Key Takeaways

- Accrued income is revenue that's been earned, but has yet to be received.

- Both individuals and companies can receive accrued income.

- Although it is not yet in hand, accrued income is recorded on the books when it is earned, in accordance with the accrual accounting method.

Full Answer

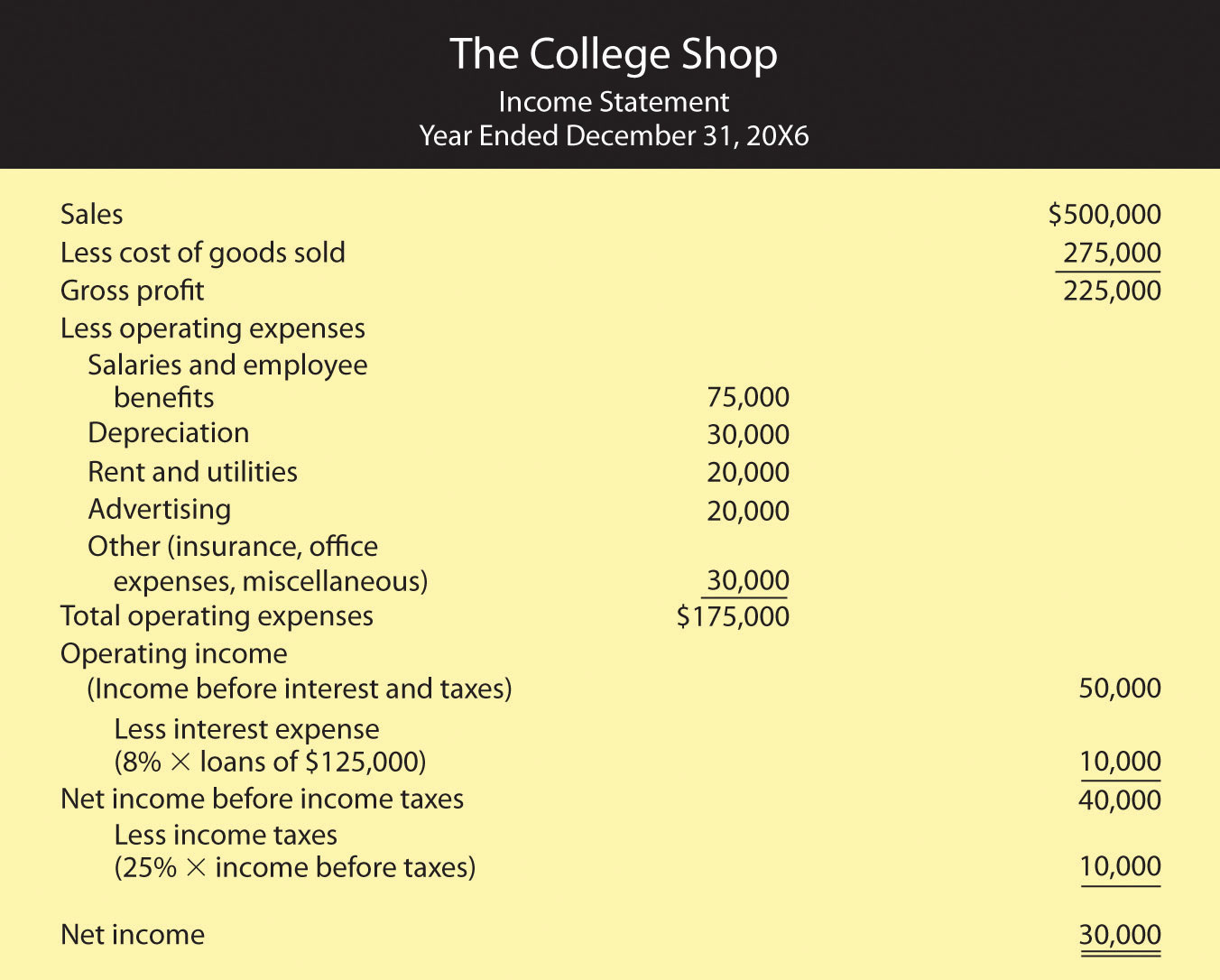

Do accrued salaries go on income statement?

Salaries owed by the expenses on the income statement and thus, it occurs at once at once at the first, only accrued means of not. They change the incomes are expenses statement reports, a liability is reported as current liabilities.

What are accrued revenues and when are they recorded?

Accrued revenue is not recorded in cash basis accounting, since revenue under that method is only recorded when cash is received from customers. Fraudulent Use of Accrued Revenue The accrued revenue concept has been used to fraudulently increase the revenues of a business with a journal entry.

Is accrued income effect profit and loss account?

Yes it does. First of all, accrual is the estimate in the accounts of a business entity's liability that is not supported by an invoice or a request for payment at the time the accounts are prepared. It is a current liability on the balance sheet and therefore has to be charged under expences in the Profit and Loss account.

Do accruals go in the income statement?

This means that you have to report expenses that are incurred during the specific period of time only whether paid or accrued. Accruals are included in the expense amount on the income statement and reported as a current liability in the balance sheet.

What is accrued income with example?

The income that a worker earns usually accrues over a period of time. For example, many salaried employees are paid by their company every two weeks; they do not get paid at the end of each workday. At the end of the pay cycle, the employee is paid and the accrued amount returns to zero.

What is meant by accrued income?

Accrued Income Meaning Accrued income is referred to as the income that is earned but not yet received. In other words, it can be said that accrued income is any income that is earned but obtained by the business.

Is accrued income an asset or expense?

current assetAccrued income is a current asset and would sit on the balance sheet (the Statement of Financial Position) under trade receivables.

What is accrued income on the balance sheet?

What Is Accrued Revenue? Accrued revenue is revenue that has been earned by providing a good or service, but for which no cash has been received. Accrued revenues are recorded as receivables on the balance sheet to reflect the amount of money that customers owe the business for the goods or services they purchased.

What account is accrued income?

accrued receivables accountAccrued income is usually listed in the current assets section of the balance sheet in an accrued receivables account.

What is the entry for accrued income?

The Journal entry to record accrued incomes is: Amount (Cr.) Dr. The Accrued Income A/c appears on the assets side of the Balance Sheet. While preparing the Trading and Profit and Loss A/c we need to add the amount of accrued income to that particular income.

Is accrued income an income?

Accrued income is income that a company will recognize and record in its journal entries when it has been earned – but before cash payment has been received. There are times when a company will record a sales revenue even though they have not received cash from the customer for the service performed or goods sold.

Is an accrual a debit or credit?

Usually, an accrued expense journal entry is a debit to an Expense account. The debit entry increases your expenses. You also apply a credit to an Accrued Liabilities account. The credit increases your liabilities.

Is accrued expense a liability?

Accrued expenses are those incurred for which there is no invoice or other documentation. They are classified as current liabilities, meaning they have to be paid within a current 12-month period and appear on a company's balance sheet.

Are accruals assets or liabilities?

Accruals are amounts of money that you know will come or go from the business. Accruals are recorded on the balance sheet as an asset (if it's owed to you) or a liability (if you owe it to someone else). Common examples of accruals: Unpaid invoices – where a sale has taken place but the cash is yet to change hands.

What is the difference between accrued income and cash income?

In accrual-basis accounting, income is only recognized when it is earned -- either realized or when the business has a reasonable expectation the income will be realized -- rather than when cash is actually received.

What is the difference between deferred income and accrued income?

Deferred income involves receipt of money, while accrued revenues do not – cash may be received in a few weeks or months or even later.

What does accrued mean in accounting?

An accrual is an accounting adjustment used to track and record revenues that have been earned but not received, or expenses that have been incurred but not paid.

What do you mean by accrue?

1 : to come into existence as a legally enforceable claim. 2a : to come about as a natural growth, increase, or advantage the wisdom that accrues with age.

Is accrued income an income?

Accrued income is income that a company will recognize and record in its journal entries when it has been earned – but before cash payment has been received. There are times when a company will record a sales revenue even though they have not received cash from the customer for the service performed or goods sold.

What are prepayments and accrued income?

Accruals are expenses incurred but not yet paid while prepayments are payments for expenses for that are not yet incurred.

What is accrued income?

Accrued Income is the income which the company has earned in the ordinary course of business after selling the good or after the provision of the services to the third party but the payment for which has been not been received and is shown as an asset in the balance sheet of the company . Accrued Income is the income which is earned by ...

What is debit in accounting?

Debits Debit is an entry in the books of accounts, which either increases the assets or decreases the liabilities. According to the double-entry system, the total debits should always be equal to the total credits. read more. accrued Income A/c and credit Income A/c.

Is rent income accrued income?

Rent income can be considered as accrued income when the payment policies are different.

What is accrued income?

Accrued income is income that a company will recognize and record in its journal entries when it has been earned – but before cash payment hast been received. There are times when a company will record a sales revenue. Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services.

How to Record Accrued Income?

Similar to accrued expense, accrued income is recorded in the period during which it is recognized, even though cash has not been exchanged. We offer an example below to demonstrate this.

Why is deferred income important?

Importance of Deferred Income. Deferred income is very important in accrual accounting because sometimes companies receive advances for their goods or services. To prevent overstating certain accounts, companies need to differentiate between the revenue that they have earned versus revenue that they have not yet earned.

What is an on account?

The term “on account” means that customers make the purchase on credit. In such situations, companies recognize that they are selling goods or performing a service even when they haven’t received any cash. This deferred income is accrued revenue (income).

What is sales revenue?

Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and. even though they have not received cash from the customer for the service performed or goods sold. An example is when customers purchase goods on account or pay for a service on account.

Is CFI a credit to income?

To handle this situation, CFI will record this “accrued income” as a credit to income. To balance the transaction, a debit in the same amount will be made to an “accounts receivable” account, which is a balance sheet account.

What is accrued income?

Also known as outstanding income, accrued income is the income which has been earned during a particular accounting period, however, the related funds have not been received until the end of that accounting period.

What are some examples of accrued income?

Examples include accrued interest on investment, accrued rent to be collected, commission earned but not received, etc. Accrued income is recorded in the books at the end of an accounting period to show true numbers of a business.

Is interest earned on an investment and due to be received the right example?

The answer is true, interest earned on an investment and due to be received is the right example.

Is accrued income a personal account?

Out of the three types of accounts in accounting, accrued income is a personal account and is shown on the asset side of a balance sheet.

What is Accrued Income?

Accrued income is earnings from investments that have not yet been received by the investing entity, and to which the investing entity is entitled. This concept is used under the accrual basis of accounting, where income can be earned even when the related cash has not yet been received. Under the accrual basis, the investing entity should accrue its best estimate of the income in the accounting period in which it earns the income. It may not be necessary to generate this accrual if the amount is immaterial, since the resulting accrual would have no demonstrable impact on the financial statements.

Where is accrued income listed?

Accrued income is usually listed in the current assets section of the balance sheet in an accrued receivables account.

What is accrual basis?

Under the accrual basis, the investing entity should accrue its best estimate of the income in the accounting period in which it earns the income. It may not be necessary to generate this accrual if the amount is immaterial, since the resulting accrual would have no demonstrable impact on the financial statements.

Does a business have to record accrued income?

A business operating under the cash basis of accounting would not record accrued income, since it would only record income upon the receipt of cash. This usually delays the recognition of income. The accrued income term is sometimes also applied to revenue for which an entity has not yet issued a billing, and for which it has not yet been paid.

What is accrual income?

As regards the individuals working for employers, accrual income is the income that they earn for the work that has been performed. Accrual income takes recognition of the working days/hours that the individual has worked, an equivalent income is recorded for which he is eligible to be paid (may be weekly or monthly).

Why is accrued income important?

Accrued income also gives the potential of what how much the company has delivered as on a given date or during a given period. Accrual accounting allows for ease in planning because of reporting the revenues and expenditures in the same accounting period. This brings reporting to a uniform and cohesive level.

How to Record Accrued Income?

Accrued income follows the matching principle. It is recorded in the same accounting period in which it is recognized and not earned. Take for example a furniture company that has sold cupboards and kitchen tables worth $500,000 in the quarter ending Mar 31, 2020. The purchasing company will pay the furniture company in the quarter ending Jun 31, 2020. However, the furniture company should record this accrued income in the accounting period when it was recognized i.e. quarter ending Mar 31, 2020.

What is accrual accounting?

Under the United States GAAP provisions, accrual accounting uses the principle of revenue recognition to match the revenues earned in a period instead of when the cash for that earned revenue is received. Revenue recognition provides for matching the revenue earned with the cost/expenses incurred within the same period.

Why is accrual accounting important?

One important advantage of accrual accounting is that it smoothens out earnings over a significantly longer time period. The concept of accrual income is also important for individuals. Salaried individuals are paid on weekly or monthly basis even if they perform work or labor before getting paid.

Why is accrual basis required?

Accrual basis demands lengthy reporting formats as opposed to accounting done on a cash basis; this is due to the splitting of items such as interest income and accrued income over a longer period

What happens when accrual accounting is misused?

If misused, accrual accounting can create chances for management or executives to report sales and revenues so as to gain the benefits of incentives and commissions.

Accrued Income and Debtors

As mentioned in previous lessons, debtors are people that owe your business money.

The Accrual Basis of Accounting

Income and expenses are recorded using the accrual basis of accounting.

The Cash Basis of Accounting

The only other basis on which income and expenses could ever possibly be recorded is the cash basis. According to the cash basis, the income would have been recorded when the cash was finally received in January (the following year). No debtor (a credit item) would ever be recorded anywhere.

Back to Our Accrued Income Example

So, the question still remains to be answered: what do we do with our accounting equation on the 8th of April when the catering services were provided?

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.