What is a release of levy?

IRS Definition If the levy on your bank account or other account is creating an immediate economic hardship, the levy may be released. A levy release does not mean you are exempt from paying the balance. The IRS will work with you to establish a payment plan or take other steps to help you pay off the balance.

How do I release a levy from the IRS?

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision.

What is a 668 a levy?

Form 668-A, Notice of Levy, is utilized by the IRS to seize funds in bank accounts, accounts receivable, and the cash value of life insurance from third parties holding assets for the taxpayer. The Levy attaches only to the funds/assets held for the taxpayer at the time the levy is received by the third party.

How long does it take for a levy to be released?

21 daysHow long does it take for the IRS to release a levy? You have 21 days before your funds will be sent to the IRS once it levies your bank account. If you set up an agreement with the IRS, an IRS bank levy release can be same-day.

How long does it take to get an IRS levy removed?

With simple payment agreements, the IRS will release the levy immediately. That's assuming you haven't already gotten a payment extension. Normally, when you request an extension, you can get up to 120 days.

How long does an IRS levy last?

If the IRS chooses a bank levy as the means of collection, they will contact your bank and require a hold on any funds in your account. That hold is in effect for 21 days—a period during which you can act to stop the levy.

What is worse a levy or a lien?

Levies are different from liens. A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt. A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that you neglect or refuse to pay it.

Why did I receive a Notice of levy?

If you have unpaid taxes, you typically receive the IRS final notice of levy 30 days before the levy takes place. The notice of levy IRS means that the levy is for federal taxes. If you receive a notice of levy from the state, that means the state plans to seize your assets for unpaid state taxes.

How do I get a levy removed?

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.

How serious is a levy?

A tax levy is the most powerful action the IRS can take to collect what you owe. The IRS has more rights than other creditors, so they can take more serious action against you. The only way to stop a tax levy is to work with the IRS.

What happens if your bank account is levied?

A bank levy is a legal action that allows creditors to take funds from your bank account. Your bank freezes funds in your account, and the bank is required to send that money to creditors to satisfy your debt.

What happens when you get a tax levy?

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

How do I contact the IRS about my levy?

The state and IRS notices refer you to call (800) 829-7650 or (800) 829-3903 for assistance.

How do you pay off a levy?

How to get rid of a tax lien or tax levyPay your tax bill. Sounds obvious, but in most cases paying your back taxes is the only way to stop a tax lien or tax levy. ... Get on an IRS payment plan. ... Ask for an offer in compromise. ... File an appeal. ... File for bankruptcy.

Will a payment plan stop a levy?

The IRS generally won't levy your assets or garnish your wages while you are paying off your tax debt with an installment agreement. However, you must meet all the terms of your installment agreement to avoid a potential payment plan default.

Will payment plan stop IRS levy?

Installment Agreement Interest continues to accrue, but as long as you make payments on time, the IRS reduces the failure to pay penalty by 50%. Generally, taxpayers need to request the tax levy stop once an installment agreement is pending.

What is IRS Form 668 A?

The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank, freezing the funds held in that account. ... The Form 668-W Notice of Levy is a continuous levy or garnishment placed usually on your wages.

What to do after signing a 668D?

Once you’ve finished signing your 668 d, decide what you wish to do after that - save it or share the doc with other people. The signNow extension provides you with a variety of features (merging PDFs, including several signers, and so on) to guarantee a much better signing experience.

What does an IRS lien mean?

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

Why is 668das so popular?

668das gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to eSign form 668 d right in your browser.

What is 668dke on iPhone?

668dke an iPhone or iPad, easily create electronic signatures for signing a form 668 d in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

Can I esign a 668D?

That goes for agreements and contracts, tax forms and almost any other document that requires a signature. The question arises ‘How can I eSign the form 668 d I received right from my Gmail without any third-party platforms? ’ The answer is simple - use the signNow Chrome extension.

Can you download a signed 668D?

As a result, you can download the signed 668 d to your device or share it with other parties involved with a link or by email. Because of its multi-platform nature, signNow works on any device and any OS. Select our eSignature tool and leave behind the old times with efficiency, security and affordability.

What is a 668D form?

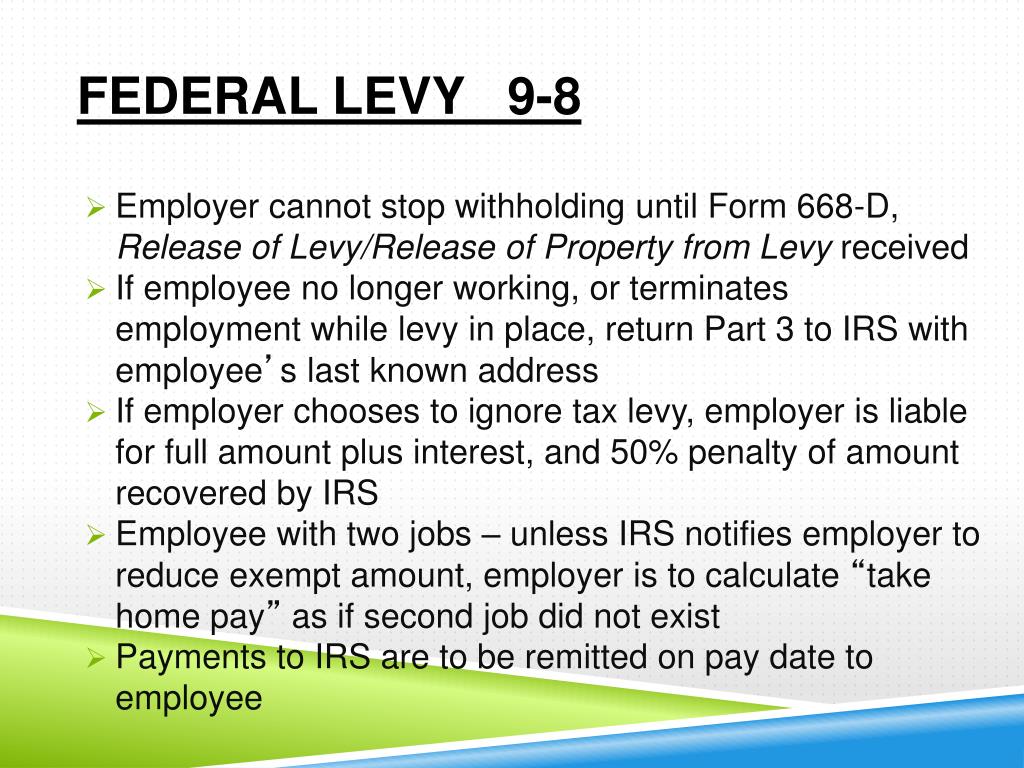

Form 668D, Release of Levy/Release of Property from Levy is sent to taxpayers who meet one of the terms for release.

What is a 668A?

Form 668A, Notice of Levy (Accounts) is sent to both individuals and businesses. When the taxpayer files a return without remitting the balance due or the IRS has prepared a substitute for return (SFR) on behalf of the taxpayer, the IRS sends a series of notices to secure payment of the balance due. The final notice of the series gives the taxpayer 30 days to pay or request a hearing. If the taxpayer fails to respond to the final notice and intent to levy, the IRS will seek enforced collection by levy. Taxpayers have 21 calendar days from the date of the letter to respond. This notice applies to the taxpayer’s money or assets held by third parties. Such third parties are then compelled to turn over the taxpayer’s assets to the IRS.

How is the IRS levy determined?

The amount required to be sent to the IRS is determined from a chart provided by the IRS. The levy will remain in place until the taxpayer submits full payment, enters into a payment agreement to address the unpaid balance or provides substantiation of financial hardship.

What is the 668 series?

The 668 series of forms typically appear on a taxpayer’s credit record and damage the credit score. Much of that damage may be mitigated by filing form 12277 requesting withdrawal once the requirements are met.

How long does it take to respond to a tax levy?

If the taxpayer fails to respond to the final notice and intent to levy, the IRS will seek enforced collection by levy. Taxpayers have 21 calendar days from the date of the letter to respond. This notice applies to the taxpayer’s money or assets held by third parties.

What is levy release?

Levy Release (with Economic Hardship): If the levy — on your wages, bank account, or other assets — is creating an immediate economic hardship on you, meaning you’re unable to meet basic, reasonable living expenses, then the levy must be released. Contact the IRS at the number on the levy or notice immediately.

What happens if the IRS denies your levy release request?

If the IRS denies your levy release request, then you can appeal the decision. See Publication 1660 for a full explanation of Collection Due Process (CDP), the Equivalent Hearing process, and Collection Appeal Process (CAP).

How did I get here?

You have a balance on your tax account. A notice was sent to you previously letting you know how much you owe, when it was due, and how to pay. Since the IRS did not hear from you it is continuing with its collection process. The IRS can use a levy to satisfy a tax debt when you don’t respond to notices informing you of the debt and asking for payment.

What is a wrongful tax levy?

Wrongful Levy: A wrongful levy occurs if you are not liable for the tax and the IRS has levied property that you believe belongs to you or the levy improperly attaches to property belonging to a third party in which the taxpayer has no rights. A third party believes the levy is wrongful because the property levied belongs to them, ...

How to check if IRS sent a levy?

Determine if the IRS sent the notice. The first thing to do is to check the return address to be sure it’s from the Internal Revenue Service and not another agency. If the levy is from the IRS, and your property or federal payments are seized, call the number on your levy notice or 1-800-829-1040. If you’re already working with ...

What does it mean when the IRS levy is a lien?

It is different from a lien — while a lien makes a claim to your assets as security for a tax debt, the levy seizes your property (such as funds from a bank account, Social Security benefits, wages, your car, or your home). It also could mean that you have requested the IRS to return funds levied, and your request has been rejected. For specifics, see Levies and Publication 1660.

How to get a tax levy relief?

Levy Relief: You should call the number on the levy notice immediately to resolve your tax liability and request a levy release. The IRS must release a levy if it determines that: