A personal budget is a financial tool used by individuals and families that helps create a plan for their monthly income and expenses. The budget includes sections for both income and expenses. The user’s expenses are further separated into spending categories which helps make planning easier.

How to prepare a personal financial budget?

The financial budget plan is comprised of the following steps:

- Calculate the expected inflow

- Calculate the expected outflow

- Set the targets

- Divide the expenses into different categories

- Keep track of components in the budget

- Set up the ledger

How to budget your personal finances?

How Fintech Can Help You Manage Your Personal Finances

- Bank More Quickly. Gone are the days when you had to go to the bank to check your balance or even deposit your checks. ...

- Budget More Transparently. Many apps now on the market easily connect to your financial institution to help you plan and budget your finances.

- Understand Your Credit Score. ...

- Improve Security. ...

- Reduce Financial Mistakes. ...

What is a personal finance budget?

Budgeting is the personal finance tool for taking control of your money. A budget is a written plan for how you will spend your money. It allows you to make financial decisions ahead of time, which makes it easier to cover all your expenses along with paying off debt, saving for the future, and being able to afford fun expenses.

How to plan a personal budget?

What to consider before you start a budget

- Think about your financial goals. Identify your short-term and long-term goals. ...

- Know where your money is going. Tracking your money will help you figure out what comes in and what goes out of your pocket. ...

- Evaluate your needs and wants. Knowing the difference between your needs and your wants is key to making a smart budget. ...

What is personal finance budgeting?

A budget is a tool that tracks income and expenses, and it allow you to set goals and make plans for the future. Developing a budget for a specific project, for a special event, or to help you with your monthly spending are all examples of using a budget to help you manage your financial situation.

How do you create a personal financial budget?

Create a Personal Budget: How to Make a BudgetGather your financial statement. ... Record all sources of income. ... Create a list of monthly expenses. ... Fixed Expenses. ... Variable Expenses. ... Total your monthly income and monthly expenses. ... Budget Spreadsheet Example. ... Set a goal.

What are the main purposes of a personal budget?

A budget helps create financial stability. By tracking expenses and following a plan, a budget makes it easier to pay bills on time, build an emergency fund, and save for major expenses such as a car or home. Overall, a budget puts a person on stronger financial footing for both the day-to-day and the long term.

What are the 3 types of budgets?

Answer: A balanced budget, a surplus budget, or a deficit budget are the three sorts of budgets.

What is a good monthly budget?

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt. By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently.

What are the 7 steps to budgeting?

7 Steps to a Budget Made EasyStep 1: Set Realistic Goals.Step 2: Identify your Income and Expenses.Step 3: Separate Needs and Wants.Step 4: Design Your Budget.Step 5: Put Your Plan Into Action.Step 6: Seasonal Expenses.Step 7: Look Ahead.

What are the types of personal budget?

The 7 Types of Personal Budgets and How to ChooseZero-Based Budgeting (ZBB)The 50/30/20 Budget.The Reverse Budget.The Debt Avalanche Method.The Debt Snowball Method.The 60% Solution.The Envelope Method.

What are the 3 purposes of a budget?

In the context of business management, the purpose of budgeting includes the following three aspects: A forecast of income and expenditure (and thereby profitability) A tool for decision making. A means to monitor business performance.

What are the five purposes of budgeting?

Five reasons why budgeting is so importantHave set goals and objectives you wish to achieve. ... Ensuring you don't spend money you don't have. ... Ensure you are happy in retirement. ... It helps to be prepared for emergencies. ... Budgeting will help address bad spending habits.

What are the 5 basic elements of a budget?

Five elements of a good budgetPlan out every cent. A budget is essentially a blueprint for what you are going to spend in the next month. ... Know much you make. If you're going to create an accurate spending plan, you need to first know how much you're working with. ... Treat yourself. ... Base yourself in reality. ... Be flexible.

What is the best budgeting method?

Simple and sweet.The 7 Best Budgeting Methods.The Balanced Money Formula.Cash-Only Budgeting.Zero-based Budget.The 60% Solution.The “No Budget” Budget.Values-based Budget.The Root Budgeting System.More items...

Which of the following is a financial budget?

Answer and Explanation: The answer is b. cash budget. A financial budget is a budget that is related to the company's balance sheet, which includes the cash budget.

What is the 50 20 30 budget rule?

Key Takeaways The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

What is the best way to budget your money?

How do I use my budget?At the beginning of the month, make a plan for how you will spend your money that month. Write what you think you will earn and spend.Write down what you spend. ... At the end of the month, see if you spent what you planned.Use the information to help you plan the next month's budget.

How do I create a personal finance spreadsheet?

To create a budget spreadsheet, start by opening a new spreadsheet and creating columns for things like amounts, due dates, and paid dates. Then, create cells to record your income sources, like your monthly pay, followed by cells to record expenses, such as food and housing.

How do I create a monthly budget?

How to make a monthly budget: 5 stepsCalculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month. ... Spend a month or two tracking your spending. ... Think about your financial priorities. ... Design your budget. ... Track your spending and refine your budget as needed.

What is personal finance?

As shown below, the main areas of personal finance are income. Remuneration Remuneration is any type of compensation or payment that an individual or employee receives as payment for their services or the work that they do for an organization or company.

What is income in financial planning?

Income refers to a source of cash inflow that an individual receives and then uses to support themselves and their family. It is the starting point for our financial planning process.

What is savings in finance?

Saving refers to excess cash that is retained for future investing or spending. If there is a surplus between what a person earns as income and what they spend, the difference can be directed towards savings or investments. Managing savings is a critical area of personal finance.

Why is it important to manage expenses?

The expenses listed above all reduce the amount of cash an individual has available for saving and investing. If expenses are greater than income, the individual has a deficit. Managing expenses is just as important as generating income, and typically people have more control over their discretionary expenses than their income. Good spending habits are critical for good personal finance management.

What is spending?

Spending includes all types of expenses an individual incurs related to buying goods and services or anything that is consumable (i.e., not an investment). All spending falls into two categories: cash (paid for with cash on hand) and credit (paid for by borrowing money).

What is the most complicated area of personal finance?

Investing is the most complicated area of personal finance and is one of the areas where people get the most professional advice. There are vast differences in risk and reward between different investments, and most people seek help with this area of their financial plan.

What is money market?

Money Market The money market is an organized exchange market where participants can lend and borrow short-term, high-quality debt securities. Most people keep at least some savings to manage their cash flow and the short-term difference between their income and expenses.

What Is A Personal Budget?

Much like a business must develop a budget to ensure it’s spending money efficiently and not spending more than it can afford, individuals who want to monitor their finances and ensure they’re spending responsibly must develop their own, personal budget.

What is budgeting in finance?

Budgeting is all about being intentional with the ways you spend money, and planning ahead to help ensure you don’t run into any inconvenient – or, potentially, financially ruinous – surprises before you receive your next paycheck.

How to make budgeting easier?

However, you can make budgeting a little easier by tracking your regular spending or having an app do it for you. Then, figure out an average for how much you spend on these types of expenses, and if you can, give yourself some wiggle room. That way, if you spend less than planned one month, you can save that extra money for a month where you end up spending more.

What does it mean to plan out what you need to spend your money on?

Even if you’re only thinking in the short term, planning out what things you need to spend your money on from week to week and month to month means you won’t accidentally spend too much on food and end up short on rent.

How much of your income should you spend on housing?

Another potentially helpful rule of thumb states that you shouldn’t spend more than 30% of your gross income on housing. However, this might not necessarily be helpful to those who live in areas where housing costs are high. Ultimately, you’re going to have to figure out what works for you.

What does it mean to be an adult with money to spend?

Being an adult with money to spend means finding a balance between needs, wants and goals that works for you. That’s where budgeting comes in.

Is total expense less than net income?

Ideally, once you add up the costs of all your expenses, the total number will be less than your net income. If your expenses are more than your income, you’ll need to look for ways to cut back. If the two numbers are about the same, think about what your goals are, and what you’re currently spending your money on.

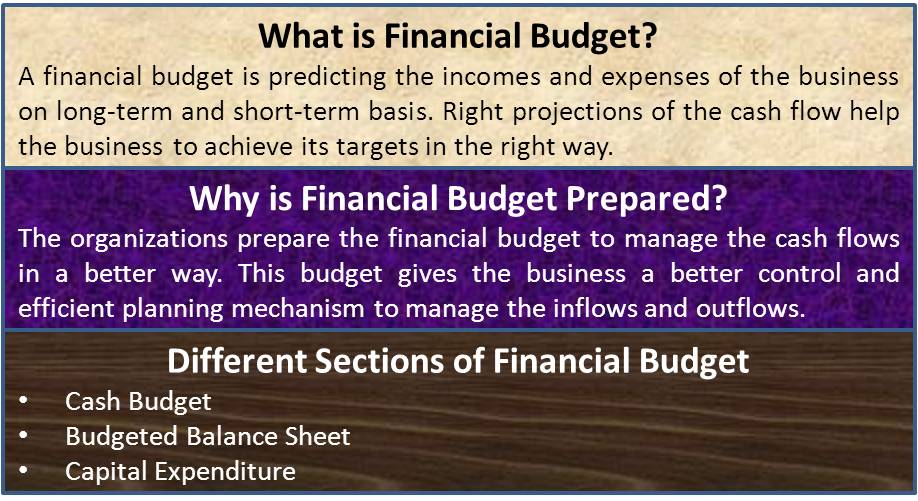

What is a financial budget?

A financial budget is a budget that is used by businesses to determine both the long-term and short-term incomes and expenses of a business. Financial budgets are also made by a business to forecast its future position. A business must first prepare an operating budget before preparing a financial budget. This is because a financial budget requires ...

What is a budget?

A budget is a quantitative plan or forecast for the future of a business in which the business allocates its resources to different departments or activities. Businesses mostly use budgets to plan for the future. Businesses use budgets as a monitor and control tool to control their actual performance according to the set budget.

Why do businesses need financial budgets?

Financial budgets can be used by a business to create a financial awareness related to its spending and earnings.

What are the three sections of a financial budget?

Financial budgets comprise three sections. These include the capital expenditure budget, cash budget, and budgeted balance sheet. Businesses need financial budgets for several reasons such as for creating financial awareness, highlighting cash flow issues, recognizing business opportunities, as a communication tool, and for financial planning.

What is capital expenditure budget?

A capital expenditure budget is a forecast of any planned future capital expenditures of a business. Capital expenditures are expenditures on long-term or fixed assets of a business, for example, plant, machinery, equipment, vehicles, etc. Similarly, the budget will include any expenditure on the renovation or replacement of these assets.

What type of budget do businesses use?

There are many types of budgets that can be used by businesses. For example, businesses use incremental budgets, zero-based budgets, imposed budgets, participative budgets, operating budgets, etc. One particular type of budget that is used by businesses is known as a financial budget.

How long do businesses prepare cash budgets?

These are short-term budgets prepared regularly, usually monthly, over some time. Typically, businesses prepare monthly cash budgets for a year.

What is personal finance?

Personal finance includes a wide range of financial management practices taken to drive the budget, spending and savings of an individual or family. It includes long-term planning that considers potential financial risks, investments and how your financial situation evolves over a lifetime.

What is a personal financial advisor?

Personal financial advisors focus on helping people manage their personal finances and plan their financial futures. They provide guidance on decisions about insurance or annuities, what types of investments to pursue and how tax laws affect their finances.

Why Is Personal Finance Important?

Personal finance is a vital part of not only managing your day-to-day financial needs but also planning your financial future. The sooner you get a grip on personal finance, the better your long-term financial prospects will be for things like investing or planning for retirement.

What is the Consumer Financial Protection Bureau?

Consumer Financial Protection Bureau offers tools and other resources ranging from credit cards to debt collection if you have specific questions about personal finance topics.

How many financial advisors will be there in 2020?

There were more than 275,000 personal financial advisors in the U.S. in 2020, according to the U.S. Bureau of Labor Statistics. That number is expected to grow by about five percent by 2030 and create 12,600 new roles.

How long have financial literacy principles been used?

Though designed to teach school kids the basics of financial literacy and responsibility, the principles have been used for more than two decades to guide adults toward better personal finance practices as well. And they hold up at any stage of life.

What is a budget analyst?

Budget analysts who focus on public and private organizations with financial planning.

What is Included in a Personal Budget?

The main things that a budget includes are expenses, saving, and spending. It tracks these categories and helps you to know how much money to place into each section of your budget.

2. 50-30-20 Budget

This is a percentage budgeting method that works well for a lot of people. The reason it works is that it’s simple. It also gives you a generous amount of income to spend on expenses, saving, and spending.

3. The No Spending Budget

These are best for times in your life where finances are tight or when you have something important you’re saving for. A no-spending budget can be challenging, but it’s very simple in some ways.

4. The Zero-Based Budget

This technique is easy to use with other budget systems. A zero-based budget means you will budget all of your income, making sure every penny has a place in a category. Since all of your money has somewhere to go, you get your budget to zero each month.

5. The Survival Budget

A survival budget is similar to a no spending budget but is a bit more extreme. It’s usually used in times of financial difficulty when you are struggling to make ends meet. It helps you survive without a lot of money.

6. The Cash Envelope Budget

This is a practical way to spend and save. The cash envelope system means that you take out money for your expenses in cash at the beginning of the pay period.

7. Reverse Budgeting

A reverse budget is unique in that you pay yourself first before you put money towards bills and other categories. It’s a way to prioritize putting money towards your savings and other goals.

What is the goal of a budget?

The goal is for your income minus expenses to equal zero when your budget is complete. Your budget includes both fixed and flexible expenses. Fixed expenses are things like your mortgage, car payments, or any bills that are the same every month. Flexible categories are for costs that are harder to predict.

Why is it important to have a budget?

Whether you’re paying down debt or saving for a house, a budget can help you achieve your goals. There are three popular budget types.

What is zero based budgeting?

Zero-Based Budgeting. A zero-based budget makes sure that every dollar has a job. Every dollar you make from your paycheck gets assigned to tackling different expenses. That means if you bring home $2,000 per month, you’ll know exactly where it will be used in your budget.

Does a zero based budget fluctuate?

Groceries fluctuate as does your power bill. Zero-based budgets fluctuate throughout the month as you spend money. If you overspend in one category, you have to reallocate money from another. Your budget will always “zero out” at the end of the month. This type of budgeting is best for people who are detail oriented.

Can you use goal based budgeting?

You can use goal-based budgeting alongside another budgeting type. Every household has a budget that works best for them and no two budgets look the same. It’s important to try out different budget types to see which one fits your lifestyle. It’s OK if your budget isn’t perfect.