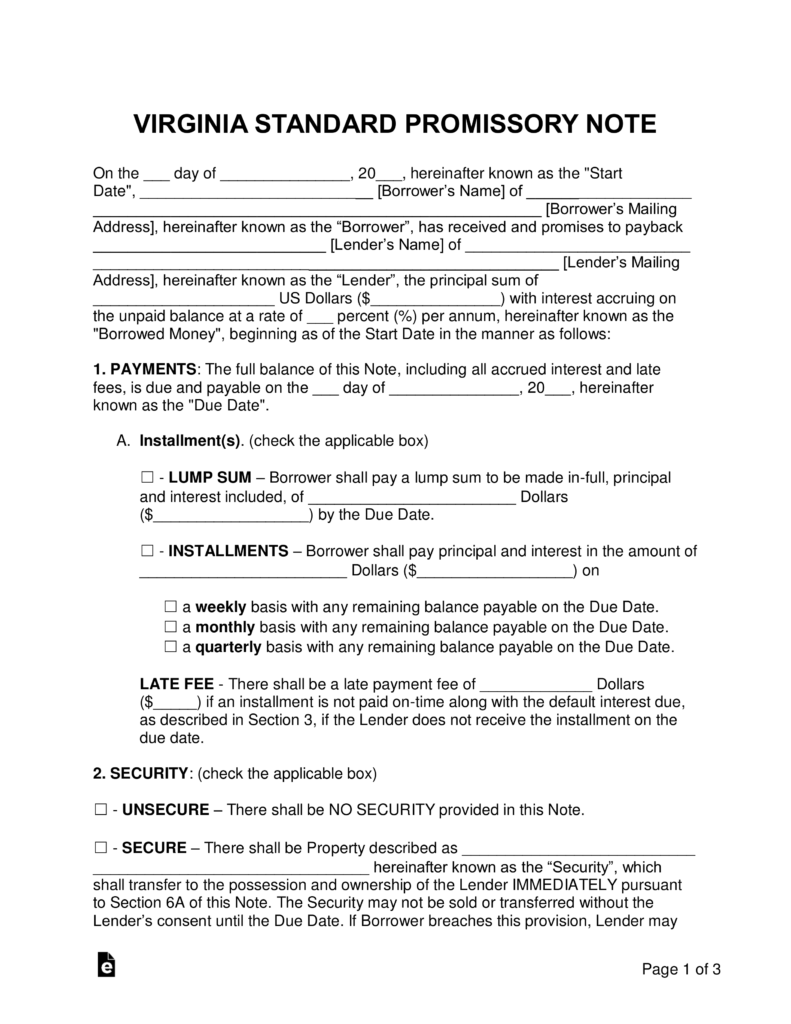

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

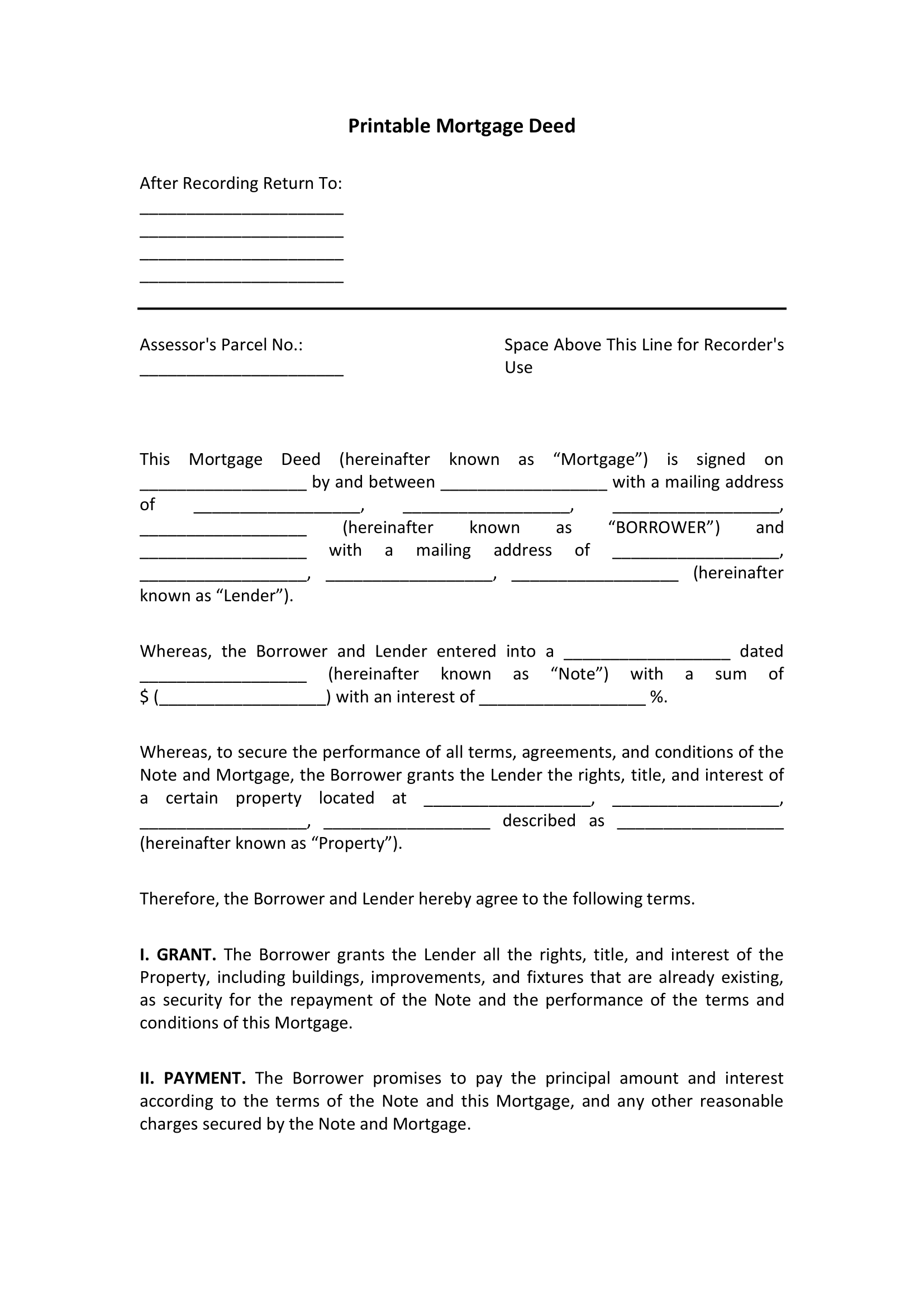

Is a mortgage note the same as a deed?

To Recap: The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

What does the mortgage note provide?

A mortgage note, also known as a promissory note, is a legal record of the borrower's promise to repay the loan. It spells out the terms of the mortgage, including the monthly payment and interest rate and consequences for late or missed payments.

Does every mortgage have a note?

If a borrower refinances a mortgage, the new mortgage pays off the original lender and a new note is created, to be held by that lender until the new mortgage is paid in full. In the event of a refinance, the borrower will not have the note or deed to the home.

How much does a mortgage note cost?

Most mortgage note investments range from $20,000 to $50,000 per note. The cost will vary based on several factors, including the age of the note, payment history, loan-to-value ratio, and more.

Is a mortgage note a contract?

Your mortgage note is also a contract pledging your property as security for the money you're borrowing. It gives the lender the right to repossess the property if you don't keep your end of the bargain by making payments promptly and regularly, as spelled out in the contract.

What is the difference between a title and a note?

Note vs. Title. If you purchase property and have a note, the note is related to the lender and the title is related to ownership of the property from a governmental standpoint. For example, property taxes are charged to the people on the title, not the person who holds the note.

Can my wife be on the title but not the mortgage?

Yes, you can put your spouse on the title without putting them on the mortgage. This would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Is a promissory note the same as a mortgage note?

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

What is the first mortgage note?

First Mortgage Note means a promissory note evidencing a loan secured by a First Mortgage.

What does it mean to be on the mortgage but not on the note?

But just because they are on the Mortgage, doesn't mean they are on the Note. For example, often times one spouse may have bad credit so they are not on the Note (lenders sometimes say “they are not on the loan”), but both spouses are on the Deed, so both spouses have to be on the Mortgage.

What is a difference between a note and mortgage document?

1. A note is a document that an individual signs promising to pay the other person or lender the sum that has been borrowed. 2. A mortgage is a document that an individual signs with a lender by pledging the property against the money that is borrowed.

What is meant by promissory note?

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

Where is the Loan Note number?

Need help locating your Loan Note Number? To locate your loan note number, on your most recent loan statement look in the top right corner for the loan account number. There is a dash after the account number and then five numbers. The last two numbers of those five are the loan note number.

What is the mortgage deed?

The Mortgage Deed is the document that states that you and the lender have agreed to use the property as a security to protect the mortgage. The Deed contains information on the conditions of the mortgage, repayment schedule, length of the mortgage, mortgage rates, type of mortgage and security for the mortgage.

Reasons Consumers Choose Private Mortgages

Stricter lending requirements and bruised credit scores led to an influx of private mortgage notes after the recent recession.During the recession,...

Risks of Holding A Mortgage Note

Those who own a private mortgage note are essentially acting as the bank would in a traditional mortgage and thus assume the risk just as the bank...

Facts on Selling A Mortgage Note

If someone with a mortgage note would rather not wait to receive the monthly payments, he or she can sell their mortgage note in exchange for a lum...

Why Should You Sell Your Mortgage Note?

One of the benefits of owning a private mortgage note is that it’s an easy investment to quickly liquidate. Some owners find that they’d rather hav...

How Can You Sell Your Mortgage Note?

These are the steps to selling a mortgage note: 1. Gather all of the details of the note you own. 2. Provide these details to a mortgage note purch...

What is a mortgage note?

Your mortgage note lays out all the specifics of your loan , including the following:

How to buy mortgage notes?

Mortgage notes can be purchased through mortgage note brokerages (you can find hundreds online). They can also be purchased in shares of mortgage bundles through real estate investment trusts or other similar products. This is a fairly complicated venture, however, so you’ll want to do lots of research before you jump in.

What is owner financing?

With owner financing, the homeowner not only sells the home, but also loans the buyer the money to make it possible. “Oftentimes, owner financing can be a form of financing for buyers who experience difficulties obtaining a traditional mortgage loan through a bank,” Noblitt explains.

Why is a mortgage note important?

A mortgage note is an important piece of paperwork to keep in your files for a variety of reasons. Here’s a rundown of what’s on this document, and why it matters.

Do banks issue mortgage notes?

Banks and other lending institutions are not the only ones to issue mortgage notes. In fact, “Mortgage notes are often associated with sales of property using owner financing,” says Alan Noblitt, owner of Seascape Capital, based in San Diego.

Do mortgage notes change with each new owner?

The important thing to know is that the terms of your mortgage note do not change with each new owner, who is required by law to see that the terms remain the same.

Do you need a copy of your mortgage if your home is destroyed?

However, if disaster strikes and you’re unprepared, know that your lender has a copy as well.

What Does a Mortgage Note Include?

Though they may sound complicated, mortgage notes actually contain all the information buyers and sellers need to keep track of the mortgage repayment schedule on a piece of property. It may help to look at a sample mortgage note if you’re wondering, “What does a mortgage note look like?”. The note first lists the amount of the mortgage loan. Due to the buyer placing a down payment on the property, this will likely not be the actual price of the property. The mortgage note then identifies the interest rate of the loan, or how much on top of the principal loan the buyer will pay the seller. Next comes the length, or term, of the mortgage loan. This simply states in what amount of time the loan needs to be paid off. Next, similar to a rental agreement, the mortgage note states what dates each monthly payment will be due from the buyer. This could be the first or last of the month or any other agreed-upon day, but it is generally the same time every month. Finally, the mortgage note details the penalties for missing payments, including late fees and the seller’s right to foreclose on the property if necessary to recover income lost from the buyer’s chronic payment defaults.

How does a mortgage note work?

The best way to understand how a mortgage note works is to look at a sample of a mortgage loan and to look at a seller-financed mortgage. In this scenario, the person selling the home finances the buyer’s purchase, and the buyer makes regular monthly installments to pay down their debt. The contract between these two parties is called a mortgage note (or promissory note).

What does it mean when a mortgage note is offloaded?

Offloading a mortgage note also means the seller no longer has to collect payments or deal with the day-to-day management of the mortgage — a big benefit to an already busy investor.

Why do mortgage notes have acceleration clauses?

Might contain an acceleration clause – Because mortgage notes pose more risk, a seller may consider adding an acceleration clause to the contract. These make the buyer liable for the entire remaining balance of the loan if they miss a payment.

What is mortgage deed?

A mortgage (or mortgage deed), on the other hand, is a document outlining the collateral that secures the loan — i.e., the house, property, piece of land/real estate . Mortgage deeds are security instruments, meaning if the borrower doesn’t pay back their loan, the property can be sold to repay that debt and cover the lender’s losses.

What is it called when you sell a mortgage note?

When someone decides to sell a mortgage note, this is called a loan assignment .

What is the difference between a deed of trust and a mortgage?

The main difference is that one involves two parties and the other involves three. With a mortgage, there is just the lender and borrower . When a deed of trust is used, there are three: the lender, the borrower and a trustee, who holds the property’s title until the loan is paid off.

Why Should You Sell Your Mortgage Note?

One of the benefits of owning a private mortgage note is that it’s an easy investment to quickly liquidate. Some owners find that they’d rather have a large lump sum in lieu of a slow trickle of scheduled payments. Other owners sell a portion of their future payments to get a lump sum to handle a sudden financial need.

What are the risks of holding a mortgage note?

Risks of Holding a Mortgage Note. Those who own a private mortgage note are essentially acting as the bank would in a traditional mortgage and thus assume the risk just as the bank does. Every loan comes with both the benefit of earning interest and the risk of failure to pay.

What happens when a note is sold as a lump sum?

When a note owner wants to convert his or her note into a lump sum, the owner begins the private mortgage note selling process.

What is a private mortgage?

In a private mortgage, the borrower makes payments to a private person or entity directly. That person or entity can choose to continue to receive payments, or sell their note for a lump sum.

What led to the influx of private mortgage notes after the recession?

Stricter lending requirements and bruised credit scores led to an influx of private mortgage notes after the recent recession.

Is a mortgage note a promissory note?

As such, mortgage notes fall into the category of promissory notes, which include all legal documents detailing repayment, including mortgage notes, as well as other types of loans. Mortgage notes act as an easily liquidated asset. Owners of private mortgage notes are able to choose to keep receiving the monthly payments described in ...

What Does a Mortgage Note Look Like?

As previously mentioned, a mortgage note is a legal document that lists all the essential financial details of your loan and repayment plan. The note should contain the following information.

How to Get a Mortgage Note

Mortgage notes are typically issued by a lending institution, such as banks, credit unions, and other financial institutions. While you can get a copy of your mortgage note, the original note is only given to you when you repay your loan. Here are a few ways you can get a copy of a mortgage note.

Key Takeaways

Many are not familiar with the mortgage note definition, but understanding it is crucial to the home-buying process.

Difference Between a Mortgage and Promissory Note

The primary difference between a mortgage and a promissory note is that the real property secures a mortgage while a promissory note is unsecured. This means that if you default on your payments, the lender can initiate a foreclosure process wherein the mortgage note will serve as a security instrument to recoup the losses.

Conclusion

A mortgage note is a legal document that lays down the terms and conditions of a mortgage loan. It’s different from a promissory note in that a promissory note is unsecured, whereas your home secures a mortgage note. A mortgage note includes the loan amount, repayment terms, interest rate, etc.

What is a mortgage note?

Mortgage notes, also known as promissory notes, are legal documents that state how the borrower will repay the loan. It also agrees to use the home as collateral if the monthly mortgage payments are not met. It is designed to provide mortgage lenders with security that the money they are loaning will be paid back. You will receive a mortgage note after closing your mortgage.

Who holds the original mortgage note?

The lender, or lending institute, holds the original mortgage note. The borrower receives an original copy of the promissory note once the loan has been paid off. Borrows receive a copy of the mortgage note with their closing documents.

What Does a Mortgage Note Do?

Mortgage notes give lenders security during the lending process, as without the note, borrowers would not be legally bound to repay the loan. Once the note has been signed by both parties, it is legally binding and gives the lender the ability to take legal action if the borrower defaults on the loan.

How to get a copy of a mortgage note?

There are a few ways a borrower can request a copy of their mortgage note. You can go directly to the servicer. Under the Federal Servicer Act, loan servicers are required to respond to qualified written requests regarding information related to the loan. Alternately, you can check with the county recorder.

What is an institutional loan?

Institutional loan. An institutional loan is a loan from a traditional mortgage lender or bank. These loans are heavily regulated, and, therefore, the note must adhere to standard interest rates and payment terms —typically 15 or 30 years.

Why do mortgage notes have a lower interest rate?

Because the property is being used as collateral, the mortgage note may include a lower interest rate and longer payment term. The lender takes less financial risk with a secured loan and can make a better deal with the borrower.

When a lender agrees to give money to a borrower to purchase property, the lender and borrower agree?

When a lender agrees to give money to a borrower to purchase property, the lender and borrower agree on a plan for repaying the borrowed money. The plan is recorded as a mortgage note, a written document that specifies deadlines and payment amounts agreed upon by both parties.

Is it legal to sell a mortgage note?

Selling a mortgage note is legal and can be done as long as the borrower is notified during the application for the loan. Whether the seller is an institution or private entity, they are legally required to notify the borrower of the change.

What Is a Mortgage Note?

A mortgage note is a type of progress note which serves as the borrower’s pledge to secure the loan through a collateral, in this case, the property or house purchased using the loan. A mortgage note usually states the borrower’s name, address of the property secured as collateral, and detailed property description.

What is mortgage note template?

Mortgage note template simply ensure the security of the mortgage and will be the one at work the moment the borrower fails to follow the agreement written in the promissory note.

What is promissory note?

Promissory notes are the ones signed by the borrower containing the promise of repaying the borrowed amount under certain conditions . They are usually considered as the contractual agreement of a mortgage. A promissory blank note usually includes the terms of the loan, including the total amount borrowed, rate of interest, payment due, ...

What happens if you stop paying on a mortgage note?

If these conditions are not met by the borrower, or if he/she simply stops paying, the lending company may practice its right to claim the property in foreclosure. In this case, the lender may issue ...

Can a lender seize a property?

The lender may also se ize the property and sell it, considering the earnings as payment for the rest of the debt. If, however, the borrower meets all the set conditions and has fully paid the loan, the lending company may issue a release document or a mortgage release note, meaning your property has been released as collateral.

Is a mortgage note the same as a release note?

The terms mortgage notes and release notes are often used interchangeably, and sometimes used to mean the same thing. Mortgage notes and promissory notes, however, differ from each other, though not entirely. Both documents are, in most cases, issued upon processing a loan intended to purchase a new property or house.