Full Answer

What is the repo market and how does it work?

First things first: what exactly is the repo market? A repurchase agreement (repo) is a short-term secured loan: one party sells securities to another and agrees to repurchase those securities later at a higher price. The securities serve as collateral.

What is a repo purchase agreement?

A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group of securities for a specified period. The buyer agrees to sell those same assets back to the original owner at a slightly higher price using a reverse repo agreement.

What is the full form of Repo?

Repo is short for Sale and Repurchase. Repo transactions are the sale and repurchase of securities over agreed time periods with fixed start and end pricing on the securities. In a repo parties exchange cash and securities agreeing the rate of interest.

What are the different types of repos?

Repurchase agreements with longer maturity are commonly referred to as “open” repos; these types of repos usually do not have a set maturity date. The agreements with a specified short maturity are referred to as “term” repos. The dealer sells securities to investors on an overnight basis, and the securities are bought back on the following day.

How does a repo trade work?

A repurchase agreement (repo) is a short-term secured loan: one party sells securities to another and agrees to repurchase those securities later at a higher price. The securities serve as collateral.

What is the purpose of a repo?

While the purpose of the repo is to borrow money, it is not technically a loan: Ownership of the securities involved actually passes back and forth between the parties involved. Nevertheless, these are very short-term transactions with a guarantee of repurchase.

How are repo trades settled?

Settlement of repurchase leg: Upon termination of the repo, securities collateral is returned to the cash borrower and cash, including interest, is returned to the cash lender. For the settlement of the repurchase leg, counterparties rely on the same payment and securities settlement systems as for the purchase leg.

What is repo example?

In general, high-quality debt securities are used in a repurchase agreement. The securities function as collateral in a repurchase agreement. Examples may include government bonds, agency bonds, supranational bonds, corporate bonds, convertible bonds, and emerging market bonds.

Who uses repo market?

Traditionally, the principal users of repo on the sellers' side of the market have been securities market intermediaries (market-makers and other securities dealers in firms called 'broker-dealers' or 'investment banks') and leveraged and other bond investors seeking funding.

What is the advantage of repo?

The main benefit of repos to borrowers is that the repo rate is less than borrowing from a bank. The main benefit to lenders over other money market instruments, such as commercial paper, is that the maturity of the repo can be precisely tailored to the lender's needs.

What is the current US repo rate?

ActualPreviousFrequency2.312.31Daily

What is the current repo rate?

5.40 per centThe Reserve Bank of India announced renewed rate hikes in the August 2022 Monetary Policy committee review. The repo rate was hiked by 50 bps to 5.40 per cent.

Is a repo a true sale?

To the extent that ownership is treated as transferred to the repo buyer, a repo is treated as a true sale and repurchase.

What are the types of repos?

Broadly, there are four types of repos available in the international market when classified with regard to maturity of underlying securities, pricing, term of repo etc. They comprise buy-sell back repo, classic repo bond borrowing and lending and tripartite repos.

Are repos assets or liabilities?

Repurchase agreements (often referred to as "repos") are transactions in which a transferor transfers a financial asset (typically a high-quality debt security) to a transferee in exchange for cash.

How does repo rate affect consumers?

Increasing the repo rate causes the Banks to increase their lending rates to consumers. When lending rates are higher, the demand on money by consumers drops. This drop in demand results in less money being spent.

Why do hedge funds use repos?

Hedge funds use the repo market both to borrow cash, by placing securities as collateral with dealers, and to borrow securities from dealers, offering cash in return. Hedge funds can use repo to increase their leverage, which magnifies both their potential gains and their potential losses.

Are repos assets or liabilities?

Repurchase agreements (often referred to as "repos") are transactions in which a transferor transfers a financial asset (typically a high-quality debt security) to a transferee in exchange for cash.

What happens when repo rate increases?

The repo rate is the rate at which the RBI lends money to banks. If the repo rate is high, the banks would have less money to lend, which in turn reduces the purchasing power of people. The reduction in purchasing power reduces demand which in turn reduces inflation.

What are the different types of repos?

Broadly, there are four types of repos available in the international market when classified with regard to maturity of underlying securities, pricing, term of repo etc. They comprise buy-sell back repo, classic repo bond borrowing and lending and tripartite repos.

Why do we use repurchase agreements?

) for cash. Repurchase agreements are commonly used to provide short-term liquidity.

What does it mean when a party sells securities in a repurchase agreement?

At a high level, the party selling securities in a repurchase agreement commonly does so to be able to raise short-term funds, while the party purchasing the securities commonly does so to earn interest on excess cash.

What is a repurchase agreement rate?

The repo rate is a simple interest rate that is stated on an annual basis using 360 days. To understand this, an example is presented below.

What are the types of securities used in a repurchase agreement?

The securities function as collateral in a repurchase agreement. Examples may include government bonds, agency bonds, supranational bonds, corporate bonds, convertible bonds, and emerging market bonds.

What is the lifecycle of a repurchase agreement?

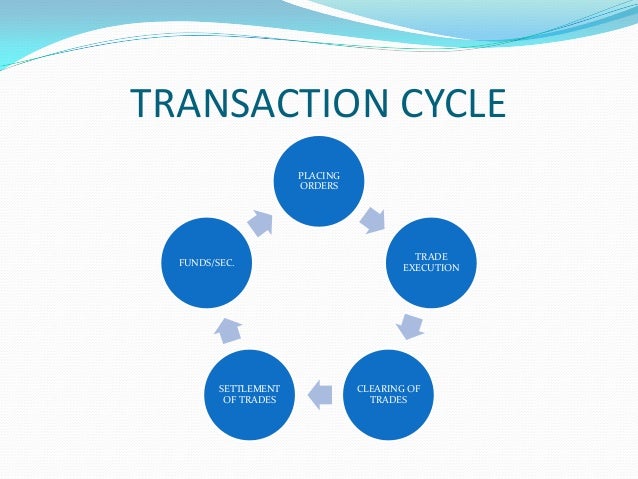

The lifecycle of a repurchase agreement involves a party selling a security to another party and simultaneously signing an agreement to repurchase the same security at a future date at a specified price. The repurchase price is slightly higher than the initial sale price to reflect the time value of money. This is visually illustrated below.

What is a party purchasing in a repurchase agreement?

The party “purchasing” in a repurchase agreement: This party is buying the security from the opposing party through lending cash. Eventually, this party resells the same security back to the opposing party at a future date at a specified price.

How many parties are involved in a repurchase agreement?

There are two parties involved in a repurchase agreement:

What does repo mean?

Repo means repurchasing agreement, which is a type of short-term, fixed-income exchange. In a repo, one party sells an asset (normally a security) to another party at a set price, under the condition that they will buy it back at a different, slightly higher price in the future.

What is the purpose of a repo?

The main purpose of the repo market is to aid in the efficient running of almost every other financial market by underpinning liquidity. Specifically, here are a few other aims of the repo market:

What is tenor in repurchasing agreements?

The tenor of a repurchasing agreement is the amount of time before the contract expires. Most repo contracts are only overnight, but different types of repo agreement can be created that either have longer tenors or indefinite tenors.

What are the different types of repos?

There are lots of different types of repos depending on the underlying collateral and process of the contract. Here are some of the most well-known types of repos:

How do central banks impact the repo market?

The repo market is both a vital source of information for central banks about the state of the economy, and the way in which central banks carry out monetary policy.

What is the role of the repo market in the central bank?

Facilitating central bank monetary policy operations: the repo market enables central banks to conduct monetary policies by buying securities – this adds reserves and liquidity into financial markets

What is a third party repo?

Tri-party repo: a third-party acts as the intermediary between the lender and borrower – usually a broker. The collateral is left with the third party, and the lender receives a substitution. This is the most common repo

Why do banks use repo?

The repo market allows financial institutions that own lots of securities (e.g. banks, broker-dealers, hedge funds) to borrow cheaply and allows parties with lots of spare cash (e.g. money market mutual funds) to earn a small return on that cash without much risk, because securities, often U.S. Treasury securities, serve as collateral. Financial institutions do not want to hold cash because it is expensive—it doesn’t pay interest. For example, hedge funds hold a lot of assets but may need money to finance day-to-day trades, so they borrow from money market funds with lots of cash, which can earn a return without taking much risk.

What is reverse repo?

A reverse repurchase agreement (reverse repo) is the mirror of a repo transaction. In a reverse repo, one party purchases securities and agrees to sell them back for a positive return at a later date, often as soon as the next day. Most repos are overnight, though they can be longer.

What happened in the repo market in September 2019?

The repo rate spiked in mid-September 2019, rising to as high as 10 percent intra-day and, even then, financial institutions with excess cash refused to lend. This spike was unusual because the repo rate typically trades in line with the Federal Reserve’s benchmark federal funds rate at which banks lend reserves to each other overnight. The Fed’s target for the fed funds rate at the time was between 2 percent and 2.25 percent; volatility in the repo market pushed the effective federal funds rate above its target range to 2.30 percent.

How does the Fed use reverse repos?

The Federal Reserve uses repos and reverse repos to conduct monetary policy. When the Fed buys securities from a seller who agrees to repurchase them, it is injecting reserves into the financial system. Conversely, when the Fed sells securities with an agreement to repurchase, it is draining reserves from the system. Since the crisis, reverse repos have taken on new importance as a monetary policy tool. Reserves are the amount of cash banks hold – either currency in their vaults or on deposit at the Fed. The Fed sets a minimum level of reserves; anything over the minimum is called “excess reserves.” Banks can and often do lend excess reserves in the repo market.

How does the Fed keep the funds rate in its target range?

The Fed can take direct action to keep the funds rate in its target range by offering its own repo trades at the Fed’s target rate. When the Fed first intervened in September 2019, it offered at least $75 billion in daily repos and $35 billion in long-term repo twice per week. Subsequently, it increased the size of its daily lending to $120 billion and lowered its long-term lending. But the Fed has signaled that it wants to wind down the intervention: Federal Reserve Vice Chair Richard Clarida said, “It may be appropriate to gradually transition away from active repo operations this year,” as the Fed increases the amount of money in the system via purchases of Treasury bills.

What is a repurchase agreement?

A repurchase agreement (repo) is a short-term secured loan: one party sells securities to another and agrees to repurchase those securities later at a higher price. The securities serve as collateral.

Are any financial regulations contributing to the problems in the repo market?

The short answer is yes – but there is substantial disagreement about how big a factor this is. Banks and their lobbyists tend to say the regulations were a bigger cause of the problems than do the policymakers who put the new rules into effect after the global financial crisis of 2007-9. The intent of the rules was to make sure banks have sufficient capital and liquid assets that can be sold quickly in case they run into trouble. These rules may have led banks to hold on to reserves instead of lending them in the repo market in exchange for Treasury securities.

What is reverse repo?

A reverse repo is a transaction for the lender of a repurchase agreement. The lender buys the security from the borrower at a price with an agreement to sell it at a higher price at a pre-agreed future date.

What is a whole loan repo?

A whole loan repo is a repurchase agreement in which a loan or a debt obligation is the collateral instead of a security.

What is due bill repurchase?

A due bill repurchase agreement has an internal account in which the collateral for the lender is kept in. Typically, the borrower hands over possession of the collateral to the lender but in this case, it is placed in another bank account. This bank account is in the name of the borrower for the period of the agreement.

What is a repurchase agreement?

A repurchase agreement is also known as RP or repo is a type of a short-term borrowing which is generally used by individuals who deal in government securities and such an agreement can happen between multiple numbers of parties and it can be classified into three types- specialized delivery repo, held-in-custody repo, and third-party repo.

What is a third party?

A third party acts as an intermediary between the lender and the borrower. The collateral is handed over to the third party, and the third party will give substitution collateral. An example would be of a borrower handing over a certain amount of stock for which the lender can take bonds.

What is a repurchase loan?

It is simple terms, is a loan that is collateralized by underlying security, which has a value in the market. The buyer of a repurchase agreement is the lender, and the seller of the repurchase agreement is the borrower. The seller of the repurchase agreement needs to pay interest at the time of buying back the securities, which are called the Repo Rate.

What happens if a lender goes bankrupt?

If the counterparty becomes bankrupt or insolvent, the lender may suffer a loss of principal and interest.

What is a repo?

Repo. A repurchase agreement (RP) is a short-term loan where both parties agree to the sale and future repurchase of assets within a specified contract period. The seller sells a Treasury bill or other government security with a promise to buy it back at a specific date and at a price that includes an interest payment.

What is the purpose of repo and RRP?

The Federal Reserve also uses the repo and RRP as a method to control the money supply. 1 . Essentially, repos and reverse repos are two sides of the same coin — or rather, transaction — reflecting the role of each party. A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group ...

What is reverse repos?

Essentially, repos and reverse repos are two sides of the same coin — or rather, transaction — reflecting the role of each party. A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group of securities for a specified period. The buyer agrees to sell those same assets back to the original owner at a slightly higher price using a RRP.

How does a counterparty earn interest?

The counterparty earns interest on the transaction in the form of the higher price of selling the securities back to the dealer. The counterparty also gets the temporary use of the securities.

How long does it take for a repo contract to be reversed?

However, some contracts are open and have no set maturity date, but the reverse transaction usually occurs within a year. Dealers who buy repo contracts are generally raising cash for short-term purposes.

How long does a reverse purchase contract last?

However, some contracts are open and have no set maturity date, but the reverse transaction usually occurs within a year.

When are reverse repurchase and repurchase agreements agreed upon?

Both the repurchase and reverse repurchase portions of the contract are determined and agreed upon at the outset of the deal.