How does the VA funding fee work?

- You are only required to pay the VA funding fee once per VA loan.

- The fee amount can fall anywhere between 1.4% and 3.6% of the purchase price.

- These funding fees are applied to every VA mortgage with few exceptions.

- The purpose of the fee is to sustain the VA loan program for future military homeowners.

Full Answer

How do you calculate a VA funding fee?

VA funding fee calculation . Here's how to calculate the cost of the VA funding fee: Loan amount - $200,000 Funding fee percentage X 2.3% = $4,600 Add the funding fee to the loan amount - $204,600 Final mortgage amount = $204,600. Funding fee percentage for VA cash out refinance

What is the current VA funding fee for home loans?

You are only required to pay the VA funding fee once per VA loan. The fee amount can fall anywhere between 1.4% and 3.6% of the purchase price. These funding fees are applied to every VA mortgage with few exceptions. The purpose of the fee is to sustain the VA loan program for future military homeowners.

How to calculate VA funding fee?

You won’t have to pay a VA funding fee if you’re:

- Eligible to receive or are receiving VA compensation for a service-connected disability

- A surviving spouse of a Veteran who died while serving or from a service-related disability

- A recipient of the Purple Heart

How much is the VA loan funding fee?

How much is the VA funding fee? The VA funding fee is 2.3% of the loan amount for first-time users of the VA loan. Subsequent VA loan uses are typically 3.6%. However, the VA funding fee can decrease depending on if you utilize a down payment. If you're utilizing the VA Streamline refinance (IRRRL), the funding fee is .5%. The VA cash-out refinance follows purchase requirements at 2.3% or 3.6%, depending on prior use.

Do I have to pay a VA funding fee?

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs that supports the VA home loan program. Veterans who put down less than 5% on their home purchase will pay 2.3% of the total loan amount when buying a home for the first time and 3.6% on subsequent loans.

Is VA funding fee the same as closing cost?

Buyers who receive VA disability compensation are exempt from paying this fee. The funding fee is the only closing cost VA buyers can roll into their loan balance, and that's how most borrowers approach this fee. You could ask the seller to pay it, but doing so would count against the 4 percent concessions cap.

What is a typical VA funding fee?

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs. While most Veterans pay 2.3%, this fee ranges from 0.5% to 3.6%, depending on the loan type, if you've used a VA loan before or if you have a down payment greater than 5%.

Who pays the VA funding fee?

BorrowersBorrowers must pay the one-time VA funding fee when taking out a new VA loan or refinancing an existing VA mortgage. Borrowers pay the fee directly to the Department of Veterans Affairs, who uses the money collected to continue funding home purchases for active military members, retired veterans and surviving spouses.

What is the new VA funding fee for 2020?

VA funding fee rate charts You'll pay a VA funding fee of $3,135, or 1.65% of the $190,000 loan amount. The funding fee applies only to the loan amount, not the purchase price of the home.

Is VA funding fee refundable?

You may be eligible for a refund of the VA funding fee if you're later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

How do I get rid of VA funding fee?

Reach out to your mortgage lender directly — or the VA regional loan center at 877-827-3702 — if you believe you're entitled to a VA funding fee refund.

How much is a VA funding fee 2022?

a 2.3 percentVA funding fees in 2022 Most veterans will pay a 2.3 percent funding fee when buying a home. This is equal to $2,300 for every $100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a mortgage loan with no down payment.

How is VA funding fee calculated?

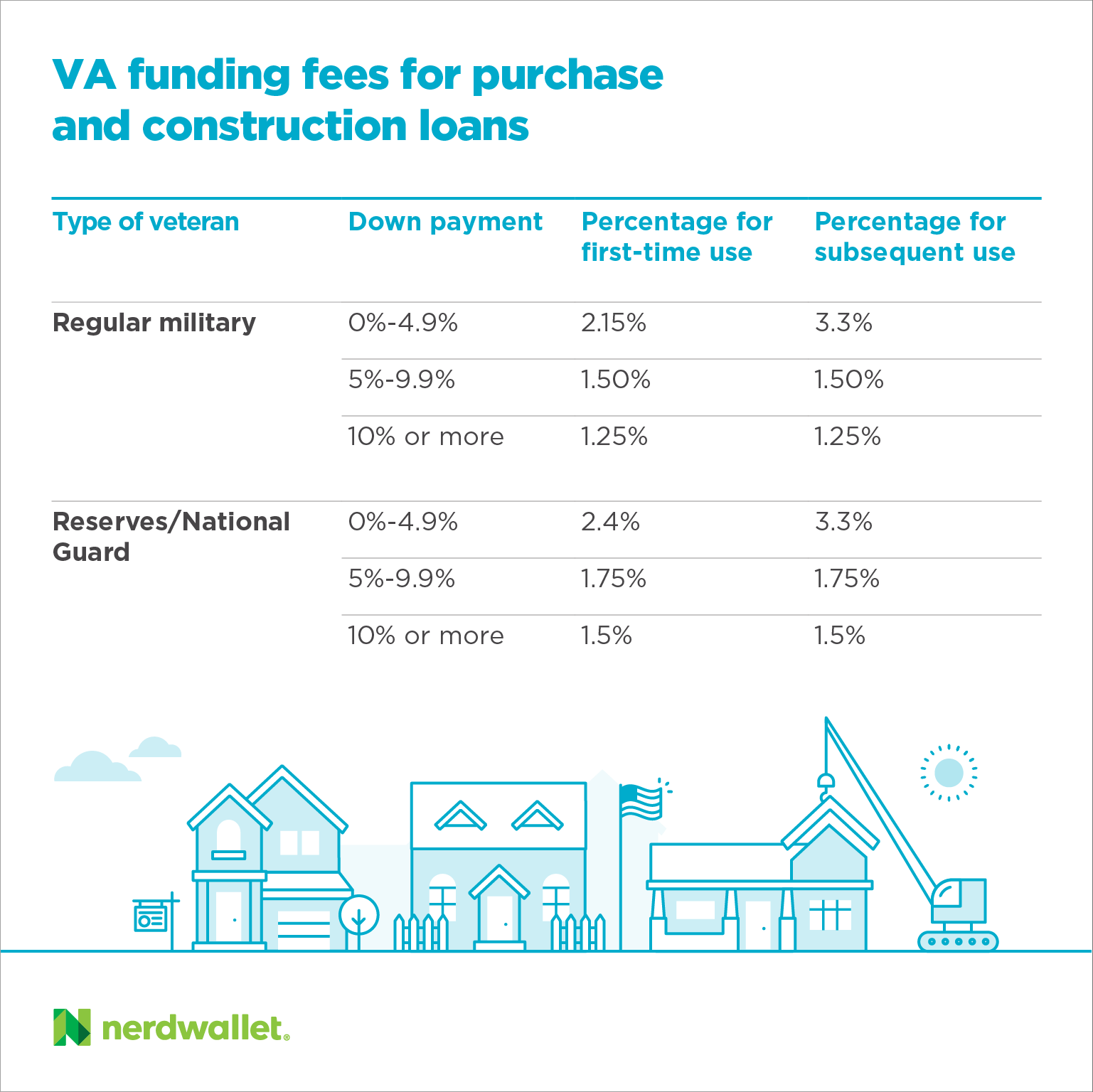

The VA funding fee is expressed as a percentage of the loan amount. For regular military borrowers with no down payment, the funding fee is 2.15%. The fee increases to 3.3% for borrowers with previous VA loans. For those with a down payment of 5% to 9%, the funding fee is 1.5%.

Who is exempt from VA funding fee?

Who is exempt from paying the VA Funding Fee? Veterans with a disability rating of higher than 10%, Purple Heart recipients, and surviving spouses of veterans who died in the line of duty are exempt from paying the VA funding fee.

Is VA funding fee rolled into mortgage?

The fee is a one-time charge that can be paid upfront or rolled into the mortgage, whether it's for a VA home purchase or a VA refinance. VA loans are backed by the Department of Veterans Affairs, which repays the lender a portion of the loan if the borrower defaults.

How much are VA closing costs?

Average Closing Costs By StateStateAverage Closing Costs (Including Taxes)Average Closing Costs (Excluding Taxes)Vermont$5,946.84$3,038.06Virginia$6,185.83$3,357.78Washington$11,513.23$4,205.82Washington, DC$29,329.89$6,250.2047 more rows

What is VA funding fee?

A VA funding fee is a one-time payment made by current or former military personnel (or their surviving spouses) as part of the VA home loan program. This funding fee is paid to the Department of Veterans Affairs and applies to loans taken out for a home purchase, repair or refinance.

How to take care of VA funding fee?

As a borrower, you can take care of your VA funding fee in a few ways: Financing the fee by rolling it into the total loan amount. Pay the fee upfront along with closing costs, discount points, lender fees, among others. Have the seller pay the funding fee.

How does VA funding work?

How does the VA funding fee work? 1 You are only required to pay the VA funding fee once per VA loan. 2 The fee amount can fall anywhere between 1.4% and 3.6% of the purchase price. 3 These funding fees are applied to every VA mortgage with few exceptions. 4 The purpose of the fee is to sustain the VA loan program for future military homeowners.

What determines the percentage of a loan a potential borrower will pay?

The biggest factor that determines the percentage a potential borrower will pay is the down payment. The more money you put down, the lower the funding fee rate. It’s worth noting that the VA does not have a minimum credit score requirement. Fees for a VA purchase loan can vary, depending on whether it’s the first loan.

What is a COE for VA loan?

Eventually, you will have to present a Certificate of Eligibility (COE) to prove your entitlement for the VA loan benefit.

When will VA funding fees be reviewed?

Current VA funding fees came into effect on January 1st, 2020, and will remain in place until January 1st, 2022, at which time they will be reviewed. Like mortgage rates, VA funding fees have fluctuated over time. The biggest factor that determines the percentage a potential borrower will pay is the down payment.

Who can make a decision on a pre discharge disability?

Only the Department of Veterans Affairs can make a decision in regard to exemption. If exemption status has not been determined and/or you have a pre-discharge disability claim pending at the closing date, the lender will collect the funding fee and send it to the VA.

How much is the funding fee for a VA loan?

For Interest Rate Reduction Refinance Loans, also known as a VA Streamline refinance (where you’re refinancing your current VA loan into another VA loan), the funding fee is 0.5% for all borrowers.

What is the VA funding fee?

What Is A VA Funding Fee? The VA funding fee is a one-time fee paid to the Department of Veterans Affairs that supports the VA loan program. Veterans who put down less than 5% on their home purchase will pay 2.3% of the total loan amount when buying a home for the first time and 3.6% on subsequent loans. VA borrowers can pay less on the funding fee ...

What happens if a borrower defaults on a VA loan?

This means that if a borrower defaults on the loan, the lender is partially protected from the loss because the government insures the loan. The funding fee helps with this cost and others related to the VA loan program and ensures that the program remains sustainable.

What is MIP in FHA?

If you were applying for an FHA loan, you’d be paying mortgage insurance premiums (MIP). At the VA, it’s called a funding fee. While these terms all have very particular meanings within their bureaucracies, if you’re looking to buy a home, they’re all pretty similar.

When will VA loan be available in 2021?

May 21, 2021. For eligible veterans, service members and surviving spouses who are hoping to become homeowners, the VA loan program provides a lot of benefits to help them do so. With good interest rates, low- or no-down-payment options and no monthly mortgage insurance, a VA loan is a great mortgage option for those who are eligible.

Do you have to pay the closing fee out of pocket?

Fortunately, you don’t necessarily have to pay it all out of pocket in one lump sum. You have a few options for how this fee gets paid. While you can pay the funding fee at closing if you choose, you also have the option to roll the fee into your mortgage loan.

Is VA loan good for military?

The VA mortgage program is a popular and valuable benefit of military service. Even with the funding fee, VA loans are a great option for those who are eligible for the program, whether you’re purchasing a new home or refinancing your current home loan.

What is VA funding fee?

The VA funding fee is a government fee applied to many VA purchase and refinance loans. Here we take a deep dive into why this fee exists, how much it costs and who is exempt from paying.

What is the VA funding fee for cash out refinance?

Unless otherwise exempt, the VA funding fee for borrowers using the VA streamline refinance (IRRRL) is 0.5 percent regardless of service history or prior usage. The funding fee for a Cash-Out refinance is similar to a VA purchase loan, except borrowers cannot lower the VA funding fee by making a down payment or using equity.

What are the benefits of VA?

Those exempt from paying the VA funding fee include: 1 Veterans who receive compensation for service-connected disabilities 2 Veterans who would receive disability compensation if they didn't receive retirement pay 3 Veterans rated as eligible to receive compensation based on a pre-discharge exam or review 4 Veterans who can but are not receiving compensation because they're on active duty 5 Purple Heart recipients 6 Surviving spouses who are eligible for a VA loan

How much down payment do you need to pay for VA loan?

Though not required, both first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

What happens if two veterans contribute to a VA loan?

If two veterans contribute entitlement, but one of them is exempt from paying the funding fee, the funding fee on their loan is cut in half. If the same set of veterans seek a VA loan, but the exempt veteran is not contributing entitlement, their loan would carry the full funding fee. Last, VA loan assumptions come with a 0.5 percent funding fee.

Do mortgage lenders have to pay VA funding fees?

Mortgage lenders have no control over who must pay the VA funding fee or the specific amount. Your Certificate of Eligibility (COE) typically indicates if you're required to pay the VA funding fee.

Who is responsible for collecting the VA funding fee?

Your lender is responsible for collecting the funding fee and sending it directly to the VA through their automated system. VA buyers have a handful of options to pay the VA funding fee. These options include: Financing the VA funding fee over the life of the loan. Paying the fee out of pocket.

What is VA funding fee?

The VA funding fee is a one-time closing costthat’s calculated as a percentage of the total VA loanamount. You can roll the fee into your mortgage and repay it over time, or pay the fee upfront at closing. You can also ask the seller to pay for it. The fee varies based on three factors:

When will VA funding fees go into effect?

The most recent rate adjustments went into effect on Jan. 1, 2020.

Can you write off a funding fee at closing?

Is the fee tax-deductible? The funding fee can be written off as long as you claim it for the same tax year it was paid.

Does having extra equity reduce VA refinancing fees?

Having extra equity in your home won’t reduce the funding fee on most VA refinances. You’ll pay the same percentage rate whether you’re tapping equity with a cash-out refinanceor paying off a non-VA loan, such as a conventional loan.

Do you have to pay a fee to buy a manufactured home?

Yes. Standard funding fees apply if you buy a manufactured home permanently attached to land that you own. If the manufacture d home is not permanently attached, the fee is 1% of your loan amount. You may only have to pay a first-time user fee if you take out a new VA loan to buy land and affix your home to it later.

Why is the VA funding fee good?

While fees are never fun, the VA funding fee has a very good purpose. By paying the fee on your loan, you are helping to fund these VA guaranteed programs that help countless veterans obtain well-deserved housing with affordable terms and rates.

What percentage of the loan will the VA pay if a loan defaults?

If a loan defaults, the VA will pay the lender 25 percent of the total amount to cover some of the losses. This guarantee is what allows lenders to offer lower rates, no down payment options, and better terms on VA approved loans.

How much is PMI paid?

PMI is paid monthly, and the amount depends on the size of the loan, state of the market, and your financial history. The VA funding fee, on the other hand, is paid only once. Usually, PMI costs as much as 1-5 percent of the loan amount annually. For example, if your PMI rate is 5 percent and your loan amount is $200,000, ...

Do you have to pay VA mortgage insurance at closing?

You are essentially helping paying for the VA’s guarantee. In most cases, this cost can be financed into the loan, meaning it doesn’t have to be paid out-of-pocket at closing. One great benefit of a VA home loan is that the veteran, or borrower, is not required to pay monthly mortgage insurance.

Is a conventional refinance considered a streamline refinance?

Refinancing a conventional or FHA loan to a VA loan is not considered a streamline refinance, and the funding cost amount in this case would fall under the same guidelines as a cash-out refinance.

Do veterans pay VA funding fee?

Every time a home is bought or refinanced using a VA loan, the veteran, or borrower, must pay a VA funding fee. This charge is paid to the VA, allowing them to continue guaranteeing home loans for veterans and providing other services. You are essentially helping paying for the VA’s guarantee. In most cases, this cost can be financed into ...

Can you be exempt from VA funding?

In some cases, you could be exempt from paying the VA funding fee. These instances include: You sustained a service-related injury. You are receiving compensation for a service-related injury. You would be receiving disability compensation were you not already receiving retirement pay.

What is VA funding fee?

A VA funding fee is the upfront expense paid to secure a VA mortgage. This expense helps fund the VA mortgage program and is one of the heftier expenses when closing a VA loan. The funding fee is typically settled upon closing, but you will have the option to finance the expense off over time.

How much is VA funding fee in 2021?

According to the VA, the VA funding fee in 2021 is 2.3% of the home’s principal amount. If you’ve utilized the VA mortgage program previously, you’ll have to pay a slightly higher 3.6%.

What is VA loan?

VA mortgages are backed by the U.S. government, meaning the program’s expenses are carried by taxpayers. As a means of supplemental funding and to ease the tax burden on U.S. citizens, the VA funding fee was established. Calculated as a percentage of the overall loan amount, VA funding fees allow for the continuation of veteran assistance programs ...

How much does it cost to take out a VA loan?

Let’s say it’s your first time taking out a VA mortgage that amounts to $200,000. You’d be expected to pay $4,600 to satisfy the VA funding fee. This cost can be settled as part of your closing costs in a one-time payment, or you can have the expense added to your mortgage and finance it over the term of the loan.

Can a spouse of a veteran die as a result of their military service?

If you’re uncertain about whether you qualify for VA disability benefits, you can check with the Department of Veterans Affairs to determine your status.

Does the VA require a credit score to approve a mortgage?

The VA also does not set a credit score minimum for mortgage eligibility, so any financial issues in your past won’t automatically disqualify you from the program. Your lender, however, will set their own credit score minimums and approve your application accordingly.

Do you have to pay a funding fee for VA mortgage?

Borrowers who qualify for a VA mortgage will almost always be required to pay a funding fee. These mortgages come with the advantages of zero down payment requirements, comparatively lower interest rates and no need for private mortgage insurance, making them an extremely popular lending option for military members and their families.

What is a VA funding fee?

A VA funding fee is a one-time upfront cost that is used in lieu of monthly mortgage insurance. The fee is also necessary for the VA loan program to continue. You may pay your VA funding fee upfront or, if acceptable, have it rolled into your mortgage.

How much is the VA funding fee?

There isn’t a set cost for the VA funding fee. It will depend on how much your down payment is and if you’ve previously used the benefit. Speak with your lender to find out more details on how much your VA funding fee will cost.

Do all VA loans have a funding fee?

Maybe — all VA loan types have a funding fee. The price of the funding fee may vary, but all VA loans have one unless you are exempt. According to the official VA website, you may find yourself exempt if you’re:

Can you get a VA funding fee refunded?

If you don’t fall under one of the exempt eligibilities, you may be required to pay for the fee and won’t be eligible to receive a refund. If you subsequently fall under an exemption but it did not process until after you closed and paid the fee, you may apply for a refund.