Reimbursement schedule is a set of listing fee schedule used by healthcare insurance company (Medicare) to pay doctors, providers, or suppliers which is used to reimburse healthcare professionals on a fee for service basis.

What is Medicare reimbursement schedule?

Who determines the Medicare fee schedule?

What factors determine Medicare reimbursement?

Can Medicare patients be billed?

Do hospitals have to accept Medicare?

Who has the final say in a fee schedule?

Is Medicare reimbursement less than private insurance?

See 2 more

What does reimbursement mean in healthcare?

A healthcare reimbursement plan is a benefit where employers reimburse their employees for medical expenses. This differs from traditional group health plan coverage because the employer makes a benefit allowance available instead of choosing and administering a group health insurance policy from a carrier.

What is Medicare reimbursement fee schedule?

The Medicare fee schedule is a listing of all the fees that Medicare uses to pay doctors and other providers for their services. This listing is used to reimburse doctors or other health care providers.

What is reimbursement rate?

Reimbursement rates means any rates that apply to a payment made by a sickness and accident insurer, health insuring corporation, or multiple employer welfare arrangement for charges covered by a health benefit plan.

How are reimbursement rates calculated?

To calculate the average reimbursement rate, divide the sum of total payments by the sum of total submitted charges/claims. To calculate the average reimbursement rate per encounter, divide the sum of total payments within a given period by the number of encounters within the same period.

How does Medicare reimbursement account work?

Reimbursement Account for Basic Option Members Enrolled in Medicare Part A and Part B. Basic Option members enrolled in Medicare Part A and Part B are eligible to be reimbursed up to $800 per calendar year for their Medicare Part B premium payments. The account is used to reimburse member-paid Medicare Part B premiums.

Who is entitled to Medicare reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

How does reimbursement work?

Reimbursement is when a business pays back an employee, client, or other people for money they spent out of their pocket or for overpaid money. Some examples are getting money back for business costs, insurance premiums, and overpaid taxes. In contrast to regular pay, however, reimbursement is not taxed.

What is the most common form of reimbursement?

Fee-for-service (FFS)Fee-for-service (FFS) is the most common reimbursement structure and is exactly what it sounds like: providers bill a code for every service performed, including supplies.

Is a reimbursement considered a payment?

Reimbursement is used when the subject is paid back for travel expenses such as mileage, lodging, food while traveling. Compensation is "payment" for things such as time, discomfort, inconvenience. What are the requirements for reimbursement?

What are the rules for reimbursement?

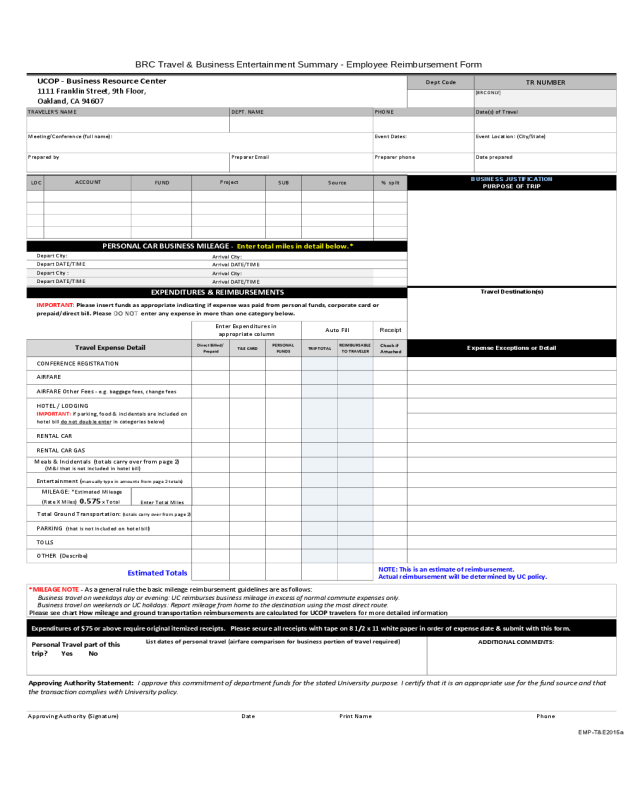

What Is An Expense Reimbursement?The expense must be for deductible business expenses that are paid or incurred by an employee in the course of performing services for your organization.The employee must be required to substantiate the amount, time, use, and business purpose of the reimbursed expenses.

What are the four main methods of reimbursement?

Here are the five most common methods in which hospitals are reimbursed:Discount from Billed Charges. ... Fee-for-Service. ... Value-Based Reimbursement. ... Bundled Payments. ... Shared Savings.

What are the 3 components of reimbursement?

The three parts of reimbursement are coding, coverage, and payment. The code is a standard alphanumeric sequence that describes drugs, medical devices, and medical and surgical procedures and services.

Has the 2022 Medicare fee schedule been released?

On November 2, CMS the Centers for Medicare and Medicaid Services (CMS) finalized its calendar year (CY) 2022 updates to the Medicare Physician Fee Schedule (PFS).

Where can I find Medicare fee schedules?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

What is Medicare fee schedule 99213?

CPT CODE 2016 Fee 2017 FEE99201$35.96 $43.699212$37.17 $43.199213$58.89 $72.799214$88.33 $107.299215$118.95 $144.85 more rows

How do I get reimbursed for Medicare payments?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Physician Fee Schedule | CMS

Learn What’s New for CY 2023. CMS issued a CY 2023 Medicare Physician Fee Schedule (PFS) final rule to expand access to behavioral health care, cancer screening coverage, and dental care. See the press release, PFS fact sheet, Quality Payment Program fact sheets, and Medicare Shared Savings Program fact sheet for provisions effective January 1, 2023.

Fee Schedules - General Information | CMS

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

Medicare Reimbursement Rates and Payment Schedule Explained

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you.

Copayment - Glossary | HealthCare.gov

: You pay $20, usually at the time of the visit. If you haven't met your deductible: You pay $100, the full allowable amount for the visit. Copayments (sometimes called "copays") can vary for different services within the same plan, like drugs, lab tests, and visits to specialists.

What types of services does the term “procedure coding” include?

Use in-text citations appropriately and provide full citations for your initial post and at least one of your response posts. One of your citations needs to be outside of your text.

What is Medicare reimbursement schedule?

A Medicare reimbursement schedule is the amount of money a doctor or medical facility will receive for a certain procedure in the United States when treating a patient covered by the Medicare program. This money is set by the United States government and can change based on a number of different factors. The Medicare reimbursement schedule is generally less than doctors will receive if a patient has private insurance or is paying personally for the procedure. Some in the medical community have criticized the lower payments and, because of that, the issue is often politicized.

Who determines the Medicare fee schedule?

The fee schedule is determined by the Physician Payment Review Commission, which recommends the schedule to Congress. Under the previous system, Medicare payments were determined by a "reasonable fee" policy, which led to big differences between health care providers.

What factors determine Medicare reimbursement?

One of the major factors in determining the Medicare reimbursement schedule is the geographic location. Some procedures may receive higher payments in certain areas because of factors such as the cost of providing service. If the physician's costs are lower, then physicians in those areas may receive a lower payment.

Can Medicare patients be billed?

This is one of the only legal times a Medicare patient can be billed. One of the other major exceptions is when the procedure being done is not covered under the Medicare reimbursement schedule.

Do hospitals have to accept Medicare?

If a hospital, private doctor, or other type of medical facility accepts Medicare patients, then they must also accept the Medicare reimbursement schedule. Those who try to increase income by requiring a certain co-pay from the individual are in violation of the law, if that co-pay extends beyond the maximum allowed by the schedule.

Who has the final say in a fee schedule?

Congress has the final say in any schedule, and can potentially be swayed by constituent groups. The fee schedule is based on the relative cost of the procedure, the area, and other parts of a formula may include such provisions as a 10 percent incentive for those providers practicing in areas that have critical shortages.

Is Medicare reimbursement less than private insurance?

The Medicare reimbursement schedule is generally less than doctors will receive if a patient has private insurance or is paying personally for the procedure. Some in the medical community have criticized the lower payments and, because of that, the issue is often politicized. The fee schedule is determined by the Physician Payment Review ...

What Is Reimbursement?

Reimbursement is compensation paid by an organization for out-of-pocket expenses incurred or overpayment made by an employee, customer, or another party. Reimbursement of business expenses, insurance costs, and overpaid taxes are common examples. However, unlike typical compensation, reimbursement is not subject to taxation. 1

What is reimbursement in insurance?

Beyond business expenses, reimbursement is also used in the insurance industry. When a health insurance policyholder needs urgent medical attention, the policyholder is unlikely to have the time to contact the insurer to determine the extent to which the policy covers expenses. The policyholder may have to pay for medication, medical services, or related expenses out-of-pocket.

How does Medicare reimburse out of pocket expenses?

Out-of-pocket Medicare expenses are usually reimbursed by filing a claim. You can ask your health care provider to file the claim or you can do it yourself. Medicare then reimburses the medical costs directly to the service provider.

What is the vested interest in reimbursement?

Organizations, whether businesses, insurers, or governments , have a vested interest in ensuring that reimbursements are only provided for legitimate reasons. Employees, insurance policyholders, and taxpayers can file for an expense that never occurred or inflate the value of an expense. This requires the reimbursing organization to develop internal control processes in an attempt to catch fraudulent reimbursement requests.

Can insurance reimburse you for fitness?

This is common in the case of fitness reimbursement. An insurer may reimburse up to a certain amount each year if a policyholder pays for and actively participates in a fitness program at a qualified fitness center.

Who has a vested interest in ensuring that reimbursements are only provided for legitimate reasons?

Organizations, whether businesses, insurers, or governments, have a vested interest in ensuring that reimbursements are only provided for legitimate reasons. Employees, insurance policyholders, and taxpayers can file for an expense that never occurred or inflate the value of an expense. This requires the reimbursing organization to develop internal control processes in an attempt to catch fraudulent reimbursement requests.

Is a reimbursement a state or federal tax?

Reimbursement is also common with taxes paid to state and federal governments. Most income taxpayers have federal taxes withheld each pay period through payroll deductions, which does not take into account the credits that a taxpayer may be entitled to due to other taxes paid or expenditures made. 2 Contractors pay their taxes in quarterly estimated tax payments. 3 Tax refunds provided to the taxpayer by the government are a form of reimbursement, as the money being returned to the taxpayer is due to a previous overpayment.

What Are Medicare Reimbursement Rates?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you.

What percentage of Medicare is reimbursed?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate.

What is Medicare coded number?

Medicare uses a coded number system to identify health care services and items for reimbursement. The codes are part of what’s called the Healthcare Common Procedure Coding System (HCPCS).

What is Medicare reimbursement schedule?

A Medicare reimbursement schedule is the amount of money a doctor or medical facility will receive for a certain procedure in the United States when treating a patient covered by the Medicare program. This money is set by the United States government and can change based on a number of different factors. The Medicare reimbursement schedule is generally less than doctors will receive if a patient has private insurance or is paying personally for the procedure. Some in the medical community have criticized the lower payments and, because of that, the issue is often politicized.

Who determines the Medicare fee schedule?

The fee schedule is determined by the Physician Payment Review Commission, which recommends the schedule to Congress. Under the previous system, Medicare payments were determined by a "reasonable fee" policy, which led to big differences between health care providers.

What factors determine Medicare reimbursement?

One of the major factors in determining the Medicare reimbursement schedule is the geographic location. Some procedures may receive higher payments in certain areas because of factors such as the cost of providing service. If the physician's costs are lower, then physicians in those areas may receive a lower payment.

Can Medicare patients be billed?

This is one of the only legal times a Medicare patient can be billed. One of the other major exceptions is when the procedure being done is not covered under the Medicare reimbursement schedule.

Do hospitals have to accept Medicare?

If a hospital, private doctor, or other type of medical facility accepts Medicare patients, then they must also accept the Medicare reimbursement schedule. Those who try to increase income by requiring a certain co-pay from the individual are in violation of the law, if that co-pay extends beyond the maximum allowed by the schedule.

Who has the final say in a fee schedule?

Congress has the final say in any schedule, and can potentially be swayed by constituent groups. The fee schedule is based on the relative cost of the procedure, the area, and other parts of a formula may include such provisions as a 10 percent incentive for those providers practicing in areas that have critical shortages.

Is Medicare reimbursement less than private insurance?

The Medicare reimbursement schedule is generally less than doctors will receive if a patient has private insurance or is paying personally for the procedure. Some in the medical community have criticized the lower payments and, because of that, the issue is often politicized. The fee schedule is determined by the Physician Payment Review ...