What is a straight note loan?

Definition of "Straight note". Loan agreement that generally requires payments of interest only over the term of the note. At the end of the term, the entire debt balance becomes payable in a single balloon payment.

What is a note in legal terms?

A note is a legal document that serves as an IOU from a borrower to a creditor or an investor. Notes have similar features to bonds in which investors receive interest payments for holding the note and are repaid the original amount invested—called the principal —at a future date. Notes can obligate issuers to repay creditors ...

What is the difference between a note and a bond?

For example, a note might pay an interest rate of 2% per year and mature in one year or less. A bond might offer a higher rate of interest and mature several years from now.

What are the different uses of notes?

Notes have various applications, including informal loan agreements between family members, safe-haven investments, and complicated debt instruments issued by corporations. A note is a legal document representing a loan made from an issuer to a creditor or an investor.

What is a straight note?

Why do people use straight notes?

Can a straight note demand interest?

Is a straight note a sleeper trust?

How does a straight note work?

The term straight note in real estate is also known as a promissory note. A straight note is defined as a loan agreement that generally requires payments of interest only over the term of the note. At the end of the term, the entire debt balance becomes payable in a single balloon payment.

What is the difference between a straight note and an installment note?

Installment Note – most common, where monthly payments are a set amount for principal and interest throughout the term of the Note. Interest only Note – monthly payments are interest only and principal is paid only at maturity. Straight Note – payment of interest and principal are due at one time in one lump sum.

Can straight loans be used to finance real estate?

A straight bank loan can be used to purchase real property. The borrower obtains the loan based on good credit or on some type of collateral (stocks, bonds, personal property) other than the real property.

What is the difference between a note and deed of trust?

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

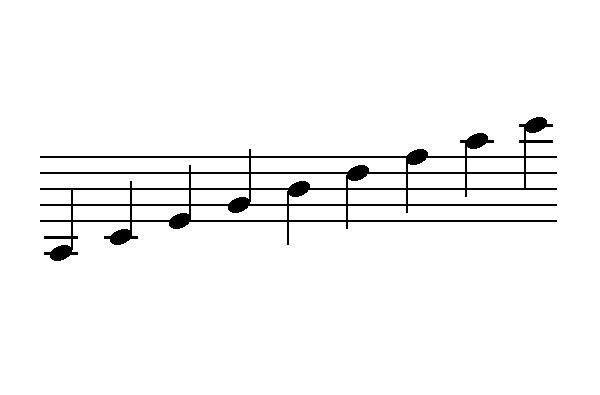

How do you calculate a straight note?

Likewise, for a daily time period, multiply the product by the ratio of days to years. For example, for a 90-day promissory note, divide 90 by 365 (the number of days in a year) to equal 0.25. Multiply 750 by 0.25 to equal 187.50.

What are three types of promissory notes?

Types of Promissory NotesSimple promissory note.Demand promissory note.Secured promissory note.Unsecured promissory note.

What does straight loan mean?

In a term or straight loan, the payments made only include interest. In other words, it is nonamortized, which means none of the money paid went towards the principal. Making payments can be done on a periodic basis, such as monthly, quarterly or annually.

How long is a straight loan?

Tabular summaryLoan typeWho handlesTermStraightBank, credit union, or another lenderShorter, 3–5 yearsConventionalBank, credit union, or another lenderLonger, 15–30 yearsGovernment-backedBank, credit union, or another lenderLonger, 15–30 yearsSeller financingArranged between sellers and buyersVariesJul 18, 2022

What type of loan is a straight mortgage?

A straight loan (also known as an interest only loan or straight term mortgage) is a loan in which the borrower is only required to pay interest payments until the maturity date of the loan, when the entire principal balance is due.

Who has the legal title of the property in a trust?

The TrusteeThe Trustee is the person or financial institution (such as a bank or a Trust company) who holds the legal title to the Trust estate. There may be one or more trustees.

Can you be on the note but not the mortgage?

But just because they are on the Mortgage, doesn't mean they are on the Note. For example, often times one spouse may have bad credit so they are not on the Note (lenders sometimes say “they are not on the loan”), but both spouses are on the Deed, so both spouses have to be on the Mortgage.

Can my wife be on the title but not the mortgage?

Can I have my spouse on the title without them being on the mortgage? Yes, you can put your spouse on the title without putting them on the mortgage. This would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

What is an installment note in real estate?

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals. This periodic reduction of principal amortizes the loan.

What is installment note in accounting terms?

An installment note is a debt that requires the borrower to make equal periodic payments to the lender for the term of the note. Each note payment includes the following: Payment of a portion of the amount initially borrowed, called the principal. Payment of interest on the outstanding balance.

Which of the following is true about an installment land contract?

Which of the following is TRUE about an installment land contract? The buyer is given immediate possession and use of the property.

What does the term balloon payment mean?

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Straight Note - WFG National Title

DO NOT DESTROY THIS NOTE: When paid, this note and the Deed of Trust must be surrendered to the trustee with request for reconveyance. STRAIGHT NOTE $[Note Amount] [Branch City] , [California], [Date] [ ] after date, for value received, [] promise[ ] to pay to:

What is an Installment Note? - Definition | Meaning | Example

Definition: An installment note is an obligation or liability that requires the borrower to repay the principal to the lender in a series of periodic payments. In contrast, a lump sum note or balloon loan requires that the borrower repay the entire note principal at a specific date. There is no payment plan.

Straight Note

STRAIGHT NOTE $ with interest from at for value received, I promise to pay to payable, California, until paid at the rate of DO NOT DESTROY THIS NOTE

What is the difference between a promissory note and straight ... - Answers

A promissory note is a contract where one party (the maker or issuer) makes an unconditional promise in writing to pay a sum of money to the other (the payee). They differ from IOUs in that they ...

What are the benefits of interest only mortgages?

The benefits of interest only mortgages are that an investor would only be required to make repayments towards interest without needing to repay the principle until the full term of the note is reached.

What is a straight note?

A straight note is a promissory note for a loan whereby only interest payment is required for a period of time, and the full principal due for payment in one lump sum on maturity.

What happens if a house appreciates before the end of the note?

If for example, a house appreciates in value from $150,000 to $170,000 before the end of the note’s term, then the investor can sell it on the open market, used sales proceeds to fully redeem the loan, and bank in the remaining excess as profits.

What Is a Note?

A note is a legal document that serves as an IOU from a borrower to a creditor or an investor. Notes have similar features to bonds in which investors receive interest payments for holding the note and are repaid the original amount invested—called the principal —at a future date.

What is a structured note?

Structured notes are essentially a bond, but with an added derivative component, which is a financial contract that derives its value from an underlying asset such as an equity index.

What is note in finance?

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame. Notes are similar to bonds but typically have an earlier maturity date than other debt securities, such as bonds. For example, a note might pay an interest rate of 2% per year and mature in one year or less.

What happens to a convertible note?

Under the termed conditions of a convertible note, which is structured as a loan, the balance automatically converts to equity when an investor later buys shares in the company. For example, an angel investor may invest $100,000 in a company using a convertible note, and an equity investor may invest $1 million for 10% of the company’s shares.

What happens to unsecured notes?

An unsecured note is merely backed by a promise to pay, making it more speculative and riskier than other types of bond investments.

How long is an unsecured note?

An unsecured note is a corporate debt instrument without any attached collateral, typically lasting three to 10 years. The interest rate, face value, maturity, and other terms vary from one unsecured note to another. For example, let's say Company A plans to buy Company B for a $20 million price tag.

What is demand note?

A note can refer to a loan arrangement such as a demand note, which is a loan without a fixed repayment schedule. Payback of demand notes can be called in (or demanded) at any point by the borrower. Typically, demand notes are reserved for informal lending between family and friends or relatively small amounts.

What Is a Loan Note?

A loan note is an extended form of a generic I Owe You (IOU) document from one party to another. It enables a payee (borrower) to receive payments from a lender, possibly with an interest rate attached, over a set period of time, and ending on the date at which the entire loan is to be repaid. Loan notes are usually provided in lieu of cash at the payee's request.

How does a loan note work?

How a Loan Note Works. A loan note, a form of promissory agreement, includes all of the associated loan terms. It is considered a legally binding agreement with both parties considered committed to the terms as they are written. A loan note can be drawn up by either borrower or lender, though it is more traditionally completed by the lender.

What is a prepayment clause?

While prepayment clauses serve as a protection to the lender against losing interest income over the course of the loan, the clause means the borrower will pay a penalty for paying down or paying off the loan during a specified time, usually within the first few years of the loan's start date.

Why are loan notes preferred?

In many cases, a loan note is preferable to an informal IOU because a loan note holds more legal significance and is easier to uphold in court should there be a disagreement between the parties.

Why do people use loan notes?

A loan note can help an individual avoid an undue tax hit due to a lump-sum payment from a settlement or cash-out package from a company . In these cases, the individual is given a choice between cash or a loan note.

What is included in a loan note?

This includes the names and contact information for both parties, as well as the principal balance and any interest rate being applied over the term of the loan. Additional information regarding the payment schedule, including the due date, will be included.

Who is Alan Farley?

By. Full Bio. Follow Twitter. Alan Farley is a writer and contributor for TheStreet and the editor of Hard Right Edge, one of the first stock trading websites. He is an expert in trading and technical analysis with more than 25 years of experience in the markets.

What is a straight note?

Definition of "Straight note". Loan agreement that generally requires payments of interest only over the term of the note. At the end of the term, the entire debt balance becomes payable in a single balloon payment.

Why do people use straight notes?

The most common reason to use straight notes in real estate is for short-term debt by lenders or carryback sellers. Another instance when the straight note is used in real estate is for evidence of short-term real estate commitments. For example, if someone wants to purchase a property, but the funds necessary for the closing might take a while to be granted, a straight note works as a bridge loan. The buyer will use the straight note to demonstrate a real estate obligation until the mortgage is granted.

Can a straight note demand interest?

While other types of installment notes require monthly principal payments, a straight note can only demand interest payments. The principal payment is only covered at the end of the loan.

Is a straight note a sleeper trust?

In real estate transactions, a straight note can also be referred to as a sleeper trust deed because interest usually accrues unpaid and is only required with the lump sum payment of the principal. However, if the principal is not required for a year or two, periodic accruing interest may be demanded during the term of a straight note.