To qualify for a USDA loan in Florida, you must meet the following criteria:

- Income Limits: You cannot make more than 115% of your area’s median income.

- United States Citizenship: Only permanent residents can apply for a USDA loan.

- Mortgage Insurance: USDA loans require mortgage insurance.

- Primary Residence in a Rural Area: The home must be located in an area with less than 20,000 people. ...

How to qualify for an USDA loan?

You can get a no down payment USDA loan as long as you meet the eligibility criteria:

- The borrower must be a U.S. citizen, U.S. ...

- Purchase a home in a qualifying USDA area

- Meet the USDA loan income limits

- Home needs to be the buyer’s primary residence. Some examples of USDA eligible properties include: Planned Unit Developments (PUD) 1-Unit single family residences Manufactured homes Approved condo units

How to find homes that qualify for USDA loans?

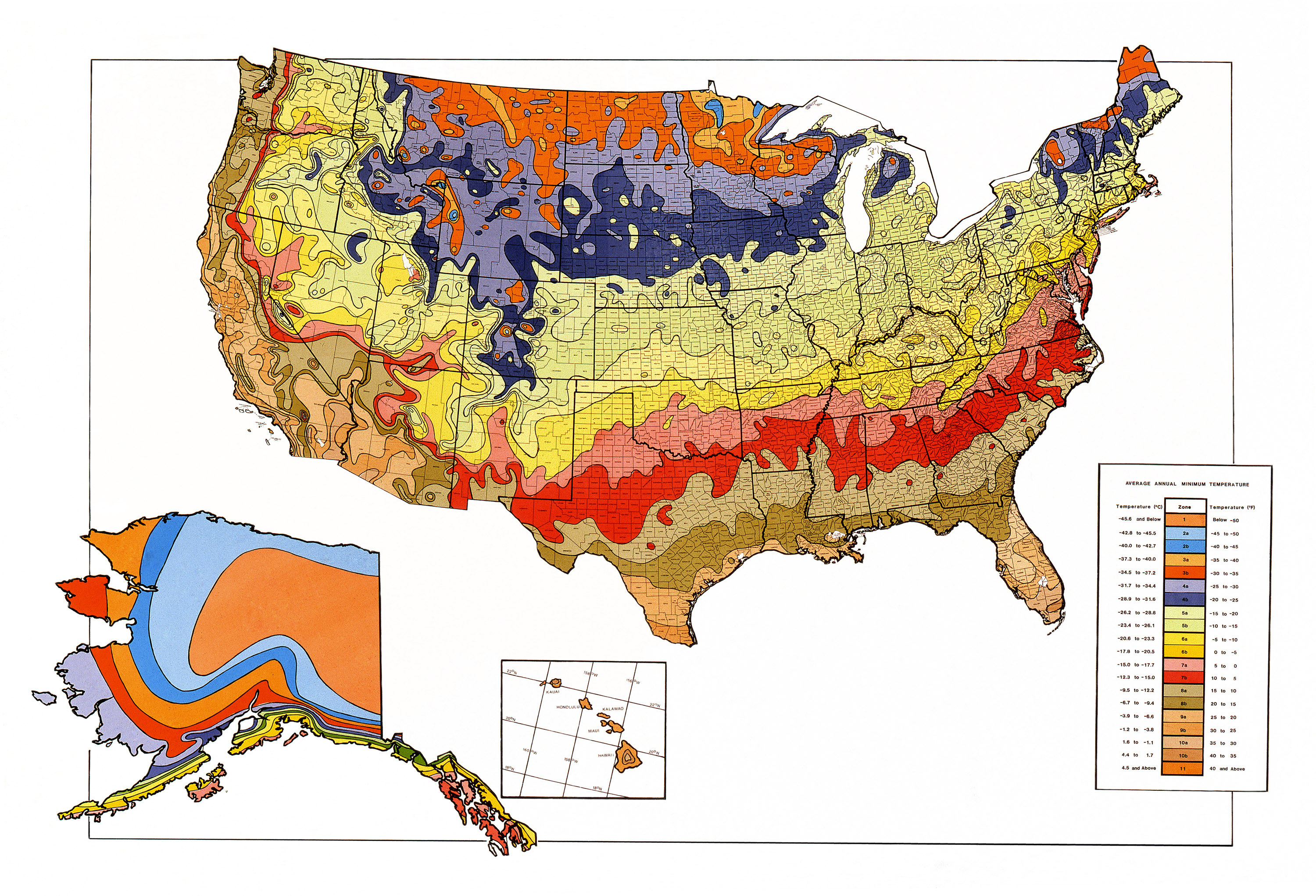

- If you have a specific address to check, type the full address (including the ZIP code) into the search bar on the map. ...

- The map will zero in on the address and put a pushpin on the location. ...

- If you want to continue searching on the map for another address, click on the pushpin icon above the map next to the search bar.

What is USDA loan requirements?

- Length of credit history

- Payment history

- Total amount owed

- Types of credit

- Credit inquiries in your name

Is my house eligible for USDA loan?

Verify your property address and make sure your home is in a USDA eligible area. Our network of loan officers specialize in USDA loans. They will make the loan process smooth and seamless.

Who qualifies for USDA loan in Florida?

Florida USDA Mortgage Approved Locations Include: Locations outside of Orlando like Ocoee, Winter Garden, Kissimmee, and Osceola County, may still be eligible. Locations outside of Tampa like Riverview, Valrico, Ruskin, Sun City, Wesley Chapel Pasco, Odessa, Pasco County still have approved areas.

Is a USDA loan a good choice?

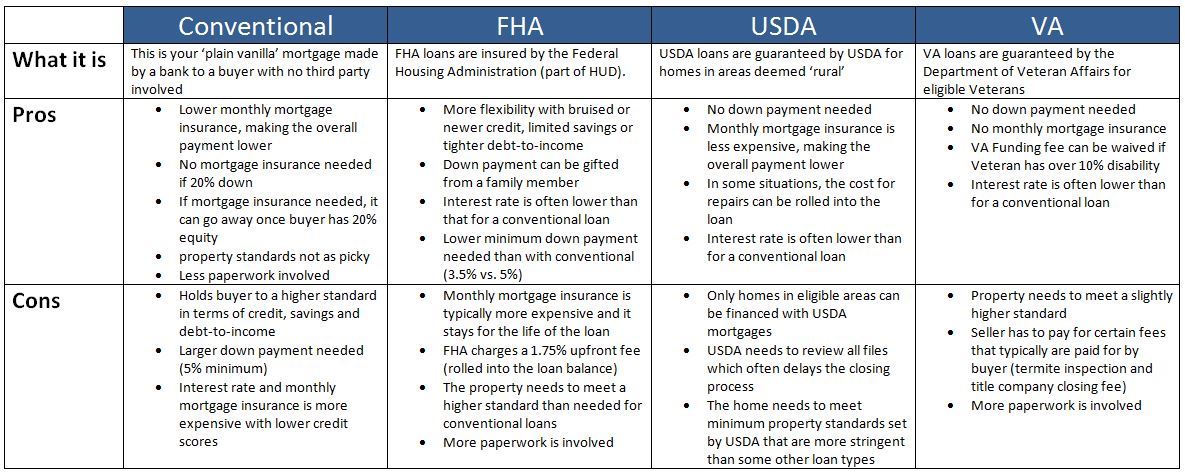

conventional. A USDA home loan is often the best choice for borrowers who meet the U.S. Department of Agriculture's guidelines. With no down payment requirement and low mortgage insurance rates, USDA mortgages are often cheaper both upfront and in the long run than FHA loans.

What is a USDA loan and how does it work?

A USDA loan is a home loan guaranteed by the United States Department of Agriculture. Being backed by the government allows USDA loans to have lower interest rates and lower down payment requirements than conventional loans.

What is the difference between a FHA loan and a USDA loan?

An FHA loan requires you to make a down payment of 3.5% if your credit score is 580 or higher. For a credit score range of 500 – 579, you'll need a 10% down payment. USDA loans, on the other hand, do not require you to come up with a down payment at all. That's one of the most appealing factors of a USDA loan.

What is the downside of a USDA loan?

What is the downside to a USDA loan? Not everyone — or every property — is eligible for a USDA loan, as there are strict income and location requirements. Additionally, USDA loans come with lifetime mortgage insurance premiums (MIP), although USDA's MIP rates are lower than those for FHA loans.

Do USDA loans have closing costs?

Generally, USDA loan closing costs run between 3% to 6% of the home's purchase price. The total cost of the loan and cash needed at closing can vary widely from one borrower to the next depending on your credit, the lender and the property. Working with an experienced USDA lender can help you to avoid surprises.

What credit score do you need for USDA loan?

640Approved USDA loan lenders typically require a minimum credit score of at least 640 to get a USDA home loan. However, the USDA doesn't have a minimum credit score, so borrowers with scores below 640 may still be eligible for a USDA-backed mortgage. If your credit score is below 640, there's still hope.

Are USDA loans better than conventional?

This program helps low- to moderate-income households buy safe and comfortable dwellings in designated rural areas. These houses may be sited on acreage that disqualifies them for other types of financing. For many, USDA loans are a better option than traditional financing.

Can I get a USDA loan with a 500 credit score?

USDA Loan Credit Benchmarks The USDA does not set a minimum credit score requirement, but most USDA lenders typically look for a credit score of at least 640, which is the lowest score allowed for the USDA's Guaranteed Underwriting System (GUS).

Is USDA easier to get than FHA?

Lenient credit requirements: You can generally qualify for maximum FHA financing with a credit score of 580 versus a 640 score for a USDA loan. You might also be eligible with a credit score between 500 and 579 if you can make a 10% down payment.

Can you refinance to a USDA loan?

USDA loans, which are backed by the U.S. Department of Agriculture, can be refinanced just like any other home loan. As long as your credit is decent and your loan payments are up to date, you should be able to refinance into a lower rate and monthly payment.

Does USDA loan have PMI?

So no, USDA loans don't require PMI; only conventional loans have PMI, and only on those loans where the borrower has less than 20% equity in their home.

What is USDA loan?

USDA loans are zero-down-payment mortgages for rural homebuyers. They’re mainly for borrowers who aren't wealthy and can’t get a traditional mortgage. Hal M. Bundrick, CFP May 14, 2020. Many or all of the products featured here are from our partners who compensate us.

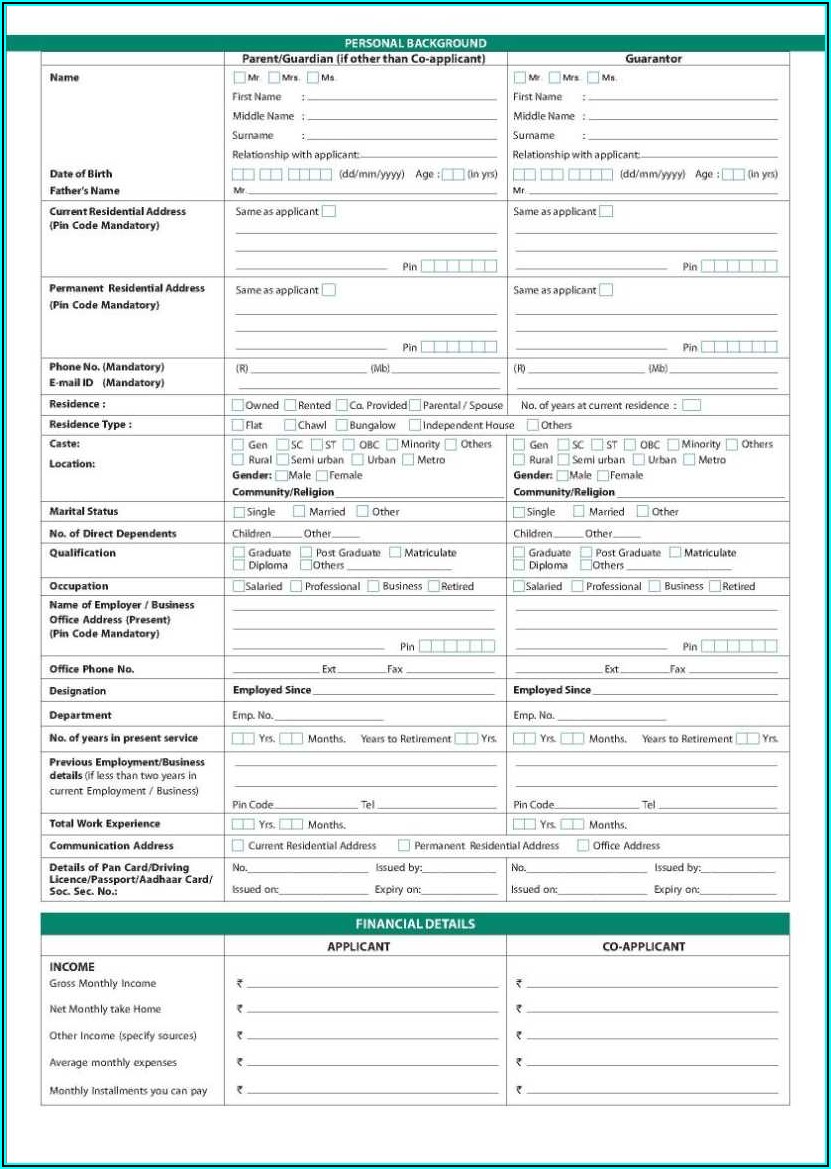

How to apply for a USDA loan?

To apply for a USDA-backed loan, talk to a participating lender. If you’re interested in a USDA direct mortgage or home improvement loan or grant, contact your state’s USDA office.

How does USDA work?

How USDA loan programs work. There are three USDA home loan programs: Loan guarantees: The USDA guarantees a mortgage issued by a participating local lender — similar to an FHA loan and VA-backed loans — allowing you to get low mortgage interest rates, even without a down payment.

How to get the best mortgage loan?

To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. If you’re planning to buy a home in a rural area, or even in a suburb, a USDA loan may be an option for you. The U.S. Department of Agriculture offers these zero-down-payment loans to home buyers who qualify.

How many people did the USDA help in 2017?

In 2017, as a part of its Rural Development program, the USDA helped some 127,000 families buy and upgrade their homes. The program is designed to “improve the economy and quality of life in rural America.”. It offers low interest rates and no down payments, and you may be surprised to find just how accessible it is.

Is the USDA a zero down payment mortgage?

In fact, the USDA might have one of the government’s least-known mortgage assistance programs. A USDA home loan is a zero down payment mortgage for eligible rural homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture.

USDA Loans in Florida

USDA loans are guaranteed by the United States government (the United States Department of Agriculture), and they require zero required down payments for those who qualify. This is compared to FHA loans, which typically require at least 3.5% down payments.

USDA Eligible Areas

Before checking eligibility according to individual details, make sure that the property is in a suitable location in Florida. Apart from the specifics of an individual’s current income and credit score, this is the most important aspect when applying for a loan.

USDA Loan Eligibility Requirements

To be eligible for USDA loans, the household income must meet specific guidelines, and the home that will be purchased must be situated in an eligible area, which USDA defines. The USDA requires the following from all applicants:

USDA Loan Income Eligibility

Within Florida, income eligibility varies based on numerous factors, as well as the USDA loan program. As an example, we have outlined the process and income eligibility determinations for Single Family Housing Guaranteed.