In most cases, the IRS allows what is known as a 1035 exchange of non-qualified annuity contracts between insurance companies. A 1035 exchange lets you switch companies while continuing to defer taxes, ensuring that your annuity stays up-to-date with the latest advantages and benefits available to you.

What qualifies as a 1035 exchange?

What are "like-kind" exchanges that qualify for 1035 Exchanges?

- Life insurance for life insurance

- Life insurance for endowment

- Life insurance for non-qualified annuity

- Endowment for endowment, with a maturity not later than the original endowment

- Endowment for non-qualified annuity

- Non-qualified annuity for non-qualified annuity

What is the cost basis on a 1035 exchange?

Your Cost Basis Travels Under IRS Code 1035, it allows you to take your existing annuity contract and transfer it to another annuity contract. If you decide to transfer your deferred annuity, that cost basis will transfer with it. So the gains from the original premium dollar amount put in the first policy will transfer to the new annuity.

When should you use a 1035 exchange with life insurance?

You can use the IRS’s 1035 exchange rules for life insurance to avoid taxation when switching to a new company. If your needs have changed or you have a poor-performing policy, you can use a 1035 exchange to seamlessly transfer your accumulated cash values into a new and improved policy. What are the 1035 exchange rules for life insurance?

Is a 1035 exchange taxable?

The same amount taken in cash as part of a 1035 Exchange would be taxable to the extent of the gain in the contract. There may be forced out gain if the contract was issued after 1984 and the reduction is in the first 15 years of the contract.

What qualifies for a 1035 exchange?

Generally, the Section 1035 exchange rules allow the owner of a financial product, such as a life insurance or annuity contract, to exchange one product for another without treating the transaction as a sale—no gain is recognized when the first contract is disposed of, and there is no intervening tax liability.

What can a non qualified annuity be exchanged for?

For example, nonqualified annuities can't be exchanged for qualified annuities. The IRS allows the exchange of multiple annuity contracts for a single contract, one contract for multiple contracts, and a portion of an annuity for an alternate annuity.

Can you 1035 from non qualified annuity to life insurance?

1035 Exchange Annuity To Life Insurance A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy.

Do I have to report a 1035 exchange on my tax return?

You will receive a 1099-R if you complete a 1035 exchange to another insurance company. However, a 1035 exchange is not a taxable event. All such 1035 exchanges are reportable and the distribution code of '6' on the tax form indicates to the IRS it was a tax-free 1035 exchange.

What is an example of a non-qualified annuity?

If money is non-qualified, that means it is not part of a tax-deferred account. Examples of tax deferred account are traditional or Roth individual retirement account (IRA), a simplified employee pension (SEP) or an employer sponsored defined benefit plan such as a 401(k).

What does it mean if an annuity is non-qualified?

A non-qualified annuity is funded with after-tax dollars, meaning you have already paid taxes on the money before it goes into the annuity. When you take money out, only the earnings are taxable as ordinary income.

What is the difference between a 1035 exchange and a rollover?

An indirect rollover is not taxable unless it's a Roth conversion. Exchange, 1035 Exchange -- similar to a direct rollover or direct transfer, but with nonqualified accounts. It allows life insurance, long-term care insurance or other annuities to be exchanged for an annuity.

Which one of the following is not permitted under the 1035 exchange rules?

Sec. 1035 permits the tax-free exchange of an annuity for any other type of annuity, but not for a life insurance policy.

What is the difference between 1031 and 1035 exchange?

While a 1031 exchange requires the purchase of a replacement property that is considered “like-kind” to the relinquished property, a 1033 exchange requires the purchase of a replacement property that is “similar or related in service or use” to the lost property.

How many 1035 exchanges can I do in a year?

There is no limit on the number of old variable annuity contracts that can be exchanged for new contracts.

Can you transfer a non-qualified annuity to an IRA?

If an annuity is non-qualified or funded with after-tax dollars, you can't transfer or roll over to a traditional IRA. Non-qualified refers to any type of retirement plan funded with after-tax dollars, such as a Roth 401(k), Roth 403(b) or a Roth IRA.

Do I get a 1099 for a non-qualified annuity?

2. Annuity Tax Forms for a Non-Qualified Immediate Annuity or Non-Qualified Longevity Annuity. If you are receiving annuity payments you will receive form 1099R by January 31st. The 1099R is used to report the amount of taxable income you received from your annuity in the last calendar year.

What are the distribution options for the beneficiary of a non-qualified annuity?

These include lifetime income, death benefit options, and the ability to transfer among investment options without sales or withdrawal charges. Pacific Life, its affiliates, their distributors, and respective representatives do not provide tax, accounting, or legal advice.

How do I get out of a non-qualified annuity?

Definition and Example of Non-Qualified Annuities After that age, you can choose to take withdrawals from the annuity or annuitize it and receive payments. If you take withdrawals, you pay taxes on a last-in-first-out basis (LIFO). This means you'll pay tax on the entire withdrawal up to the amount of your gains.

Can a non-qualified annuity be rolled over to a Roth IRA?

Although you cannot directly convert a non-qualified annuity to a Roth IRA, you can transfer your annuity to a Roth IRA by withdrawing your funds, paying the taxes on the growth and depositing the remainder -- up to your annual contribution limit -- in your Roth account.

How are withdrawals from a non-qualified annuity taxed?

For non-qualified annuities: You won't owe tax on the amount you paid into the annuity. But you will owe ordinary income tax on the growth. And when you make a withdrawal, the IRS requires that you take the growth first — meaning you will owe income tax on withdrawals until you have taken all the growth.

What is a Section 1035 Exchange?

A 1035 exchange is a provision in the tax code which allows you, as a policyholder, to transfer funds from a life insurance, endowment or annuity to a new policy, without having to pay taxes.

How does a 1035 Exchange work?

If the policy is surrendered without a 1035 Exchange, the gain from the original life insurance contract will be taxed as ordinary income (not capital gains).

When is surrendering a policy better than doing a 1035 Exchange?

If there is no gain on the existing contract, or if there are loans outstanding that may represent a partial gain, a 1035 Exchange would not offer an advantage.

What happens if there is no gain in the original contract?

What if there is no gain? Even if there is no gain in the original contract, the policy owner may still want to take advantage of the other tax benefits of a 1035 Exchange which are not available if the original contract is simply surrendered

How long does it take to process a 1035 exchange?

A 1035 Exchange is more cumbersome and time consuming than a policy surrender. The timing is uncertain and the process can often take several months.

Can the owner be changed during a tax-free 1035 Exchange?

No, an ownership change is not allowed during a 1035 Exchange. There may be both income tax and gift tax consequences depending on the circumstances. If the policy owner wants the new policy to be owned by someone else, an option is to change the ownership prior to the exchange.

Why use a 1035 exchange?

The primary advantage of using a 1035 exchange to change your life insurance policy or annuity choices is to avoid triggering taxes on those transactions. There are different scenarios where exchanging policies or annuity contracts might make sense.

How does a 1035 exchange work?

A 1035 exchange may sound complicated, but it’s actually a simple way to make sure that you have the right annuity or life insuranceproduct that fits your needs. Essentially, if you have an annuity or life insurance policy you would replace either one with a new annuity contract or insurance policy, respectively.

What happens if you surrender a life insurance policy without a 1035 exchange?

If you were to surrender a life insurance policy without going through a 1035 exchange to replace it with a new policy or an annuity, any gains associated with your original contract would be considered ordinary income.

Do 1035 exchanges apply to annuities?

If the ownership of either one changes, then the 1035 exchange tax rules no longer apply. The Bottom Line. A 1035 exchange can be a useful tax rule to know about if you have an annuity, life insurance policy, endowment or long-term care product.

Is a 1035 exchange tax free?

That doesn’t mean the exchange is completely tax-free, however. If annuity payments are taxable, then the tax is simply deferred until you begin receiving payments from it. A 1035 exchange can be a useful tax loophole if you want to use an annuityor life insurance policy to plan your estate but decide at some point that the one you have no longer fits your needs.

Can you cash out an old 1035?

You can’t cash out the old policy and use the money to buy a new one. 1035 exchanges can only go certain ways. For example, you can exchange life insurance for life insurance or life insurance for a non-qualified annuity. But you can’t exchange a non-qualified annuity for a life insurance policy.

Can you exchange an annuity for another?

Along with life insurance policies, annuities can be important parts of a well-rounded estate plan. But if at some point you decide you need to swap one annuity or life insurance policy for another, you can do so – without incurring a tax – through a 1035 exchange.

What is the 1035 exchange?

Section 1035 of the Internal Revenue Code, which also applies to life insurance policy exchanges, governs annuity exchanges. Named for the section that regulates them, Section 1035 exchanges also allow the exchange of a life insurance policy for an annuity — but not the exchange of an annuity for a life insurance policy.

Why do you need to exchange 1035?

According to the Financial Industry Regulatory Authority, legitimate reasons for making a 1035 exchange include: A new annuity contract may come with a premium, or bonus, toward the value of your contract, ranging from 1 to 5 percent of purchase payments. New features are becoming available, particularly with variable annuities.

What is exchange treatment?

The exchange treatment includes the provision that “the exchange, without recognition of gain or loss, of an annuity contract for another annuity contract under § 1035 (a) (3) is limited to cases where the same person or persons are the obligee or obligees under the contract received in the exchange as under the original contract.”.

Is 1035 exchange good for annuity?

Your fixed annuity contract has a lower interest rate than a newer one. But FINRA warns that 1035 exchanges may not be a good idea for you. Often, bonuses or premiums can be offset by other charges added to the contract.

Can you exchange an annuity for a single contract?

The IRS allows the exchange of multiple annuity contracts for a single contract, one contract for multiple contracts, and a portion of an annuity for an alternate annuity. Expand. According to the IRS chief counsel’s 2003 Internal Revenue Bulletin, “the legislative history of § 1035 states that exchange treatment is appropriate for ‘individuals who ...

Can you exchange an annuity for another?

If you purchase an annuity and later find an annuity with better terms, there is a provision in the law that permits exchanging one annuity for another, as long as the person who holds the contract doesn’t change. Get Your Free Guide to Annuities.

Is a Section 1035 Exchange Right for You?

In order to determine if the exchange meets your needs, read all the documents associated with the transaction.

Maintain Deferral by Making Tax-Free Transfers

The tax-deferral advantage of an annuity is what allows annuity holders to make tax-free transfers from one deferred annuity to another.

Common Reasons To 1035 Exchange An Annuity For Another

Not all annuity products are created equal. In fact, most annuities are underwhelming. So why are these annuities being sold in the first place? Common reasons are:

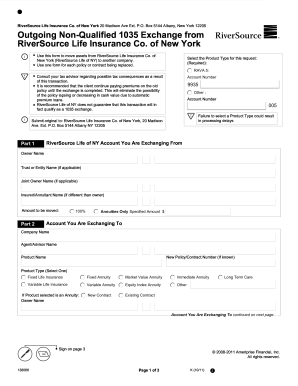

How To 1035 Exchange An Annuity For Another

Nonqualified annuities can be transferred without a taxable event via 1035 Exchange. The exchange must happen directly between insurance companies. There is a form in the annuity application to instruct the insurance company to execute the transfer.

1035 Exchange Annuity To Life Insurance

A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy. However, one can 1035 exchange an annuity to an annuity life insurance hybrid plan.

How Do I Know I Can 1035 Exchange My Annuity Or Life Insurance Policy?

Annuity providers are comfortable with replacing annuities as long as the replacement makes sense to both the consumer and the insurance company. A replacement will be considered if the following requirements are met:

1035 Exchange At A Glance

I’m a licensed financial professional focusing on annuities and insurance for more than a decade. My former role was training financial advisors, including for a Fortune Global 500 insurance company. I’ve been featured in Time Magazine, Yahoo! Finance, MSN, SmartAsset, Entrepreneur, Bloomberg, The Simple Dollar, U.S.

What is 1035 exchange?

A 1035 annuity exchange is a rule under Section 1035 of the Internal Revenue Code that allows for a tax-free exchange of a life insurance or annuity policy for a different annuity contract better suited to an owner’s needs. When transferring from one plan to another via a 1035 exchange, the transfer must be “like-to-like.”.

When transferring from one plan to another via a 1035 exchange, must the transfer be “like to like”?

When transferring from one plan to another via a 1035 exchange, the transfer must be “like-to-like.” This means the annuity owner, annuitant, and the beneficiary must be the same during the exchange. Changes to the annuity contract can be changed AFTER the 1035 exchange is completed.

How is a Non-Qualified Annuity Taxed?

All annuities are allowed to grow tax-deferred. This means any earned money on the investment is not taxed until paid out to the annuity owner. However, there are differences in how taxes are taken out in non-qualified annuities. Income distributed from non-qualified annuities is taxed in 2 distinct ways, LIFO and the Exclusion Ratio.

What is the difference between a qualified annuity and a non qualified annuity?

Qualified annuities are purchased with pre-tax funds , while non-qualified annuities are funded with money on which taxes have been paid. When you withdraw money from a qualified annuity, all of it is taxed as regular income. But if you withdraw money from a non-qualified annuity, only the earnings are taxed as regular income.

Can annuities be changed after 1035 exchange?

This means the annuity owner, annuitant, and the beneficiary must be the same during the exchange. Changes to the annuity contract can be changed AFTER the 1035 exchange is completed. Annuity companies make this transfer easy for applicants by filling out a 1035 exchange form.

What is a 1035 exchange?

Last, but certainly not least, is a 1035 exchange. Contrary to popular belief, a 1035 exchange involves only non-qualified monies. Qualified plan and IRA rules apply for qualified monies. A 1035 exchange occurs whenever your client moves from annuity (A) to annuity (B). Constructive receipt cannot occur for a valid 1035 exchange to exist.

Is a direct rollover a constructive receipt?

As a practical matter, if the distribution check is made out to the receiving insurer, deposited accordingly, then your client has no constructive receipt. In this case, the transaction would be a direct rollover. Direct rollovers suffer no tax consequences.

Can you exchange an annuity for two annuities?

Much has been written lately about a recent IRS Private Letter Ruling that allowed for multiple exchanges i.e., an exchange of one annuity for two annuities, all within one company. Unfortunately for most of you, this ruling isn’t directly on point. Specifically, most often you would have a client with annuity A with company A and annuity B with company B wishing to exchange both to annuity C with company C. The IRS has never ruled specifically on this point. Some carriers believe this to be allowed and have done it for years. Some others who have a more conservative position have never allowed it. Yet others have viewed the recent Private Letter Ruling as indicating IRS flexibility on the issue and have started to allow multiple exchanges.