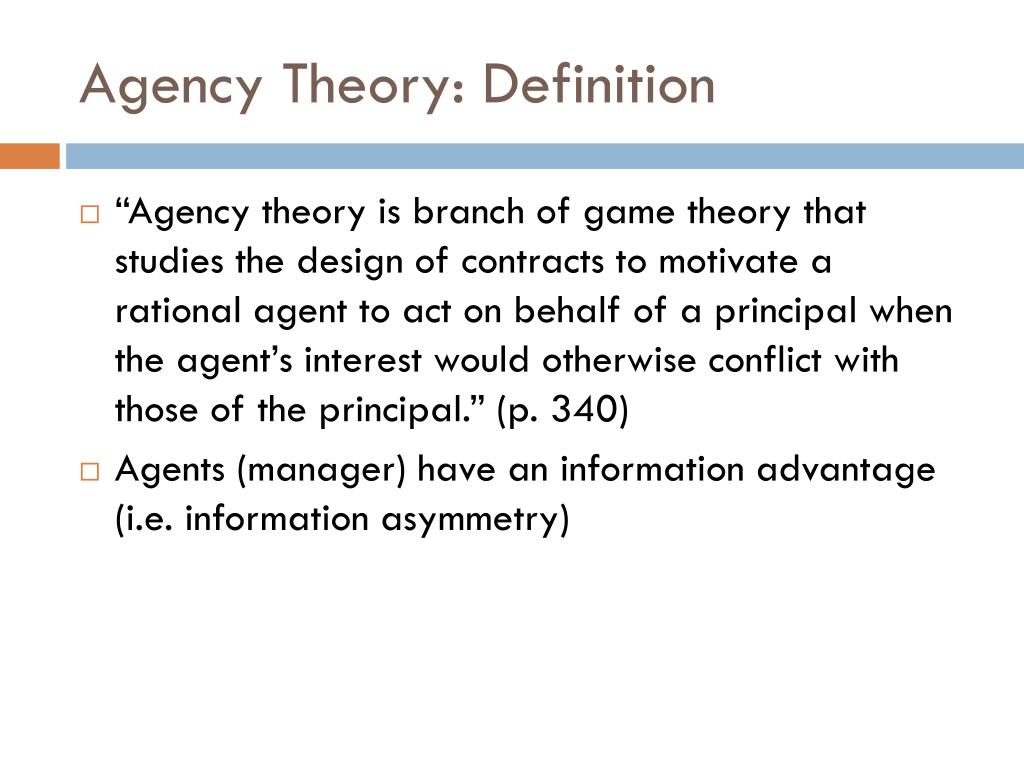

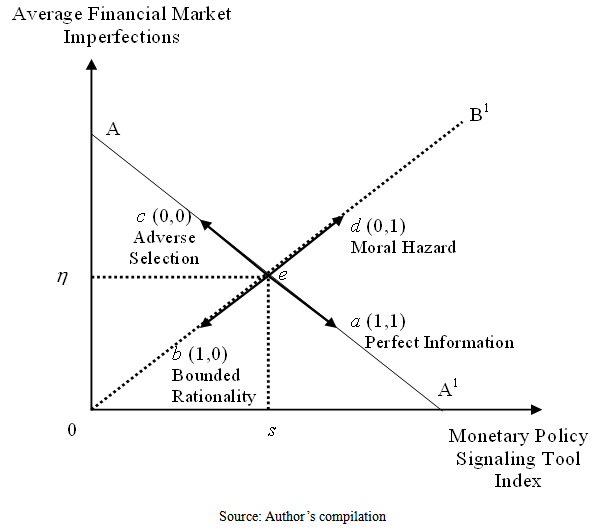

Moral hazard and adverse selection are both terms used in economics, risk management, and insurance to describe situations where one party is at a disadvantage to another.

What is the difference between adverse selection and moral hazard?

The Difference between Adverse Selection and Moral Hazard

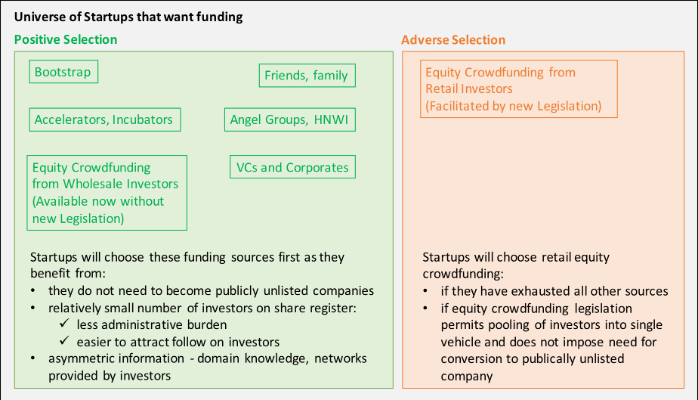

- Adverse Selection. Adverse selection occurs when there is asymmetric information between a buyer and a seller before a deal.

- Moral Hazard. Moral hazard occurs when there is asymmetric information between a buyer and a seller and a change in behavior after a deal.

- Summary. ...

What is the risk of adverse selection?

Adverse selection risk Adverse selection puts one party at risk or at a higher risk than normal. If one of the parties involved assumes that adverse selection is highly probable, it can affect their overall participation negatively, which will affect the project, initiative, company, or market.

What are some examples of adverse selection?

Other examples include:

- Adverse Selection in Banking

- Adverse Selection in Used Cars

- Adverse Selection in Insurance

- Adverse Selection in Financial Markets

What is the meaning of adverse selection?

Adverse selection refers to a scenario where either the buyer or the seller has information about an aspect of product quality that the other party does not have. Adverse selection is a common scenario in the insurance sector

What is meant by adverse selection?

adverse selection, also called antiselection, term used in economics and insurance to describe a market process in which buyers or sellers of a product or service are able to use their private knowledge of the risk factors involved in the transaction to maximize their outcomes, at the expense of the other parties to ...

What is adverse selection with example?

Adverse selection in the insurance industry involves an applicant gaining insurance at a cost that is below their true level of risk. Someone with a nicotine dependency getting insurance at the same rate of someone without nicotine dependency is an example of insurance adverse selection.

What is an example of a moral hazard?

As an example, a moral hazard is the risk that an employee who is enrolled in their company's dental insurance plan may be less concerned about their oral hygiene, whereas someone who knowingly has a high-risk lifestyle is making an adverse selection by taking out a life insurance policy.

How does moral hazard and adverse selection cause market failure?

In the end, adverse selection leads to higher premiums and fewer insured people than if there were no informational asymmetries. Moral hazard occurs when people take advantage of their private information (to the disadvantage of the less-informed party) after entering a contractual arrangement.

What is the difference between moral hazard and adverse selection?

Distinguishing Moral Hazard from Adverse Selection In a moral hazard situation, the change in the behavior of one party occurs after the agreement has been made. However, in adverse selection, there is a lack of symmetric information prior to when the contract or deal is agreed upon.

Which statement best explains adverse selection?

Answer: Adverse selection means that users will demand information that is RELEVANT to their decisions.

Can moral hazard exist without adverse selection?

Yes, adverse selection can occur without moral hazard.

Why is it called moral hazard?

It is called "moral hazard" because morality comes into play in determining parties' right and wrong behavior in a transaction that could lead to or prevent a hazard whereby the party not engaging in the behavior will possibly suffer the consequences.

What is moral hazard and why it is important?

"Moral hazard" is a term used in the insurance industry to describe situations in which people may be inclined to take bigger risks if they are insured than if they're not. It arises when someone has limited responsibility for the risks they take and the costs they create.

What is the difference between moral hazard and adverse selection quizlet?

Moral hazard is primarily an issue prior to a transaction. Adverse selection is primarily an issue after a transaction. Moral hazard is the result of an information asymmetry. Resolving adverse selection also resolves moral hazard.

What are the adverse economic consequences of moral hazard?

Moral hazard can lead to personal, professional, and economic harm when individuals or entities in a transaction can engage in risky behavior because the other parties are contractually bound to assume the negative consequences.

How do insurance companies deal with moral hazard?

Insurance companies try to mitigate moral hazard by structuring policies that incentivize behavior that does not lead to claims and penalizing actions that do. It can also take the form of more practical strategies like deductibles and premium reduction for fewer claims.

What is an example of adverse?

having a negative or harmful effect on something: The game has been canceled because of adverse weather conditions. They received a lot of adverse publicity/criticism about the changes. So far the drug is thought not to have any adverse effects.

What is an example of asymmetric information?

Asymmetric information exists in certain deals with a seller and a buyer whereby one party is able to take advantage of another. This is usually the case in the sale of an item. For example, if a homeowner wanted to sell their house, they would have more information about the house than the buyer.

What is adverse selection and how does this relate to banking?

Adverse selection is an impediment to the efficient functioning of a market that arises when one of the parties to a transaction has more information than the other.

What is adverse selection and how do insurers deal with the problem?

Adverse selection occurs because of anti-selection behaviors by people with higher health risks. Since sick people are more inclined to enroll and use more coverage, the insurance company must increase rates to fund the excess claims. This, in turn, drives healthier applicants away from enrollment.

What is moral hazard and why is it important?

Moral hazard describes the situation where an individual acts in a manner that exposes them to risk because of the assumption that their insurer wi...

What do you mean by adverse selection?

Adverse selection refers to the situation where an individual makes a decision without complete information on a matter. This may result in undesir...

What is an example of moral hazard?

An example of a moral hazard is when an individual has insured their house. The individual may fail to take appropriate risk mitigation activities...

What is an example of adverse selection?

An example of adverse selection is when a seller in the market knows the actual cost incurred in producing a commodity and the market price. The se...

What is the difference between moral hazard and adverse selection?

Adverse selection results when one party makes a decision based on limited or incorrect information, which leads to an undesirable result. Moral hazard is a when an individual takes more risks because he knows that he is protected due to another individual bearing the cost of those risks.

When one party has access to better or more information than the other party during a transaction, it is said that one?

When one party has access to better or more information than the other party during a transaction, it is said that one has asymmetric information. Therefore, when a party has asymmetric information , they may make an adverse selection.

What happens when you are unaware of the car you are buying?

While you think you have found the one that fits you best, you are unaware, that the seller has some information about problems with the car that he is not telling you. Because you are unaware of this information, or asymmetric information, you decide to buy the car. What has just happened is you were not aware of the true quality of the car you were buying, so having asymmetric information, the seller was able to sell you a 'bad' product.

What is adverse selection?

Adverse selection is a situation where one party in a transaction has more information about the quality or legitimacy of a product or service than the other party. This can apply to situations where the seller knows more than the buyer or, if the reverse is true, and the buyer withholds relevant information from the seller.

Why is adverse selection important?

Adverse selection is important because it can have serious consequences for both buyers and sellers depending on the situation. For example, if a seller is aware of a defect in a product and chooses not to disclose that defect, the buyer is a victim of adverse selection.

Adverse selection vs. moral hazard

Adverse selection has some overlap with moral hazard, another term used in economics, risk management and insurance. They both describe situations where one party disadvantages another because of withheld information.

Examples of adverse selection

Here are some examples of adverse selection that can help illustrate how the concept works in practical applications:

What is adverse selection?

Adverse selection normally occurs when one party in a transaction has information that the other does not and makes a decision based on that information.

What is moral risk?

Moral Hazard is a little different. It says that people with insurance actually change their behavior in a way that can lead to higher claims. And the more insurance they have, the more we witness this phenomenon. For instance, people with health insurance might engage in more risky behavior than they would if they were uninsured since someone else will pay the bill if they have an accident. Or someone who rarely uses health care services might actually seek more medical attention if he or she gets health insurance and can see a doctor for an affordable copayment.

What is the tendency of people in dangerous jobs or high risk lifestyles to get life insurance?

A classic example, as Investopedia points out, is “the tendency of those in dangerous jobs or high-risk lifestyles to get life insurance.” In other words, these individuals know better than the insurance company that they are placing themselves in risky situations, and they act on that knowledge by buying an insurance policy that will pay money to their loved ones if something happens. This is similar to the fact that people with pre-existing medical conditions are more likely to purchase health coverage than people who do not have any ongoing conditions , and the likelihood of this circumstance increases when plans are guarantee issue with no medical underwriting, which means that insurance companies must accept all applicants who apply for coverage. Also, insurance companies are limited on the rates they can charge for people whose claims are likely to exceed their monthly premiums.

What is the difference between moral hazard and adverse selection?

Adverse selection and moral hazard describe many different situations between two parties, where one of them is at a disadvantage due to a lack of information. Adverse selection occurs when there is asymmetric information between a buyer and a seller before they close a deal. By contrast, moral hazard occurs when there is asymmetric information ...

What is adverse selection?

Adverse selection occurs when there is asymmetric information between a buyer and a seller before a deal. That means one of the two parties (usually the seller) has more accurate or different information than the other party (typically the buyer) before they reach an agreement. This puts the less knowledgeable party at a disadvantage because it is more difficult for them to assess the value or risk of the deal. Meanwhile, the more knowledgeable party has access to all the relevant information and can more easily evaluate the quality of the agreement. This ultimately leads to an inefficient outcome and a lower quality of goods and services in the market.

What is moral hazard?

Moral Hazard. Moral hazard occurs when there is asymmetric information between a buyer and a seller and a change in behavior after a deal. That means one of the parties (usually the buyer) accepts a deal with the intention to change their behavior after a deal is made.

What are moral hazard examples?

In this market, the buyers can avoid a large share of the negative consequences of their actions once they have insurance for their cars. Many of them will be extra careful with their trucks before getting insurance because they have to pay for damages and repairs themselves. However, once they get insurance, some drivers feel like they don’t have to be as careful anymore because insurance will cover the costs if anything happens to their car. This can lead to more reckless driving or just an overall increase in carelessness on the road. Of course, this kind of behavior is not desired and puts the insurance companies at a disadvantage.

Why is the less knowledgeable party at a disadvantage?

This puts the less knowledgeable party at a disadvantage because it is more difficult for them to assess the value or risk of the deal. Meanwhile, the more knowledgeable party has access to all the relevant information and can more easily evaluate the quality of the agreement.

What Is Adverse Selection?

Adverse selection refers generally to a situation in which sellers have information that buyers do not have, or vice versa, about some aspect of product quality. In other words, it is a case where asymmetric information is exploited. Asymmetric information, also called information failure, happens when one party to a transaction has greater material knowledge than the other party.

What is an adverse selection in auto insurance?

Another example of adverse selection in the case of auto insurance would be a situation where the applicant obtains insurance coverage based on providing a residence address in an area with a very low crime rate when the applicant actually lives in an area with a very high crime rate. Obviously, the risk of the applicant's vehicle being stolen, vandalized, or otherwise damaged when regularly parked in a high-crime area is substantially greater than if the vehicle was regularly parked in a low-crime area.

When does moral hazard occur?

Like adverse selection, moral hazard occurs when there is asymmetric information between two parties, but where a change in the behavior of one party is exposed after a deal is struck. Adverse selection occurs when there's a lack of symmetric information prior to a deal between a buyer and a seller.

What is moral hazard?

Moral hazard is the risk that one party has not entered into the contract in good faith or has provided false details about its assets, liabilities, or credit capacity. For instance, in the investment banking sector, it may become known that government regulatory bodies will bail out failing banks; as a result, bank employees may take on excessive amounts of risk to score lucrative bonuses knowing that if their risky bets do not pan out, the bank will be saved anyhow.

What Is a Moral Hazard?

Moral hazard is the risk that a party has not entered into a contract in good faith or has provided misleading information about its assets, liabilities, or credit capacity. In addition, moral hazard also may mean a party has an incentive to take unusual risks in a desperate attempt to earn a profit before the contract settles. Moral hazards can be present at any time two parties come into agreement with one another. Each party in a contract may have the opportunity to gain from acting contrary to the principles laid out by the agreement.

When does moral hazard exist?

Key Takeaways: Moral hazard can exist when a party to a contract can take risks without having to suffer consequences. Moral hazard is common in the lending and insurance industries but also can exist in employee-employer relationships.

Why is moral hazard important?

The moral hazard exists that the property owner, because of the availability of the insurance, may be less inclined to protect the property, since the payment from an insurance company lessens the burden on the property owner in the case of a disaster.

Where is moral hazard common?

Moral hazard is common in the lending and insurance industries but also can exist in employee-employer relationships.

What happens when a party in an agreement does not have to suffer the potential consequences of a risk?

Any time a party in an agreement does not have to suffer the potential consequences of a risk, the likelihood of a moral hazard increases.

What Is Adverse Selection?

- Adverse selection, also known as anti-selection, is when one party in a transaction has more or better information about the quality or legitimacy of a product or service. They use that private knowledge to maximize their outcomes at the expense of the other party. This term can apply to situations where the seller knows more than the buyer or vice versa. Adverse selection often fav…

Consequences of Adverse Selection

- Adverse selection can have serious consequences for both buyers and sellers, depending on the situation. It can create a disparity in the perceived valueof a product or service, which can affect transactions. For example, if a seller is aware of a product defect and doesn't disclose it, the buyer may purchase a product that doesn't meet their needs or expectations. Similarly, potential buyer…

Adverse Selection vs. Moral Hazard

- Adverse selection has some overlap with moral hazard, another term used in economics and insurance. A moral hazard is the risk that one party has provided false details about its assets or liabilities. This asymmetric information can lead one party to take increased risks after the completion of a transaction. For example, in investment banking, em...

Examples of Adverse Selection

- Here are three examples of adverse selection that can help illustrate how the concept works in practical applications: