What Are the Components of a Total Compensation Statement?

- Direct compensation: your salary, hourly rate and any overtime pay. It can also include commissions or bonuses and incentive pay.

- Indirect compensation: areas like unemployment tax, social security tax or workers compensation insurance.

- Benefits: anything that is outlined in your benefits package. Things like vision, dental and health insurance. ...

Should I give employees a total compensation statement?

The use of total compensation statements has proven that an extremely high percentage of employees now have a greater appreciation for the value of their employer paid benefits. This boosts employee satisfaction, which in turn, leads to retention. Include a letter from the president of the company or Human Resources.

What are the elements of total compensation?

What are the five components of a compensation system?

- Organizational Goals –. Make sure to pay employees for their individual performances as well as reward them for efforts which support the business goals of the company, department, and/or team.

- Employee Communications –. Realistically communicate the company’s compensation program. ...

- Rewards and Recognitions –. ...

- Timely Acknowledgements –. ...

- Simple Measures –. ...

What makes up total compensation?

They are:

- Base Salary

- Annual/Quarterly Bonus

- Other bonus (Peer, boss, outstanding non-normal accomplishments)

- Stock options

- Stock units (Hurray!)

- 401k contribution (Pre-tax and Roth)

- Health & Wellness (Medical, dental, vision, employee assistance program)

How to calculate total compensation package?

- Learn about your insurance. If the position you’re considering offers health insurance, find out what premiums, deductibles, and co-pays you’re responsible for, and what’s covered.

- Think about retirement. ...

- Look at unique benefits. ...

- Subtract out lifestyle costs. ...

What are compensation statements?

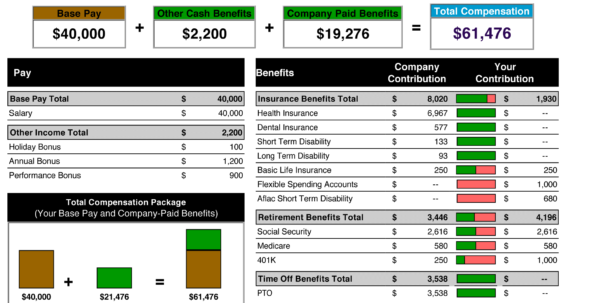

The purpose of a total compensation statement is to show employees the total value of their rewards package. It includes personalized data that goes into detail not just about compensation but also benefits, incentives and how much the employer is contributing.

What is the meaning of total compensation?

Total compensation includes all forms of pay and benefits an employee receives. It can include base salary, overtime pay, bonuses, commissions, benefits, and any other cash or non-cash compensation.

Is a compensation statement the same as a pay stub?

A total compensation statement is a document that shows an employee's total compensation/rewards for the year. Though this may sound like a pay stub, it's not. Pay stubs are concerned with gross-to-net wages — meaning the employee's gross pay, deductions, and take-home pay for the pay period.

What is included in a total compensation report?

This includes gross wages and extra financial compensation, such as bonuses or commissions, as well as the employer-paid portion of retirement plan contributions, insurance premiums, and paid time off benefits.

What should I put for total compensation?

What should be included in a total compensation statement?Salary/hourly rate.Medical benefits coverage—include amount paid by employee and employer.Flexible spending account information.Paid leave—include vacation/sick/PTO, holiday, personal, bereavement, military pay, jury duty, etc.Disability insurance.More items...

How do I calculate my total compensation?

Add time-off benefits To calculate your total compensation, you will need to assess the value of the paid time off you receive in a year. Multiply the number of days off you have, across all paid time off buckets, by the amount of money you are paid for a day of work to get that total.

Why are total compensation statements important?

Pros of Providing Total Compensation Statements It allows them to see the pay and benefit package all in one place. It can be a way for employees to see how their compensation compares to the market. This can be a benefit, assuming the total compensation is in alignment with market rates.

What is the difference between compensation and pay?

Compensation is the total cash and non-cash payments that you give to an employee in exchange for the work they do for your business. It's typically one of the biggest expenses for businesses with employees. Compensation is more than an employee's regular paid wages.

Why does my W-2 show more than my salary?

Why is My W-2 Different from My Salary? The compensation may be different on a W-2 vs a final pay stub, but here's why. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions.

What is the difference between base salary and total compensation?

Base Pay vs. Total pay refers to the total compensation of an employee, including all overtime pay, bonuses, benefits, insurance, etc., while base pay is the minimum fixed amount an employee will receive for a job.

What represents an employee's total compensation plan?

A compensation plan is a complete package that details your employees' wages, salaries, benefits, and terms of payment. Compensation plans include details about bonuses, incentives and commissions that may be paid to employees.

How do you answer total compensation questions?

How to answer "What are your total compensation expectations?"Research the industry and geographic area. ... Emphasize your flexibility. ... State a range rather than a fixed amount. ... Consider offering high compensation. ... Be honest. ... Focus on why you expect the amount. ... Prepare for price negotiation.

What is the difference between base salary and total compensation?

Base Pay vs. Total pay refers to the total compensation of an employee, including all overtime pay, bonuses, benefits, insurance, etc., while base pay is the minimum fixed amount an employee will receive for a job.

What is your current total compensation for fresher?

An Entry Level fresher with less than three years of experience earns an average salary of ₹3.3 Lakhs per year. A mid-career fresher with 4-9 years of experience earns an average salary of ₹2.8 Lakhs per year, while an experienced fresher with 10-20 years of experience earns an average salary of ₹4.4 Lakhs per year.

Why is total compensation important?

Here are some of the benefits of providing total compensation statements to employees: They can show the employees the true cost of the entire compensation package, which represents the investment the organization is making into the individual. It allows them to see the pay and benefit package all in one place.

HR Question

Can you explain Total Compensation Statements … What are they? What should they include? When should we use them?

HR Answer

Total Compensation Statements convey the total value of your compensation and benefits offerings as they include an employee’s direct and indirect compensation.

What is total compensation statement?

A Total Compensation Statement shows the employee the overall value of what they receive.

What makes up an employee's total compensation?

What makes up an employee’s total compensation? A total compensation statement tells employees everything they need to know about pay, primarily what is included in it. Total compensation can have a number of components that can dramatically increase the job’s overall value.

What is TDC compensation?

TDC – The acronym for total direct compensation, it’s the combined value of base salary, annual bonus, and annual long-term incentive grants over the year.

What is base salary?

Base Salary – The employee’s fixed annual income that they earn in the role.

What is the pay market?

Pay Market – The geographic region to which the job is being priced.

Why is it important to outline the total value of the elements within an employee's pay package?

As discussed in detail within Understanding Total Compensation, outlining the total value of the elements within an employee’s pay package is critical to demonstrate the organization’s commitment to the employee.

When writing out an employee's total compensation statement, should employers explain?

When writing out an employees’ total compensation statement, employers should explain reasoning behind pay decisions made for employees, and show how employees can increase their compensation over time. Embracing Fair Pay in the War for Talent.

What is a total compensation statement?

A total compensation statement is a document that shows an employee’s total compensation /rewards for the year. Though this may sound like a pay stub, it’s not.

How many employers offer total compensation statements?

The practice is catching on, albeit slowly. According to Payscale’s 2020 Compensation Best Practices survey, 38% of U.S. companies provide total compensation statements. This is a slight increase from the 36% in Payscale’s 2019 survey.

What is the concern of Payscale report?

The 2019 Payscale report says that “One common concern [among employers] is employees may compare total compensation statements with their peers and not be happy with what they discover.”

What is indirect compensation?

Although indirect compensation is often associated with voluntary benefits and perks, it also includes mandated benefits, such as the employer’s portion of Social Security and Medicare taxes plus workers compensation payments.

Why do employees interpret the statement?

Or, they may interpret it as the employer discouraging future salary negotiations because (in the employer’s eyes) what’s in the statement should suffice.

What is the intent of a pay and benefits report?

At all times, the intent is to give the employee a complete view of the annual value of their pay and benefits.

What are some examples of total compensation?

Examples of items that may appear in a total compensation statement: Paid leave for sick, personal, vacation, bereavement, jury duty, voting, military, and family and medical purposes.

How to create a compensation package statement?

1. Construct an Outline. In the first part of the procedure, it is suggested to create an outline. To make things easier you can search for a blank outline online.

What are the categories of compensation?

An employee’s salary or compensation has two major categories. These are the direct and the indirect compensation. Direct compensation includes overtime pay, incentives, bonus, and sales commission. Moreover, the scope of the indirect compensation stretches from the social security taxes, expenses budget for relocation, educational assistance, disability insurance, and other non-monetary benefits.

What is a salary structure?

A salary structure, also known as a compensation structure, is a strategy that is developed by the employer that involves compensation analysis to evaluate and regulate the wages of their employees. In this structure, some of the factors that greatly affect one’s compensation are the employee record, the minimum and maximum wage in the industry, as well as the duration of the employment.

What do you mean by fixed compensation?

A fixed compensation is the basic amount of the wage before any deductions or increases are made due to either the taxes or merits. As stated in the name, it is the fixed amount offered to the employees in exchange for the services provided. Furthermore, it is also where the adjustments of the salary slip will be based.

Why is it so hard to create a compensation statement?

Creating a compensation statement can appear intimidating to some employers because of all the numbers and the details that need to be included in this legal document. Another thing that makes it complicated is the fact that one mistake in the form could lead to complications which could make the statement erroneous.

What is the third step in a document?

The third step is to make sure that you write the appropriate information to where they belong. Since this document covers a lot of costs, it is necessary to make sure that they are written accurately and clearly. Also, label all the important information to avoid confusion and mix-up of the details.

Can you create a compensation statement from scratch?

Unlike before you no longer need to create complex documents such as a compensation statement from scratch. You can look for a template that will suit you best on the internet. Be that as it may, you still need to be careful in selecting a template. You should go for a template that is easy to understand but at the same time can provide the employee with all the details they need.

What is total compensation statement?

A total compensation statement is something many employers opt to provide to employees to quantify and communicate the monetary value of their full compensation package.

Why do companies provide total compensation statements?

Here are some of the benefits of providing total compensation statements to employees: They can show the employees the true cost of the entire compensation package, which represent s the investment the organization is making into the individual. It allows them to see the pay and benefit package all in one place.

Why is it important to see the pay and benefits package?

It allows them to see the pay and benefit package all in one place. It can be a way for employees to see how their compensation compares to the market. This can be a benefit, assuming the total compensation is in alignment with market rates.

How to make a statement more accurate?

Consider incorporating net benefit amounts. This makes the statement more accurate by taking into account the expenses involved for the employee for any particular benefit . This will, of course, reduce the total compensation listed—but employees may feel it’s more accurate and be more inclined to trust the information.

Do employers list non-quantifiable benefits?

Some employers also use this opportunity to list non-quantifiable benefits and show them alongside the total monetary value of the others. The key is that each total compensation package should be as tailored as possible to the individual employee, making it accurate for them.

Is total compensation accurate?

Employees may feel the total compensation is not accurate. For example, they may see benefits listed and quantified that they’re indifferent to or do not utilize. In those cases, it may make the total compensation feel artificially inflated and make the employee distrust it.

Why is a total compensation statement important?

Providing a total compensation statement can encourage the idea of comparison. It can quantify disparities between different employees. For example, an employee with family coverage for their health insurance may get a higher health insurance benefit than an employee who does not have a family.

What is annual usage value?

Annual usage value of an employee’s company car (and associated benefits, such as maintenance costs) OR value of the employee’s use of a shared company vehicle. A list of other perks, even those that do not have a quantifiable component, so that the total compensation statement shows the whole picture.

What happens if you have inaccuracies in your HR statement?

If there are any inaccuracies on the statement, it can erode trust in the employer —HR in particular. Some employees will also see the statement as a negotiation tool—and potentially use it to request that unwanted benefits be cut in favor of a higher salary.

Is 401(k) a representation of the big picture?

Employees may also feel the statement is not a true representation of the big picture if it does not take into account expenses incurred. For example, there are often 401 (k) fees the employee must sacrifice out of their contributions, but this lost money is not taken back out of the total compensation figure.

Do all employers offer benefits?

Naturally, not every employer will offer all of these benefits, and even those who do will not offer them to every employee. A total compensation statement must be personalized for each individual situation.

Is travel expense a benefit or a gain?

Counting certain reimbursed expenses (such as travel costs) as though they are a benefit, when in fact the net gain is zero for the employee

Should Employers Create a Total Compensation Statement for Employees?

Putting together a total compensation statement for employees can serve several purposes. It can: