Full Answer

What is financial statement analysis?

Mar 03, 2022 · Financial statement analysis involves gaining an understanding of an organization's financial situation by reviewing its financial reports. The results can be used to make investment and lending decisions. This review involves identifying the following items for a company's financial statements over a series of reporting periods: Trends

What should the Financial Analysis section of a business plan contain?

Feb 11, 2022 · Financial reporting refers to standard practices to give stakeholders an accurate depiction of a company’s finances, including their revenues, expenses, profits, capital, and cash flow, as formal records that provide in-depth insights into financial information.

What is the purpose of an analysis plan?

Aug 06, 2020 · Our financial projections template includes many standard financial ratios which can be used to highlight trends in the projections and to make comparisons with historical and industry data. Financial ratios can be split into six main categories. Profitability Ratios; Liquidity Ratios; Efficiency ratios; Leverage Ratios; Activity ratios; Investor ratios

What is financial analysis and why is it important?

What are the elements of financial analysis?

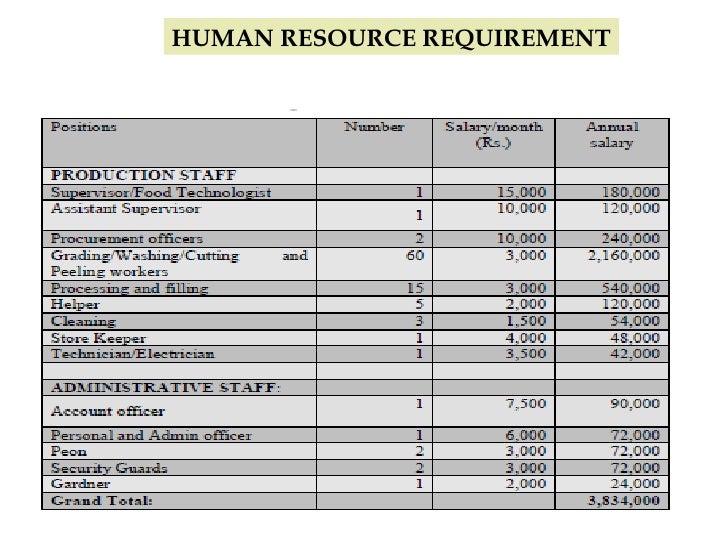

The financial analysis section should be based on estimates for new businesses or recent data for established businesses. It should include these elements: 1 Balance sheet: Your assumed and anticipated business financials, including assets, liabilities, and equity. 2 Cash-flow analysis: An overview of the cash you anticipate will be coming into your business based on sales forecasts, minus the anticipated cash expenses of running the business. 3 Profit-and-loss analysis: Your income statement that subtracts the costs of the business from the earnings over a specific period of time, typically a quarter or a year. 4 Break-even analysis: Demonstrates the point when the cost of doing business is fully covered by sales. 5 Personnel-expense forecast: The expenses of your team, as outlined in a management summary section.

How to lose the attention of a potential investor?

A quick way to lose the attention of a potential investor is by having flawed calculations or numbers that are not backed up. Double and triple check all of your calculations and figures, and have a third-party do the same to ensure everything adds up.

Is there a section of a business plan where you need help as much as you do with your financial analysis

There may be no section of your business plan where you need help as much as you do with your financial analysis section. The assumptions, forecasting, and specific numbers can be complicated and generally difficult to wrap your head around, especially if you don’t have a financial background.

What is horizontal analysis?

Horizontal analysis involves taking several years of financial data and comparing them to each other to determine a growth rate. This will help an analyst determine if a company is growing or declining, and identify important trends.

What is liquidity analysis?

This is a type of financial analysis that focuses on the balance sheet, particularly, a company’s ability to meet short-term obligations (those due in less than a year). Common examples of liquidity analysis include:

What is leverage analysis?

Leverage Analysis. Leverage ratios are one of the most common methods analysts use to evaluate company performance. A single financial metric, like total debt, may not be that insightful on its own, so it’s helpful to compare it to a company’s total equity to get a full picture of the capital structure.

What are the different types of budgets?

Types of Budgets There are four common types of budgeting methods that companies use: (1) incremental, (2) activity-based, (3) value proposition, and (4) or forecast . Financial Forecasting Financial forecasting is the process of estimating or predicting how a business will perform in the future.

What is efficiency ratio?

Efficiency ratios are an essential part of any robust financial analysis. These ratios look at how well a company manages its assets and uses them to generate revenue and cash flow.

What is profitability in accounting?

Profitability is a type of income statement#N#Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or#N#analysis where an analyst assesses how attractive the economics of a business are. Common examples of profitability measures include:

What is the acid test?

Acid-Test Ratio The Acid-Test Ratio, also known as quick ratio, is a liquidity ratio that measures how sufficient a company's short-term assets can cover current liabilities. Cash ratio.

What is financial analysis?

Financial Analysis Definition. Financial analysis refers to an analysis of finance-related projects/activities or company’s financial statements which includes a balance sheet, income statement, and notes to accounts or financial ratios to evaluate company’s results, performance and its trend which will be useful for taking significant decisions ...

Why is analysis important in financial statements?

of the company. Analysis and examination of Financial statements are essential tools in assessing the company’s health , and it provides information to company management. Then it is used by them for future planning and decision making. It helps the company to raise capital in domestic as well as overseas.

What is internal rate of return?

The internal rate of return is a metric employed in capital budgeting, which is used to measure the extent of profitability of potential investments. It is also known as ERR or economic rate of return. IRR is defined as the discount rate that sets the NPV of a project to zero is the project’s IRR. The following tools can be used to rate of return analysis –

What is financial information?

It is the systematic process of analyzing or examination of financial information#N#Financial Information Financial Information refers to the summarized data of monetary transactions that is helpful to investors in understanding company’s profitability, their assets, and growth prospects. Financial Data about individuals like past Months Bank Statement, Tax return receipts helps banks to understand customer’s credit quality, repayment capacity etc. read more#N#of the company to reach a business decision. People in the company examine how stable, solvent, and profitable business or any project of the company and these assessments are carried out by examining the income statement, balance statement, and cash flow statement#N#Cash Flow Statement Statement of Cash flow is a statement in financial accounting which reports the details about the cash generated and the cash outflow of the company during a particular accounting period under consideration from the different activities i.e., operating activities, investing activities and financing activities. read more#N#of the company.

What are the disadvantages of financial analysis?

Disadvantages. One of the disadvantages of financial analysis is that it uses facts and figures that are as per current market conditions, which may fluctuate. False data in the statement will give you false analysis, and data may be manipulated companies, and it may not be accurate.

What is valuation analysis?

Valuation Analysis helps us identify the fair value of the business, investment, or a company. While valuing a business, choosing the correct valuation methodology is very important. You may use one of the following valuation financial analysis tools –. DDM.

What is risk analysis?

Risk Analysis Risk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business. There are two types of risk analysis - quantitative and qualitative risk analysis. read more.

1. Revenues

Revenues are probably your business's main source of cash. The quantity, quality and timing of revenues can determine long-term success.

2. Profits

If you can't produce quality profits consistently, your business may not survive in the long run.

3. Operational Efficiency

Operational efficiency measures how well you're using the company’s resources. A lack of operational efficiency leads to smaller profits and weaker growth.

4. Capital Efficiency and Solvency

Capital efficiency and solvency are of interest to lenders and investors.

5. Liquidity

Liquidity analysis addresses your ability to generate sufficient cash to cover cash expenses. No amount of revenue growth or profits can compensate for poor liquidity.

Basis for Comparison

The final part of the financial analysis is to establish a proper basis for comparison, so you can determine if performance is aligned with appropriate benchmarks. This works for each data point individually as well as for your overall financial condition.

What is financial analysis?

Financial analysis and reporting are accurate, cohesive, and widely accessible means of sharing critical financial information throughout your organization. If your financial insights or data is fragmented, things can quickly fall apart.

What is financial reporting?

Financial reporting refers to standard practices to give stakeholders an accurate depiction of a company’s finances, including their revenues, expenses, profits, capital, and cash flow, as formal records that provide in-depth insights into financial information.

What is a KPI dashboard?

Offering an essential snapshot of vital financial performance data, a robust financial KPI dashboard offers a cohesive mix of tables, graphs, and charts designed to maintain fiscal health. Working with KPIs such as Working Capital, Cash Conversion Cycle, Budget Variance, and more, this dynamic financial reporting system will empower you to reduce inefficiencies, make accurate forecasts, and keep cash flowing through the organization effectively.

What is the accounting system used by the United States?

The GAAP (Generally Accepted Accounting Principles). This is the system used by the United States, and almost no one else (just like the Imperial measurement system!). The IFRS (International Financial Reporting Standards).

Why are financial KPIs important?

Each of these financial KPIs is incredibly important because they demonstrate the overall ‘health’ of a company – at least when it comes to the small matter of money. These types of KPI reports don’t offer much insight into a company’s culture or management structure, but they are vital to success, nonetheless.

Why is financial reporting required?

Financial reporting and analysis give investors, creditors, and other businesses an idea of the financial integrity and creditworthiness of your company.

Why is cash flow important?

Cash flow: Big or small, an organization’s cash flow is essential to its ongoing financial health. Working with a mix of detailed metrics and KPIs, it’s possible to drill down into cash flow in relation to anticipated profit and liabilities, keeping your monetary movements secure and fluent in the process.

What is financial ratio?

Financial ratios are derived from information included in the income statements and balance sheets of the business plan financial projections. The ratios are used as indicators of the the financial health of the business and for comparing the performance of the business with other businesses in the same sector, ...

Why are financial ratios important?

Financial ratios are used to analyse business trends and measure performance of both the business and the management. One financial ratio viewed in isolation will not tell you a great deal about a business.

What is liquidity ratio?

A liquidity ratio is used to measure the ability of a business to generate cash to meet its short term liabilities and debts. The following financial ratios are included and calculated for you in the financial projections template: Current ratio. Quick ratio.

How to calculate current ratio?

It is calculated by dividing current assets by current liabilities.

What is profitability ratio?

Profitability ratios are used to measure the ability of a business and its management to generate profit and the following financial ratios are included and calculated for you in the financial projections template:

How to calculate return on equity?

It is calculated by dividing the net income by the owners equity.

How to calculate asset turnover ratio?

It is a measure of the efficiency with which the business uses its resources. It is calculated by dividing revenue by assets

Understanding Financial Analysis

- Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. This is done through the synthesis of financial numbers and data. A financial analyst will thoroughly examine a company'…

Corporate Financial Analysis

- In corporate finance, the analysis is conducted internally by the accounting department and shared with management in order to improve business decision making. This type of internal analysis may include ratios such as net present value (NPV) and internal rate of return(IRR) to find projects worth executing. Many companies extend credit to their customers. As a result, the cas…

Investment Financial Analysis

- In investment finance, an analyst external to the company conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach. A top-down approach first looks for macroeconomic opportunities, such as high-performing sectors, and then drills down to find the best companies within that sector. From this point, they further analyze th…

Examples of Financial Analysis

- As an example of fundamental analysis, Discover Financial Services reported its fourth quarter 2021 diluted earnings per share (EPS) at $3.64. That was a significant gain from the fourth quarter of the previous year, when Discover reported a diluted EPS of $2.59.1A financial analyst using fundamental analysis would take this as a positive sign that the intrinsic value of the secur…

Types of Financial Analysis

Vertical Analysis

- This type of financial analysis involves looking at various components of the income statementIncome StatementThe Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit orand dividing them by revenue to express them as a percentage. For this exercise to be most effective, the results s…

Horizontal Analysis

- Horizontal analysis involves taking several years of financial data and comparing them to each other to determine a growth rate. This will help an analyst determine if a company is growing or declining, and identify important trends. When building financial modelsWhat is Financial ModelingFinancial modeling is performed in Excel to forecast a company's financial performanc…

Leverage Analysis

- Leverage ratios are one of the most common methods analysts use to evaluate company performance. A single financial metric, like total debt, may not be that insightful on its own, so it’s helpful to compare it to a company’s total equity to get a full picture of the capital structure. The result is the debt/equity ratioDebt to Equity RatioThe Debt to Equity Ratio is a leverage ratio that …

Growth Rates

- Analyzing historical growth rates and projecting future ones are a big part of any financial analyst’s job. Common examples of analyzing growth include: 1. Year-over-year (YoYYoY (Year over Year)YoY stands for Year over Year and is a type of financial analysis used for comparing time series data. It is useful for measuring growth and detecting trends.) 2. Regression analysis…

Profitability Analysis

- Profitability is a type of income statementIncome StatementThe Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit oranalysis where an analyst assesses how attractive the economics of a business are. Common examples of profitability measures include: 1. Gross marginGross Margin RatioThe Gr…

Liquidity Analysis

- This is a type of financial analysis that focuses on the balance sheet, particularly, a company’s ability to meet short-term obligations (those due in less than a year). Common examples of liquidity analysis include: 1. Current ratioCurrent Ratio FormulaThe Current Ratio formula is = Current Assets / Current Liabilities. The current ratio, also known as the working capital ratio, me…

Efficiency Analysis

- Efficiency ratios are an essential part of any robust financial analysis. These ratios look at how well a company manages its assets and uses them to generate revenue and cash flow. Common efficiency ratios include: 1. Asset turnover ratioAsset Turnover RatioThe asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency with which a company uses its …

Cash Flow

- As they say in finance, cash is king, and, thus, a big emphasis is placed on a company’s ability to generate cash flow. Analysts across a wide range of finance careers spend a great deal of time looking at companies’ cash flow profiles. The Statement of Cash FlowsStatement of Cash FlowsThe Statement of Cash Flows (also referred to as the cash flow statement) is one of the th…

Rates of Return

- At the end of the day, investors, lenders, and finance professionals, in general, are focused on what type of risk-adjusted rate of return they can earn on their money. As such, assessing rates of return on investment (ROI) is critical in the industry. Common examples of rates of return measures include: 1. Return on Equity (ROE)Return on Equity (ROE)Return on Equity (ROE) is a m…

Top 15 Financials Analysis Techniques

Advantages

- With the help of financial analysis, method management can examine the company’s health and stability.

- It provides investors an idea about deciding whether to invest a fund or not in a particular company, and it answers a question such as whether to invest? How much to invest? And what time to invest?

- With the help of financial analysis, method management can examine the company’s health and stability.

- It provides investors an idea about deciding whether to invest a fund or not in a particular company, and it answers a question such as whether to invest? How much to invest? And what time to invest?

- It simplifies the financial statements, which help in comparing companies of different sizes with one another.

- With the help of financial analysis, the company can predict the future of the company and can forecast future market trends and able to do future planning.

Disadvantages

- One of the disadvantages of financial analysis is that it uses facts and figures that are as per current market conditions, which may fluctuate.

- False data in the statement will give you false analysis, and data may be manipulated companies, and it may not be accurate.

- A comparison between different companies is not possible if they adopt other accounting po…

- One of the disadvantages of financial analysis is that it uses facts and figures that are as per current market conditions, which may fluctuate.

- False data in the statement will give you false analysis, and data may be manipulated companies, and it may not be accurate.

- A comparison between different companies is not possible if they adopt other accounting policies.

- If any company is working in a rapidly changing and highly competitive environment, its past results shown in the financial statement may or may not be indicators of future results.

Limitations of Financial Analysis

- When companies do financial analysis, most of the time, they fail to consider the price changes, and due to this, they unable to show inflation impact.

- It only considers the monetary aspects of companies’ financial statementsFinancial StatementsFinancial statements are written reports prepared by a company's management to present the company's fin...

- When companies do financial analysis, most of the time, they fail to consider the price changes, and due to this, they unable to show inflation impact.

- It only considers the monetary aspects of companies’ financial statementsFinancial StatementsFinancial statements are written reports prepared by a company's management to present the company's fin...

- It is based on past data in financial statements,s and future results can’t be like a past.

- Many Intangible assetsIntangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franch...

Conclusion

- It is the systematic process of analyzing or examination of financial informationFinancial InformationFinancial Information refers to the summarized data of monetary transactions that is helpful to investors in understanding company’s profitability, their assets, and growth prospects. Financial Data about individuals like past Months Bank Statement, Tax return receipts helps ban…

Recommended Articles

- This article has been a guide to what is Financial Analysis and its definition. Here we discuss the top 15 most common financial analysis techniques, including its advantages, disadvantages, and limitations. You can learn more about financing from the following articles – 1. Financial Statements Objectives 2. Job Description of a Financial Analyst 3. Financial Analysis Types 4. Fi…