/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5ef627e948cf1000076f5e9d%2F0x0.jpg)

Are municipal bonds a good investment?

On the plus side, highly-rated municipal bonds are generally very safe investments compared to almost any other investment. The default rate is tiny. As with any bond, there is interest rate risk. If your money is tied up for 10 or 20 years and interest rates rise, you'll be stuck with a poor performer.

Why invest in municipal bond funds?

Municipal bonds generally pay interest income that is exempt from federal and potentially state income taxes. At higher tax rates, munis generally yield more than comparable taxable bonds like corporates or Treasuries.

What is a municipal bond, and how does it work?

Municipal bonds are another option. Municipal bonds are issued by state and local governments -- also called municipalities -- to raise money for public works projects like the construction and maintenance of bridges, hospitals, schools and water treatment facilities. A bondissuer (the municipality) sells the bond to the bond holder (the investor). The bond holder lends the issuer a fixed amount of money for a certain amount of time in exchange for regularly scheduled interest payments.

Are municipal funds a good investment?

Municipal bonds aren’t bulletproof, but they are one of the safest investment vehicles you will find. They also offer substantial tax advantages and are very liquid when held as ETFs.

Is a municipal bond fund a good investment?

Municipal bonds aren't bulletproof, but they are one of the safest investment vehicles you will find. They also offer substantial tax advantages and are very liquid when held as ETFs. These benefits lead to lower returns, but those returns will be tax-free.

How does a municipal bond fund work?

Municipal bonds are structured like standard bond investments with coupon payments and a lump sum payment at maturity. Municipal bond funds pay regulator distributions to investors from coupon payments and capital gains. Distributions are determined at the discretion of the fund.

What is a municipal bond and how does it work?

Municipal bonds (munis) are debt obligations issued by government entities. When you buy a municipal bond, you are loaning money to the issuer in exchange for a set number of interest payments over a predetermined period.

Are municipal bond funds safe?

Municipal or corporate bonds are a great alternative for investors who want to create a reliable stream of income, particularly during their retirement years. Highly-rated bonds are by their nature very safe investments compared to almost any other alternative and especially compared to stocks.

Can you lose money on municipal bonds?

The Bottom Line. If you are investing for income, either municipal bonds or money market funds will pay you interest. Just know that bonds can lose value and money market funds most likely won't. Note also that since municipal bonds are income-tax free, you are actually making more than the interest rate would indicate ...

What are the disadvantages of municipal bonds?

ConsMarket prices could tank. If interest rates go up, the market prices of existing bonds will go down. ... Not inflation-friendly. Municipal bonds don't hold up against inflation as well as stocks do. ... Still a chance of default. While default risk is very low, municipal bonds could still go into default.

Who typically buys municipal bonds?

Who buys municipal bonds? About 72 percent of bonds are owned by individuals directly or through mutual funds and the like. About 25 percent of bonds are owned by businesses, primarily property and casualty and life insurance companies, but also banks.

Do municipal bonds pay interest monthly?

Most municipal bonds and short-term notes are issued in denominations of $5,000 or multiples of $5,000. Bond interest typically is paid every six months (though some types of bonds work differently); interest on notes is usually paid at maturity.

How much interest do municipal bonds pay?

You have a choice between investing in general corporate bonds or tax-free municipal bonds. The corporate bonds yield 7%, and the tax-free municipal bonds yield 5%.

What are the best municipal bonds to Invest in?

Top municipal bond fundsVanguard Tax-Exempt Bond ETF (VTEB) ... Fidelity Tax-Free Bond Fund (FTABX) ... T. ... BlackRock Allocation Target Shares: Series E Fund (BATEX) ... Delaware National High-Yield Municipal Bond Fund Institutional Class (DVHIX) ... Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWALX)

What happens to municipal bonds when interest rates rise?

Bonds and interest rates have an inverse correlation: as interest rates increase, bond prices fall.

What is the average return on bond funds?

2020 Bond Fund ReturnsCategory1-Year5-YearUltra Short-Term2.36%1.88%Short-Term4.80%2.51%Intermediate-Term8.50%4.86%Long-Term12.78%8.75%

Do municipal bonds pay interest monthly?

Most municipal bonds and short-term notes are issued in denominations of $5,000 or multiples of $5,000. Bond interest typically is paid every six months (though some types of bonds work differently); interest on notes is usually paid at maturity.

What is a typical maturity for municipal bonds?

Most munis are sold in minimum increments of $5,000 and have maturities that range from short term (2 – 5 years) to very long term (30 years).

How much interest do municipal bonds pay?

You have a choice between investing in general corporate bonds or tax-free municipal bonds. The corporate bonds yield 7%, and the tax-free municipal bonds yield 5%.

Do you pay taxes on municipal bond funds?

Income from investing in municipal bonds is generally exempt from Federal and state taxes for residents of the issuing state. While the interest income is tax-exempt, any capital gains distributed are taxable to the investor. Income for some investors may be subject to the Federal Alternative Minimum Tax (AMT).

What Is a Municipal Bond?

A municipal bond is a debt security issued by a state, municipality, or county to finance its capital expenditures, including the construction of highways, bridges, or schools. They can be thought of as loans that investors make to local governments. Municipal bonds are often exempt from federal taxes and most state and local taxes (for residents), making them especially attractive to people in higher income tax brackets .

What happens to the market price of municipal bonds?

As a fixed-income security, the market price of a municipal bond fluctuates with changes in interest rates: When interest rates rise, bond prices decline; when interest rates decline, bond prices rise. In addition, a bond with a longer maturity is more susceptible to interest rate changes than a bond with a shorter maturity, causing even greater changes in the municipal bond investor’s income. Furthermore, the majority of municipal bonds are illiquid; an investor needing immediate cash has to sell other securities instead.

What is call provision on municipal bonds?

Many municipal bonds carry call provisions, allowing the issuer to redeem the bond prior to the maturity date . An issuer typically calls a bond when interest rates drop and reissues municipal bonds at a lower interest rate.

What is revenue bond?

A revenue bond secures principal and interest payments through the issuer or sales, fuel, hotel occupancy or other taxes. When a municipality is a conduit issuer of bonds, a third party covers interest and principal payments.

What is a GO bond?

A general obligation bond (GO) is issued by governmental entities and not backed by revenue from a specific project, such as a toll road.

Is municipal bond interest tax free?

Interest paid on municipal bonds is often tax-free, making them an attractive investment option for individuals in high tax brackets.

Is municipal bond a federal tax?

Municipal bonds are exempt from federal taxes and most state and local taxes, making them especially attractive to people in high income tax brackets. Municipal bonds may also be known as "muni bonds" or "muni.".

What Are Municipal Bonds?

Municipal bonds (munis) are debt obligations issued by government entities. When you buy a municipal bond, you are loaning money to the issuer in exchange for a set number of interest payments over a predetermined period. At the end of that period, the bond reaches its maturity date, and the full amount of your original investment is returned to you.

What are the two types of municipal bonds?

Types of Municipal Bonds. Municipal bonds come in the following two varieties: general obligation bonds. revenue bonds. General obligation bonds, issued to raise immediate capital to cover expenses, are supported by the taxing power of the issuer. Revenue bonds, which are issued to fund infrastructure projects, ...

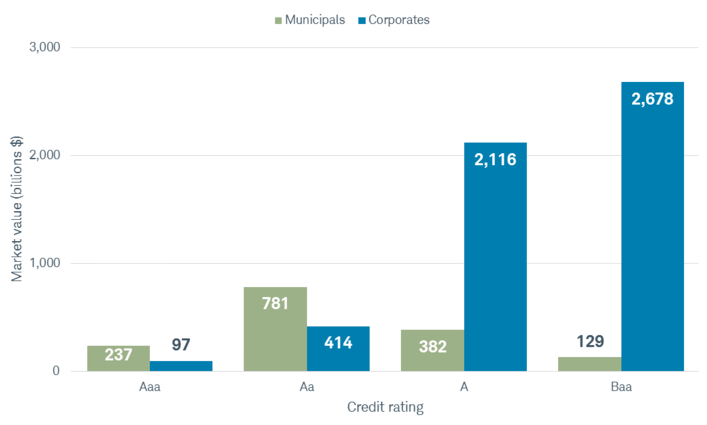

What is the default rate on municipal bonds?

The most recent study covers defaults from 1970 to 2020. 5 Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds. 6

How many municipal bonds were defaulted in 2017?

Nevertheless, municipal bonds defaults are not uncommon. There were 10 defaults in 2017, seven of which were associated with Puerto Rican debt crisis. A record $31.15 billion in bonds were in default that year, up 15% from 2016. 7

How to generate income from bond portfolio?

Investors seeking to generate both income and capital appreciation from their bond portfolio may choose an active portfolio management approach, whereby bonds are bought and sold instead of held to maturity. This approach seeks to generate income from yields and capital gains from selling at a premium.

What is a BBB bond?

Bonds rated 'BBB', 'Baa', or better are generally considered appropriate investments when capital preservation is the primary objective . To reduce investor concern, many municipal bonds are backed by insurance policies guaranteeing repayment in the event of default .

What is a ladder bond?

A ladder consists of a series of bonds, each with a different interest rate and maturity date. As each rung on the ladder matures, the principal is reinvested into a new bond. Both of these strategies are categorized as passive strategies because the bonds are bought and held until maturity.

What is the benefit of investing in municipal bonds?

Your investment in a muni bond fund gives you a small stake in every municipal bond the fund owns. The benefit is instant diversification, which can help you avoid losses from being too exposed to a single bond. The downside is potentially high recurring fund management fees.

What are the two types of municipal bonds?

Types of municipal bonds. Municipal bonds come in two varieties: general obligation and revenue bonds. General obligation bonds are used to finance public projects that aren't linked to a particular revenue stream. Revenue bonds, by contrast, are used to finance public projects with the potential to generate revenue.

How many municipal bonds have defaulted?

On the whole, municipal bonds have a low default rate. Between 1970 and 2015, there were only 99 muni bond defaults issued. Of these, only nine general obligation bonds defaulted, and not a single municipal bond with the highest credit rating defaulted. Municipal bonds have been 50 to 100 times less likely to default than corporate bonds.

Why are revenue bonds issued?

Revenue bonds are issued by municipalities to finance revenue-generating projects like a toll road or concert hall. The cash generated by the project itself will pay back investors in those bonds. Revenue bonds have higher default rates than general obligation bonds since the funds are used for a specific project, which may or may not be completed on time and within budget and may not generate the projected revenues. So it's important to research the issuer's credit rating before risking your capital.

What happens if interest rates go up on muni bonds?

Muni bonds carry "interest rate risk " as well. If interest rates go up while you still own a particular muni bond, you will earn a lower yield than you'd be able to attain from a new issue in the future. Interest rate changes will affect the value of your bonds on the secondary market, too.

What is a new issue bond?

New issues are bonds that a municipality sets up for a new project. The secondary market is where you can buy bonds that are already issued from other investors or sell not-yet-matured bonds you already hold. Bond funds are investments in a fund that owns bonds.

Why are bonds more stable than stocks?

The main thing that affects the value of a bond is the interest rate. A bond that pays a higher interest rate than a new issue -- meaning brand-new bonds just coming up for sale -- is worth more money, while a bond that pays a lower interest rate than a new issue is worth less money. That's because the price you could sell the bond or buy it for is adjusted up or down based on current available yields.

What is municipal bond?

Municipal bonds are loans investors make to local governments. They are issued by cities, states, counties, or other local governments. For that reason, the interest they pay on the bonds is tax-free for residents of that state. In 2020, the municipal bond market was $3.9 trillion. 1 . Municipal bonds are securities.

How many types of municipal bonds are there?

Three Types of Bonds. According to the Securities and Exchange Commission (SEC), there are three types of municipal bonds. One of the most common types are general obligation bonds. The borrower generally repays them using tax revenue, and they are not backed by a specific asset or project that will produce revenue. 3 .

How long does it take for a municipal bond to pay interest?

Bond issuers repay the principal on the bond's maturity date. That's one to three years for short-term bonds and 10 years or more for long-term bonds. 2

Why do lower rated bonds pay higher rates?

Lower-rated bonds pay a higher rate to compensate investors for the greater risk of default. 7 . The length of the bond will change the yield. Bonds with longer maturities, such as 10 to 30 years, will pay more than short-term bonds of less than 10 years.

What is revenue bond?

Revenue bonds are the other most common type of municipal bonds. The municipality repays those with proceeds from a specific source. These bonds pay for revenue-generating projects. That includes toll highways, sports arenas, or city-sponsored developments. If the revenue sources dry up, the municipality doesn't have to pay.

What is the highest rating for municipal bonds?

It also depends on the municipality's credit rating. The highest is AAA. Since they are also the safest, they pay the lowest rates. Lower-rated bonds pay a higher rate to compensate investors for the greater risk of default. 7

Why are cities issuing bonds?

These health costs are rising, which could cut into state revenue-sharing with cities. Cities and states are issuing bonds to cover current operating costs. They are selling off assets to pay operating expenses. 8 . As a result, many cities don't have the funds to invest in new infrastructure.

How often do municipal bonds pay interest?

The interest paid on municipal bonds comes in installments usually every six months. This makes these bonds a prosecutable source of cash flow. The payments are sent out to bondholders biannually.

Is interest paid on a bond subject to federal income tax?

The interest that is paid to bondholders is not subject to federal income tax. If the bondholder is resident in the issuing state, the bond is also exempted from local and state taxes.

What is municipal bond?

State, county, and city government entities often take on debt to fund ongoing operations or large projects. The vehicle for this type of funding is called a “ municipal bond .”. If you purchase a municipal bond, you’re essentially lending the government money.

Why do investors need municipal bonds?

Diversification: Investors who have high-risk investments such as company stocks may wish to include municipal bonds in their investment s to balance and diversify their portfolio.

How Are Returns Earned on Municipal Bonds?

For instance, a revenue-backed bond would be using highway tolls or express lane fees to return principal and interest back to people who bought the bonds.

How do municipal bonds earn returns?

How Do Investors Earn Returns on Municipal Bonds? The government uses its taxing power or revenue generation to pay back the bonds to investors with interest. General obligation bonds are paid back with taxes, and revenue bonds are paid back with revenue generated by the government.

What are the pros and cons of municipal bonds?

Pros and Cons of Investing in Municipal Bond Funds 1 Tax advantaged 2 Steady rate of return 3 Historically low risk 4 Diversification

How to see how municipal bonds perform over time?

To see how municipal bonds perform over time, check an index that tracks them. The S&P Municipal Bond Index is a good place to start. As of April 2021, the one-year return of this index stood at 6.69%. 4

Why are municipal bonds considered low risk?

Historically low risk: While municipal bonds do come with some element of risk as almost all investments do, they are known to be a lower-risk investment choice because they have a specified maturity date and are designed to protect the principal investment. 1.

What is municipal bond mutual fund?

Municipal bond mutual funds offer tax-exempt yields to certain investors, using diversified portfolios that mitigate some of the debt instruments' risk. Municipal bond funds tend to provide long-term, steady capital appreciation with a low degree of volatility.

What is municipal bond?

Municipal bonds are debt securities issued by government entities that provide modest returns by way of interest payments over the duration of the bonds. The interest received on a municipal bond is generally exempt from federal tax, and in some cases, state and city tax as well.

What is Amhix fund?

The American High-Income Municipal Bond Fund (AMHIX) was established in 1994 to provide investors with a high level of current income exempt from regular federal income tax. The fund's managers invest a substantial portion of the fund's $7.8 billion assets in municipal bond debt securities exempt from federal tax. 1 .

Why are municipal bonds lower than other bonds?

Because general obligation bonds expose investors to less risk, interest rates paid on these municipal bonds are lower than other debt securities. Revenue bonds have a greater risk of default over time, but they can provide a higher rate of return to investors who are willing to take on that risk.

What is Vanguard Intermediate-Term Tax-Exempt Fund?

The fund seeks to provide investors with current income that is exempt from federal personal income tax by investing a minimum of 75% of its $78.2 billion in assets in municipal bonds rated in the top three rating categories. 4

What is MDXBX?

The T. Rowe Price Maryland Tax-Free Bond Fund (MDXBX) was established in 1987 and sought to provide a high level of current income to fund investors. Fund managers invest a minimum of 80% of the fund's $2.5 billion assets in debt securities that are exempt from federal and Maryland state and local personal income taxes. 6

How long does a municipal bond last?

As an intermediate municipal bond fund, it maintains a dollar-weighted average maturity of six to 12 years, but fund managers do not have specific limitations on the maturity of individual securities held within the fund.

What Is a Bond Fund?

A bond fund, also referred to as a debt fund, is a pooled investment vehicle that invests primarily in bonds (government, municipal, corporate, convertible) and other debt instruments, such as mortgage-backed securities (MBS). The primary goal of a bond fund is often that of generating monthly income for investors.

What is the primary goal of a bond fund?

The primary goal of a bond fund is often that of generating monthly income for investors. Both bond mutual funds and bond exchange traded funds (ETF) are available to most investors.

Why are bond funds so attractive?

Bond funds are attractive investment options as they are usually easier for investors to participate in than purchasing the individual bond instruments that make up the bond portfolio. By investing in a bond fund, an investor need only pay the annual expense ratio that covers marketing, administrative and professional management fees. The alternative is to purchase multiple bonds separately and deal with the transaction costs associated with each of them.

What is Morningstar bond style box?

For investors interested in bonds, a Morningstar bond style box can be used to sort out the investing options available for bond funds. The types of bond funds available include: US government bond funds; municipal bond funds; corporate bond funds; mortgage-backed securities (MBS) funds; high-yield bond funds; emerging market bond funds; and global bond funds.

Why do bond funds exist?

Bond funds provide instant diversification for investors for a low required minimum investment. Since a fund usually has a pool of different bonds of varying maturities, the impact of any single bond’s performance is lessened if that issuer should fail to pay interest or principal .

How does NAV affect bond funds?

Therefore, the NAV of bond funds with longer-term maturities will be impacted greatly by changes in interest rates. This, in turn, will affect how much interest income the fund can distribute to its participants monthly.

Why are bond funds important?

Bond funds provide instant diversification for investors for a low required minimum investment. Due to the inverse relationship between interest rates and bond prices, a long-term bond has greater interest rate risk than a short-term bond. 1:36.

Three Types of Bonds

How They Work

- Municipal bonds pay interest to investors, usually twice a year. Bond issuers repay the principal on the bond's maturity date. That's one to three years for short-term bonds and 10 years or more for long-term bonds.2 Municipal bonds are generally not subject to federal taxes on interest, and they are often exempt from state and local taxes. As a r...

Rates

- Like any bond, municipal bond rates depend on three factors. Most bond rates follow the equivalent Treasury bond yield.5 These are risk-free bonds issued by the federal government. Since munis have a bit more risk, they will pay slightly higher rates than federal bonds.6 It also depends on the municipality's credit rating. The highest is AAA. Since they are also the safest, th…

How to Buy Municipal Bonds

- Most people buy municipal bonds through a financial advisor, bank, or even through the municipality directly. Many people also benefit from municipal bonds through a bond fund. You can also research municipal bonds yourself at the Electronic Municipal Market Accesswebsite. It provides each bond's type, yield, and maturity. It also gives you the bond's credit quality, risk fact…

Four Looming Threats

- In 2014, former Federal Reserve Chairman Paul Volckerco-authored a three-year study with the boring title, "Final Report of the State Budget Crisis Task Force." Its findings were anything but boring. The team uncovered structural flaws in state and city financing that are worsening. That represents a future threat to all municipal bondholders. At its worst, it could trigger another fina…

Example: How Detroit's Bankruptcy Changed The Game

- On July 18, 2013, the city of Detroit filed for Chapter 9 bankruptcy on $18.5 billion in debt. It was the largest American city to take this desperate action.910 Detroit used the bankruptcy to default on its general obligation bonds. It said it no longer had the income to pay for the bonds.11 Creditors and insurers absorbed $7 billion in losses. They received between 14 a…